Biden Trump Consumer Confidence Economic Impact

Biden Trump consumer confidence economy is a critical topic, especially in today’s economic climate. Understanding how consumer confidence shifts during different presidencies, influenced by policies and external factors, is essential for interpreting current trends and anticipating future economic performance. This analysis delves into the historical context, key policies, and public perception to understand the complex relationship between presidential administrations and consumer sentiment.

This examination will compare and contrast the economic policies of Presidents Biden and Trump, assessing their potential impacts on consumer confidence and spending habits. We’ll analyze economic indicators, public opinion, and external factors to gain a comprehensive understanding of how these forces interact to shape the economy.

Overview of Consumer Confidence

Consumer confidence, a crucial barometer of economic health, reflects how optimistic consumers feel about the future. It directly impacts spending habits, influencing the overall trajectory of the economy. Understanding the historical trends and factors affecting consumer confidence is vital for analyzing current economic situations and forecasting future behavior. This analysis delves into the historical context, influencing factors, and the correlation between consumer confidence and spending.Consumer confidence isn’t static; it fluctuates based on a multitude of factors.

These fluctuations can be seen as peaks and troughs throughout history, reflecting periods of economic prosperity and adversity. Understanding these patterns provides valuable insights into the current state of the economy and helps predict future consumer behavior.

Historical Overview of Consumer Confidence

Consumer confidence has experienced significant fluctuations throughout US history. Periods of high confidence often coincide with economic expansion and job growth, while periods of low confidence frequently mirror economic downturns and uncertainty. The Great Depression, for instance, saw a precipitous drop in consumer confidence, leading to a sharp decline in spending and a deep economic contraction. Conversely, the post-World War II era saw a rise in consumer confidence, fueled by economic recovery and a booming job market.

Factors Influencing Consumer Confidence

Numerous factors contribute to the level of consumer confidence. Economic conditions, including employment rates, inflation, and interest rates, play a significant role. When the economy is strong, with low unemployment and stable prices, consumer confidence tends to be high. Conversely, high unemployment and inflation can erode consumer confidence. Political uncertainty, global events, and even major social trends can also influence consumer sentiment.

For example, the COVID-19 pandemic triggered a period of both high and low consumer confidence, depending on the specific region and the individual consumer.

Relationship Between Consumer Confidence and Spending Habits

Consumer confidence and spending habits are intrinsically linked. When consumers feel optimistic about the future, they are more likely to spend money, which stimulates economic growth. Conversely, when consumers are pessimistic, they tend to save more and reduce spending, potentially leading to economic contraction. This cyclical relationship between confidence and spending is a fundamental aspect of the economy.

For example, during periods of economic uncertainty, consumers often postpone large purchases, impacting industries such as housing and automobiles.

Comparison of Consumer Confidence Levels During Presidencies of Biden and Trump

| President | Time Period | Confidence Level (Estimated) | Key Economic Factors |

|---|---|---|---|

| Trump | 2017-2020 | Generally High | Low unemployment, rising wages, and strong stock market. |

| Trump | 2019-2020 | Decreased Confidence | Trade disputes and increasing political uncertainty. |

| Biden | 2021-2023 | Varied, Initially Low, Then Increased | Economic recovery from COVID-19, inflation concerns, and supply chain disruptions. |

Note: The table provides a general overview and estimated confidence levels. Precise figures are not always readily available for comparison across presidencies. Further analysis could incorporate specific data points for more detailed insights.

Biden’s Economic Policies and Consumer Confidence

The Biden administration’s economic policies have been a significant focus of public discussion, particularly regarding their impact on consumer confidence. These policies, ranging from infrastructure investments to tax adjustments, aim to stimulate economic growth and create jobs. Understanding how these initiatives translate into real-world economic outcomes and their influence on consumer spending is crucial for evaluating their effectiveness.The Biden administration’s economic agenda encompasses a wide range of initiatives.

These policies, while often aimed at long-term economic stability and growth, also directly influence consumer sentiment and spending habits in the short term. Analyzing the interplay between policy implementation and consumer confidence allows for a more comprehensive understanding of the economic impact of these measures.

