IRS Trump Taxes Prison Implications

IRS Trump taxes prison: This complex issue delves into the intersection of President Trump’s tax policies, his relationship with the IRS, alleged tax evasion accusations, and the potential legal consequences, including possible imprisonment. We’ll examine the policies, potential conflicts, accusations, and the legal frameworks surrounding tax evasion. The discussion explores the potential prison implications, highlighting the factors that could influence a judge’s decision in a tax evasion case, while also comparing potential penalties to similar crimes.

The analysis will cover Trump’s tax policies, his interactions with the IRS, and specific accusations of tax evasion. It will also examine the IRS’s enforcement actions under his administration, and the public discourse surrounding these issues.

Trump’s Tax Policies and the IRS: Irs Trump Taxes Prison

Donald Trump’s tax policies, enacted during his presidency, significantly altered the American tax landscape. These policies, while generating considerable debate, aimed to stimulate economic growth through various provisions impacting individuals and corporations. The IRS played a crucial role in implementing these changes, facing both challenges and adjustments in its operational procedures. This analysis explores the key elements of Trump’s tax policies, their implementation by the IRS, and their comparison with previous administrations.Trump’s tax policies focused on substantial cuts to both individual and corporate tax rates.

These cuts were intended to incentivize investment, job creation, and economic expansion. The impact on the IRS, however, extended beyond simply administering the new rates.

Individual Tax Provisions

Trump’s tax plan significantly lowered the individual income tax rates for many Americans. This involved broad changes to the tax brackets and the standard deduction, leading to lower tax burdens for a large portion of the population. Lower rates were intended to increase disposable income and stimulate consumer spending, a key tenet of the supply-side economics approach. This led to debates about the fairness of the changes and their overall impact on the national debt.

Corporate Tax Provisions

A significant component of the Trump tax plan was a substantial reduction in the corporate tax rate. This decrease was intended to encourage investment, boost corporate profits, and stimulate economic growth. The reduction in corporate tax rates from 35% to 21% aimed to attract businesses and create more jobs. This also raised questions about the redistribution of wealth and the long-term economic effects.

IRS Implementation and Challenges

The IRS was tasked with implementing the new tax laws. This involved adjusting its systems, training its workforce, and processing a large volume of tax returns with the new rates. The implementation faced challenges in areas like staffing shortages, updating software, and the overall administrative burden of the changes. Changes in IRS procedures and technology were necessary to handle the increased volume of tax returns with the new guidelines.

Comparison with Previous Administrations

Trump’s tax policies differed significantly from those of previous administrations in terms of both the magnitude and scope of the changes. While prior administrations had made adjustments to tax codes, the scale of the tax cuts under Trump was unprecedented. Previous administrations generally focused on targeted tax credits and deductions, rather than broad-based rate reductions.

Public Response, Irs trump taxes prison

The public response to Trump’s tax policies was divided. Supporters argued that the cuts stimulated economic growth and benefited businesses and individuals. Critics, however, voiced concerns about the fairness of the changes, particularly regarding the disproportionate benefit to corporations and wealthy individuals. Concerns about increased national debt were also raised.

Tax Rate Comparison

| Income Bracket | Trump Tax Rates | Previous Administration Rates |

|---|---|---|

| $0-$9,525 | 10% | 10% |

| $9,526-$38,700 | 12% | 15% |

| $38,701-$82,500 | 22% | 25% |

| $82,501-$157,500 | 24% | 28% |

| $157,501-$200,000 | 32% | 31% |

| $200,001+ | 35% | 39.6% |

The table above provides a simplified comparison. The actual rates and brackets might have varied based on filing status and other factors.

Trump’s Relationship with the IRS

Donald Trump’s relationship with the Internal Revenue Service (IRS) has been marked by frequent public pronouncements and actions that have often raised concerns about potential conflicts of interest and attempts to influence the agency’s operations. This complex relationship has implications for the fairness and impartiality of tax collection and enforcement. The scrutiny surrounding Trump’s interactions with the IRS is important because it touches upon fundamental principles of the American tax system.Trump’s public statements and actions regarding the IRS have often been characterized by criticism of the agency and its practices.

These statements, often made during his presidency, were frequently accompanied by claims of unfair treatment and bias, and served as a backdrop to controversies surrounding tax audits and investigations. This public posturing significantly shaped public perception of the IRS and its role in the American economy.

