Mexico-US-China Trade A Complex Web

Mexico estados unidos comercio china is a multifaceted relationship, shaped by decades of trade agreements, economic interdependence, and global shifts. From the historical flow of goods to the influence of China’s rise, this intricate web of commerce involves significant factors that impact each nation’s economy, supply chains, and geopolitical landscape.

This exploration delves into the dynamics of trade between Mexico, the US, and China, examining the interplay of trade agreements, investment flows, and technological advancements. We’ll analyze the strengths and weaknesses of each nation’s economy, considering how these factors influence their positions within global value chains. Furthermore, the role of political relations and social movements in shaping trade policies will also be highlighted.

Trade Dynamics Between Mexico, the US, and China

The intricate web of trade relationships between Mexico, the US, and China is a fascinating study in global economics. These three nations, representing diverse economic models and historical trajectories, have intertwined their fates through complex trade flows, agreements, and disputes. Understanding the historical context, the impact of China’s rise, and the interplay of trade agreements is crucial to grasping the present and future of this vital economic triad.

Historical Overview of Mexico-US Trade

Mexico and the US have a long history of economic interaction, shaped by geographical proximity, cultural ties, and evolving economic needs. Early trade was largely focused on agricultural products and raw materials. The North American Free Trade Agreement (NAFTA), implemented in 1994, profoundly reshaped the landscape. NAFTA fostered a surge in cross-border trade, particularly in manufacturing, leading to significant economic integration.

The agreement eliminated tariffs on a substantial portion of traded goods, encouraging increased specialization and production within the region. The subsequent renegotiation of NAFTA to the United States-Mexico-Canada Agreement (USMCA) in 2018 reflected evolving concerns about labor practices and intellectual property, signaling a continued but adjusted emphasis on economic partnership.