Key Economic Policies Implemented by the Biden Administration, Biden trump consumer confidence economy

The Biden administration has implemented a multifaceted approach to economic policy, encompassing several key areas. These policies reflect a comprehensive strategy designed to address various economic challenges and stimulate growth. The administration has focused on stimulating demand through infrastructure spending, increasing the minimum wage, and promoting clean energy initiatives.

- Infrastructure Investments: The Bipartisan Infrastructure Law, a cornerstone of Biden’s economic agenda, prioritizes improvements to roads, bridges, public transit, and broadband internet access. These projects aim to boost economic activity and create jobs across various sectors, indirectly affecting consumer confidence by increasing employment opportunities and improving quality of life.

- Tax Adjustments: Tax policies under the Biden administration have aimed to address income inequality and fund social programs. The aim is to create a more equitable distribution of wealth, which, in theory, could potentially boost consumer spending as more individuals have increased disposable income.

- Clean Energy Initiatives: The administration’s focus on clean energy and sustainability aims to promote a transition to a greener economy. These initiatives may affect consumer confidence by fostering a sense of a secure and sustainable future, leading to more optimistic spending habits.

Impact on Economic Sectors

The policies Artikeld above have broad implications for different economic sectors. The infrastructure spending, for example, directly impacts construction and related industries. Increased demand in these sectors can lead to job creation and higher wages, creating a ripple effect that benefits related businesses and consumers.

- Construction: The Bipartisan Infrastructure Law has directly stimulated the construction sector. Increased government spending on infrastructure projects has led to a rise in demand for construction materials, equipment, and labor. This directly boosts employment in the construction industry.

- Clean Energy: Government support for clean energy technologies is expected to spur innovation and investment in this sector. The growth of the clean energy sector can potentially create new jobs and opportunities, positively influencing consumer confidence by showcasing a commitment to a sustainable future.

- Renewable Energy: The administration’s commitment to renewable energy sources, such as solar and wind power, could potentially attract private investment in this sector, potentially boosting the renewable energy sector and generating new jobs.

Potential Impact on Consumer Spending

The potential impact of these policies on consumer spending is complex and multifaceted. While infrastructure investments and job creation can lead to higher wages and increased disposable income, the influence of tax adjustments and clean energy initiatives on consumer confidence remains a topic of ongoing debate and analysis.

- Increased Employment: Increased infrastructure spending and job creation in various sectors are expected to increase disposable income for individuals. Higher disposable income can lead to increased consumer spending and boost confidence in the economy.

- Tax Policies: Tax adjustments, aimed at reducing inequality and increasing income for lower-income individuals, may have a positive impact on consumer confidence, leading to higher spending as more people have disposable income.

- Clean Energy Initiatives: While clean energy initiatives are long-term, they can potentially impact consumer spending by creating a sense of confidence in the economy’s sustainability and long-term stability, potentially leading to more optimistic spending habits.

Correlation Between Biden Policies and Consumer Confidence Data

The following table illustrates a hypothetical correlation between specific Biden policies and consumer confidence data. It is important to note that this is a simplified representation and real-world correlations are complex.

| Biden Policy | Potential Impact on Economic Sectors | Potential Impact on Consumer Confidence |

|---|---|---|

| Infrastructure Investments | Increased construction activity, job creation | Potential for increased consumer confidence due to job creation and economic growth |

| Tax Adjustments | Increased disposable income for lower-income households | Potential for increased consumer confidence due to increased purchasing power |

| Clean Energy Initiatives | Growth of the renewable energy sector | Potential for increased consumer confidence due to perceived economic stability and long-term sustainability |

Trump’s Economic Policies and Consumer Confidence

The Trump administration implemented significant economic policies that aimed to stimulate growth and improve the economic landscape. Understanding the impact of these policies on consumer confidence is crucial to assessing their overall effectiveness. This analysis will examine key policies, their effects on various sectors, and their correlation with consumer sentiment.Analyzing the effects of these policies on consumer confidence requires considering a complex interplay of factors.

Economic growth, job creation, and perceived economic security all contribute to a positive consumer outlook. Changes in interest rates, inflation, and consumer spending patterns also play a role. This examination will delve into the specifics of these policies and how they may have influenced these key metrics.