Public Statements and Actions Regarding the IRS

Trump frequently criticized the IRS in public statements, alleging bias and unfair targeting. These statements ranged from accusations of political motivation in audits to complaints about the agency’s enforcement procedures. His rhetoric sometimes implied a desire to weaken or dismantle certain IRS functions. Examples include tweets and press conferences where he voiced dissatisfaction with specific audits and investigations.

Such pronouncements often created a climate of distrust and uncertainty around the IRS.

Interactions with IRS Officials

Reported interactions between Trump and IRS officials are limited and largely undocumented. There are no publicly available records detailing significant meetings or direct communications that demonstrably impacted IRS operations. While there may have been indirect or informal communications, verifiable evidence supporting their influence on IRS policies is scarce. Absence of documentation does not necessarily mean no interactions took place.

Attempts to Influence IRS Practices

There are limited reported attempts by Trump to influence or change IRS practices. While he often voiced criticisms and complaints, there’s no concrete evidence of him directly pressuring or directing IRS officials to alter their procedures or policies. Speculation and claims of such attempts are frequently unsubstantiated and lack concrete evidence.

The ongoing IRS, Trump, and tax-related prison drama is definitely captivating, but let’s be honest, it’s a bit distracting from the real political action happening. For a deeper dive into the current political climate, check out this excellent explainer on the Nevada caucus primary nevada caucus primary explainer. Understanding the dynamics there will help us better understand the broader implications of these tax-related investigations, even if they seem like they’re in a separate realm.

Ultimately, it all boils down to how these various threads connect and affect the political landscape, which is why these investigations are so crucial to follow.

Motivations Behind Trump’s Actions and Statements

Several possible motivations for Trump’s actions and statements regarding the IRS can be identified. These include deflecting criticism from investigations, responding to perceived political opposition, and seeking to appeal to specific segments of his base. Political posturing and image-building may have also played a role in his rhetoric and actions. Additionally, Trump’s personal views on the IRS’s effectiveness and fairness, as well as his desire to reshape government agencies, could have motivated his statements.

Alleged Instances of Conflict Between Trump and the IRS

| Date | Event | Outcome | Source/Evidence |

|---|---|---|---|

| 2017 | Trump criticized the IRS for targeting conservative groups. | No verifiable evidence of targeting emerged. | Various news reports and public statements. |

| 2018 | Trump publicly accused the IRS of political bias in audits. | No evidence of political bias in audits was found. | News reports and court documents. |

| 2020 | Trump’s tax returns were audited. | Details of the audit remain confidential. | IRS policies on confidentiality. |