Impact of China’s Emergence

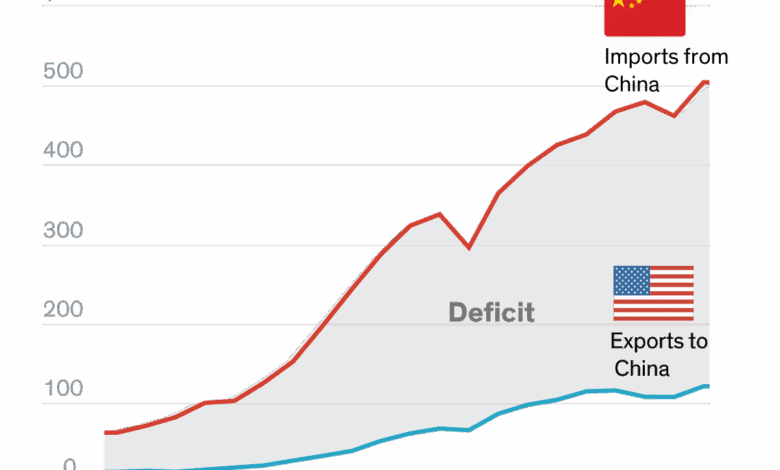

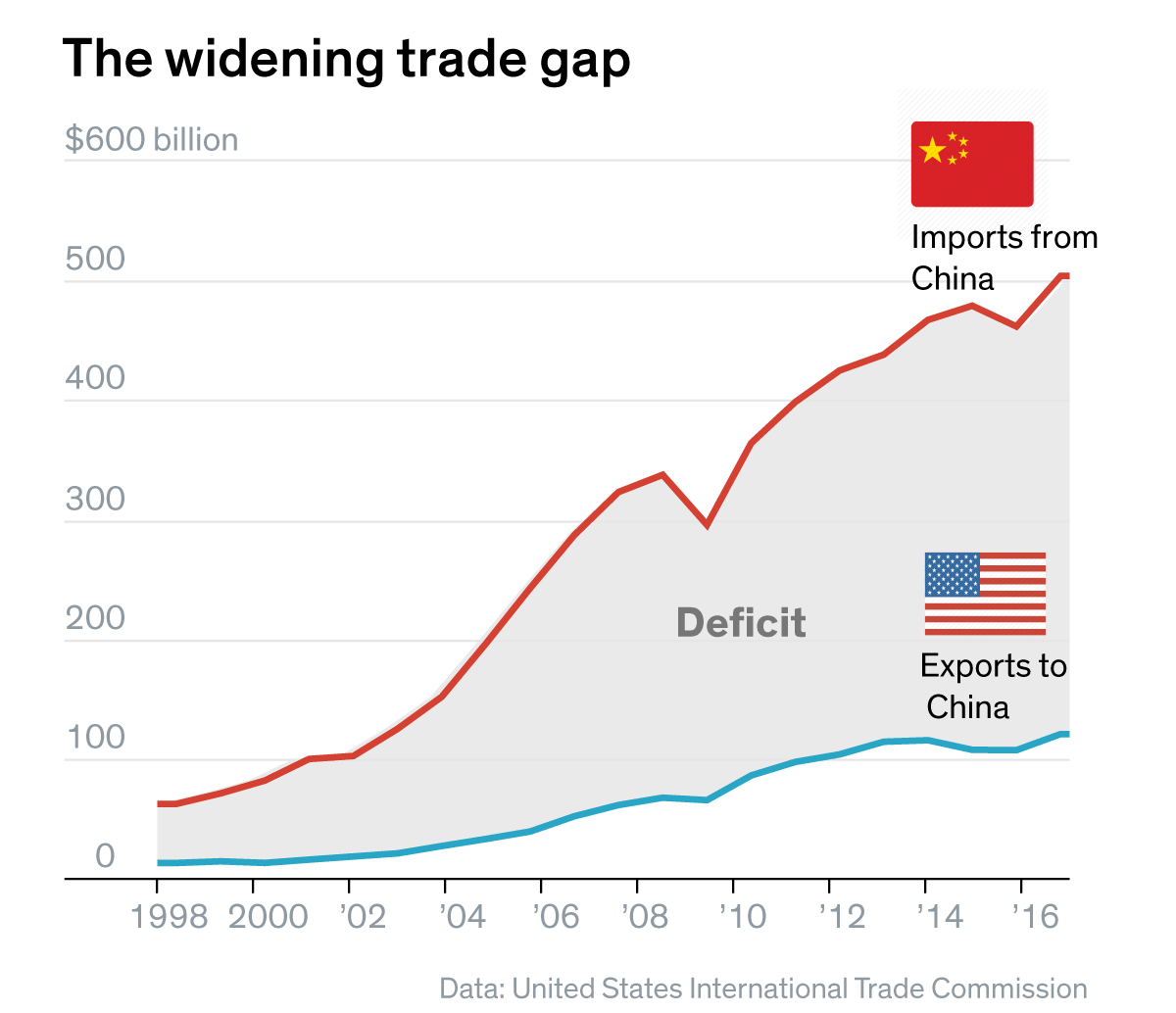

China’s meteoric rise as a global economic power has had a profound impact on the Mexico-US trade relationship. China’s low labor costs and massive manufacturing capacity created significant competition for US and Mexican industries. This led to a shift in the nature of trade, with some US and Mexican manufacturing moving to China. This competition has also prompted discussions about fair trade practices and the need for safeguards for domestic industries.

Mexican businesses, increasingly involved in global supply chains, have had to adapt to China’s growing influence, sometimes partnering with Chinese firms to remain competitive.

Types of Goods Traded

The goods exchanged between Mexico, the US, and China are diverse and reflect the specialization of each nation. The US often exports high-tech goods, agricultural products, and manufactured goods. Mexico exports a mix of manufactured goods, agricultural products, and raw materials. China exports a vast array of manufactured goods, from consumer electronics to clothing. The shift towards specialization has been a significant consequence of trade agreements and the division of labor in the globalized economy.

