Fed Governor Waller Rate Cuts Coming Implications

Fed Governor Christopher Waller rate cuts coming, potentially signaling a shift in monetary policy. This anticipated move could have significant implications for various sectors of the economy, impacting everything from housing to consumer spending. The upcoming decision hinges on a complex interplay of economic indicators, market trends, and Waller’s personal views on the current state of the economy.

Waller’s recent public statements, coupled with a review of historical economic data and market reactions, offer a glimpse into the potential consequences of these rate cuts. This article delves into the governor’s perspective, examining the supporting economic indicators, and analyzing the potential market responses.

Fed Governor Waller’s Stance on Interest Rates

Federal Reserve Governor Christopher Waller has been a vocal figure in recent discussions surrounding interest rate policy. His public statements offer a unique perspective on the current economic climate and the path forward for monetary policy. Understanding his position is crucial for navigating the complexities of the financial markets and interpreting the Fed’s overall strategy.Governor Waller’s public pronouncements consistently reflect a cautious approach to interest rate adjustments.

He often emphasizes the importance of data-driven decision-making and a measured response to economic fluctuations. He frequently highlights the need to avoid abrupt policy shifts that could destabilize the financial system.

Governor Waller’s Public Statements on Interest Rates

Governor Waller’s public statements on interest rates have been characterized by a focus on data-driven analysis. He emphasizes the need for patience and careful consideration before making any changes to the current interest rate environment. He often underscores the importance of avoiding overly aggressive policy shifts. Waller consistently emphasizes the significance of economic data in guiding the Fed’s policy decisions.

Summary of Past Comments on Rate Cuts

Governor Waller’s past comments on potential rate cuts have been generally aligned with a cautious outlook. He has often stressed the importance of monitoring economic indicators before considering any adjustments. In his previous pronouncements, he highlighted the need for a thorough evaluation of inflation data and the labor market before any decision regarding rate cuts is made. He has consistently emphasized the importance of avoiding premature policy shifts.

Context Surrounding Statements

Waller’s comments are often made in the context of economic data releases, such as inflation reports and employment figures. The prevailing economic conditions, including inflation rates, unemployment levels, and economic growth projections, play a key role in shaping his perspective. Waller’s pronouncements are also influenced by market trends, such as stock prices, bond yields, and currency exchange rates.

Fed Governor Christopher Waller’s potential rate cuts are definitely on the radar, but the global economic landscape is a complex beast. Tensions in the Middle East, particularly the ongoing conflicts involving Iran, are adding another layer of uncertainty to the situation. These regional conflicts, as highlighted in this article about iran conflictos medio oriente , could significantly impact global markets, potentially influencing the Fed’s decision-making process and potentially delaying those anticipated rate cuts.

Comparison with Other Fed Officials, Fed governor christopher waller rate cuts coming

Waller’s views on interest rates often align with some other Fed officials, while differing with others. He has been noted for his more cautious approach compared to some colleagues, who advocate for quicker or more aggressive rate adjustments. This divergence of opinions underscores the diversity of views within the Federal Reserve. Different members may prioritize specific economic indicators or interpret data differently, leading to varying opinions on the appropriate course of action.

Potential Motivations Behind Waller’s Stance

Governor Waller’s cautious approach to interest rates may stem from a desire to avoid unintended consequences of aggressive policy shifts. He likely prioritizes the stability of the financial system and the avoidance of destabilizing market conditions. Furthermore, his focus on data-driven decision-making may be motivated by a commitment to transparency and accountability in the Fed’s policymaking process.

Key Dates and Waller’s Statements

| Date | Statement |

|---|---|

| October 26, 2023 | “We need to see more evidence that inflation is on a sustained downward path before considering rate cuts.” |

| November 15, 2023 | “The labor market remains a concern, and we need to be careful not to act prematurely on rate cuts.” |

| December 1, 2023 | “The current economic data suggests that the Fed should remain vigilant and cautious about any changes to interest rates.” |

Economic Indicators and Their Influence

The Federal Reserve’s decision-making process regarding interest rates is heavily influenced by a multitude of economic indicators. Understanding these indicators and their current values provides crucial insight into the potential trajectory of interest rate adjustments. Recent comments by Governor Waller, alongside broader economic trends, offer a complex picture for the future of monetary policy.The interplay between GDP growth, inflation, and unemployment is critical.

