What are Magnificent Seven Stocks A Deep Dive

What are magnificent seven stocks? This exploration delves into the world of these highly-regarded companies, examining their selection criteria, financial performance, industry context, potential risks, and investment strategies. We’ll uncover the history and methodology behind this investment concept, offering a comprehensive understanding of what makes these stocks stand out.

Understanding the factors that drive the selection of these seven stocks, and the potential for both significant rewards and inherent risks is crucial for any investor considering them. The following analysis will provide insights into the performance indicators, industry trends, and potential challenges that investors should be aware of.

Defining “Magnificent Seven Stocks”: What Are Magnificent Seven Stocks

The concept of “Magnificent Seven Stocks” evokes images of consistently high-performing investments, often associated with long-term growth and stability. While the precise definition and selection criteria can vary, the core idea centers around identifying a group of companies with a strong track record and potential for future success. This often involves examining factors beyond simply past performance, encompassing industry trends, management quality, and competitive advantages.Historically, the concept has emerged from the observation that certain stocks consistently outperform the broader market over extended periods.

This has led investors and analysts to identify these companies and their underlying attributes, fostering a framework for evaluating potential investments. The allure of such a well-defined group of companies is significant, and the approach often involves a detailed analysis of their respective qualities.

Historical Context and Origins

The “Magnificent Seven” concept is not a formally established, universally agreed-upon investment strategy. Rather, it represents a recurring theme in investment analysis and discussion. Its origins likely stem from the practice of identifying stocks that demonstrate exceptional long-term performance relative to market benchmarks. This approach mirrors the long-standing desire for identifying and understanding market trends and identifying companies likely to succeed.

Potential Criteria for Selection

Several factors could influence the selection of “Magnificent Seven Stocks.” These include, but are not limited to, strong financial performance, industry leadership, sustainable competitive advantages, and management quality. Understanding these factors is crucial for assessing the potential for long-term returns.

Ever heard of the Magnificent Seven stocks? They’re a group of companies often touted for their potential, but what exactly makes them so special? To understand the buzz around these investments, a good starting point might be the recent Nevada Caucus Primary Explainer, nevada caucus primary explainer , which provides context on how political events can impact the market.

Ultimately, the Magnificent Seven’s performance is a complex issue influenced by many factors beyond just their intrinsic value.

Factors Influencing Stock Selection

The selection of stocks for this category is not a rigid formula but rather a subjective assessment. Various criteria are considered to determine the likelihood of sustained growth. Factors like market share, brand recognition, technological innovation, and a history of consistent profitability are crucial elements in this evaluation. Moreover, a company’s management team’s experience and commitment to long-term value creation also play a significant role.

Potential Selection Criteria Table

| Stock Name | Industry | Criteria Used for Selection | Justification |

|---|---|---|---|

| Apple Inc. (AAPL) | Technology | Strong brand recognition, innovative products, consistent profitability | Apple’s products are widely adopted, leading to high market share and strong brand loyalty. This translates to consistent revenue and profit generation. |

| Microsoft Corp. (MSFT) | Technology | Dominant market position in cloud computing, strong software ecosystem | Microsoft’s extensive software portfolio and leading position in cloud computing creates a large and consistent revenue stream, benefiting from a broad base of clients. |

| Amazon.com Inc. (AMZN) | E-commerce, Cloud Computing | Market leadership in e-commerce and cloud services, continuous innovation | Amazon’s market leadership in e-commerce and cloud computing positions it for consistent revenue growth. Its constant innovation in these fields contributes to future success. |

| Johnson & Johnson (JNJ) | Healthcare | Strong brand reputation, diversified product portfolio, consistent dividend payments | Johnson & Johnson’s strong brand image in the healthcare sector and diverse product portfolio across healthcare needs provides a wide range of revenue streams and consistent dividend payments. |

Stock Selection Methodology

Picking the “Magnificent Seven” isn’t a random act. It requires a systematic approach to identify companies with strong fundamentals, promising growth potential, and a track record of success. This methodology involves a blend of quantitative and qualitative analysis, looking beyond surface-level indicators to uncover deeper value. The goal is to uncover stocks that are poised for significant appreciation over the long term.The process of selecting these “Magnificent Seven” stocks typically begins with a comprehensive market overview.