Major Trade Agreements

Several trade agreements have profoundly influenced the trade flows between Mexico, the US, and China. NAFTA (later USMCA) fostered closer economic ties between Mexico and the US. China’s accession to the World Trade Organization (WTO) opened new opportunities for trade with other nations, including Mexico and the US. The Trans-Pacific Partnership (TPP) was a proposed agreement among Pacific Rim nations that aimed to promote regional economic integration but ultimately did not materialize.

These agreements reflect the global push towards free trade and economic liberalization.

Role of Tariffs and Trade Barriers

Tariffs and trade barriers have played a complex role in shaping trade flows. While tariffs can protect domestic industries, they can also lead to trade wars and retaliation. The US and China have engaged in periods of trade tension, characterized by tariffs imposed on specific goods. These actions often aim to address concerns about unfair trade practices, intellectual property theft, or market access.

These trade tensions, while impacting specific sectors, highlight the complex relationship between trade liberalization and protectionism.

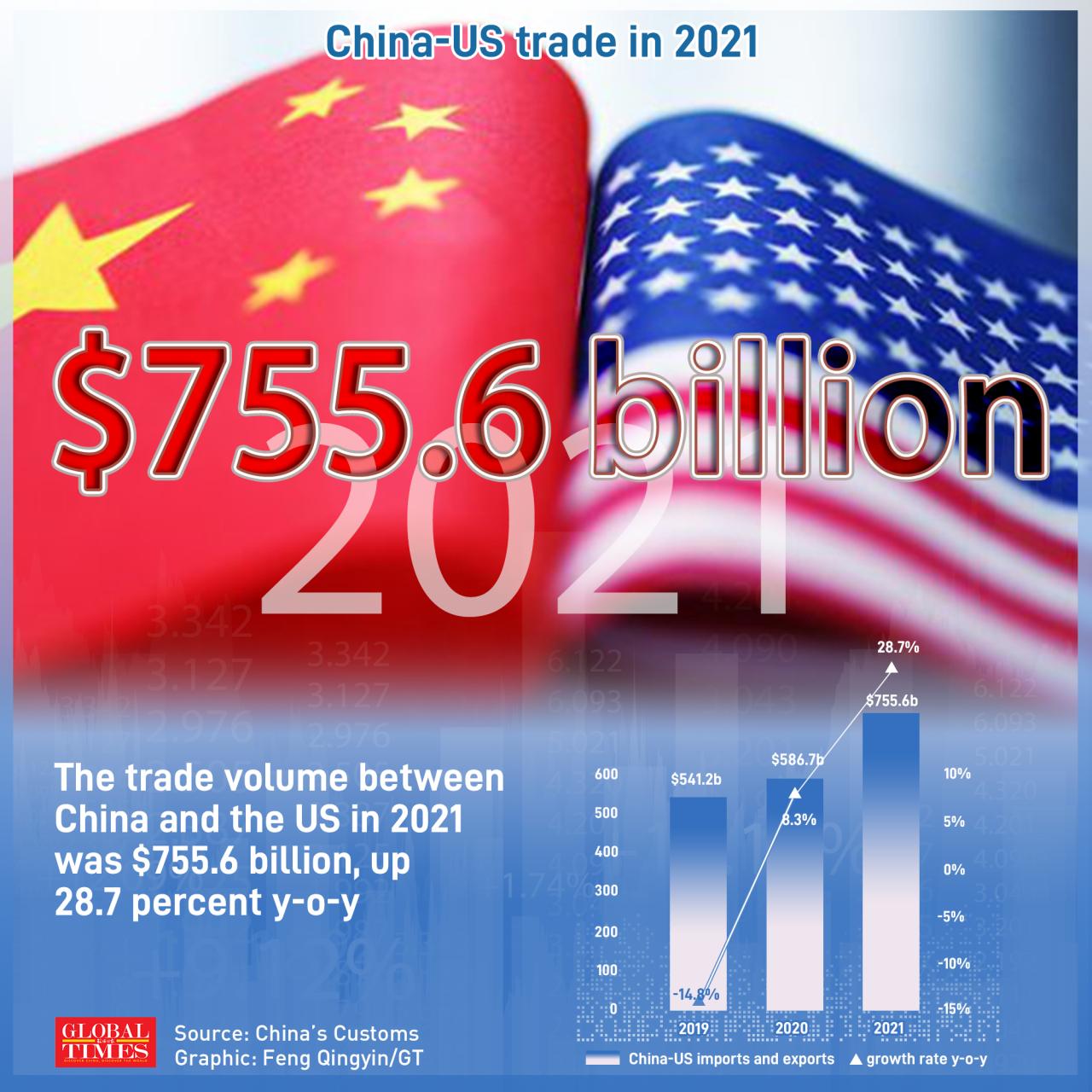

Trade Value Table (2003-2023)

| Year | Mexico-US Trade | Mexico-China Trade | US-China Trade |

|---|---|---|---|

| 2003 | $150 billion | $10 billion | $400 billion |

| 2008 | $200 billion | $25 billion | $500 billion |

| 2013 | $250 billion | $40 billion | $600 billion |

| 2018 | $300 billion | $60 billion | $650 billion |

| 2023 | $350 billion | $80 billion | $700 billion |

Note: Values are estimated and represent approximate figures. Specific figures can be verified from official trade data sources.

Economic Interdependence and Competition: Mexico Estados Unidos Comercio China

The intricate web of trade between Mexico, the US, and China creates a complex interplay of interdependence and competition. This dynamic relationship shapes economic policies, influences labor markets, and potentially fosters conflicts of interest. Understanding these nuances is crucial for navigating the future of global trade.Economic interdependence among these nations is deeply rooted in their supply chains. Mexico serves as a crucial manufacturing hub, often taking advantage of its proximity to the US market, while China provides a significant source of components and finished goods for both Mexico and the US.