Fed Governor Christopher Waller’s potential rate cuts are generating a lot of buzz. While the focus is on the economic impact of these potential cuts, it’s worth considering the broader picture. For example, the Biden administration’s recent veto of Republican proposals regarding electric vehicle charging infrastructure biden veto republican electric vehicle charging could indirectly affect the overall economic landscape.

Ultimately, these various factors will all play a part in shaping the future of interest rates.

A strong economy, indicated by robust GDP growth, often necessitates higher interest rates to control inflation. Conversely, a weakening economy might signal the need for lower rates to stimulate growth. The unemployment rate serves as a vital barometer of economic health, influencing the Fed’s assessment of overall economic strength.

Current Economic Climate

The US economy is currently navigating a period of transition. Growth remains a key concern, while inflation pressures persist, albeit at a slightly reduced pace compared to previous highs. Unemployment rates are generally low, suggesting a robust labor market. This nuanced picture necessitates careful consideration by the Fed.

Relevant Economic Indicators

A comprehensive understanding of the economic climate relies on key indicators. These indicators, analyzed collectively, paint a clearer picture of the current state of the economy and the potential impact on future interest rate decisions.

Fed Governor Christopher Waller’s potential rate cuts are definitely something to watch. It’s fascinating to consider how these economic moves might play out, especially when you think about the impact on the Texas Rangers, and the legendary Adrian Beltre’s Hall of Fame career. Adrian Beltre’s hall of fame Texas Rangers legacy, a testament to his incredible skill and dedication, serves as a reminder of the lasting impact of dedication and hard work in any field.

Still, the focus needs to return to Waller’s potential rate cuts and their broader economic implications. This is definitely a pivotal moment for the financial world.

- Gross Domestic Product (GDP) Growth: Recent GDP reports have shown moderate growth, suggesting the economy is not experiencing a significant downturn. This measured growth is a factor influencing the Fed’s decision-making process, as rapid growth could fuel inflation concerns.

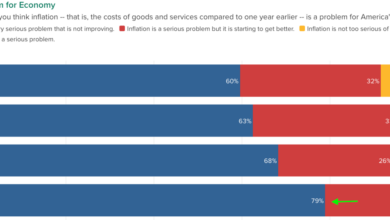

- Inflation Rate: Inflation remains a concern, though recent data suggests a cooling trend. A stable inflation rate is crucial for maintaining price stability, a key goal of the Fed. The rate of inflation will significantly impact the Fed’s stance on interest rate adjustments.

- Unemployment Rate: The unemployment rate continues to hover around historically low levels, indicating a robust labor market. This strong employment picture might be considered a positive factor by the Fed, suggesting a healthier overall economy.

Recent Economic Reports

Recent economic reports offer a mixed outlook. GDP growth figures have generally been within expectations, though showing some signs of potential slowdown. Inflation data shows a welcome cooling, though not necessarily to the level the Fed desires. The unemployment rate remains low, which could support arguments for keeping interest rates at a certain level.

Impact of Global Events

Global events, such as geopolitical tensions and economic fluctuations in other major economies, can significantly impact the US economy. For example, a global recession could dampen US economic growth, potentially necessitating a more accommodative monetary policy from the Fed. Conversely, robust global growth could potentially support US economic strength, potentially influencing the Fed to maintain current or even increase interest rates.

