Capital One Discover What You Need to Know

Capital one discover what to know – Capital One Discover: What to know, delves into the details of this popular credit card, exploring its rewards, features, fees, and more. This comprehensive guide will help you understand the ins and outs of the Capital One Discover card, whether you’re a potential applicant or an existing cardholder.

From its rewards program to the application process, we’ll cover everything you need to make an informed decision about whether or not the Capital One Discover card is right for you. This exploration aims to provide clear and concise information to help you navigate the world of credit cards.

Introduction to Capital One Discover

The Capital One Discover card is a popular choice for consumers seeking a versatile rewards credit card. It’s known for its straightforward rewards program and competitive interest rates, appealing to a wide range of credit card users. This overview delves into the card’s key features, target audience, and historical context.The Discover card is designed to be a practical and accessible option for everyday spending, offering benefits that are relevant to a variety of financial situations.

It’s a strong contender in the market, catering to both new and experienced credit card holders.

Core Offerings of the Capital One Discover Card

The Capital One Discover card provides a straightforward rewards structure, making it easy for users to understand and track their earnings. Points earned can be redeemed for a variety of rewards, including statement credits and travel. The card’s features are typically well-suited for budget-conscious consumers looking for tangible rewards.

Figuring out Capital One Discover is a bit of a minefield, isn’t it? It’s all about rewards, but knowing the ins and outs can be tricky. Meanwhile, Oregon’s stance on daylight saving time oregon daylight saving time is causing some head-scratching for residents, and I bet that impacts their budgeting decisions. Ultimately, though, the best approach to the Capital One Discover card is to thoroughly research the specific benefits and terms to ensure it aligns with your spending habits.

Target Audience for the Capital One Discover Card

The target audience for the Capital One Discover card is quite broad, encompassing individuals and families with diverse financial situations. The card’s simplicity and accessibility make it attractive to those who prioritize straightforward rewards programs and manageable credit card usage. From budget-minded students to professionals looking for a dependable credit card, the Discover card is a popular choice.

Key Benefits of the Capital One Discover Card

The Capital One Discover card offers several compelling advantages, making it a competitive option in the market. Its benefits are generally focused on offering value for daily spending, encouraging responsible financial habits.

- Reward Structure: The card offers a simple rewards structure based on spending, typically awarding points for every dollar spent, which can be redeemed for various rewards. This structure makes it easy to track and manage rewards.

- Flexibility: The rewards can be used for a range of purposes, including statement credits and travel, catering to varied needs and preferences.

- Competitive Interest Rates: The card typically features competitive interest rates, which can help to minimize financial burden for those who may carry a balance from month to month.

Historical Context of the Capital One Discover Card

The Capital One Discover card has evolved over time, adapting to changing consumer needs and market trends. Its introduction marked a significant point in the credit card industry, offering a more straightforward reward structure compared to some existing options. The card has been subject to various updates and improvements to maintain its relevance and competitive standing in the marketplace.

Comparison to Other Credit Cards

The following table provides a comparative overview of the Capital One Discover card against other cards in a similar category. This allows for a more informed understanding of its position in the market.

| Feature | Capital One Discover | Example Card A | Example Card B |

|---|---|---|---|

| Rewards Structure | Points earned on every dollar spent | Tiered rewards based on spending categories | Cash back percentage on specific spending |

| Interest Rate | Competitive, variable rate | Lower fixed rate, but limited rewards | High rewards potential, higher variable rate |

| Annual Fee | Typically no annual fee | Annual fee, but premium benefits | No annual fee, but limited rewards |

| Target Audience | Budget-minded consumers, those seeking flexibility | High-income earners, those seeking premium services | Individuals seeking specific rewards on certain categories |

Rewards and Benefits

Unlocking the potential of your spending is key with the Capital One Discover card. The rewards program is designed to offer value and flexibility, allowing you to earn rewards on everyday purchases. Understanding the intricacies of the program, including how to maximize your earnings and redeem your rewards, is crucial for making the most of your card.

Reward Programs Offered

The Capital One Discover card boasts a straightforward rewards program. Essentially, you earn a percentage back on your purchases, with the specifics depending on the card type. For example, the base Discover card offers a welcome bonus, along with a consistent percentage back on purchases, making it a popular choice for everyday spending.