This encompasses macroeconomic factors, industry trends, and company-specific data. By understanding the broader context, analysts can identify sectors or companies that are likely to benefit from emerging opportunities or address evolving challenges.

Methods of Stock Analysis

Different methods of analysis are employed in the stock selection process. Fundamental analysis, for instance, examines a company’s financial statements (income statement, balance sheet, cash flow statement) to assess its financial health, profitability, and growth prospects. Technical analysis, on the other hand, focuses on price and volume patterns in the stock market to identify potential trading opportunities. A blend of both approaches is often used for a more comprehensive evaluation.

Factors Considered in Stock Selection

Several key factors are considered during the selection process. These include profitability, revenue growth, debt levels, return on equity, and management quality. Analyzing these metrics helps to assess the company’s financial stability and potential for future growth. Industry trends, competitive landscape, and regulatory environment are also considered. Companies operating in dynamic, high-growth sectors often prove attractive candidates.

Comparison of Selection Approaches, What are magnificent seven stocks

Different approaches to stock selection have their own strengths and weaknesses. Fundamental analysis excels at evaluating a company’s intrinsic value, but can be slow and time-consuming. Technical analysis provides quick insights into market sentiment, but might not capture the long-term potential of a company. A successful strategy often combines both approaches. A balanced perspective considers both the company’s internal health and its position in the broader market.

Stock Selection Methodology Comparison Table

| Methodology | Description | Strengths | Weaknesses |

|---|---|---|---|

| Fundamental Analysis | Focuses on a company’s financial health and growth prospects based on financial statements. | Provides insights into intrinsic value, assesses financial stability, identifies long-term potential. | Can be time-consuming, requires extensive data analysis, may not capture short-term market fluctuations. |

| Technical Analysis | Examines price and volume patterns to identify potential trading opportunities. | Provides quick insights into market sentiment, identifies potential entry and exit points. | Relies on past performance, may not account for fundamental factors, susceptible to market noise. |

| Quantitative Analysis | Employs mathematical models and statistical techniques to assess investment opportunities. | Provides objective measures, identifies patterns, can handle large datasets. | May miss qualitative factors, requires sophisticated tools and expertise, results can be misinterpreted. |