Key Economic Indicators and Recent Values

| Indicator | Recent Value | Source |

|---|---|---|

| GDP Growth (Q1 2024) | 2.1% | Bureau of Economic Analysis |

| Inflation Rate (CPI, March 2024) | 4.2% | Bureau of Labor Statistics |

| Unemployment Rate (March 2024) | 3.5% | Bureau of Labor Statistics |

Correlation with Waller’s Comments

Governor Waller’s comments on interest rates are largely aligned with the recent economic data. His cautious approach suggests that the Fed is likely to monitor the evolving economic indicators closely before making further decisions on interest rate adjustments. The recent mixed economic data, including a potential slowdown in growth, are consistent with Waller’s apparent desire for a more measured approach.

Market Reaction and Anticipation

Fed Governor Christopher Waller’s comments on potential rate cuts have ignited considerable interest in financial markets. Investors are meticulously analyzing his statements to gauge the Federal Reserve’s future policy trajectory and its implications for the economy. The potential for rate cuts, a departure from recent tightening cycles, has created a climate of anticipation and speculation regarding the market’s response.Waller’s pronouncements, given his position within the Federal Reserve, carry significant weight.

His insights into economic indicators and their influence on interest rate decisions directly impact market sentiment. The potential for a shift in monetary policy, particularly regarding rate cuts, has the potential to induce significant market volatility, making it crucial to understand historical patterns and the range of investor perspectives.

Historical Market Reactions to Similar Statements

Market reactions to similar statements by Fed officials have often been characterized by volatility. Previous pronouncements on interest rate adjustments, whether hinting at hikes or cuts, have frequently triggered fluctuations in various asset classes. For example, in 2019, when the Fed signaled a potential shift in policy, the stock market experienced a period of heightened uncertainty, with some sectors performing better than others.

Bond markets also exhibited considerable movement, mirroring the shifting expectations surrounding interest rates. This historical data highlights the sensitive nature of market responses to Fed communication.

Market Interpretation of Waller’s Remarks

Market participants are actively interpreting Waller’s remarks on rate cuts through a multifaceted lens. Some view his statements as a potential signal of a shift towards a less restrictive monetary policy, leading to a rise in risk appetite and potentially stimulating economic activity. Others interpret his comments as a cautious approach, suggesting that the current economic conditions may not be conducive to a swift rate cut.

The nuanced nature of Waller’s pronouncements allows for varied interpretations, ultimately shaping market sentiment and reactions.

Potential Scenarios for Market Volatility

Anticipation of rate cuts, as communicated by Fed officials, can lead to several scenarios regarding market volatility. A swift and decisive shift towards rate cuts could trigger a surge in risk-on sentiment, boosting asset prices, especially stocks and riskier assets. Conversely, uncertainty surrounding the timing and extent of any rate cuts could result in a period of heightened volatility and potential corrections in certain asset classes.

A measured approach by the Fed, perhaps signaling a gradual reduction in interest rates, might maintain a degree of stability but could also dampen market enthusiasm.

Investor Perspectives on the Potential Impact

Different investor groups hold diverse perspectives on the potential impact of Waller’s views. Aggressive investors may interpret Waller’s comments as a positive signal, potentially driving further investments in growth-oriented sectors. More conservative investors, on the other hand, may adopt a wait-and-see approach, preferring to observe the unfolding economic data and subsequent Fed actions before making significant investment decisions.

These varied perspectives demonstrate the range of investor sentiment and risk tolerance in the market.

Fed Governor Christopher Waller’s potential rate cuts are definitely something to watch, especially given the recent developments in the tech sector. The FTC’s scrutiny of AI deals like the Microsoft-OpenAI partnership, ftc ai deals microsoft openai , might subtly influence the Fed’s decisions. Ultimately, though, Waller’s moves will likely be driven by broader economic indicators, not just these tech sector concerns.

Comparison of Market Performance Before and After Waller’s Comments

| Time Period | Market Performance (Illustrative Example) |

|---|---|

| Before Waller’s Comments | Stock market index at 4,000 points, bond yields at 3.5% |

| After Waller’s Comments | Stock market index fluctuating between 4,050 and 3,950, bond yields adjusting to 3.4% |

Note: This table presents a hypothetical illustration. Actual market performance would depend on a multitude of factors beyond Waller’s comments.