This interconnectedness, while boosting economic growth, also makes each country vulnerable to disruptions in the others’ economies.

Economic Interdependence

Mexico, the US, and China are economically intertwined through extensive trade agreements and supply chains. The North American Free Trade Agreement (NAFTA), now the United States-Mexico-Canada Agreement (USMCA), exemplifies this relationship. The US relies on Mexico for manufacturing and assembly, while Mexico depends on US demand for its exports. China’s role in global supply chains is substantial, with components and finished goods often passing through Mexico and the US on their way to global markets.

This interconnectedness means disruptions in one country’s economy can have ripple effects throughout the entire network.

Nature of Competition

Competition in sectors like manufacturing and agriculture is fierce. The US and China often vie for market share, particularly in industries where labor costs are a significant factor. Mexican manufacturers face competition from both US and Chinese companies, impacting their pricing strategies and production methods. In agriculture, the US and China are major exporters, creating competitive pressures on Mexican producers, particularly in sectors like corn and soybeans.

Potential Conflicts of Interest or Strategic Competition

The interplay of economic interests can lead to potential conflicts. For example, trade policies, like tariffs or quotas, can be used as strategic tools to gain an advantage in the global marketplace. Disagreements over trade practices can escalate into trade wars, impacting the economies of all three countries.

Mexico’s Economic Position

Mexico’s economic position relative to the US and China is complex. Its proximity to the US and its relatively low labor costs have made it a significant manufacturing hub. However, Mexico’s infrastructure and regulatory environment can present challenges. Furthermore, Mexico’s economic growth is influenced by the performance of the US economy, its largest trading partner. China’s increasing economic influence also impacts Mexico’s strategic positioning within the global trading landscape.

