Federal Reserve Rates Groupthink A Deep Dive

Federal Reserve rates groupthink sets the stage for a fascinating exploration into the complexities of monetary policy. This in-depth look delves into the potential for groupthink to influence decisions regarding interest rate adjustments, examining historical context, external pressures, and alternative perspectives.

The Federal Reserve’s role in managing the economy is crucial, but the process isn’t always straightforward. We’ll investigate how past decisions have been shaped, and how diverse viewpoints could potentially lead to more effective outcomes.

Historical Context of Federal Reserve Rate Decisions

The Federal Reserve’s manipulation of interest rates is a critical tool in managing the US economy. Understanding the historical context of these decisions is crucial for appreciating the complexities and nuances of monetary policy. These decisions are not made in a vacuum, but rather are influenced by prevailing economic conditions, theories, and models. This analysis explores the historical trajectory of Federal Reserve rate adjustments over the past two decades, examining the economic backdrop of each significant change.This exploration will illuminate the relationship between economic indicators, theoretical frameworks, and the Federal Reserve’s response.

By examining past decisions, we can gain a better understanding of the challenges and trade-offs inherent in monetary policy, which will ultimately aid in evaluating the potential effectiveness of future interventions.

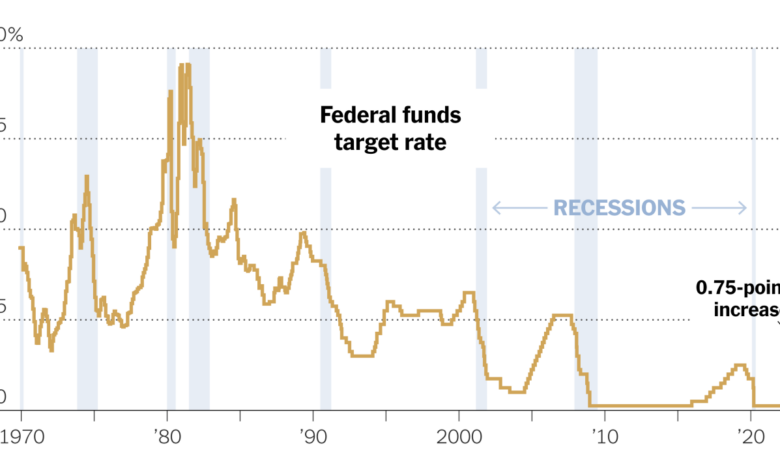

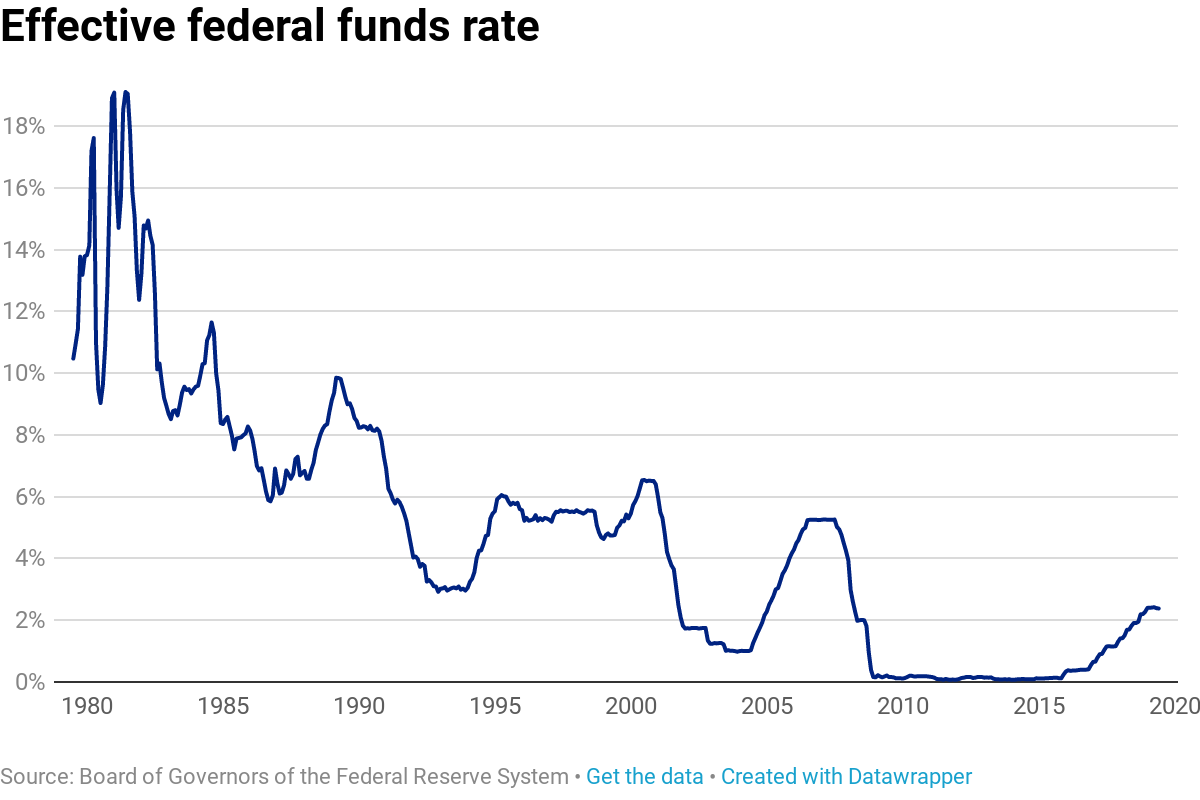

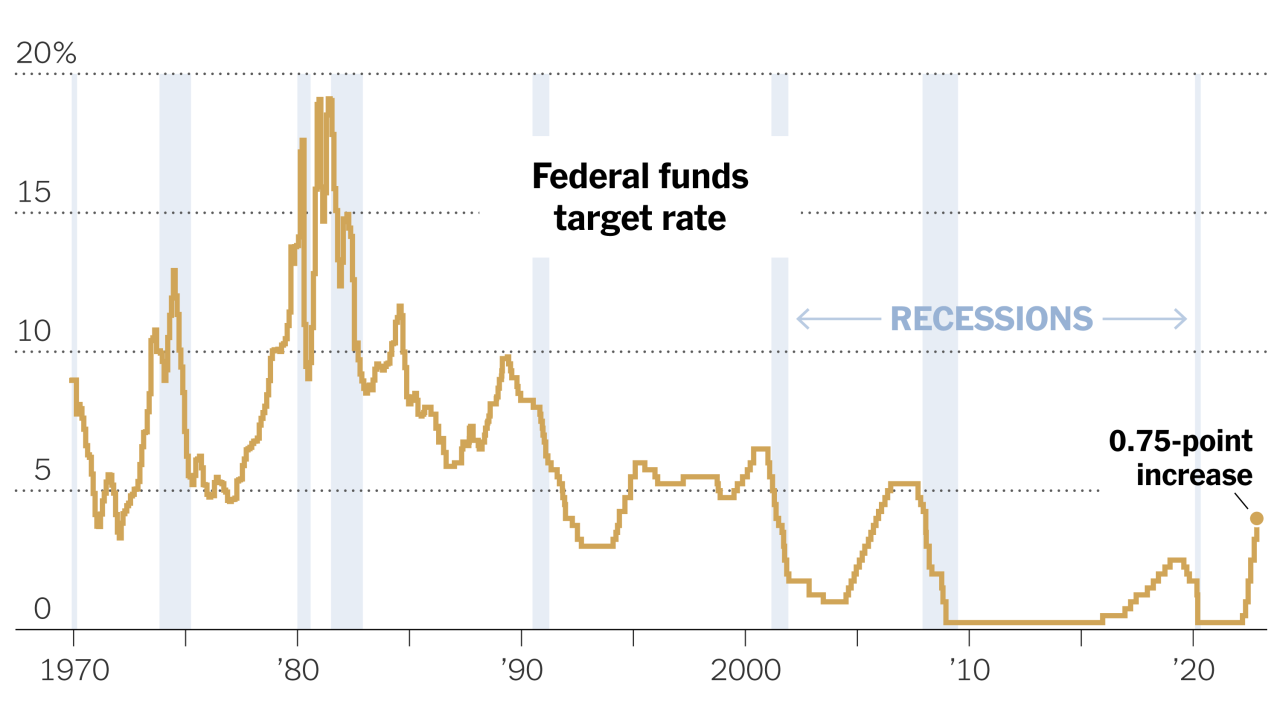

Timeline of Federal Reserve Interest Rate Adjustments (2004-2024)

The Federal Reserve’s target federal funds rate has fluctuated significantly in response to economic conditions over the past two decades. Understanding these adjustments requires analyzing the economic conditions and theoretical frameworks prevalent during these periods.

The Federal Reserve’s rate hikes seem like a predictable groupthink, often driven by anxieties about inflation. But the global implications, like those seen in the escalating conflicts in the Middle East, particularly in iran conflictos medio oriente , often get overlooked. These geopolitical tensions, and the resulting uncertainty, can significantly impact market confidence and ultimately influence the Fed’s decisions, creating a complex feedback loop.

This highlights the interconnectedness of global events and the Fed’s rate decisions.