Redemption Options

Capital One Discover rewards are typically redeemable for cash back, statement credits, or travel. The flexibility in these redemption options is valuable, catering to different spending priorities. For instance, you could choose to receive a statement credit to offset a specific bill or accumulate travel points for future adventures.

Figuring out Capital One Discover is a bit of a minefield, isn’t it? But, understanding the nuances of freezing embryos in Alabama, like in this recent case of alabama frozen embryos children , might help you better understand the importance of reading the fine print. Ultimately, knowing what you’re getting into with Capital One Discover is key to avoiding any surprises.

Limitations and Restrictions

Certain restrictions and limitations apply to the reward program. There might be exclusions on certain types of purchases, or a minimum spending requirement to activate certain rewards. Reviewing the terms and conditions carefully is crucial to avoid any unforeseen circumstances. For instance, some rewards might not apply to purchases made at specific merchants.

Comparison with Competitors

Capital One Discover’s rewards program is comparable to other credit card reward programs. However, the specific benefits and redemption options may vary. Competitors might offer higher earning rates on specific categories, but Discover’s broad application across various spending categories is a significant advantage. For example, one competitor might offer higher rewards on gas purchases, but Discover might offer higher rewards on a broader range of daily purchases.

Reward Categories and Points

| Reward Category | Points Earned Per Dollar Spent |

|---|---|

| Everyday Purchases | 1.5% cash back |

| Select Restaurants and Gas Stations | 2% cash back (in some cases) |

| Travel | Varying percentages, depending on travel purchase categories |

| Balance Transfers | No points are awarded |

This table illustrates the basic reward structure of the Capital One Discover card. Note that specific percentages and categories may change over time, so it’s essential to refer to the official Capital One Discover card website for the most up-to-date information.

Features and Functionality

The Capital One Discover card offers a comprehensive suite of features designed to enhance the user experience and provide added value. Beyond the rewards program, the card boasts a range of protections and benefits that can be extremely helpful in various life situations. This section delves into the key functionalities, from online banking to security measures, providing a complete picture of the card’s practical applications.

Purchase Protection

The Discover card offers various purchase protections, safeguarding consumers against unforeseen circumstances. These protections typically cover instances of unauthorized charges, damaged or lost merchandise, and even offer some assistance with return issues. The specific coverage varies depending on the terms and conditions. Consumers should carefully review the fine print of their card agreement for precise details regarding the extent of these protections.

Travel Insurance

Capital One Discover often includes travel insurance benefits, offering peace of mind during trips. This insurance typically covers medical emergencies, lost luggage, and sometimes trip cancellations. While the exact scope of coverage can differ, these benefits are generally a valuable addition for travelers. Travel insurance details are typically Artikeld in the cardholder agreement.

Online and Mobile Banking

Capital One’s online and mobile banking platforms provide convenient access to account information and transactions. The platform allows users to view statements, make payments, transfer funds, and manage their accounts securely from anywhere with an internet connection. This accessibility and ease of use are crucial for today’s fast-paced lifestyle.

Figuring out Capital One Discover is a bit of a minefield, isn’t it? But, if you’re looking for a fun way to spend your weekend, check out the Subway Weekend in Jose Lasalle, subway weekend jose lasalle. It looks like a great time! Regardless of your weekend plans, learning about the rewards and benefits of the Capital One Discover card is still a worthwhile endeavor.

Account Management and Payments

Managing accounts and making payments online is straightforward on the Capital One platform. Users can log in to their online account, access account statements, and make payments via various methods, such as through online bill pay or direct debit. These options are typically secure and efficient, streamlining the financial management process.

Security Features

Capital One prioritizes security in its online and mobile banking environment. The platform employs robust security measures, including encryption and multi-factor authentication, to protect sensitive financial data. These measures help safeguard user accounts from unauthorized access. This commitment to security is paramount for maintaining user trust.

So, you’re looking to learn more about Capital One Discover? Great! But while you’re researching, did you know that the latest Winthrop poll on the South Carolina primary race, focusing on candidates like Nikki Haley and Donald Trump, winthrop poll haley trump south carolina , might offer some interesting insights into current political trends? Ultimately, understanding the current financial landscape, especially with cards like the Discover, is key.