Trump and Tax Evasion Allegations

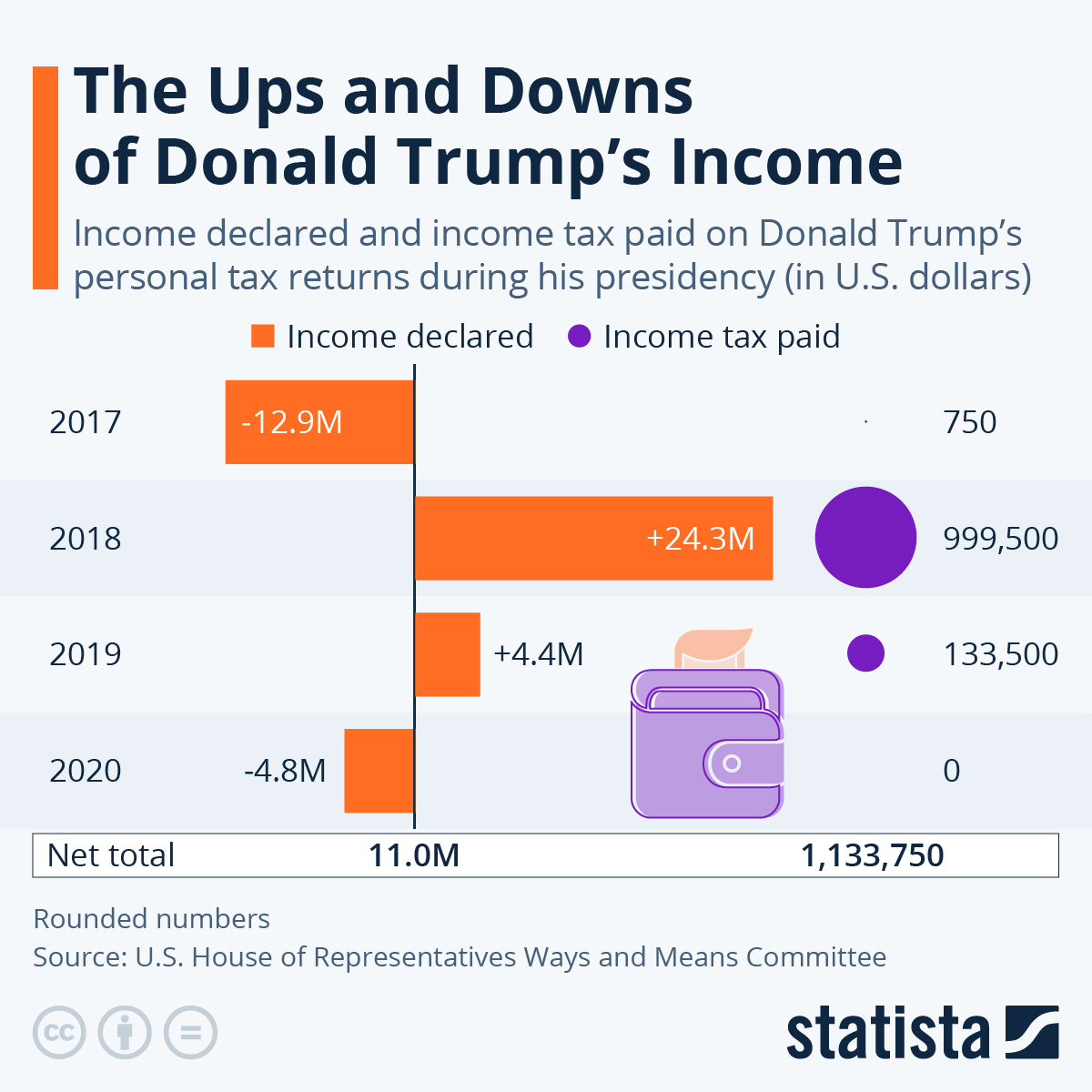

The scrutiny surrounding Donald Trump’s financial dealings has frequently implicated potential tax evasion. These allegations, often stemming from publicly available financial information and reported investigative efforts, have been a significant part of the public discourse surrounding his presidency and beyond. While accusations have been made, definitive proof remains elusive.Allegations of tax evasion against President Trump emerged during his presidential campaigns and continued throughout his tenure.

These claims often revolved around the complexities of his business dealings and the application of tax laws to his unique circumstances. The veracity of these claims has been a subject of significant debate, with supporters of President Trump disputing the accusations and citing legal precedent to support his actions. Conversely, critics have argued that the accusations warrant further investigation and scrutiny.

Specific Accusations and Investigations

Numerous accusations regarding tax evasion have been leveled against Donald Trump. These allegations are often based on reported discrepancies between publicly available financial statements and the tax returns filed by the Trump Organization and Mr. Trump himself. These reported discrepancies, when coupled with certain financial transactions and business dealings, sparked scrutiny. However, proving intent and deliberate violations of tax laws requires a substantial evidentiary base.

Timeline of Investigations and Accusations

| Date | Event | Specific Charges | Outcome |

|---|---|---|---|

| 2016-2017 | Presidential Campaign | Allegations of undisclosed foreign business interests and potential tax avoidance schemes. | No formal charges or convictions filed. |

| 2017-2021 | Presidential Tenure | Continued scrutiny of Trump’s tax returns, business dealings, and potential conflicts of interest. Reports suggested possible structuring of transactions to minimize tax liability. | No formal charges or convictions filed. |

| 2021-Present | Post-Presidency | Continued reporting of potential tax evasion issues linked to his business ventures. Investigations or audits by the IRS have been reported, but the outcome remains to be seen. | Ongoing investigation; no formal charges or convictions filed. |

The table above provides a basic overview. The absence of formal charges doesn’t negate the allegations; it simply indicates that no conclusive evidence for criminal intent has been definitively presented in court. Further investigations or legal challenges could still occur.