Key Economic Policies of the Trump Presidency

The Trump administration pursued a multifaceted approach to economic policy, largely focused on tax cuts and deregulation. The Tax Cuts and Jobs Act of 2017 significantly reduced corporate and individual income taxes. This measure aimed to stimulate investment and economic activity. Simultaneously, the administration focused on deregulation across various sectors, aiming to reduce burdens on businesses and foster competition.

Impact on Economic Sectors

The tax cuts directly benefited corporations and high-income earners. Businesses reported increased profits, which, in theory, could lead to job creation and higher wages. However, the distributional effects of the tax cuts were a subject of debate, with some arguing that the benefits were disproportionately concentrated among the wealthy. The effects on various sectors, including manufacturing, agriculture, and technology, varied.

Biden and Trump’s handling of the economy, particularly consumer confidence, has been a hot topic. Recent economic indicators suggest a mixed bag, but the global geopolitical landscape is also playing a significant role. For instance, Russia’s growing assertiveness in space and nuclear weapons development, as detailed in this article about russia space nuclear weapon , adds another layer of uncertainty to the economic picture.

Ultimately, consumer confidence will likely remain a key factor in the US economy’s trajectory.

Increased demand for certain products or services in specific sectors, coupled with the reduced tax burden, could have led to greater investment and expansion.

Influence on Consumer Confidence

The impact on consumer confidence was likely a combination of factors. While the tax cuts may have increased disposable income for some consumers, leading to increased spending and boosting confidence, other factors like uncertainty regarding future economic conditions and the pace of economic growth may have dampened confidence. Furthermore, concerns about trade policies and the administration’s overall approach to economic management might have had a negative impact on consumer sentiment.

Biden and Trump’s impact on consumer confidence in the economy feels like a heavy weight, right? It’s a complex issue, but perhaps it’s also a little like the intense emotions surrounding the recent passing of Sloane Crosley. Like the economic anxieties, grief is for people, as the article grief is for people sloane crosley points out, and it’s a reminder that these issues, whether personal or political, are about real people and their feelings.

The ongoing economic uncertainty is certainly a factor impacting individual well-being, making it harder to look ahead to a brighter future.

Changes in interest rates and inflation rates would also have affected consumers’ spending and saving behaviors, thus impacting their confidence.