Table of Features and Benefits

| Feature | Benefit |

|---|---|

| Purchase Protection | Covers unauthorized charges, damaged/lost merchandise, and potential return issues. |

| Travel Insurance | Provides coverage for medical emergencies, lost luggage, and potentially trip cancellations. |

| Online Banking | Facilitates easy access to account information, statements, and transactions from anywhere with an internet connection. |

| Online Payments | Offers convenient methods for paying bills and transferring funds securely. |

| Security Features | Protects sensitive financial data through encryption and multi-factor authentication. |

Fees and Charges

The Capital One Discover card, while known for its generous rewards program, does come with certain fees. Understanding these fees is crucial for making informed financial decisions and ensuring the card aligns with your spending habits. This section will detail all associated fees, provide examples of when they might apply, and compare them to competitor cards.Understanding the terms and conditions surrounding these fees allows you to effectively manage your card usage and avoid unexpected charges.

A proactive approach to fee management is vital for maintaining a positive credit history and achieving your financial goals.

Fee Structure

The Capital One Discover card typically has a few key fees. These fees vary based on factors like your spending habits and creditworthiness. A detailed breakdown is essential for informed decision-making.

- Annual Fee: Some Discover card variants may have an annual fee, which is a fixed amount charged annually for card membership. This fee is typically not charged for the standard Discover card. For example, if the annual fee is $50, you would pay $50 each year to maintain the card.

- Late Payment Fee: A late payment fee is levied when you fail to make your minimum payment by the due date. This fee can vary depending on the amount of the late payment and the specific terms of your agreement. For instance, if your payment is late by a few days, the fee could be $35.

- Foreign Transaction Fee: A fee might be applied to transactions made in foreign currencies. This fee covers the additional costs associated with converting currencies. For instance, if you use your Discover card to buy something in a foreign country, the fee could be 3% of the transaction amount.

- Cash Advance Fee: If you use the card to take out a cash advance, a fee will typically be charged. This fee covers the costs associated with processing the cash advance. For example, a cash advance fee might be 5% of the advance amount.

- Balance Transfer Fee: Some Discover cards offer balance transfer options. However, a balance transfer fee might be charged when you transfer an existing balance from another credit card to your Discover card. This fee might be a percentage of the transferred balance.

Terms and Conditions

The specific terms and conditions regarding fees are Artikeld in the cardholder agreement. This document should be carefully reviewed to understand the details of each fee, including the circumstances under which it might be charged. It is crucial to understand the specifics of each fee and the associated conditions.

Comparison with Competitor Cards

Comparing the Discover card’s fees with those of competitor cards is essential for making a well-informed decision. Factors like annual fees, late payment penalties, and foreign transaction fees should be considered. A comprehensive comparison of fees is necessary for effective evaluation.

| Fee Type | Capital One Discover | Example Competitor Card |

|---|---|---|

| Annual Fee | Typically no annual fee | May have an annual fee of $95 |

| Late Payment Fee | $35 or more | $30 or more |

| Foreign Transaction Fee | May apply | May apply, but rate varies |

| Cash Advance Fee | Typically 5% of the advance amount | Typically 3% of the advance amount |

Account Opening and Management

Getting started with a Capital One Discover card is straightforward and secure. This section Artikels the process for opening an account, managing it effectively, and ensuring your financial information remains protected. We’ll also cover the required documents for account setup, and a step-by-step guide to account activation.