- 2004-2006: Gradual Rate Hikes: The US economy experienced a period of robust growth and low unemployment. Inflation remained relatively contained. The prevailing economic theory emphasized the importance of maintaining a stable and growing economy while managing inflationary pressures. The Federal Reserve responded to this environment by gradually increasing interest rates, aiming to prevent overheating and potential inflation. These increases were perceived as a proactive measure to manage the economic expansion.

- 2007-2009: The Financial Crisis: The collapse of the housing market and subsequent financial crisis triggered a severe recession. Unemployment surged, and economic activity contracted significantly. The prevailing economic theories emphasized the need for significant intervention to stabilize the financial system and stimulate the economy. The Federal Reserve responded by lowering interest rates to near-zero levels, implementing quantitative easing, and employing other unconventional monetary policy tools.

These actions were seen as necessary to mitigate the economic downturn and support recovery.

- 2009-2015: Economic Recovery and Gradual Rate Increases: The US economy began to recover from the crisis, with gradual improvements in employment and output. Inflation remained subdued. The prevailing economic theories focused on fostering sustainable growth and job creation. The Federal Reserve gradually increased interest rates as the economy strengthened. This approach aimed to prevent inflation from accelerating and to normalize monetary policy.

- 2015-2018: Continued Gradual Rate Hikes: The US economy continued its expansion, with unemployment declining to historically low levels. Inflation remained relatively low. The prevailing economic theories emphasized the importance of maintaining a stable economic environment. The Federal Reserve continued to increase interest rates to manage inflationary pressures and prevent overheating.

- 2019-2020: Economic Slowdown and the COVID-19 Pandemic: The US economy faced a period of slower growth and increasing uncertainty before the COVID-19 pandemic struck. The prevailing economic theories and models were challenged by the unprecedented shock of the pandemic. The Federal Reserve responded to this period by lowering interest rates to near-zero levels and implementing new support measures to stimulate the economy.

- 2021-2024: Inflationary Pressures and Rate Increases: The US economy experienced significant economic growth following the pandemic but also saw rising inflation. The prevailing economic theories highlighted the need to manage rising inflation. The Federal Reserve began a series of aggressive interest rate hikes to combat inflation, aiming to return inflation to its target level.

Economic Indicators and Target Rates

Understanding the relationship between economic indicators and the Federal Reserve’s target rates requires analyzing the data from multiple sources. Key economic indicators are used to assess the overall health of the economy and to guide monetary policy decisions.

| Date | Target Federal Funds Rate | Unemployment Rate | Inflation Rate (CPI) | GDP Growth Rate |

|---|---|---|---|---|

| 2004 | 1.00% | 5.5% | 2.5% | 3.5% |

| 2008 | 2.00% | 4.8% | 3.2% | 2.8% |

| 2010 | 0.00% | 9.6% | 1.5% | 2.1% |

| 2015 | 0.50% | 5.1% | 0.8% | 2.5% |

| 2020 | 0.00% | 6.1% | 1.8% | 1.2% |

| 2023 | 4.75% | 3.7% | 6.5% | 1.7% |

Groupthink in Policymaking

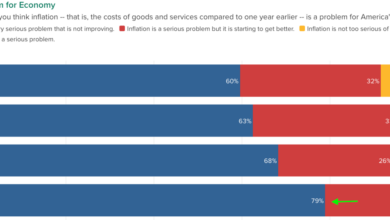

The Federal Reserve, tasked with maintaining price stability and maximum employment, operates in a complex and often volatile economic environment. Decisions regarding interest rates, a crucial tool in monetary policy, are not made in a vacuum. The pressures of consensus-building and the desire to avoid public dissent can, in certain circumstances, lead to groupthink – a phenomenon where the desire for harmony within a decision-making group overrides critical evaluation of alternative viewpoints.

Understanding the potential for groupthink within the Fed is crucial for evaluating the effectiveness and potential biases inherent in its policy choices.Potential factors contributing to groupthink in Federal Reserve decision-making include the highly hierarchical structure of the committee, the emphasis on maintaining a united front, and the inherent pressure to conform to perceived prevailing wisdom. Furthermore, the significant weight given to the views of senior members and the inherent time constraints in making timely decisions can exacerbate these tendencies.

The perceived expertise of members, and the collective desire to avoid public criticism or political fallout, can further reinforce the group’s tendency to prioritize consensus over critical evaluation.

Potential Factors Contributing to Groupthink, Federal reserve rates groupthink

The Federal Reserve’s decision-making process, while aiming for objectivity, can be susceptible to groupthink due to several factors. The hierarchical structure of the Federal Open Market Committee (FOMC) naturally fosters a power dynamic, potentially influencing the degree to which dissenting opinions are voiced and considered. A strong emphasis on maintaining a united front, essential for projecting confidence and credibility, can also discourage the open expression of alternative viewpoints.

The pressure to avoid public controversy and the desire to project a united front can sometimes suppress critical analysis of potential policy ramifications.