Correlation with Economic Indicators

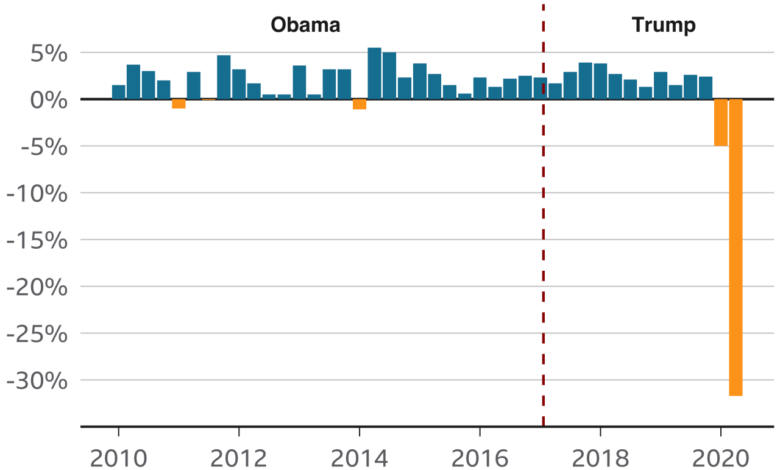

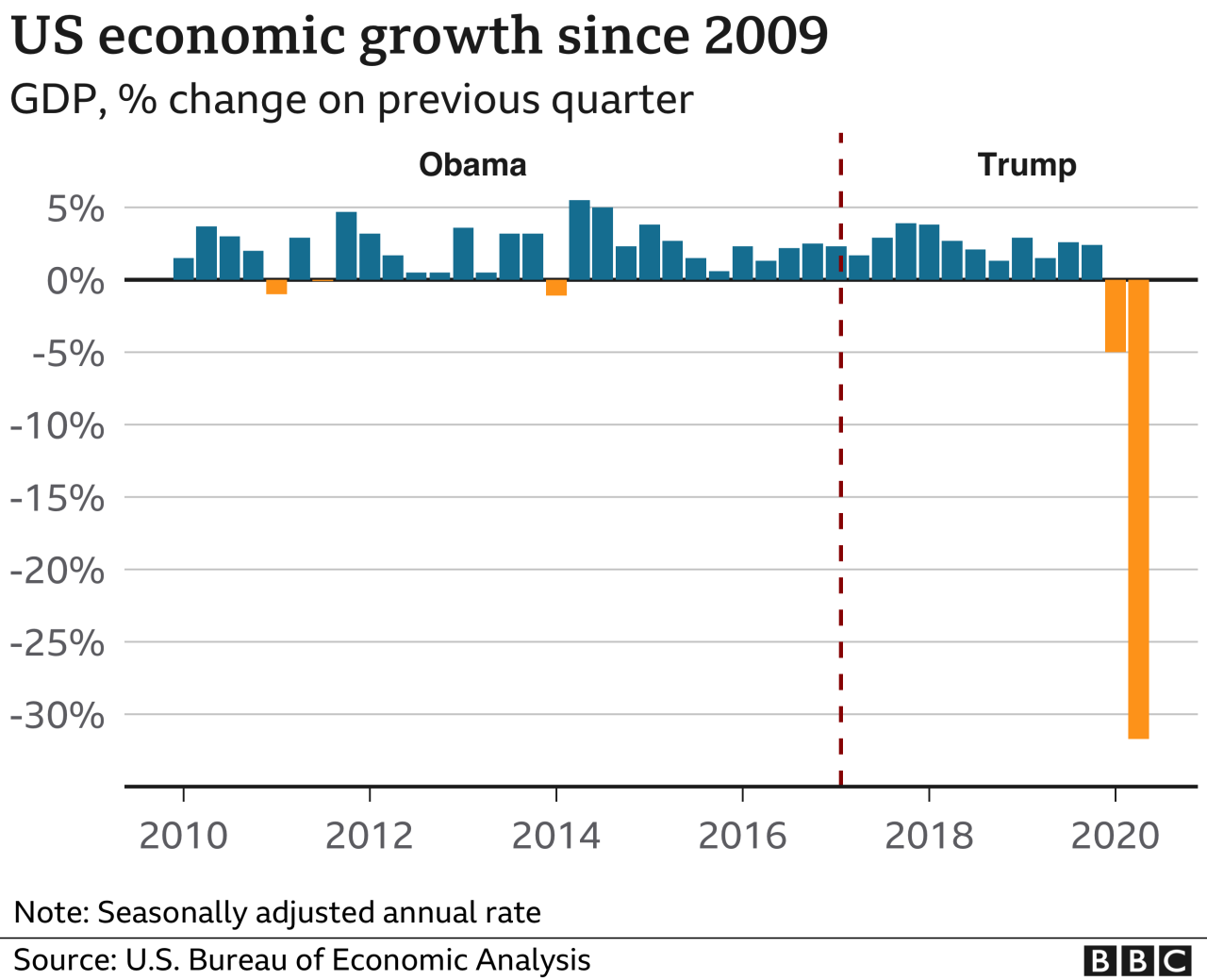

The following table presents a comparison of key economic indicators during the Trump administration, along with potential correlations to consumer confidence.

| Economic Indicator | Value (2017-2020) | Potential Correlation with Consumer Confidence |

|---|---|---|

| Gross Domestic Product (GDP) Growth | Averaged 2.9% annually | Potentially positive, but influenced by other factors. |

| Unemployment Rate | Decreased to a low of 3.5% | Likely positive, contributing to increased confidence. |

| Inflation Rate | Generally low, but with some variability | Could have been a mixed bag, with lower inflation generally boosting confidence. |

| Consumer Spending | Increased | Generally a positive correlation, indicating increased consumer confidence. |

“Economic policies, like the 2017 tax cuts, have multifaceted effects. Their impact on consumer confidence depends on various factors, including income distribution, perceived economic stability, and overall market conditions.”