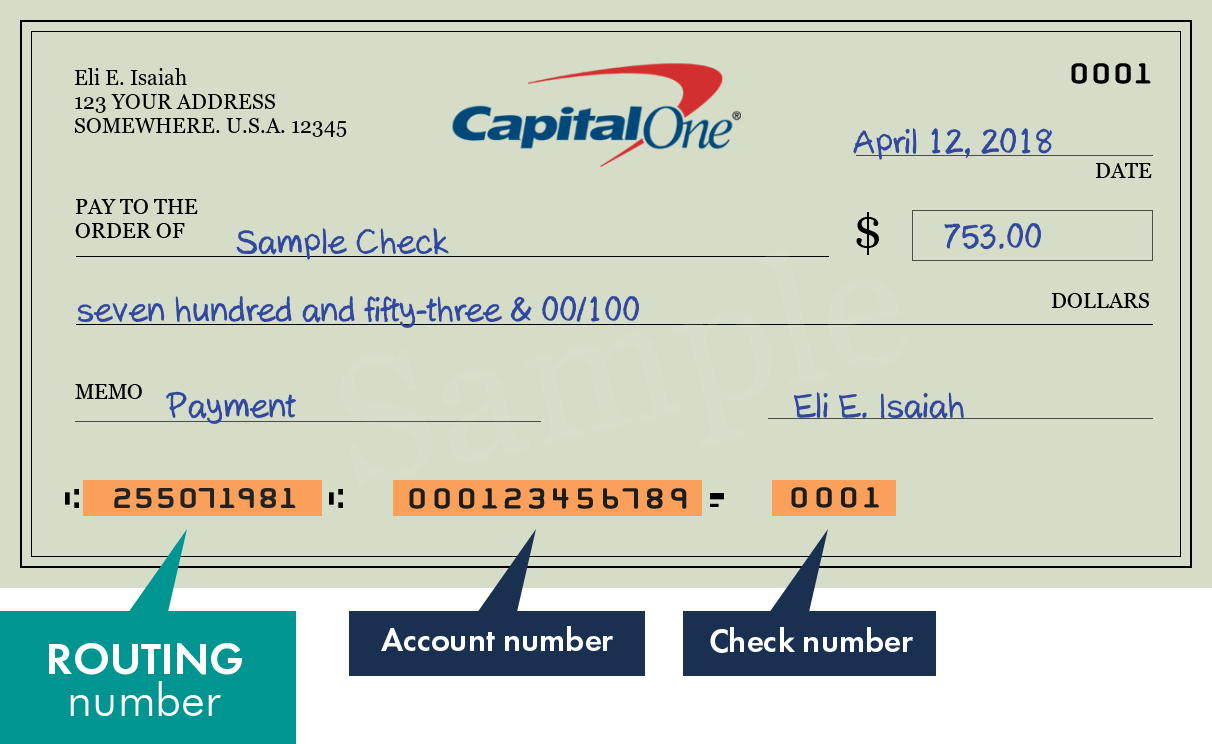

Opening a Capital One Discover Account

The application process for a Capital One Discover card is typically completed online. Visit the Capital One website to initiate the application. You’ll need to provide personal information, including your name, address, social security number, and employment details. Be prepared to answer questions about your financial history and creditworthiness. Thorough completion of the online form is crucial for a smooth application process.

Managing Your Account Online

Managing your Capital One Discover account online offers convenience and control. Once logged in, you can access your account balance, transaction history, and make payments. The online portal provides detailed insights into your spending habits and helps you stay on top of your finances. Features such as setting up alerts for low balances or upcoming payments enhance proactive financial management.

Managing Your Account via Phone

Capital One offers phone support for account management. Customer service representatives can assist with inquiries, address issues, and provide personalized guidance. Phone support is available during specific hours, and it is crucial to check Capital One’s website for the most up-to-date information on support hours.

Account Security Measures

Protecting your Capital One Discover account is paramount. Capital One utilizes robust security measures, including encryption and multi-factor authentication, to safeguard your financial information. You’ll be prompted to create a strong password and may need to verify your identity through additional security checks. These measures help prevent unauthorized access to your account.

Required Documents for Account Opening

To initiate the account opening process, you’ll need to furnish specific documents. These typically include government-issued photo identification, proof of address, and proof of income. The specific requirements may vary depending on your situation. Ensure that the documents you provide are accurate and complete to expedite the account opening process.

- Valid government-issued photo ID (driver’s license, passport, etc.)

- Proof of residence (utility bill, lease agreement, etc.)

- Proof of employment (pay stubs, W-2 forms, etc.)

- Bank statements (if applicable)

Account Opening Process

This table Artikels the typical process from application to account activation.

| Step | Description |

|---|---|

| Application | Complete the online application form, providing accurate and complete information. |

| Verification | Capital One verifies your information and may request additional documents. |

| Credit Check | A credit check is performed to assess your creditworthiness. |

| Account Approval | If approved, you receive an email or notification. |

| Account Activation | Activate your account through the online portal or via phone. |

Customer Service and Support: Capital One Discover What To Know

Navigating financial matters can sometimes feel daunting. Capital One Discover, however, strives to make the customer experience as smooth and straightforward as possible. Understanding the various support channels and the typical response times is key to getting the assistance you need quickly and effectively.Customer service is a crucial aspect of any financial institution, and Capital One Discover is no exception.