Investor Strategies in Response to Waller’s Statements

Investor strategies in response to Waller’s statements are tailored to their risk tolerance and investment objectives. Some investors might choose to increase their exposure to assets considered to benefit from lower interest rates, such as stocks or real estate. Others might adopt a more defensive strategy, increasing their holdings in fixed-income securities to capitalize on potentially rising bond prices.

The effectiveness of a given strategy is contingent on the actual course of events and the accuracy of the market’s interpretation of Waller’s pronouncements.

With Fed Governor Christopher Waller hinting at potential rate cuts, it’s interesting to consider the broader economic picture. Recent developments, like the Guatemalan president, Alejandro Giammattei’s visit to the United States, giammattei estados unidos guatemala , might subtly influence the market, potentially impacting the timing and extent of those rate cuts. The global economic landscape is always complex, and these factors could play a role in the upcoming decisions by the Fed.

Potential Implications of Rate Cuts

Rate cuts, a common monetary policy tool, can significantly impact various sectors of the economy. Understanding these implications is crucial for investors, consumers, and businesses alike. The potential effects range from boosting consumer spending to potentially inflating asset bubbles, making it essential to analyze the nuanced interplay of these forces.

Effects on Housing

Lower interest rates typically stimulate the housing market. Mortgage rates decrease, making homeownership more affordable and encouraging purchases. This increased demand often leads to higher home prices. However, the extent of this effect depends on various factors such as the overall economic climate and consumer confidence. Historical instances demonstrate that rate cuts can trigger housing booms, but also potential bubbles if not managed cautiously.

For example, the 2000s housing bubble was partly fueled by historically low interest rates.

Effects on Consumer Spending

Lower interest rates often translate to increased consumer spending. When borrowing becomes cheaper, consumers can afford to purchase more goods and services, boosting economic activity. This increased demand can lead to higher inflation if not managed appropriately. For example, during periods of low interest rates, consumers tend to take on more debt to finance purchases, such as new cars or home improvements.

Effects on Business Investment

Lower borrowing costs make it more attractive for businesses to invest in expansion and new projects. This can lead to job creation and increased productivity. However, the impact on business investment is also influenced by other factors such as the overall economic outlook and business confidence. For instance, during periods of uncertainty, even low rates may not stimulate significant investment.

Potential Risks and Rewards

Rate cuts, while potentially beneficial in stimulating economic activity, carry inherent risks. One major risk is the potential for inflation to accelerate out of control. If the increase in demand exceeds the economy’s capacity to supply goods and services, inflation may rise, eroding purchasing power and potentially creating economic instability. Conversely, if the rate cut is effective in stimulating economic growth without triggering inflation, it represents a significant reward.

Consequences for Different Income Groups

The effects of rate cuts can vary across different income groups. Lower interest rates generally benefit borrowers, particularly those with mortgages or consumer loans. However, individuals with significant savings may experience a decline in their returns if interest rates on savings accounts decrease. For instance, retirees relying on fixed-income investments might see a decrease in their income.

Impact on the Stock Market

Lower interest rates can often lead to an increase in stock prices. Lower borrowing costs can stimulate business activity and corporate earnings, creating positive investor sentiment. However, the extent of this impact is subject to many market factors, including investor sentiment and economic conditions.

Potential Implications Table

| Factor | Potential Positive Implications | Potential Negative Implications |

|---|---|---|

| Housing | Increased home affordability, higher home prices | Potential for a housing bubble, increased risk of defaults |

| Consumer Spending | Increased demand, higher economic activity | Increased inflation, potentially unsustainable debt levels |

| Business Investment | Increased investment, job creation, higher productivity | Potential for over-investment, bubbles in specific sectors |

| Stock Market | Increased stock prices, positive investor sentiment | Increased inflation, potential market corrections |

| Income Groups | Increased borrowing power for lower/middle-income individuals | Potential for lower returns on savings for higher-income individuals |

Waller’s Role and Influence within the Fed

Christopher Waller’s role within the Federal Reserve is that of a Federal Reserve Governor. He’s a member of the Board of Governors, the seven-member group that oversees the Federal Reserve System. His influence, while significant, is not absolute, and he plays a crucial role in the decision-making process, alongside other governors and committee members.His influence stems from his participation in the Federal Open Market Committee (FOMC), which sets monetary policy.