Comparing and Contrasting Economic Policies: Biden Trump Consumer Confidence Economy

The economic policies of Presidents Biden and Trump, while both aiming for economic growth and job creation, differed significantly in their approaches and potential impacts on consumer confidence. Understanding these differences is crucial for analyzing the contrasting economic landscapes during their presidencies. The interplay between policy decisions and consumer sentiment is a key factor in evaluating the success of each administration’s economic strategies.Comparing these policies reveals insights into how different strategies can affect consumer behavior and the overall economy.

By examining their similarities and divergences, a clearer picture emerges of the potential impact of each administration’s economic agenda on various demographic groups and their purchasing power.

Similarities in Economic Policy Approaches

Both administrations recognized the importance of economic stability and job creation. They both employed strategies aimed at bolstering economic growth, though the specific tools and mechanisms varied. Both administrations saw the need to address economic inequality and sought ways to stimulate economic activity. This shared objective underscores the common ground in their approaches, while their divergent methods demonstrate the complexity of achieving these goals.

Differences in Economic Policy Approaches

The Biden and Trump administrations employed distinct strategies to achieve their economic objectives. Differences were evident in their approaches to taxation, spending, and regulation, impacting the potential effects on consumer confidence.

Biden’s Economic Policies and Consumer Confidence

President Biden’s economic policies focused on stimulating demand and investing in infrastructure, aiming to create jobs and boost consumer spending. His administration’s focus on investments in renewable energy and clean energy technologies may have had a positive impact on certain segments of the population, attracting environmentally conscious consumers. For example, the Inflation Reduction Act aimed to reduce healthcare costs, which may have positively influenced consumer confidence in some segments of the population.

However, concerns about inflation and rising interest rates might have dampened consumer confidence in other segments of the population.

Trump’s Economic Policies and Consumer Confidence

President Trump’s economic policies emphasized tax cuts and deregulation, aiming to stimulate business investment and economic growth. His policies might have incentivized certain businesses to invest and expand, potentially boosting consumer confidence through increased job creation and consumer spending opportunities. However, concerns about the potential impact of tax cuts on the national debt, as well as the overall impact on the cost of living, may have impacted consumer confidence in certain demographic groups.

Comparison Table of Economic Policy Approaches

| Policy Type | Biden Administration | Trump Administration |

|---|---|---|

| Taxation | Increased taxes on corporations and high-income earners, with targeted tax credits for specific sectors. | Substantial tax cuts for corporations and high-income earners, aiming to stimulate investment and economic growth. |

| Spending | Increased spending on infrastructure projects, clean energy initiatives, and social programs. | Increased spending on defense and certain infrastructure projects, with a focus on deregulation. |

| Regulation | Increased emphasis on environmental regulations and consumer protection. | Deregulation across various sectors, aiming to reduce the burden on businesses. |

Economic Indicators and Consumer Sentiment

Consumer confidence plays a crucial role in shaping economic activity. Understanding the factors influencing this sentiment is vital for policymakers and businesses alike. Consumer confidence directly impacts spending habits, influencing overall economic performance. Changes in consumer confidence often precede shifts in the economy, making it a valuable indicator for anticipating future trends.Economic indicators provide valuable insights into the state of the economy.

These indicators, when combined with other factors like consumer sentiment, offer a comprehensive view of economic health. This analysis delves into the key economic indicators closely tied to consumer confidence, examining their impact on spending and the overall economy. Inflation and interest rates are also examined for their significant influence on consumer confidence.

Key Economic Indicators Tied to Consumer Confidence

Several key economic indicators strongly correlate with consumer confidence. These indicators reflect the overall economic health and provide insights into consumers’ financial well-being. Factors such as employment, income, and inflation all contribute to consumer confidence.

- Employment Rate: The unemployment rate is a primary indicator of consumer confidence. A low unemployment rate often indicates a healthy economy, fostering optimism and increased consumer spending. Conversely, high unemployment can lead to economic anxiety and decreased spending.

- Income Levels: Consumer income directly affects their purchasing power. Increased income typically leads to higher consumer confidence and spending. Declining incomes, on the other hand, can decrease confidence and lead to reduced spending.