This section details the different ways to reach out to customer service representatives, the expected response times, and the common issue resolution processes. This information empowers you to effectively manage your Discover account and address any concerns promptly.

So, you’re looking to understand Capital One Discover? It’s a good card, but there are some things you should know. Recent news about the Felicia Snoop Pearson, Ed Burns wire situation, might have you wondering about financial news and the implications for your own choices, particularly if you are considering a new credit card. Fortunately, the details of the felicia snoop pearson ed burns wire case are separate from the specifics of the Capital One Discover card.

Ultimately, doing your research on a credit card like the Discover is always a good idea to ensure you’re making the best financial decisions for yourself.

Available Customer Service Channels

Capital One Discover offers a variety of ways to contact customer service, catering to different preferences and needs. This ensures that you can access assistance using the method most convenient for you.

- Online Portal: The Capital One Discover website provides a comprehensive online portal with FAQs, troubleshooting guides, and a secure online chat option. This is often the first point of contact for resolving minor issues, as it offers immediate assistance.

- Phone: Direct phone support is available for more complex issues or when online resources are insufficient. This option allows for immediate conversation and personalized guidance.

- Email: Email support provides a written record of your inquiry and allows for more detailed explanations. This is a good option for issues requiring in-depth explanations.

- Mail: For situations requiring physical documents or when other channels prove ineffective, Capital One Discover also accepts mail correspondence. This method provides a tangible record of your inquiry and is often used for formal complaints or disputes.

Contacting Customer Service Representatives

The specific contact information for Capital One Discover customer service is available on the website’s contact page. This page details various methods for reaching out and provides the relevant phone numbers, email addresses, and online chat options.

Typical Response Time for Customer Service Inquiries, Capital one discover what to know

Capital One Discover aims to provide prompt and efficient responses to customer service inquiries. While exact response times may vary depending on the complexity of the issue, they strive to address most inquiries within a reasonable timeframe, typically within 24-48 hours for routine issues. This timeframe may vary based on the nature of the inquiry. For more complex issues, it might take a bit longer.

Resolution Process for Common Issues

The resolution process for common issues like account inquiries, password resets, or address updates generally follows a structured approach. Capital One Discover prioritizes resolving issues effectively and efficiently. A common issue resolution involves the following steps:

- Identifying the issue: The representative will first ascertain the specific nature of your concern.

- Gathering necessary information: Providing the necessary information, such as account details or transaction history, helps the representative promptly address your issue.

- Proposing a solution: The representative will then present possible solutions or options.

- Verifying the resolution: The representative confirms the resolution to ensure your issue is fully addressed.

Contact Information and Customer Support Channels

| Channel | Contact Information |

|---|---|

| Online Portal | Capital One Discover website |

| Phone | (XXX) XXX-XXXX (or see website for specific numbers) |

| [email protected] (or see website for specific email address) | |

| Capital One Discover, [Address] |

Note: Replace placeholders with the actual contact information found on the Capital One Discover website.

Credit Score and Approval

Getting approved for a Capital One Discover card hinges significantly on your creditworthiness. This section dives into the factors that determine your chances of approval, the credit score requirements, the application process, and the types of credit history that impact your chances.Understanding the criteria for credit card approval is crucial for successfully navigating the application process. A strong credit profile generally translates to a higher approval likelihood and potentially better terms.

Factors Influencing Approval

Your creditworthiness is assessed by multiple factors. Payment history, credit utilization, length of credit history, new credit, and credit mix all play a role. Consistent on-time payments demonstrate responsible financial management, while low credit utilization (keeping your credit card balances low compared to your credit limits) signifies good financial responsibility. A longer credit history provides a more comprehensive picture of your credit management habits.

Applying for numerous credit cards in a short period might raise concerns about your creditworthiness. Finally, having a diverse mix of credit accounts, such as credit cards, installment loans, and mortgages, provides a more complete view of your credit management.

Credit Score Requirements

Capital One Discover doesn’t publish specific credit score requirements for approval. However, a higher credit score generally increases your chances of approval and favorable terms, such as lower interest rates. Credit scores vary, and a score within the “good” or “excellent” ranges (typically 670 or above) is more likely to result in a positive outcome. Keep in mind that individual circumstances and the specific terms of the card are considered during the approval process.