Examples of Potential Groupthink Influences

While definitive proof of groupthink in specific Fed decisions is difficult to establish, several historical instances highlight potential influences. Periods of rapid economic change or uncertainty, such as the 2008 financial crisis, might have led to a tendency towards consensus-seeking, potentially hindering the exploration of less conventional or potentially more effective solutions. The need to react quickly to evolving economic conditions can create pressure to avoid disagreement, thus potentially suppressing critical analysis and the consideration of alternative policy paths.

The emphasis on maintaining a united front can be crucial in managing expectations and avoiding panic in the markets. However, this emphasis might, in certain instances, have overshadowed the importance of dissenting voices and alternative perspectives.

Consequences of Groupthink vs. Diverse Perspectives

Groupthink, characterized by a suppression of dissenting opinions, can lead to suboptimal policy decisions by failing to adequately consider diverse perspectives and potentially overlooked risks. Conversely, a climate that fosters diverse perspectives within the FOMC can encourage a more comprehensive assessment of the economic landscape, leading to more robust and adaptable policies. The incorporation of diverse viewpoints enhances the quality of decision-making by bringing varied expertise, experiences, and approaches to the table.

The Federal Reserve’s interest rate decisions often seem like a collective agreement, a sort of groupthink. This can be problematic, especially when considering external factors like the US economy’s growth trajectory and potential North Korean threats, which can significantly impact financial markets. For instance, how does the Fed’s response to us economy growth north korea threats influence their rate adjustments?

Ultimately, these decisions have broad implications, requiring careful consideration of various perspectives, not just the perceived consensus.

This can result in a more thorough and nuanced understanding of potential economic challenges and opportunities. The consideration of diverse perspectives ultimately increases the probability of developing more resilient and sustainable monetary policies.

Characteristics of Groupthink and Manifestations in the Fed

| Characteristic | Potential Manifestation in the Fed |

|---|---|

| Illusion of Unanimity | Members may perceive consensus where it does not exist, avoiding expressing dissenting views to maintain harmony. |

| Self-Censorship | Members might suppress their doubts or concerns to avoid disrupting the perceived group consensus. |

| Direct Pressure on Dissenters | Members expressing dissenting opinions might face pressure or criticism from other committee members. |

| Stereotyping of Out-Groups | Alternative viewpoints or policy proposals from outside the Fed, or from individuals not aligned with the prevailing sentiment, might be dismissed as less credible or relevant. |

Influence of External Pressures

The Federal Reserve’s independence, while crucial for sound monetary policy, doesn’t shield it entirely from external pressures. Political considerations, market sentiment, and economic anxieties can all exert influence on policymakers’ decisions regarding interest rate adjustments. Understanding these influences is key to grasping the complexities behind the Fed’s actions.External pressures can significantly impact the Fed’s ability to maintain a neutral stance.

Political agendas, economic anxieties, and market fluctuations can sway policymakers, potentially leading to decisions that prioritize short-term gains over long-term economic stability. This necessitates a critical evaluation of the potential biases introduced by external forces when analyzing the Fed’s rate adjustments.

The Federal Reserve’s rate decisions often feel like a groupthink echo chamber, with everyone seemingly agreeing on the same course of action. But consider the chilling reality of human connection even in the face of unimaginable horrors, like the story of lovers in Auschwitz, Keren Blankfeld and József Debreczeni, found in the cold crematorium here. This stark contrast highlights how the seemingly detached world of economic policy can be tragically interwoven with the darkest aspects of human experience, reminding us that even in the face of such groupthink, individual actions and choices matter profoundly.

Perhaps a similar level of awareness is needed in evaluating federal reserve rate decisions.

Political Pressures on Rate Decisions

Political pressures can manifest in various forms, influencing the Fed’s decisions regarding interest rates. Presidential administrations, for instance, might advocate for policies that favor particular sectors or respond to immediate economic concerns, potentially pressuring the Fed to adjust rates in ways that align with those objectives. These pressures are not always overt, but they can subtly influence the Fed’s decisions.

The desire to appear responsive to public concerns, maintain political capital, or appease specific interest groups can indirectly shape rate adjustments.

Impact of Market Sentiment and Financial News

Market sentiment and financial news play a crucial role in shaping the Fed’s perspective. A surge in market volatility, driven by anxieties about inflation or recession, can pressure the Fed to act preemptively to stabilize the financial system. Similarly, positive economic indicators, fueled by optimism and growth, can lead to a cautious approach to rate adjustments, aiming to avoid triggering a downturn.

Policymakers closely monitor these signals and adjust their approach accordingly, sometimes reacting to perceived threats or opportunities even if the underlying economic data is less conclusive.