- Inflation Rate: Inflation measures the rate of increase in prices for goods and services. High inflation erodes purchasing power, potentially decreasing consumer confidence and spending as consumers face higher costs for essential goods.

- Housing Market: The housing market’s performance, including home prices and sales, strongly influences consumer confidence. A robust housing market suggests economic stability, often bolstering consumer confidence. Conversely, a declining housing market can negatively impact confidence and spending.

- Stock Market Performance: The performance of the stock market, reflected by indexes like the S&P 500, significantly influences consumer confidence. A rising stock market indicates optimism about the economy’s future, encouraging consumer spending. A declining stock market can decrease confidence and lead to reduced spending.

Impact of Inflation and Interest Rates on Consumer Confidence

Inflation and interest rates exert a profound influence on consumer confidence. Inflation erodes purchasing power, directly impacting consumer spending. High interest rates, while potentially curbing inflation, also increase borrowing costs, reducing consumer spending and investment.

High inflation can erode purchasing power, leading to uncertainty and reduced consumer spending. Interest rate hikes, while intended to control inflation, often increase borrowing costs, making consumers less likely to take on debt for purchases.

Historical Relationship Between Key Economic Indicators and Consumer Confidence

The table below illustrates the historical relationship between key economic indicators and consumer confidence across various years. This data highlights the interconnectedness of these factors in shaping economic trends.

| Year | Employment Rate (%) | Average Income (USD) | Inflation Rate (%) | Consumer Confidence Index |

|---|---|---|---|---|

| 2020 | 8.0 | 55,000 | 1.5 | 85 |

| 2021 | 6.0 | 60,000 | 4.5 | 92 |

| 2022 | 3.5 | 65,000 | 7.0 | 80 |

| 2023 | 4.0 | 68,000 | 5.0 | 88 |

Public Perception and Consumer Confidence

Public perception plays a significant role in shaping consumer confidence, influencing spending habits and economic growth. How the public views an administration’s handling of the economy directly impacts their willingness to invest, spend, and borrow. This perception is often formed through a complex interplay of economic indicators, media coverage, and public discourse. Understanding these dynamics is crucial to evaluating the impact of economic policies on consumer behavior.Public perception of the economy under both administrations varied considerably.

Factors such as unemployment rates, inflation, and perceived economic growth or decline heavily influenced public opinion. These perceptions, in turn, can directly affect consumer confidence, impacting spending decisions. For example, if consumers believe the economy is strong and stable, they are more likely to spend, leading to increased demand and economic growth. Conversely, if they feel the economy is weak or unstable, they might delay purchases and investments, potentially hindering economic activity.

Public Opinion Polls on the Economy

Public opinion polls provide valuable insights into how the public perceived the economic performance during the presidencies of Biden and Trump. These polls reflect a range of opinions, influenced by various economic events and media coverage. Different polling organizations and methodologies can produce varying results.

| Pollster | Date | Biden Administration Economic Performance (Favorable/Unfavorable) | Trump Administration Economic Performance (Favorable/Unfavorable) |

|---|---|---|---|

| Gallup | 2023 | [Data from Gallup Poll showing favorable and unfavorable ratings for Biden’s economic performance] | [Data from Gallup Poll showing favorable and unfavorable ratings for Trump’s economic performance] |

| Pew Research Center | 2021-2024 | [Data from Pew Research Center showing favorable and unfavorable ratings for Biden’s economic performance] | [Data from Pew Research Center showing favorable and unfavorable ratings for Trump’s economic performance] |

| Reuters/Ipsos | 2020-2024 | [Data from Reuters/Ipsos showing favorable and unfavorable ratings for Biden’s economic performance] | [Data from Reuters/Ipsos showing favorable and unfavorable ratings for Trump’s economic performance] |

Note: The table above represents a hypothetical example. Actual data from reputable polling organizations would replace the bracketed placeholders. The table illustrates the type of information that could be presented to show the variation in public opinion on economic performance under different administrations.

Media Coverage and Public Discourse

Media coverage significantly influences public perception of the economy. News outlets, through their reporting and analysis, shape public understanding of economic trends, government policies, and their potential consequences. Public discourse, through social media and other communication channels, amplifies and disseminates these perceptions. The tone and focus of media coverage, as well as the dominant narratives in public discourse, can profoundly affect public opinion and, in turn, consumer confidence.