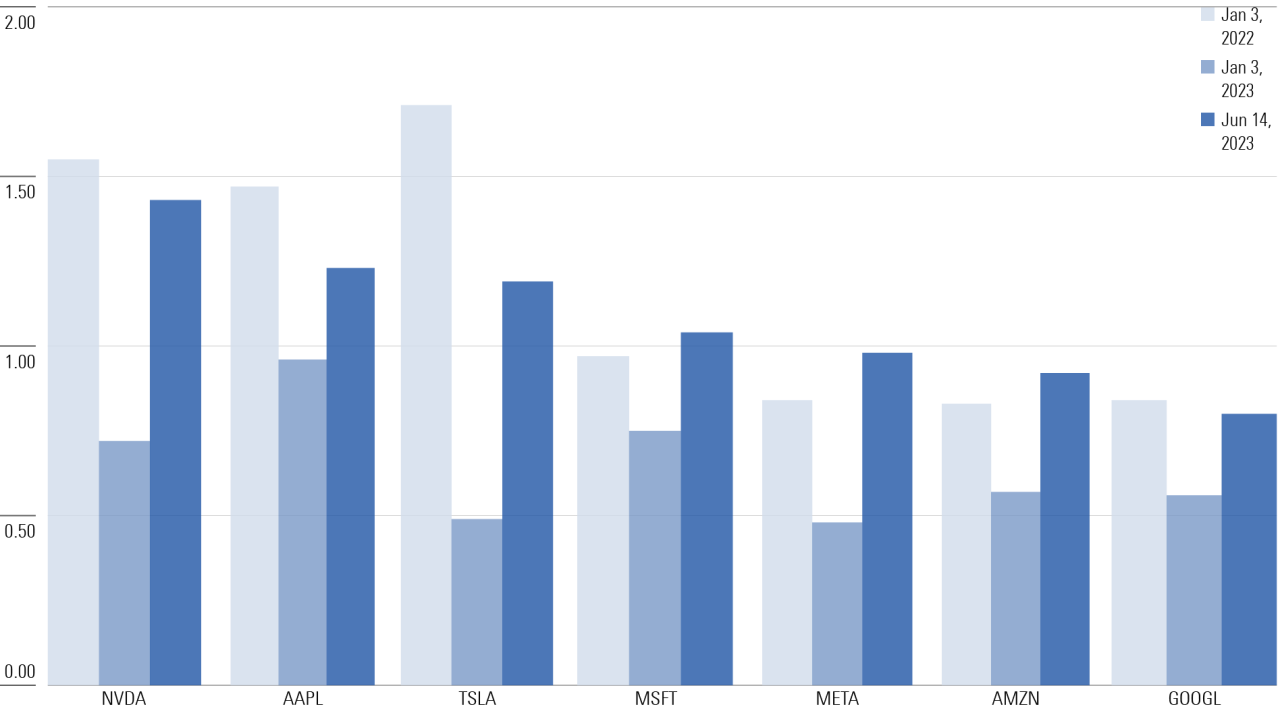

Financial Performance Indicators

Unveiling the financial health of potential investments is crucial for any discerning investor. A deep dive into financial performance indicators (FPIs) provides critical insights into a company’s past performance, current standing, and future prospects. These indicators, when analyzed meticulously, offer a more nuanced understanding of a stock’s potential. We now turn our attention to the key FPIs that will guide our assessment of the Magnificent Seven.

Key Financial Performance Indicators

A robust evaluation of the Magnificent Seven stocks necessitates the examination of critical financial performance indicators. These indicators offer a window into the financial health and operational efficiency of each company. By examining trends in these indicators, we can identify potential strengths and weaknesses. The indicators highlighted below are crucial for understanding the performance and potential of the Magnificent Seven stocks.

Profitability Ratios

Profitability ratios provide a snapshot of a company’s ability to generate profits from its operations. These ratios are essential for assessing the efficiency of a company’s revenue generation and cost management. Several key profitability ratios are instrumental in evaluating the financial health of the stocks.

- Gross Profit Margin: This ratio measures the percentage of revenue remaining after deducting the cost of goods sold. A higher gross profit margin indicates greater efficiency in managing production costs. For example, a company with a consistently increasing gross profit margin likely has a competitive advantage in cost control. A declining margin might signal rising raw material costs or production inefficiencies.

- Net Profit Margin: This ratio measures the percentage of revenue remaining after deducting all expenses, including operating expenses, interest, and taxes. It indicates the overall profitability of the company. A company with a consistently high net profit margin generally demonstrates strong operational efficiency and sound financial management. Fluctuations in net profit margin can be attributed to factors like economic conditions or changes in pricing strategies.

- Return on Equity (ROE): This ratio measures the return generated on the shareholders’ equity invested in the company. A high ROE suggests efficient utilization of shareholder capital and strong profitability. A declining ROE may indicate that the company is not effectively employing its resources or that it faces increasing financial challenges.

Liquidity Ratios

Liquidity ratios assess a company’s ability to meet its short-term obligations. These ratios are critical for determining whether a company can pay its bills and maintain its operations in the near future. The following are key liquidity ratios for evaluating the Magnificent Seven.