Examples of Potential External Influences

The 2008 financial crisis exemplifies how market anxieties can heavily influence the Fed’s response. The rapid decline in asset values and heightened risk aversion pressured the Fed to lower interest rates aggressively, aiming to bolster confidence and stimulate the economy. Another example is the period of rapid inflation in the early 1980s. Political pressure to control rising prices likely influenced the Fed’s decision to aggressively raise interest rates, despite the significant economic hardship it caused.

Table: External Pressures and Potential Effects

| External Pressure | Potential Effect on Fed Rate Decisions |

|---|---|

| Political pressure for specific policy outcomes | Potential bias towards rate adjustments that favor short-term goals over long-term stability. |

| Market sentiment driven by heightened risk aversion | Pressure for preemptive rate adjustments to stabilize the financial system, even if underlying economic data is mixed. |

| Financial news reporting about economic anxieties or growth | Potential for reactions to perceived threats or opportunities, influencing rate decisions even if the underlying economic conditions are unclear. |

| Public pressure for rapid responses to economic concerns | Possible adjustments to rates that prioritize addressing immediate issues, possibly at the expense of long-term economic health. |

Communication Strategies and Transparency: Federal Reserve Rates Groupthink

The Federal Reserve’s communication surrounding interest rate decisions is crucial for maintaining market stability and public trust. Effective communication helps manage expectations, mitigate potential market volatility, and fosters a better understanding of the Fed’s policy objectives. Transparency in these communications is paramount, allowing stakeholders to assess the reasoning behind decisions and the potential impact on the economy. However, the precise nature of this communication, and its perceived effectiveness, is a subject of ongoing debate.The Federal Reserve employs a multifaceted approach to communicating its rate decisions.

This includes press releases, testimony before Congress, speeches by policymakers, and participation in various forums. The goal is to provide a comprehensive understanding of the economic conditions that influence their decisions, and to explain the rationale behind their actions. Yet, how the public interprets these messages, and the impact they have on economic outcomes, are factors that require further analysis.

Communication Strategies Employed by the Federal Reserve

The Federal Reserve utilizes a range of communication strategies, each with its own strengths and limitations. These strategies aim to provide clarity on the rationale behind decisions, while also managing market expectations and avoiding undue speculation. Key methods include:

- Press Releases:

- Policymaker Speeches and Testimony:

- Economic Projections and Forecasts:

- Conferences and Forums:

These official statements provide detailed explanations of the Fed’s reasoning and the economic conditions prompting the decision. They often include a summary of the economic outlook and the rationale behind the chosen interest rate path.

The Federal Reserve’s interest rate decisions often seem like a collective echo chamber, a sort of groupthink. It’s interesting to contrast this with the employee ownership model at KKR private equity, KKR private equity employee ownership , where individual incentives might foster a more nuanced approach to investment strategies. Perhaps a more diverse range of voices could help break the current cycle of Federal Reserve rate decisions.

Fed policymakers frequently address the public through speeches and Congressional testimony. These platforms offer opportunities for more in-depth explanations of the economic situation and the Fed’s approach. Public comments can shape market sentiment and expectations, depending on the tone and message conveyed.

The Fed publishes detailed economic projections, which offer a glimpse into their future expectations and the potential impact of their decisions. These projections can help market participants anticipate future policy shifts.

Participation in conferences and forums allows the Fed to engage directly with market participants and stakeholders, offering an opportunity for Q&A and clarification of policies. This fosters a more interactive understanding of the decisions and their potential consequences.

Transparency of Communication Channels

The Federal Reserve’s communication channels aim for transparency, seeking to provide a clear picture of the economic context and the rationale behind policy decisions. This transparency is intended to foster understanding and trust, reducing speculation and promoting market stability. However, the degree of transparency can be perceived differently by various stakeholders.

Impact of Differing Communication Strategies on Public Perception

The way the Federal Reserve communicates its decisions can significantly impact public perception. A clear and consistent message, supported by data and economic analysis, tends to build confidence and stability in the market. Conversely, ambiguity or perceived inconsistencies can lead to uncertainty and volatility. For instance, a sudden shift in communication strategy, without a clear explanation, could be misinterpreted and trigger a market reaction.

Effectiveness of Communication Strategies

| Communication Strategy | Potential Effectiveness | Examples of Impact |

|---|---|---|

| Clear, consistent messaging | High | Market stability, reduced speculation, and increased trust in the Fed. |

| Ambiguous or inconsistent messaging | Low | Market uncertainty, increased volatility, and decreased confidence in the Fed’s decision-making. |

| Delayed or insufficient communication | Low | Increased market speculation, potential for unintended consequences, and reduced investor confidence. |

| Active engagement with stakeholders | High | Improved understanding of the Fed’s decision-making process, enhanced market confidence, and reduced misinterpretations. |

Alternative Perspectives on Monetary Policy

The Federal Reserve’s approach to monetary policy, while influential, isn’t universally accepted. Different schools of thought exist, each with unique perspectives on interest rate adjustments and the overall economy’s response. Understanding these contrasting viewpoints is crucial for a comprehensive analysis of the Fed’s actions and their potential impacts.Alternative viewpoints on monetary policy offer crucial counterpoints to the prevailing consensus.