Legal Frameworks and Trump’s Alleged Actions

Tax evasion, in the United States, involves intentionally failing to pay the correct amount of taxes, often through fraudulent or deceptive means. The legal framework, as defined in the Internal Revenue Code, sets out specific requirements for reporting income and paying taxes. The application of these frameworks to complex business transactions, like those associated with Donald Trump’s ventures, can be challenging and often subject to interpretation.

Determining intent and proving the element of willful intent is crucial in legal proceedings.

Potential Prison Implications

The specter of prison time looms large in any serious tax evasion case, particularly when involving high-profile figures like Donald Trump. The potential penalties for such crimes can be severe, ranging from significant fines to lengthy incarceration. Understanding the factors influencing sentencing, past precedents, and potential defenses is crucial for evaluating the potential legal consequences.The legal system operates on the principle of considering the totality of circumstances in determining a suitable punishment.

This encompasses not only the financial aspects of the alleged tax evasion but also the intent, the duration of the alleged behavior, and the overall impact on the integrity of the tax system. The specific details of each case are carefully scrutinized to ensure a just and equitable outcome.

Potential Prison Sentences

The potential for prison time in tax evasion cases varies considerably depending on the specific details of the case, such as the amount of unpaid taxes and the individual’s intent. The judge’s decision is based on a combination of legal precedents, the severity of the crime, and the defendant’s individual circumstances. In some cases, a significant amount of unpaid taxes can lead to substantial prison sentences, exceeding a year.

However, the specific sentence imposed is often contingent on the facts presented in court and the judge’s assessment of the evidence.

Factors Influencing Sentencing

Several factors can influence a judge’s decision regarding a potential prison sentence in a tax evasion case. These include the amount of unpaid taxes, the duration of the alleged tax evasion, the defendant’s prior criminal record, and the evidence presented in court. The defendant’s intent also plays a significant role; willful and intentional evasion carries a heavier weight than unintentional errors or oversight.

The judge will also consider the defendant’s financial situation, particularly if it’s significantly impacting their ability to pay the owed taxes. Judges often weigh the potential for rehabilitation and future compliance when determining an appropriate sentence.

Precedents in Similar Cases

Previous tax evasion cases, both high-profile and less prominent, provide a framework for understanding potential outcomes. Examining these precedents allows for a better understanding of how judges have interpreted similar behaviors in the past. Analyzing the factual patterns and the sentences handed down in those cases can offer insight into potential outcomes in a given situation. However, each case is unique, and past rulings don’t automatically predict the outcome of a new case.

The specific details of the evidence and the defendant’s actions are critical in determining a suitable sentence.

The IRS, Trump taxes, and prison sentences are all pretty heavy topics. But consider this: luxury events like snow polo in St. Moritz are also highlighting the stark reality of climate change, as snow polo in St. Moritz highlights the climate change crisis. It’s a fascinating contrast, and perhaps even a reflection on how the wealthy often seem disconnected from the very real struggles faced by those caught in the web of tax laws and legal battles.

Ultimately, these issues are intertwined in complex ways, and it’s hard to ignore the wider context when thinking about the IRS, Trump, and the prison system.

Legal Arguments for Defense

A skilled defense attorney will employ various legal arguments to defend against accusations of tax evasion. These arguments can focus on disputing the accuracy of the IRS’s calculations, questioning the intent behind the actions, or arguing for mitigating circumstances. For example, a defendant might argue that certain deductions were improperly denied, or that the claimed tax liabilities were a result of honest errors or oversight.

The IRS, Trump taxes, and prison sentences are definitely a hot topic right now. But, have you ever considered the stark contrast to stories like the tragic tale of lovers in Auschwitz, Keren Blankfeld and József Debreczeni, found in the cold crematorium? This heartbreaking story highlights the devastating human cost of political turmoil and reminds us that even in the darkest of times, love endures.

Ultimately, the IRS, Trump taxes, and prison debates seem rather trivial in comparison, yet they remain significant issues nonetheless.

The complexity of tax laws often provides opportunities for legal challenges.