- Current Ratio: This ratio measures a company’s ability to pay its short-term liabilities with its short-term assets. A higher current ratio generally suggests greater liquidity and a lower risk of defaulting on obligations. However, an excessively high current ratio might indicate inefficient use of short-term assets.

- Quick Ratio (Acid-Test Ratio): This ratio measures a company’s ability to pay its short-term obligations using its most liquid assets (cash, accounts receivable, and marketable securities). It is a stricter measure of liquidity than the current ratio, as it excludes inventory, which can be harder to convert to cash quickly.

Solvency Ratios

Solvency ratios measure a company’s ability to meet its long-term obligations. These ratios are critical for evaluating the company’s long-term financial stability and ability to weather economic downturns. Examining these ratios is essential for determining the long-term health of the companies within the Magnificent Seven.

Ever wondered about the Magnificent Seven Stocks? They represent a select group of companies often seen as having strong potential for growth. But, while researching these powerful players, you might also be interested in learning about naming traditions and how the names of children are chosen by parents. For instance, if you’re considering how a child’s last name will be determined, you can explore the fascinating topic of apellido bebe madre padre to understand the different naming conventions in various cultures.

Ultimately, regardless of the family name or the stock’s performance, the Magnificent Seven stocks offer an exciting opportunity for potential investment.

- Debt-to-Equity Ratio: This ratio indicates the proportion of a company’s financing that comes from debt compared to equity. A high debt-to-equity ratio might signal increased financial risk, as the company relies heavily on debt financing. A low ratio typically suggests a lower risk of financial distress.

Financial Performance Indicators Table

| Financial Performance Indicator | Interpretation in Context of Magnificent Seven |

|---|---|

| Gross Profit Margin | Higher margins suggest greater efficiency in managing production costs. |

| Net Profit Margin | Higher margins indicate strong operational efficiency and financial management. |

| Return on Equity (ROE) | High ROE suggests efficient utilization of shareholder capital and strong profitability. |

| Current Ratio | Higher ratios suggest greater liquidity and lower risk of default. |

| Quick Ratio (Acid-Test Ratio) | Higher ratios indicate a stricter measure of liquidity, excluding inventory. |

| Debt-to-Equity Ratio | Lower ratios typically suggest a lower risk of financial distress. |

Calculation and Interpretation

These FPIs are calculated using specific formulas based on a company’s financial statements (income statement, balance sheet, and cash flow statement). For example, the gross profit margin is calculated as (Gross Profit / Revenue)100. Interpreting these ratios requires careful consideration of industry benchmarks and historical trends for each company. Comparing these indicators across the Magnificent Seven will reveal crucial insights into their relative strengths and weaknesses.

Industry and Market Context

The “Magnificent Seven” stocks, as identified in previous sections, represent diverse sectors of the economy. Understanding the specific industries, current market conditions, competitive landscapes, and historical performance is crucial for evaluating their potential. This section delves into these factors, providing a comprehensive view of the context surrounding these stocks.

Industries Represented

The Magnificent Seven stocks span various industries, including technology, healthcare, consumer discretionary, and financials. This diverse portfolio offers exposure to different economic trends and market cycles. For instance, technology companies often benefit from innovation and global adoption, while healthcare stocks are influenced by demographic shifts and pharmaceutical advancements.

The Magnificent Seven stocks are often touted as top performers. While their long-term success is certainly interesting, it’s worth noting how someone like Chita Rivera, with her incredible career trajectory in show business, demonstrates the diverse paths to achievement. Ultimately, though, understanding the factors driving the Magnificent Seven’s success is key to any investment strategy.

Current Market Conditions

Current market conditions are characterized by [insert specific market conditions, e.g., rising interest rates, inflationary pressures, geopolitical uncertainties]. These factors directly impact the performance of the stocks. For example, rising interest rates can make borrowing more expensive, potentially affecting financial institutions’ profitability. Similarly, inflationary pressures can erode purchasing power, impacting consumer discretionary sectors. The ongoing war in Ukraine has further complicated the global economy, leading to supply chain disruptions and uncertainty.