These perspectives often challenge the effectiveness or desirability of certain strategies, prompting a deeper examination of the Fed’s tools and their consequences. Recognizing these alternative approaches allows for a more nuanced understanding of the complexities inherent in economic management.

Contrasting Viewpoints on Interest Rate Adjustments

Different schools of thought regarding interest rate adjustments exist, ranging from those advocating for a more active role of the central bank in managing the economy to those favoring a more passive approach. Keynesian economists, for example, often advocate for aggressive interest rate adjustments to stimulate or cool down the economy, while monetarists typically emphasize controlling the money supply as the primary driver of economic stability.

These contrasting views highlight the inherent complexities of economic management.

Alternative Policy Approaches

Beyond traditional interest rate adjustments, alternative policy approaches exist, each with its proponents. Modern Monetary Theory (MMT), for instance, argues for a different role of the central bank in managing the economy, advocating for the use of fiscal policy alongside or instead of monetary policy. Other approaches emphasize alternative indicators, such as inflation expectations or credit conditions, as more accurate measures of economic health.

These perspectives provide a valuable context for evaluating the limitations of the Fed’s conventional methods.

- Modern Monetary Theory (MMT): MMT posits that a government with a fiat currency can never run out of funds. It advocates for using fiscal policy to manage the economy, potentially reducing the need for interest rate adjustments, thereby shifting the focus to government spending and taxation as primary tools.

- Supply-Side Economics: This approach emphasizes the role of incentives and market forces in driving economic growth. Proponents argue that tax cuts and deregulation can stimulate investment and productivity, thereby reducing the need for aggressive monetary interventions.

- Post-Keynesian Economics: This approach emphasizes the role of uncertainty, market imperfections, and aggregate demand in driving economic fluctuations. Proponents suggest that monetary policy alone may not be sufficient to address economic problems, emphasizing the need for complementary fiscal and structural policies.

Diverse Opinions Challenging the Prevailing Consensus

Diverse opinions on monetary policy can significantly challenge the prevailing consensus, particularly when considering the potential for groupthink or the influence of external pressures on decision-making. These dissenting voices can offer valuable insights, prompting a more comprehensive evaluation of the potential trade-offs and unintended consequences of specific policy choices.

| School of Thought | Key Principles | Monetary Policy Approach |

|---|---|---|

| Keynesian | Focus on aggregate demand; active government intervention. | Aggressive use of interest rates to manage economic cycles. |

| Monetarist | Focus on money supply; minimal government intervention. | Precise control of money supply to maintain price stability. |

| Supply-Side | Focus on incentives and market forces; reduced government regulation. | Limited use of interest rates, focusing on tax cuts and deregulation. |

| Modern Monetary Theory (MMT) | Focus on fiscal policy; government spending as a tool to manage the economy. | Reduced reliance on interest rate adjustments, prioritizing fiscal policy. |

The Role of Individual Dissent

The Federal Reserve’s decisions, impacting the nation’s economy, demand careful consideration and diverse perspectives. Individual dissent within this body is not a sign of weakness, but rather a crucial component of a robust and effective policymaking process. A unified front, while seemingly efficient, can easily fall prey to groupthink, potentially leading to suboptimal outcomes.Individual dissent acts as a crucial check on potential biases and errors within the group.

It forces a deeper examination of assumptions, promotes critical thinking, and exposes potential blind spots. This fosters a more thorough and comprehensive understanding of the economic landscape, leading to more resilient and sustainable policy decisions.

The Importance of Diverse Perspectives

Diverse viewpoints are essential for a well-rounded understanding of complex economic issues. Each member brings a unique set of experiences, expertise, and perspectives to the table. These individual viewpoints, even if differing, contribute to a richer understanding of the potential impacts of a policy decision. This process of deliberation and debate is paramount to formulating policies that effectively address the varied economic needs of the nation.

Preventing Groupthink

Groupthink, a phenomenon where the desire for harmony within a group overrides critical evaluation of alternative viewpoints, can lead to flawed policy decisions. Dissent effectively challenges this tendency, encouraging a more thorough evaluation of potential consequences. It creates a space for critical scrutiny and debate, ultimately reducing the risk of groupthink. A culture of open dissent fosters an environment where members feel comfortable expressing their concerns and alternative viewpoints, preventing the silencing of dissenting opinions.