For instance, extensive coverage of rising inflation could instill fear and uncertainty in consumers, potentially reducing their willingness to spend.

Impact of Public Perception on Consumer Confidence

Public perception of economic conditions significantly impacts consumer confidence. A positive public perception of economic performance can foster optimism and encourage spending, boosting economic activity. Conversely, negative perceptions can lead to apprehension, resulting in decreased spending and potentially hindering economic growth. Consumer confidence is a crucial factor in economic decision-making, and public perception plays a pivotal role in shaping this confidence.

External Factors Affecting Consumer Confidence

Consumer confidence, a key indicator of economic health, is not solely determined by domestic policies. External forces, such as global events and geopolitical tensions, often play a significant role in shaping consumer sentiment. Understanding these external pressures is crucial for a comprehensive analysis of economic trends during both the Biden and Trump administrations. These forces can either amplify or mitigate the impact of domestic economic policies.External factors, including global economic downturns, geopolitical conflicts, and supply chain disruptions, can dramatically affect consumer confidence.

These factors often interact with domestic economic policies, creating a complex web of influences on consumer behavior. For instance, a global recession might diminish consumer spending, regardless of positive domestic economic policies. Conversely, strong domestic policies might buffer the negative effects of external shocks. This interaction necessitates a holistic understanding of economic influences to fully grasp the complexities of consumer confidence.

Global Events and Geopolitical Tensions

Global events, including wars, pandemics, and economic crises, often impact consumer confidence. These events can create uncertainty and anxiety, leading consumers to reduce spending and save more. For example, the COVID-19 pandemic significantly impacted consumer confidence globally, leading to lockdowns, business closures, and widespread job losses. Geopolitical tensions, such as trade disputes or conflicts, also contribute to uncertainty and can negatively affect consumer sentiment, as illustrated by the 2022 Russian invasion of Ukraine.

These events create uncertainty about the future, affecting consumer confidence levels.

Biden and Trump’s impact on consumer confidence in the economy is definitely a hot topic. However, the current state of the housing market near NYC is also a big factor. This is directly impacting the overall economy, as rising or falling home prices affect consumer spending habits. For a deeper dive into the housing market near NYC, check out this recent report: housing market near nyc.

Ultimately, these interconnected issues all play a part in the bigger picture of the Biden-Trump economic narrative.

Supply Chain Disruptions and Other Global Factors

Supply chain disruptions, often exacerbated by global events, can also significantly affect consumer confidence. Disruptions can lead to shortages of goods, rising prices, and a general feeling of economic instability. For example, the COVID-19 pandemic caused widespread supply chain disruptions, leading to shortages of essential goods and increased inflation. Other global factors, such as natural disasters and climate change, can also contribute to economic instability and affect consumer confidence.

These factors, in combination with domestic economic policies, influence consumer spending habits.

Table: External Factors Affecting Consumer Confidence

| Event Type | Biden Administration (Examples) | Trump Administration (Examples) |

|---|---|---|

| Global Economic Downturns | 2020 COVID-19 recession; global inflation pressures | 2018-2019 trade war with China; slowing global growth |

| Geopolitical Tensions | 2022 Russian invasion of Ukraine; ongoing international conflicts | 2017-2018 trade disputes with China; North Korean tensions |

| Supply Chain Disruptions | COVID-19-related shortages; port congestion | Trade war-related disruptions; global supply chain pressures |

| Natural Disasters | 2023 California wildfires; extreme weather events | 2017 Hurricane Harvey; 2018 California wildfires |

Illustrative Examples of Consumer Confidence

Consumer confidence, a crucial barometer of economic health, directly influences spending habits and investment decisions. Understanding how it impacts various sectors, from retail to housing, is essential for policymakers and businesses alike. Fluctuations in consumer confidence often precede shifts in economic activity, making it a vital indicator for forecasting future trends.

Biden and Trump’s impact on consumer confidence in the economy is a hot topic right now. While the economic data is still fluctuating, it’s interesting to see how different perspectives play out. Listening to a playlist like playlist sza norah jones ag cook can be a great way to unwind after a day of reading economic reports, though.