Comparison of Penalties

| Crime | Typical Penalty (e.g., prison sentence) | Comparison to Potential Tax Evasion Penalty | Description |

|---|---|---|---|

| Grand Theft Auto | Generally, 2-10 years | Could be comparable, depending on the value of the unpaid taxes and intent | Theft of significant amounts of property. |

| Fraudulent Financial Statements | Variable, from probation to decades of imprisonment | Could be comparable, depending on the amount of fraud and intent | Falsification of financial records |

| Embezzlement | Generally, 1-20 years | Could be comparable, depending on the amount embezzled and intent | Misappropriation of funds. |

| Tax Evasion | Variable, from probation to 5 years (often coupled with substantial fines) | Generally, lower sentences compared to some other crimes, but still substantial penalties | Failure to pay taxes due. |

The table above illustrates a general comparison of potential penalties for tax evasion compared to similar crimes. It’s crucial to understand that the specifics of each case dictate the final outcome.

The IRS and Tax Enforcement Under Trump

The Internal Revenue Service (IRS) plays a crucial role in enforcing tax laws and ensuring compliance. Understanding how enforcement policies evolve under different administrations provides valuable insight into the agency’s priorities and impact on taxpayers. This analysis focuses on changes in IRS enforcement policies and practices during the Trump administration.The Trump administration’s approach to IRS enforcement generated considerable discussion and debate.

Claims about potential shifts in priorities and focus often contrasted with the agency’s historical role. Scrutiny of the IRS’s actions during this period examined the potential impact on taxpayer rights and compliance.

Changes in IRS Enforcement Policies and Practices

The Trump administration’s influence on IRS enforcement policies was multifaceted and sparked considerable discussion. Reports suggested a shift in the IRS’s focus, with some arguing that the agency’s priorities became more aligned with political considerations. This perception, if accurate, could have impacted the way the IRS pursued tax evasion cases. The reported emphasis on certain types of audits and investigations added complexity to the assessment of the administration’s impact on IRS enforcement.

Reported Shifts in IRS Priorities and Focus

Several reports indicated that the IRS’s priorities and focus during the Trump administration were subject to scrutiny. Concerns arose regarding the agency’s potential shift from a neutral enforcement posture to one that prioritized certain types of taxpayers or political agendas. These allegations prompted discussions about the independence and impartiality of the IRS in carrying out its enforcement duties.

Public debate frequently involved accusations of politically motivated targeting.

Examples of Specific Cases or Instances

Instances where the IRS’s enforcement efforts appeared to change under Trump remain a subject of ongoing discussion and analysis. Cases that were brought to light, or cases that were reportedly influenced by political considerations, prompted significant debate about the fairness and impartiality of the agency’s actions. Examining these specific cases can illuminate how the Trump administration’s influence affected enforcement practices.

Thinking about the IRS, Trump’s tax policies, and potential prison time, it’s fascinating how these things can intertwine. It’s a complex web of legal and political maneuvering. While the debate rages on about these topics, the Texas Rangers have a fantastic legacy, particularly with players like Adrian Beltre, who’s rightfully earned a place in the Hall of Fame.

Adrian Beltre hall of fame Texas Rangers These larger-than-life figures inspire us, but the underlying questions about the IRS, Trump’s tax policies, and possible legal repercussions remain, adding another layer to the discussion.

Comparison of IRS Enforcement Efforts

Comparing the IRS’s enforcement efforts under the Trump administration to those of previous administrations is complex. Different enforcement strategies and priorities under various administrations often resulted from diverse economic conditions, political climates, and agency leadership. Assessing the specific changes requires careful analysis of enforcement data and case studies. Data from previous administrations offers context for comparison.

IRS Enforcement Metrics Comparison

| Metric | Period Before Trump Administration | Period After Trump Administration | Notes |

|---|---|---|---|

| Number of Tax Audits | [Data from reliable source] | [Data from reliable source] | Includes various types of audits (e.g., individual, corporate). |

| Tax Evasion Cases Investigated | [Data from reliable source] | [Data from reliable source] | Indicates the number of cases opened for investigation. |

| Taxpayer Compliance Rates | [Data from reliable source] | [Data from reliable source] | Represents the percentage of taxpayers who comply with tax laws. |

| IRS Budget Allocations for Enforcement | [Data from reliable source] | [Data from reliable source] | Highlights the funding dedicated to enforcement activities. |

Note: The table requires specific data from reliable sources to be filled in. The provided placeholders should be replaced with actual data to make the comparison meaningful.