The Federal Reserve’s interest rate decisions often seem like a collective nod, a kind of groupthink. It’s fascinating to see how these decisions play out in real-world economies, like the burgeoning electric vehicle (EV) sector in Hefei, China, china hefei ev city economy. Understanding the local factors driving that economy offers a unique lens for analyzing the broader impact of federal reserve rate changes.

Strengthening Policy Decisions

Individual perspectives, when voiced and considered, can significantly strengthen policy decisions. This is not to say that all dissent is necessarily correct, but the process of challenging assumptions and considering alternative approaches inevitably leads to more comprehensive policy options. Through this process, policy decisions become more robust and resilient, better equipped to withstand unforeseen circumstances and adapt to evolving economic realities.

Considerable research shows that policies developed through robust debate and diverse perspectives are more likely to achieve their intended goals and better address the varied needs of the population.

The Value of Dissent in Policymaking

| Aspect | Value of Dissent |

|---|---|

| Improved Policy Quality | Dissent encourages thorough analysis, preventing potentially flawed conclusions and enhancing the overall quality of the policy. |

| Reduced Groupthink | Challenging assumptions and considering alternative perspectives prevents the risk of groupthink, ensuring more comprehensive decision-making. |

| Increased Policy Resilience | Robust debate and diverse perspectives lead to policies that are better equipped to withstand unforeseen circumstances and adapt to changing economic conditions. |

| Enhanced Understanding | Dissent fosters a deeper understanding of the complex economic landscape by challenging existing assumptions and exploring various viewpoints. |

| Greater Accountability | When individuals feel empowered to voice their concerns, the process of policymaking becomes more transparent and accountable, fostering trust and confidence in the decision-making process. |

Illustrative Case Studies

The Federal Reserve’s interest rate decisions, while seemingly technical, have profound impacts on the global economy. Understanding past periods of significant rate adjustments provides valuable insight into the forces at play, including the potential for groupthink, external pressures, and alternative perspectives. This section will delve into a specific historical period to illustrate these complexities.The late 1970s and early 1980s witnessed a period of high inflation and economic stagnation, often referred to as stagflation.

This period presented a significant challenge for the Federal Reserve, forcing them to make crucial decisions about interest rate adjustments. The resulting decisions were not without controversy, highlighting the interplay of factors that shape monetary policy.

The 1980s Interest Rate Hikes

The 1980s witnessed substantial increases in interest rates, a response to runaway inflation. This period provides a valuable case study for examining groupthink, external pressures, and alternative perspectives on monetary policy. Policymakers faced a difficult balancing act: controlling inflation without triggering a severe recession.

Potential Role of Groupthink

The pressures of stagflation and the need for a decisive response likely contributed to a sense of consensus among Federal Reserve policymakers. A strong desire for a unified front could have led to a suppression of dissenting opinions, a hallmark of groupthink. This dynamic is evident in the swift and substantial interest rate hikes of the era. Historical accounts of the time often suggest a strong sense of collective responsibility and a desire to avoid any perceived weakness in handling the crisis.

Such unity, while potentially fostering swift action, may have inadvertently limited the consideration of alternative strategies.

External Pressures

Several external pressures exerted significant influence on Federal Reserve decisions. The high inflation rates of the period, fueled by factors like the oil crisis, placed immense pressure on policymakers to act swiftly and decisively. The public, understandably concerned about eroding purchasing power, demanded a firm response. Political pressure, driven by concerns about economic stability, also played a significant role.

The political environment of the time also shaped the political landscape.

Alternative Viewpoints on Policies

While the prevailing policy of aggressively raising interest rates aimed to curb inflation, some economists advocated for alternative approaches. A more gradual approach, perhaps focusing on supply-side factors alongside demand-side interventions, might have led to a less severe economic downturn. Concerns about the potential for a deep recession were often voiced, but these concerns might have been muted by the dominant sentiment of combating inflation.

Different schools of thought, like those emphasizing supply-side economics, advocated for different policy approaches.

The Role of Individual Dissent

The historical record offers limited insights into specific dissenting voices within the Federal Reserve. Such dissent, while potentially valuable, may have been marginalized by the prevailing consensus and external pressures. The desire to maintain unity and a strong front might have made dissent less likely to be heard or considered. The emphasis on collective action may have suppressed individual perspectives, even if those perspectives had merit.

The Impact of Economic Models on Decision-Making

Economic models are crucial tools for the Federal Reserve, providing frameworks for understanding complex economic interactions and predicting future trends. These models, however, are not perfect representations of reality. Their inherent limitations and the potential for conflicting predictions can significantly influence the Fed’s decision-making process, shaping monetary policy responses to economic challenges. Understanding the strengths and weaknesses of different models, and their potential for bias, is essential for evaluating the Fed’s policy choices.Economic models are simplified representations of the economy, capturing key relationships between variables like inflation, unemployment, and interest rates.