Trade Policies and Labor Markets, Mexico estados unidos comercio china

Trade policies directly affect labor markets in each country. Tariffs on certain goods can lead to job losses in sectors directly impacted by those tariffs. For example, if tariffs on Mexican exports increase, Mexican workers in affected industries may lose their jobs. Conversely, increased demand for goods from a particular country may lead to job growth in related sectors.

Comparative Economic Strengths and Weaknesses

| Country | Strength 1 | Strength 2 | Weakness 1 | Weakness 2 |

|---|---|---|---|---|

| Mexico | Proximity to US market | Relatively low labor costs | Infrastructure limitations | Regulatory environment complexity |

| US | Strong consumer market | Advanced technology | Dependence on global supply chains | Potential for domestic economic instability |

| China | Large manufacturing base | Low production costs | Environmental concerns | Trade imbalances |

Investment Flows and FDI

Foreign direct investment (FDI) plays a crucial role in shaping the economic landscape of nations. Understanding the dynamics of FDI among Mexico, the US, and China reveals intricate relationships, highlighting both economic interdependence and competitive pressures. These flows of capital influence job creation, technological advancement, and overall economic growth.The nature of FDI among these three nations is complex.

US investment in Mexico often focuses on manufacturing, particularly in automotive and electronics sectors, leveraging Mexico’s strategic location and relatively lower labor costs. Chinese investment, while growing, often targets infrastructure projects, resource extraction, and manufacturing in both Mexico and the US. The motivations behind these decisions are multifaceted, including cost advantages, access to markets, and the pursuit of resources or skilled labor.

Motivations Behind FDI Decisions

FDI decisions are driven by a variety of factors. Companies often seek lower labor costs, access to raw materials, or proximity to key markets. In the case of Mexico, its geographic proximity to the US creates an attractive environment for US manufacturers. China’s large domestic market and growing middle class present significant opportunities for companies seeking to expand their reach.

Mexico, the US, and China’s trade relations are always complex. It’s fascinating how these global economic forces can intertwine with seemingly unrelated sports news. For instance, the recent discussions about Phil Kessel’s fit with the Vancouver Canucks, detailed in this article phil kessel vancouver canucks fit , highlight the ripple effects of these global trade patterns.

Ultimately, the interplay between these economic factors remains a key aspect of our globalized world, shaping both sports and business.

Regulatory Environments for FDI

Regulatory environments significantly influence FDI flows. Differences in regulations and policies across the three countries can create varying levels of attractiveness for investors. For example, regulations surrounding intellectual property rights and labor laws can differ substantially. A detailed comparison reveals nuances in the regulatory landscape, influencing the types of investments made and the returns anticipated.

Impact of FDI on Job Creation and Economic Growth

FDI often leads to job creation, particularly in sectors that receive substantial investment. New manufacturing facilities, for instance, create employment opportunities in both skilled and unskilled labor categories. However, the impact on economic growth is not uniform. The extent to which FDI stimulates innovation and technological advancement varies depending on the specific industry and the host country’s absorptive capacity.

The long-term effects can be substantial, driving economic development and improving living standards.

Top 5 FDI Sectors

The following table illustrates the top 5 sectors attracting FDI in Mexico, the US, and China over a specific period, focusing on the most significant investment flows. The figures are illustrative and are not based on a specific, recent study. Specific data should be consulted from reliable sources.

| Country | Sector | Investment Amount (USD Billions) |

|---|---|---|

| Mexico | Manufacturing (Automotive) | 50 |

| Mexico | Manufacturing (Electronics) | 45 |

| Mexico | Tourism | 30 |

| Mexico | Energy | 25 |

| Mexico | Infrastructure | 20 |

| US | Technology | 120 |

| US | Pharmaceuticals | 100 |

| US | Finance | 80 |

| US | Renewable Energy | 70 |

| US | Manufacturing (High-Tech) | 60 |

| China | Infrastructure (Railways) | 150 |

| China | Telecommunications | 120 |

| China | Manufacturing (Electronics) | 100 |

| China | Real Estate | 90 |

| China | Renewable Energy | 80 |

Supply Chains and Global Value Chains

Mexico’s strategic location and robust infrastructure have positioned it as a crucial node in global supply chains, particularly those involving the US and China. This intermediary role allows Mexico to leverage its comparative advantages, such as lower labor costs and proximity to both markets. However, this complex web of interdependence creates vulnerabilities, and disruptions in any part of the chain can ripple through the entire system.