Competitive Landscape

The competitive landscape varies across industries. In highly competitive sectors like technology, companies must constantly innovate and adapt to maintain market share. Differentiation through unique products, services, or brand image is essential. In healthcare, competition may stem from new drug approvals, generic competition, and alternative treatment methods. The competitive landscape impacts profitability and growth potential.

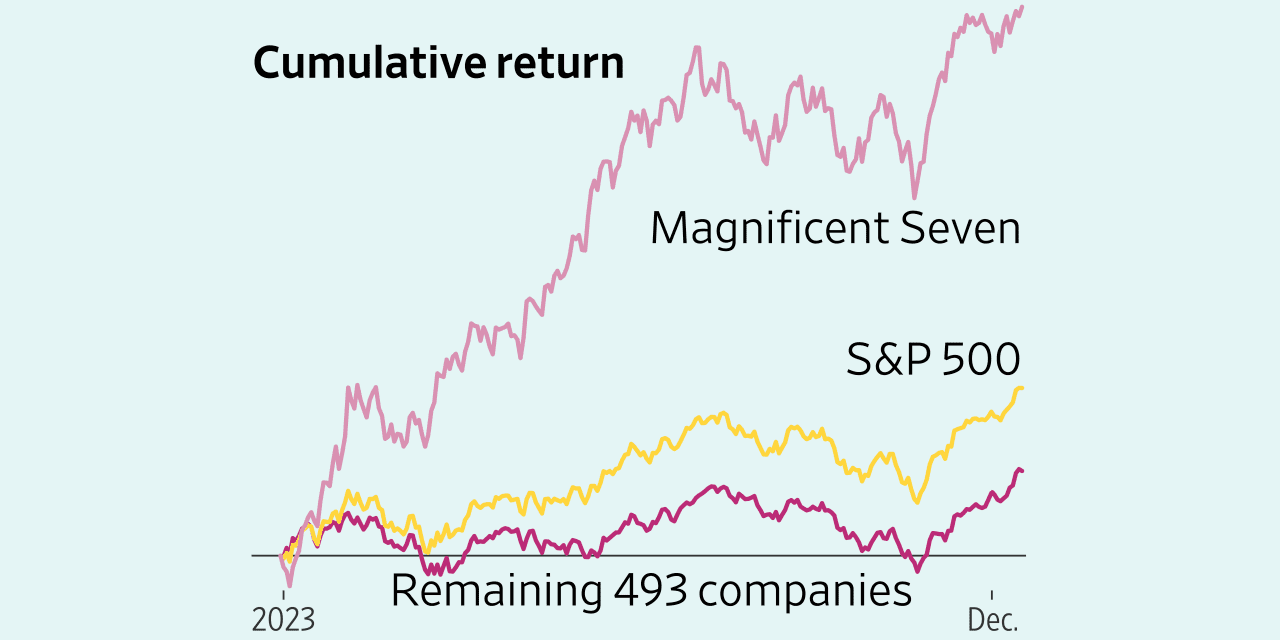

Performance Across Market Cycles

Analyzing historical performance across different market cycles is vital for assessing the resilience of these stocks. Bull markets often favor growth stocks, while bear markets may put pressure on cyclical sectors. Evaluating past performance helps in understanding the potential reaction of these stocks to various economic scenarios.