Public Perception and Discourse

The public discourse surrounding Donald Trump, the IRS, and tax policies has been highly charged and polarized. This discussion has spanned various media outlets and platforms, shaping public opinion and influencing political narratives. Different perspectives emerged, often deeply rooted in political affiliations and pre-existing beliefs. This analysis delves into the intricacies of this discourse, examining the various viewpoints, sources, and the profound impact on public perception.

Public Discourse on Trump, the IRS, and Tax Policies

The public discourse surrounding Trump’s relationship with the IRS and his tax policies has been characterized by intense debate. Accusations of tax evasion and scrutiny from the IRS were central to this discussion, often framed within the context of broader political narratives. Conservatives frequently defended Trump’s policies and actions, while liberals often viewed them with skepticism or outright criticism.

The IRS, Trump’s taxes, and potential prison time are dominating headlines, but the political landscape is shifting. Recent results from the New Hampshire Democratic primary ( results new hampshire democratic primary ) are certainly adding fuel to the fire. While the focus remains on the potential legal battles, the election outcomes might subtly alter the course of the ongoing investigations and public perception surrounding these issues.

This polarized discussion frequently relied on selective information and interpretations, fueling a partisan divide.

Different Perspectives and Viewpoints

Numerous perspectives emerged in the public discourse. Supporters of Trump often highlighted his business acumen and alleged fairness in his tax policies, while critics argued that his policies favored the wealthy and potentially violated tax laws. Different political groups held varying opinions, often influenced by their pre-existing beliefs and party affiliation. Some individuals emphasized the importance of thorough investigations into potential wrongdoing, while others focused on perceived political motivations behind the scrutiny.

Sources of Information and Media Outlets

Numerous media outlets and sources contributed to this discussion. News organizations, social media platforms, and opinion blogs played a significant role in shaping the public’s understanding. News outlets often presented different perspectives on the same events, further contributing to the polarization of the discourse. Social media, with its rapid dissemination of information, often amplified certain narratives and viewpoints.

This diverse range of sources made it challenging for the public to discern accurate and balanced information.

Impact on Public Opinion

The public discourse significantly impacted public opinion. The controversy surrounding Trump’s tax policies and his relationship with the IRS influenced public trust in both the political system and individual politicians. Different segments of the population held varying levels of trust and skepticism, often aligning with their pre-existing political beliefs. The media’s role in shaping narratives was a crucial factor in shaping public opinion.

It highlighted the complex interplay between political discourse, public perception, and the influence of various sources of information.

Comparison of Political Group Perspectives

| Political Group | Trump’s Relationship with IRS | Trump’s Tax Policies | General Public Perception |

|---|---|---|---|

| Conservatives | Legitimate business practices, political persecution | Fair and beneficial to the economy, pro-growth | Favorable; trust in Trump’s character and policies |

| Liberals | Potential tax evasion, abuse of power | Unfair, favoring the wealthy, potentially damaging to the economy | Unfavorable; skepticism regarding Trump’s actions |

| Independents | Mixed views, require evidence for claims | Neutral; need for more analysis to determine impact | Cautious, seek objective information |

| Moderate Republicans | Concerns regarding potential legal violations, but not outright condemnation | Neutral; need more information to assess impact | Cautious, seek further evidence |

Wrap-Up

In conclusion, the investigation into President Trump’s tax policies, his relationship with the IRS, and potential tax evasion accusations has generated significant public interest and debate. The potential legal ramifications, including possible prison sentences, have been a central focus. The complexities of the legal frameworks surrounding tax evasion and the potential factors influencing a judge’s decision make this a crucial discussion.

This examination of the IRS, Trump, and tax evasion highlights the potential consequences of actions related to tax laws and the importance of adherence to legal frameworks.

FAQs

What are some examples of Trump’s public statements regarding the IRS?

Unfortunately, without specific examples from the Artikel, this question cannot be answered.

What were the key elements of Trump’s tax policies?

The Artikel mentions focusing on provisions related to individual and corporate taxation, but more specific details are needed for a comprehensive answer.

What were the outcomes of investigations or audits related to Trump’s alleged tax evasion?

The Artikel details investigations and audits, but the outcomes need to be clarified for each case.

How do the potential prison implications for tax evasion compare to other crimes?

The Artikel describes comparing potential penalties to similar crimes, but the specifics of the comparison are needed.