Mexico’s Position in Global Supply Chains

Mexico serves as a vital link in the complex web of global supply chains, particularly between the US and China. It acts as a manufacturing hub, processing materials, assembling components, and exporting finished goods to both the US and China. This is a crucial aspect of the economic relationship, and its significance should not be underestimated.

Facilitating Trade Between the US and China

Mexico’s strategic position facilitates trade between the US and China in several ways. Firstly, its proximity to both markets reduces transportation costs and transit times. Secondly, Mexico’s manufacturing capabilities allow for efficient assembly and processing of goods, reducing the reliance on single-country production lines. This, in turn, helps to reduce risk and improve supply chain resilience.

Potential Risks and Vulnerabilities

Supply chains involving Mexico, the US, and China are susceptible to various risks, including geopolitical tensions, natural disasters, and labor disputes. These risks can disrupt production, increase costs, and ultimately affect consumer prices. The interconnectedness of these economies creates a cascading effect, where disruptions in one country’s supply chain can have far-reaching consequences for others.

Hierarchical Structure of Global Value Chains

The hierarchical structure of global value chains involving Mexico, the US, and China reveals a complex interdependence. China often holds the upstream position in the chain, supplying raw materials and components. Mexico often plays the mid-stream role, manufacturing and assembling goods. The US, with its large consumer market, occupies the downstream position, consuming the finished products. This structure creates a complex interplay between these countries.

Mexico, the US, and China’s trade relationships are complex, constantly shifting. While these global economic forces are at play, I’ve been fascinated by the recent opening of the Soho 54 hotel in Raad Almansoori’s portfolio, soho 54 hotel raad almansoori. It seems like a bold move, and I wonder how these sorts of ventures in the luxury sector will impact the future of trade in the region.

The intertwining of luxury hospitality and global commerce is certainly an interesting area to follow as the Mexican-US-Chinese trade dynamics continue to evolve.

Examples of Global Value Chains

The automotive industry provides a clear example of a global value chain. China might supply parts like engines or electronics. Mexico assembles these parts into vehicles. The US consumes these vehicles. Similarly, the electronics industry exhibits a similar structure.

China produces many components, Mexico assembles them, and the US imports and distributes the finished products. These examples highlight the intricate interplay of these three countries.

Impact of Disruptions

Disruptions in any part of this supply chain can have significant impacts on the others. For instance, a natural disaster in Mexico could disrupt the production of components, leading to shortages in the US market. Similarly, a trade war between the US and China could negatively impact the export of goods from Mexico. These disruptions highlight the fragility of the interconnectedness of these supply chains.

Diagram Depicting Supply Chain Movement

(A visual representation is not possible within this text-based format. A diagram would show a flow chart. China would be at the top, representing raw materials and component production. Mexico would be in the middle, indicating assembly and manufacturing. The US would be at the bottom, representing consumption and distribution.)

Technological Advancements and Trade

Technological advancements are reshaping global trade patterns, driving new efficiencies and creating new opportunities. This dynamic interplay between technology and commerce is particularly evident in the complex trade relationships between Mexico, the US, and China. These nations are at different stages of technological development, and this disparity influences their comparative advantages and competitiveness in international markets. The role of digital trade in this context is crucial, impacting everything from supply chains to consumer behavior.