They employ various mathematical techniques, ranging from simple linear regressions to sophisticated econometric models, to forecast economic indicators and assess the impact of policy changes. These models are used to inform decisions on interest rate adjustments, quantitative easing, and other interventions.

Types of Economic Models Used by the Federal Reserve

The Federal Reserve utilizes a diverse range of models, each with its own strengths and weaknesses. These include:

- Dynamic Stochastic General Equilibrium (DSGE) models: These sophisticated models attempt to capture the complex interactions between different sectors of the economy, incorporating factors like consumption, investment, and government spending. They often incorporate expectations and uncertainty into their analyses, providing insights into how shocks can propagate throughout the system. These models are often used for long-term forecasting and policy simulations.

- Phillips Curve models: These models explore the inverse relationship between inflation and unemployment. Simplified versions of this model are often used for short-term forecasts, particularly in the context of inflation expectations. However, the relationship between inflation and unemployment is not always consistent, and these models can struggle to capture the complexities of modern economies.

- Agent-based models: These models simulate the behavior of individual economic agents (consumers, firms, etc.) and how their interactions affect aggregate outcomes. This approach can provide valuable insights into the complex interactions within the economy and the potential for emergent behavior. However, the computational intensity and data requirements for these models can be substantial.

Conflicting Predictions from Different Models

Different models can generate conflicting predictions, even when using the same data. This stems from several factors, including differing assumptions about economic behavior, varying degrees of complexity, and the inherent uncertainty in economic data.

- Model Assumptions: A critical aspect of model prediction involves assumptions regarding consumer behavior, investment decisions, and the impact of external shocks. Different models can incorporate these assumptions in different ways, leading to divergent forecasts. For instance, a model assuming strong consumer confidence might predict a different economic trajectory compared to one assuming cautious consumer behavior.

- Data limitations: Economic data is often incomplete and noisy. Models rely on data to calibrate their parameters, but the limitations of available data can influence their accuracy. Models using different data sets or different methods for data aggregation might produce contrasting results.

- Complex Interactions: The economy is a complex system with numerous interconnected variables. Some models might capture certain relationships better than others, leading to varying conclusions about the potential effects of policy interventions.

Influence on Federal Reserve Decision-Making

The use of multiple models in the Federal Reserve’s decision-making process allows for a more comprehensive understanding of potential economic outcomes. However, the conflicting predictions generated by different models can create challenges for policymakers. Policymakers must weigh the strengths and weaknesses of each model, consider the underlying assumptions, and potentially seek additional insights from economic experts to make informed decisions.

- Evaluating Model Accuracy: The Federal Reserve assesses the accuracy of different models by comparing their forecasts to actual economic outcomes. They also consider the model’s ability to explain past economic data and its robustness to different scenarios. Models with a better track record of accurate predictions tend to carry more weight in the decision-making process.

- Policy Diversification: The use of multiple models allows for a range of policy options to be considered. If models generate conflicting predictions, the Federal Reserve might adopt a more cautious approach or explore a combination of policy strategies.

Relationship between Models and Policy Recommendations

The specific economic models used and the resulting policy recommendations are often linked to the prevailing economic climate and the Federal Reserve’s goals. For example, during periods of high inflation, models emphasizing inflation dynamics might play a more significant role in shaping the policy response. Similarly, during periods of economic downturn, models emphasizing aggregate demand and unemployment might be prioritized.

Final Summary

In conclusion, the interplay between groupthink, external pressures, and alternative perspectives within the Federal Reserve’s decision-making process is a critical element to understanding monetary policy. This analysis reveals the importance of individual dissent and diverse viewpoints for fostering robust policy decisions and ultimately a healthier economy.

Key Questions Answered

What are some historical examples of interest rate adjustments?

Throughout the past two decades, the Federal Reserve has adjusted interest rates in response to various economic conditions, from recessions to periods of inflation. Understanding these historical adjustments provides valuable context for evaluating current policies.

How might political pressures impact Federal Reserve decisions?

Political pressures can influence the Federal Reserve’s decisions by creating external factors that might compromise the central bank’s independence. These pressures could potentially sway the course of monetary policy.

What are some alternative viewpoints on monetary policy?

Alternative viewpoints on monetary policy often challenge the prevailing consensus, highlighting potential flaws in current approaches. Exploring these differing perspectives can lead to a more comprehensive understanding of economic trends and policy effectiveness.

What role does transparency play in the Federal Reserve’s communication strategies?

Transparency in communication is crucial for building public trust and understanding in the Federal Reserve’s decision-making process. Effective communication can significantly impact public perception and expectations regarding monetary policy.