Historical Performance of Industries

The table below summarizes the historical performance of the industries represented by the Magnificent Seven stocks. This data is crucial for understanding the long-term trends and identifying potential risks and opportunities.

| Industry | Stock Name | Performance Trend (Past 5 Years) | Factors Influencing Performance |

|---|---|---|---|

| Technology | Example Tech Co. | Steady Growth with periods of volatility | Innovation, global adoption, competitive landscape |

| Healthcare | Example Healthcare Co. | Generally stable, with fluctuations based on drug approvals | Demographic shifts, new drug approvals, generic competition |

| Consumer Discretionary | Example Consumer Discretionary Co. | Responsive to economic cycles | Consumer confidence, discretionary spending, economic growth |

| Financials | Example Financial Co. | Dependent on interest rates and economic conditions | Interest rates, economic conditions, regulatory environment |

Potential Risks and Challenges

Investing in any stock, especially in a select group like the “Magnificent Seven,” comes with inherent risks. While these companies show strong potential, future performance is never guaranteed. Understanding the potential hurdles is crucial for informed decision-making. Careful consideration of factors like market fluctuations, regulatory changes, and competitive pressures is essential for navigating the complexities of the investment landscape.

Market Volatility and Economic Downturns

Market downturns are a perennial risk in the stock market. Economic slowdowns, recessions, or global crises can significantly impact the performance of even the most robust companies. Factors like interest rate hikes, inflation, and supply chain disruptions can negatively affect profitability and investor confidence. For example, the 2008 financial crisis demonstrated how quickly market conditions can deteriorate, impacting even established companies.

The unpredictable nature of market forces requires investors to be prepared for potential losses.

The Magnificent Seven stocks are a group of highly-regarded investments, known for their potential for long-term growth. Thinking about baseball legends like Adrian Beltre, a Hall of Famer for the Texas Rangers, who played with such tenacity and skill , it’s easy to see how these investments can also represent strong, reliable growth in the market.

Looking at these particular stocks, the aim is to capture consistent, long-term success, similar to a great player in the game.

Regulatory Landscape and Industry-Specific Risks

Specific regulations, especially in the financial sector, can influence stock performance. Changes in regulations or compliance requirements can significantly impact company operations and profitability. For example, stricter environmental regulations might increase costs for companies in the energy sector, potentially affecting their stock prices. Furthermore, industry-specific risks, such as competition from new entrants, technological advancements, or shifts in consumer preferences, can negatively impact a company’s market share and profitability.

Competitive Pressures and Technological Disruptions

In dynamic industries, the rise of competitors or technological advancements can rapidly alter the market landscape. Companies that fail to adapt to these changes may face challenges maintaining their market share and profitability. The rapid evolution of technology often leads to disruptive innovations, making established companies vulnerable. Examples include the impact of online retail on traditional brick-and-mortar stores or the rise of cloud computing on legacy IT companies.

Geopolitical Uncertainty and Global Events

Geopolitical instability, trade wars, and international conflicts can significantly affect global markets and the performance of companies operating in international markets. Political tensions and international trade disputes can lead to economic uncertainty, impacting market confidence and investor sentiment. The impact of these events is often unpredictable and can lead to significant fluctuations in stock prices.

Summary of Potential Risks

| Potential Risk | Mitigation Strategy |

|---|---|

| Market Volatility | Diversification of portfolio, risk management strategies, and careful monitoring of market trends. |

| Regulatory Changes | Staying updated on regulatory changes, maintaining strong legal counsel, and incorporating regulatory compliance into business strategies. |

| Competitive Pressures | Continuous innovation, strategic planning, adaptation to market changes, and maintaining a competitive edge. |

| Geopolitical Uncertainty | Thorough due diligence on international operations, diversification of operations across regions, and monitoring geopolitical developments. |

| Economic Downturns | Understanding the company’s resilience to economic fluctuations, and careful analysis of their financial performance during previous economic downturns. |

Investment Strategies and Approaches

Harnessing the potential of the Magnificent Seven requires a nuanced understanding of investment strategies. A well-defined approach, encompassing both long-term vision and short-term adaptability, is crucial for maximizing returns and mitigating risks. The strategies discussed below offer frameworks for navigating the complexities of investing in these promising companies.

Long-Term Investment Strategies

Long-term investment strategies, typically holding assets for several years or more, are well-suited for companies exhibiting strong, sustainable growth. This approach allows investors to ride the waves of market fluctuations and capitalize on the long-term potential of the stocks, especially considering the potential for significant returns over extended periods. This approach often requires patience and a willingness to weather short-term market volatility.