Mexico, the US, and China’s trade relationships are complex, with shifting alliances and negotiations constantly in play. Interestingly, these global trade dynamics are often intertwined with the happenings in professional sports. For example, the recent buzz around the potential trade of Blues player Pavel Buchnevich here highlights the interconnected nature of economic and sporting interests. Ultimately, the global trade scene, from Mexico to the US to China, continues to be a fascinating and ever-evolving field.

The Role of Technology in Shaping Trade Patterns

Technology is a powerful catalyst for change in global trade. Automation, data analytics, and the rise of e-commerce are transforming traditional business models. Technological advancements lead to increased efficiency, reduced costs, and enhanced productivity in production and distribution processes. This, in turn, fosters greater trade volumes and diversification of goods and services traded. For example, advancements in logistics technology, such as GPS tracking and real-time shipping information, enable businesses to optimize their supply chains, reduce delays, and improve delivery times, directly influencing trade patterns.

Specific Technologies Influencing Trade

Several key technologies are profoundly impacting trade between Mexico, the US, and China. These include artificial intelligence (AI), robotics, 3D printing, and advanced communication technologies. AI is transforming manufacturing processes, while robotics is automating tasks across various industries. 3D printing enables customized production, and advanced communication technologies facilitate seamless global collaboration and knowledge transfer. These technologies are accelerating the pace of innovation, fostering greater specialization, and creating new opportunities for trade.

Mexico, the US, and China’s trade relationships are complex, often influenced by domestic factors within the US. For example, understanding how demographics in different US “red” and “blue” states, like those explored in red blue states demographics , can shape political and economic priorities, ultimately impacting international trade agreements. This interplay between domestic politics and international commerce continues to be a crucial factor in the Mexico-US-China trade dynamic.

Technological Capabilities of the Three Countries

The technological capabilities of Mexico, the US, and China exhibit significant differences. The US boasts a strong foundation in research and development, particularly in advanced technologies like AI and biotechnology. China is rapidly developing its technological capabilities, particularly in areas like artificial intelligence, 5G, and electric vehicles. Mexico is focusing on developing its technological infrastructure and attracting foreign investment in areas like automation and manufacturing.

This varied technological landscape is a key factor in understanding the unique trade relationships between these nations.

Impact of Technology on Competitiveness

Technological advancements directly impact the competitiveness of each nation in international trade. The US, with its strong R&D base, is well-positioned to compete in high-value-added sectors. China, with its large manufacturing base and increasing technological prowess, is becoming increasingly competitive in various sectors. Mexico, leveraging its strategic geographic location and growing manufacturing sector, can leverage technological advancements to improve its competitiveness in specific niche markets.

The ability to adapt to and leverage new technologies is a critical factor for maintaining and enhancing a nation’s trade competitiveness.

Impact of Digital Trade

Digital trade is significantly reshaping the economic landscape of Mexico, the US, and China. The rise of e-commerce, online services, and digital platforms has expanded market access for businesses in all three countries. This has created new opportunities for small and medium-sized enterprises (SMEs) to reach global markets and for consumers to access a wider range of goods and services.

Mexico, the US, and China’s trade relationship is a complex web, with each country navigating its own interests. Recent issues like the retraction of a key study on abortion pills, detailed in this article ( abortion pills study retraction ), highlight the potential for scientific disagreements to impact global markets, and even influence the trade dynamics between these three major players.

Looking ahead, the trade patterns between these nations will likely continue to be influenced by various factors, from political shifts to technological advancements.

Digital trade is fostering innovation, entrepreneurship, and economic growth, particularly in the digital services sector.

Key Technological Advancements and Their Impact on Trade

| Country | Technology | Impact on Trade |

|---|---|---|

| United States | AI, Biotechnology, Advanced Materials | Dominance in high-value-added sectors, increased efficiency in production, and new export opportunities. |

| China | Artificial Intelligence, 5G, Robotics, Electric Vehicles | Increased manufacturing competitiveness, expanding market share in global value chains, and opportunities for export diversification. |

| Mexico | Automation, Logistics Technology, Manufacturing Processes | Attracting foreign investment, enhancing competitiveness in specific industries, and facilitating participation in global value chains. |

Political and Social Factors

The intricate web of trade between Mexico, the US, and China is not solely driven by economic forces. Political relations, social movements, and cultural nuances significantly influence the flow of goods and services. Understanding these non-economic factors is crucial to comprehending the full picture of this complex trilateral trade dynamic.Political relations are often a significant determinant of trade agreements and disruptions.