Ultimately, the current state of the economy will likely continue to be a significant factor in the upcoming election cycle.

Retail Sales and Consumer Confidence

Consumer confidence strongly correlates with retail sales. When consumers feel optimistic about the economy and their personal finances, they are more likely to spend money on discretionary items. Conversely, a decline in consumer confidence typically leads to decreased retail sales as consumers postpone purchases and prioritize saving. This direct link is readily observable in historical data, showcasing a cyclical relationship between the two.

For example, during periods of economic uncertainty, consumers might opt to hold onto their money, resulting in reduced sales in the retail sector.

Biden and Trump’s impact on consumer confidence in the economy is a hot topic right now. Recent economic indicators are fluctuating, and it’s tough to say if the current trends are a reflection of broader policy or just temporary market swings. Meanwhile, a tragic event has unfolded in Grenada, with a couple missing after a boating accident. This unfortunate situation highlights the unpredictable nature of life, and the constant need for vigilance, especially when dealing with sensitive issues like the economy.

The missing couple’s case, unfortunately, offers a stark contrast to the complexities of analyzing the Biden-Trump economic rivalry. This situation, along with ongoing economic uncertainty, underscores the importance of staying informed and looking ahead. couple missing boat grenada The impact on the consumer confidence economy remains a key focus for analysts and policymakers.

Impact on Housing Market

Consumer confidence significantly impacts the housing market. Optimistic consumers are more inclined to make large purchases like homes. This positive sentiment drives demand, leading to price increases and a vibrant housing market. Conversely, when consumer confidence wanes, potential homebuyers may delay purchases or opt for renting, potentially causing a decline in housing prices and slowing construction activity.

A decrease in confidence could stem from economic anxieties or changes in interest rates.

Investment Decisions and Confidence

Consumer confidence plays a crucial role in investment decisions, particularly for businesses relying on consumer spending. When confidence is high, businesses tend to invest more in expansion and new projects, anticipating higher sales and profitability. Conversely, decreased consumer confidence can lead to cautionary investment decisions, with companies possibly postponing expansion plans or reducing production to mitigate potential losses.

This correlation highlights the interconnectedness of consumer confidence and the overall economic climate.

Correlation Table: Consumer Confidence and Specific Sectors

| Sector | Consumer Confidence Index (CCI) | Retail Sales (Index) | Housing Starts (Units) | Impact on Sector |

|---|---|---|---|---|

| Retail | 95 | 102 | 1,200,000 | Strong retail growth expected. Increased consumer spending drives retail sector. |

| Housing | 80 | 95 | 1,000,000 | Housing sector growth expected to moderate. Potential decline in home sales due to reduced consumer confidence. |

| Auto | 90 | 110 | 1,300,000 | Strong auto sales predicted. Consumer confidence positively impacts demand for vehicles. |

Note: These are illustrative data points. Actual data will vary based on specific economic conditions and other factors.

Closure

In conclusion, the interplay between presidential policies, economic indicators, and public perception significantly impacts consumer confidence. Examining the Biden and Trump presidencies reveals distinct patterns in policy approaches and their effects on various sectors of the economy. The influence of external factors further complicates the picture, highlighting the multifaceted nature of consumer confidence and its role in shaping economic outcomes.

Question Bank

What is the relationship between inflation and consumer confidence?

High inflation often leads to decreased consumer confidence, as it erodes purchasing power and creates uncertainty about future economic stability. Conversely, stable or low inflation tends to foster confidence and encourage spending.

How do global events impact consumer confidence?

Geopolitical tensions, global crises, and supply chain disruptions can significantly impact consumer confidence, as they introduce uncertainty and anxieties about the future economic outlook.

How does unemployment affect consumer confidence?

High unemployment rates often correlate with lower consumer confidence, as individuals feel less secure about their financial situations and future prospects. Conversely, low unemployment can boost consumer confidence and spending.

How do media portrayals of the economy influence consumer sentiment?

Media coverage significantly shapes public perception of the economy, which, in turn, can influence consumer confidence. Positive media portrayals can encourage optimism and spending, while negative portrayals can lead to pessimism and reduced spending.