Application Process for Approval

The application process is relatively straightforward. Applicants are required to provide personal and financial information, including their name, address, social security number, income, and employment details. Capital One utilizes this information to assess creditworthiness and determine if you meet the requirements for approval. The application is submitted electronically, and a decision is generally made within a few days.

The approval or denial will depend on the creditworthiness factors.

Types of Credit History That May Influence Approval

Various credit histories influence approval. A history of on-time payments and consistent credit usage demonstrates responsible financial management. A history of late payments, high credit utilization, or numerous inquiries could signal financial challenges and might negatively impact your chances of approval. Credit accounts that have a long and positive history of on-time payments are typically viewed favorably.

Credit Approval Criteria

| Criteria | Description |

|---|---|

| Payment History | Consistent on-time payments demonstrate responsible financial management. |

| Credit Utilization | Keeping credit card balances low compared to credit limits is a sign of good financial responsibility. |

| Length of Credit History | A longer history provides a more comprehensive picture of credit management habits. |

| New Credit | Applying for numerous credit cards in a short period might raise concerns about creditworthiness. |

| Credit Mix | Having a diverse mix of credit accounts (credit cards, installment loans, mortgages) provides a more complete view of credit management. |

Alternatives and Comparisons

Choosing the right credit card can significantly impact your financial well-being. Understanding alternatives to Capital One Discover and comparing their features is crucial for making an informed decision. This section explores various credit card options, highlighting similarities and differences, to help you weigh your options effectively.Comparing Capital One Discover with other credit cards involves evaluating factors such as rewards programs, interest rates, fees, and available benefits.

A thorough analysis helps you identify the card that aligns best with your spending habits and financial goals.

Alternative Credit Card Offerings

Several credit cards in the market offer competitive rewards and benefits. Understanding these alternatives provides a broader perspective when considering Capital One Discover. Popular options often include cards from major banks and financial institutions, each with its own unique set of features.

- Chase Sapphire Preferred: Known for its robust travel rewards program, this card often offers significant value for frequent travelers. Points earned can be redeemed for flights, hotels, and other travel expenses.

- American Express Gold: This card emphasizes dining, entertainment, and travel benefits, often providing valuable discounts and perks at various establishments. A strong selection of travel-related benefits makes it a compelling alternative for some.

- Citi ThankYou Premier: This card boasts a comprehensive rewards program that allows you to redeem points for various purchases, including travel, merchandise, and gift cards. Flexibility in redemption options is a key strength.

Comparison Table

A structured comparison helps visualize the key features and benefits of different credit cards. This table provides a concise overview, highlighting important distinctions between Capital One Discover and its competitors.

| Feature | Capital One Discover | Chase Sapphire Preferred | American Express Gold | Citi ThankYou Premier |

|---|---|---|---|---|

| Rewards Program | Cashback rewards on everyday purchases | Travel rewards with flexible redemption | Dining and entertainment discounts | Points redeemable for various purchases |

| Annual Fee | No annual fee | $95 annual fee | $150 annual fee | $95 annual fee |

| Interest Rate | Variable | Variable | Variable | Variable |

| Credit Score Requirements | Generally moderate | Generally moderate | Generally moderate | Generally moderate |

| Foreign Transaction Fees | No foreign transaction fees | No foreign transaction fees | No foreign transaction fees | No foreign transaction fees |

Pros and Cons of Capital One Discover

Evaluating the strengths and weaknesses of Capital One Discover helps in assessing its suitability for your financial needs.

Pros

- No annual fee: This makes it an attractive option for budget-conscious consumers.

- Cashback rewards on everyday purchases: This straightforward reward structure is easy to understand and apply.

- Simple rewards program: The ease of use and understanding is a significant advantage.

Cons

- Variable interest rate: Interest rates can fluctuate, impacting the cost of borrowing.

- Rewards redemption flexibility could be improved: Compared to some competitors, the options for redeeming rewards might be limited.

Responsible Use of Credit

Credit cards offer convenience and flexibility, but responsible use is crucial for maintaining good financial health. Understanding the implications of both responsible and irresponsible credit card practices is vital for avoiding potential pitfalls and maximizing the benefits of credit. Proper credit management can lead to improved credit scores, access to better financial products, and ultimately, greater financial freedom.Effective credit card management goes beyond simply making payments.