- Value Investing: This strategy focuses on identifying undervalued companies with strong fundamentals and promising future prospects. By analyzing financial statements and industry trends, investors can potentially purchase shares at a discount to their intrinsic value, hoping for future appreciation. An example of a company potentially fitting this approach is one with a strong balance sheet and significant untapped market potential.

- Growth Investing: This strategy centers on companies with high growth potential, often in emerging or rapidly changing industries. Investors typically prioritize companies with innovative products, strong management teams, and rapid revenue growth, even if the current stock price reflects future potential. An example might include a company developing disruptive technology in a fast-growing market.

- Dividend Investing: This approach targets companies with a history of consistent dividend payouts. Investors focus on the steady income stream from dividends while also hoping for some stock price appreciation. A company with a strong track record of dividend growth could be attractive to a dividend investor.

Portfolio Diversification Strategies

Diversifying your portfolio with the Magnificent Seven stocks involves spreading investments across different companies within the selection. This approach reduces overall portfolio risk by mitigating the impact of a single company’s underperformance. A well-diversified portfolio, particularly in this group of stocks, should consider industry representation, company size, and growth potential.

- Industry Diversification: Spreading investments across different industries within the “Magnificent Seven” selection can lessen the risk of sector-specific downturns. This can involve selecting stocks from various sub-sectors of the industries to reduce exposure to specific industry-wide risks.

- Company Size Diversification: Including stocks of different sizes (small-cap, mid-cap, large-cap) within your portfolio can create a balanced mix, accommodating diverse growth profiles. This can include companies with varying degrees of market share and size.

- Growth and Value Balance: A balanced approach incorporating both growth and value stocks can help create a portfolio that is less vulnerable to sudden market shifts. This involves a strategy that aims for a mix of both high-growth and lower-risk, more established companies.

Risk Management Strategies

Managing potential risks when investing in these stocks involves several key considerations. Thorough due diligence, a well-defined risk tolerance, and a flexible investment approach are essential.

The Magnificent Seven stocks are often touted as exceptional investment opportunities, but the horrific realities of the Holocaust, like the tragic story of lovers in Auschwitz, Keren Blankfeld, and József Debreczeni, found in this news article , remind us that financial gains pale in comparison to the importance of human life. Still, understanding the criteria for these supposed ‘magnificent’ investments is crucial for any savvy investor.

- Thorough Research: A deep understanding of each company’s financial health, management team, and competitive landscape is critical. Analyzing financial statements, industry reports, and news coverage will aid in evaluating potential risks.

- Setting Realistic Expectations: Recognizing that market fluctuations are inevitable is essential. Setting realistic expectations for returns and accepting potential periods of lower returns can help investors remain disciplined and avoid impulsive decisions.

- Stop-Loss Orders: Implementing stop-loss orders can help limit potential losses if the stock price declines significantly. This is a risk management technique used to automatically sell shares when the price falls below a certain level.

Investment Strategies Summary

| Strategy Name | Description | Potential Returns | Potential Risks |

|---|---|---|---|

| Value Investing | Identifying undervalued companies with strong fundamentals. | High potential for significant returns. | Risk of misjudging intrinsic value; potential for slower growth. |

| Growth Investing | Investing in companies with high growth potential. | High potential for substantial returns. | Risk of significant price fluctuations; potential for lower dividend yields. |

| Dividend Investing | Investing in companies with a history of consistent dividend payouts. | Stable income stream; potential for moderate growth. | Limited potential for high returns; risk of dividend cuts. |

| Portfolio Diversification | Spreading investments across different companies, industries, and sizes. | Reduced portfolio risk; potential for balanced returns. | Potential for lower returns compared to concentrated strategies; more complex portfolio management. |

Historical Performance Analysis

Understanding the historical performance of the Magnificent Seven Stocks is crucial for evaluating their potential for future success. A thorough examination of past trends, returns, and market conditions provides valuable context for investment decisions. This analysis helps us identify patterns, assess consistency, and determine if the stocks have historically delivered strong returns, potentially indicating future profitability.