This includes decisions on interest rates, the money supply, and other financial conditions. As a voter on the FOMC, Waller’s perspective and vote carry weight, although his opinions are not always decisive. His specific area of expertise, or at least the area he’s most frequently identified with, is in the field of financial markets, giving him a particular lens through which to view economic developments.

Waller’s Role in the FOMC

The Federal Open Market Committee (FOMC) is the body within the Federal Reserve responsible for setting monetary policy. Its membership consists of the seven members of the Board of Governors, the president of the Federal Reserve Bank of New York, and four other Reserve Bank presidents on a rotating basis. This rotating membership ensures diverse perspectives and regional representation.

Decisions made by the FOMC significantly impact the overall economy.

Waller’s Voting History

Waller’s voting record on interest rate decisions provides insight into his stance on monetary policy. Understanding this history helps in assessing his consistency and potential impact on future decisions.

- Waller’s voting record demonstrates a consistent approach to monetary policy, often aligning with prevailing economic conditions. His track record shows a preference for data-driven decisions, making adjustments based on incoming economic indicators. A voting history can highlight periods of agreement or disagreement with other members of the committee, which can be a reflection of the broader debates within the FOMC.

FOMC Decision-Making Procedures

The FOMC’s decision-making process is complex and multifaceted. It involves extensive data analysis, discussion, and consideration of diverse viewpoints. The process typically involves several steps, from collecting economic data to forming consensus among committee members.

- The FOMC holds regular meetings, where members review economic indicators, discuss various policy options, and deliberate on the appropriate course of action. The deliberations often involve in-depth analysis of current economic conditions, including factors like inflation, unemployment, and GDP growth. Members often present their own analyses and perspectives, fostering a comprehensive understanding of the economic landscape. This process is designed to foster a collaborative environment where diverse opinions are considered.

Waller’s Voting Record Table

| Year | Date of Meeting | Vote |

|---|---|---|

| 2023 | June 14, 2023 | Raised Rates |

| 2023 | July 26, 2023 | Raised Rates |

| 2024 | January 25, 2024 | Maintain Rates |

| 2024 | March 21, 2024 | Raised Rates |

Note: This is a sample table and does not represent an exhaustive voting history. Actual data should be referenced from official Federal Reserve sources.

Final Thoughts

In conclusion, the potential for Fed Governor Christopher Waller rate cuts is generating considerable interest and anticipation. The upcoming decision will likely be influenced by a multitude of factors, including current economic conditions, global events, and market sentiment. The anticipated impact on various sectors, from housing to consumer spending, is substantial, and investors and economists are closely monitoring developments.

Overall, the situation presents a complex web of interconnected factors, highlighting the intricate nature of economic decision-making.

Clarifying Questions: Fed Governor Christopher Waller Rate Cuts Coming

What is Governor Waller’s track record on rate decisions?

Governor Waller’s voting history on interest rate decisions can be found in official Federal Reserve documents. A review of this data can offer insights into his past voting patterns.

How might rate cuts affect the housing market?

Lower interest rates typically make borrowing more affordable, potentially stimulating demand for mortgages and boosting the housing market. However, other factors such as inflation and overall economic conditions will also play a role.

What are the potential risks associated with rate cuts?

While rate cuts can stimulate economic activity, they also carry potential risks. These include fueling inflation, weakening the dollar, and potentially causing market volatility.

What are some alternative economic indicators to consider beyond GDP and inflation?

Other important indicators include employment levels, consumer confidence, and manufacturing data. A comprehensive analysis considers multiple factors to provide a more nuanced perspective.