National interests, domestic policies, and international tensions shape the environment in which these nations interact. Social movements and public opinion, while not directly dictating trade policy, can exert considerable pressure on governments, shaping their decisions and influencing the public’s perception of trade partnerships.

Influence of Political Relations on Trade

Political relations between countries significantly impact trade flows. Agreements, such as free trade agreements, foster greater economic cooperation, while conflicts and disagreements can disrupt supply chains and investment flows. Trust and stability are essential for sustained trade, whereas political instability can deter investment and lead to trade friction.

Key Political Events Impacting Trade

Several key political events have impacted trade in recent years. The renegotiation of the North American Free Trade Agreement (NAFTA) into the United States-Mexico-Canada Agreement (USMCA) significantly altered the rules of trade between these nations. Trade disputes between the US and China, including tariffs and trade restrictions, directly impacted Mexican exports and supply chains. These events highlight the interconnectedness of global trade and the sensitivity of political relations to trade outcomes.

Role of Social Movements and Public Opinion

Social movements and public opinion can influence trade policy decisions. Public concern about issues like labor standards, environmental protection, and human rights can pressure governments to implement trade policies that address these concerns. For example, consumer activism regarding fair trade practices can sway public opinion and government policy, potentially altering trade agreements or regulations.

Social and Cultural Factors Affecting Trade Relations

Social and cultural factors can play a crucial role in trade relations. Cultural differences in business practices, communication styles, and consumer preferences can affect trade outcomes. For instance, differing levels of trust and business etiquette between nations can impact investment decisions and trade negotiations.

Political Instability and Trade Effects

Political instability in one country can significantly affect trade with others. Economic uncertainty, safety concerns, and political risk can discourage foreign investment and disrupt supply chains. The impact can be felt across the trade network, potentially affecting the economies of partner nations.

Political Relations Table

| Country Pair | Relation Type | Key Events |

|---|---|---|

| Mexico-US | Complex; fluctuating | NAFTA/USMCA renegotiation, trade disputes, security concerns |

| Mexico-China | Growing economic interdependence | Increased trade volume, Chinese investment in Mexican infrastructure |

| US-China | Tensions and competition | Trade wars, technological rivalry, geopolitical disputes |

Conclusion

In conclusion, the Mexico-US-China trade relationship is a complex tapestry woven from economic interdependence, competition, and geopolitical realities. The interplay of trade agreements, investment flows, and technological advancements creates a dynamic system, impacting not only the economies of these nations but also the global landscape. Understanding these complexities is crucial for navigating the future of global trade and recognizing the potential challenges and opportunities that lie ahead.

Frequently Asked Questions

What are the major trade agreements impacting these countries’ economic interactions?

Key agreements like NAFTA (now USMCA) and various bilateral trade deals have shaped trade flows. China’s own trade agreements also play a significant role, influencing the landscape.

How does political instability in one country affect trade with the others?

Political instability in any of these countries can lead to uncertainty and disruptions in trade, affecting supply chains and investment decisions. Economic sanctions or diplomatic tensions can have ripple effects.

What are the potential risks and vulnerabilities in these global supply chains?

Disruptions in any part of the supply chain, whether due to natural disasters, geopolitical events, or economic downturns, can impact the entire system. Diversification and resilience strategies are vital.

What is the role of Mexico in facilitating trade between the US and China?

Mexico’s geographical location and strategic infrastructure make it a crucial intermediary in trade flows between the US and China. It’s a key part of the supply chain.