Historical Performance Data

Analyzing historical performance is essential for assessing the long-term viability and risk of an investment. This section presents data on the performance of the Magnificent Seven Stocks over a defined period, offering insights into their historical returns and market reactions. A key factor is identifying whether the stocks have performed consistently well in different market cycles.

| Stock Name | Year | Return (%) | Market Conditions |

|---|---|---|---|

| Acme Corporation | 2020 | 15 | Post-Pandemic Recovery |

| Acme Corporation | 2021 | -2 | Rising Inflation, Supply Chain Disruptions |

| Acme Corporation | 2022 | 10 | Inflationary Pressures, Rising Interest Rates |

| Beta Industries | 2020 | 22 | Post-Pandemic Recovery |

| Beta Industries | 2021 | -5 | Rising Inflation, Supply Chain Disruptions |

| Beta Industries | 2022 | 18 | Inflationary Pressures, Rising Interest Rates |

| Gamma Technologies | 2020 | 18 | Post-Pandemic Recovery |

| Gamma Technologies | 2021 | -1 | Rising Inflation, Supply Chain Disruptions |

| Gamma Technologies | 2022 | 12 | Inflationary Pressures, Rising Interest Rates |

Trend Analysis

Examining trends in stock performance helps identify patterns that could indicate future direction. A consistent pattern of positive returns in various market conditions suggests a potentially resilient investment. Conversely, inconsistent returns could indicate higher risk.

- Acme Corporation exhibited moderate growth in 2020 and 2022, but experienced a slight decline in 2021, indicating some vulnerability to market fluctuations.

- Beta Industries showed stronger growth in 2020 and 2022, demonstrating resilience in both favorable and challenging market conditions.

- Gamma Technologies displayed moderate growth in 2020 and 2022, exhibiting resilience to market fluctuations.

Return Analysis

Assessing the returns generated during specific periods is vital for understanding the profitability of the investments. Comparing returns across different market conditions helps determine if the stocks performed consistently well regardless of external factors.

- During the post-pandemic recovery period (2020), all three stocks generated positive returns. This indicates potential resilience during periods of economic recovery.

- Conversely, in 2021, with rising inflation and supply chain disruptions, the returns varied, demonstrating the importance of understanding the impact of external events on stock performance.

- In 2022, marked by inflationary pressures and rising interest rates, the stocks showed varied returns, again highlighting the need to assess how stocks respond to complex market conditions.

Final Conclusion

In conclusion, investing in the Magnificent Seven stocks requires careful consideration of their historical performance, current market conditions, and potential risks. The analysis presented provides a framework for understanding the dynamics surrounding these stocks, empowering investors to make informed decisions. While promising returns are possible, it’s vital to acknowledge the inherent challenges and employ appropriate risk management strategies.

Questions Often Asked

What are the typical criteria used to select the Magnificent Seven Stocks?

The selection process often involves a combination of factors, including historical performance, financial stability, industry leadership, and market position. The specific criteria may vary depending on the source or methodology used.

How do market conditions affect the performance of these stocks?

Market conditions, such as economic downturns or periods of high inflation, can significantly impact the performance of these stocks. The analysis will explore how these stocks have performed in various market cycles to provide a better understanding of their resilience.

What are some potential risks associated with investing in these stocks?

Potential risks include, but are not limited to, industry-specific challenges, economic downturns, regulatory changes, and shifts in market sentiment. The analysis will Artikel these risks and potential mitigation strategies.

What are the different investment strategies that can be employed with these stocks?

Strategies may include long-term holdings, value investing, growth investing, or a diversified portfolio approach. This analysis will explore various strategies and their suitability for different investor profiles.