It encompasses understanding the terms and conditions, setting realistic spending limits, and proactively monitoring your credit report. This proactive approach ensures that you remain in control of your financial situation, allowing you to avoid unnecessary debt and maintain a positive credit history.

Importance of Responsible Credit Card Use

Responsible credit card use is essential for building and maintaining a positive credit history. A good credit history opens doors to better financial opportunities, including lower interest rates on loans, easier access to rental properties, and even better employment opportunities. Conversely, irresponsible use can lead to significant financial hardship and long-term consequences.

Tips for Managing Credit Card Debt Effectively

Effective debt management is crucial for avoiding accumulating high interest charges and maintaining a healthy financial situation. Here are some key strategies:

- Set a Budget and Track Spending: Establishing a realistic budget and diligently tracking your spending helps you understand where your money is going and identify areas for potential savings. This awareness is fundamental to managing your credit card spending responsibly.

- Pay Bills on Time: Prompt payments demonstrate responsible financial behavior to credit bureaus. Consistent on-time payments are a key factor in maintaining a good credit score.

- Prioritize High-Interest Debt: If you have multiple credit card debts with varying interest rates, prioritize paying off the cards with the highest interest rates first. This strategy minimizes the total interest paid over time.

- Consider Debt Consolidation: If you have significant credit card debt, debt consolidation may be an option to simplify your payments and potentially reduce interest rates. It’s important to carefully evaluate the terms and conditions of any consolidation loan.

Consequences of Irresponsible Credit Card Use

Irresponsible credit card use can have severe repercussions. These consequences extend beyond just financial difficulties and can significantly impact your overall financial well-being.

- High Interest Charges: Failure to pay your credit card balance in full each month can result in accumulating significant interest charges, increasing the total debt burden.

- Damage to Credit Score: Late payments and high credit utilization rates can severely damage your credit score, making it difficult to obtain loans or other credit products in the future.

- Debt Collection: If credit card debt remains unpaid, debt collection agencies may become involved, resulting in further financial strain and potential legal issues.

- Financial Stress: Uncontrolled credit card debt can lead to significant financial stress, impacting your mental and emotional well-being.

Understanding Credit Reports

Regularly reviewing your credit reports is essential for maintaining control over your financial situation. Understanding the information contained within your credit reports allows you to identify any inaccuracies and address any potential issues promptly.

- Identifying Inaccuracies: Your credit reports contain information about your credit accounts, including payment history, credit utilization, and credit inquiries. Regularly reviewing your reports for any inaccuracies is essential.

- Monitoring Credit Utilization: High credit utilization can negatively impact your credit score. Monitoring your credit utilization allows you to proactively manage your spending to avoid exceeding credit limits.

- Spotting Errors: Spotting errors in your credit report can prevent further damage to your credit score and ensure that the information is accurate.

Responsible Credit Card Practices

Maintaining a healthy financial relationship with your credit cards involves adhering to responsible credit card practices. These practices encompass the proactive management of your accounts and understanding the implications of your actions.

| Practice | Description |

|---|---|

| Budgeting | Creating a spending plan to allocate funds effectively. |

| On-time Payments | Making payments on time to avoid late fees and damage to your credit score. |

| Low Credit Utilization | Keeping your credit card balances low relative to your credit limits. |

| Regular Monitoring | Reviewing credit reports regularly to identify and correct any inaccuracies. |

| Debt Management | Developing strategies to manage and reduce debt effectively. |

Last Word

In conclusion, understanding the Capital One Discover card involves a thorough examination of its offerings, including rewards, features, fees, and the application process. By carefully considering these factors, you can determine if the card aligns with your financial goals and spending habits. Remember to weigh the benefits against potential drawbacks before making a decision.

FAQ Resource

What are the typical credit score requirements for approval?

While specific requirements aren’t publicly listed, a good credit score is generally needed to qualify. Check Capital One’s website for updated information.

What are some alternative credit cards in the market?

Several other credit cards offer similar rewards and benefits. Consider researching other options like Chase Freedom Unlimited or Discover It.

What are the typical fees associated with the Capital One Discover card?

Annual fees, late payment fees, balance transfer fees (if applicable), and foreign transaction fees are possible. Always review the cardholder agreement for precise details.

How do I redeem rewards points?

Reward points can often be redeemed for travel, merchandise, or statement credits. Consult the Capital One Discover card website for specific redemption options.