Retirement Plan Tax Insurance Money Finance

Retirement plan tax insurance money finance is a crucial aspect of long-term financial security. Understanding the various components, from retirement savings vehicles to tax implications and insurance strategies, is essential for a comfortable and worry-free future. This comprehensive guide delves into the intricacies of planning for retirement, offering practical insights and actionable strategies.

This guide explores the key elements of retirement planning, covering retirement savings vehicles like 401(k)s and IRAs, comparing their tax advantages and disadvantages. We’ll also examine the tax implications of withdrawals, required minimum distributions, and potential deductions. Crucially, we’ll discuss insurance options like life and disability insurance, crucial for protecting retirement savings and income. Finally, we’ll delve into financial planning principles, including budgeting, estate planning, and investment strategies, culminating in a sample financial plan for someone in their 30s.

Retirement Planning Strategies

Retirement planning is a crucial aspect of financial well-being. It’s not just about saving for the future; it’s about proactively managing your finances to ensure a comfortable and secure retirement. This involves understanding various retirement savings vehicles, tax implications, investment diversification, and risk management strategies. A well-structured retirement plan allows you to achieve your financial goals while minimizing potential pitfalls.

Retirement Savings Vehicles

Different retirement savings vehicles offer varying tax advantages and investment options. Understanding these vehicles is fundamental to creating a comprehensive retirement plan.

- 401(k) Plans: Employer-sponsored retirement plans, 401(k)s allow pre-tax contributions, potentially reducing your current tax burden. Many employers match a portion of employee contributions, significantly boosting your savings. The contributions are invested in a variety of funds, often including stocks, bonds, and mutual funds.

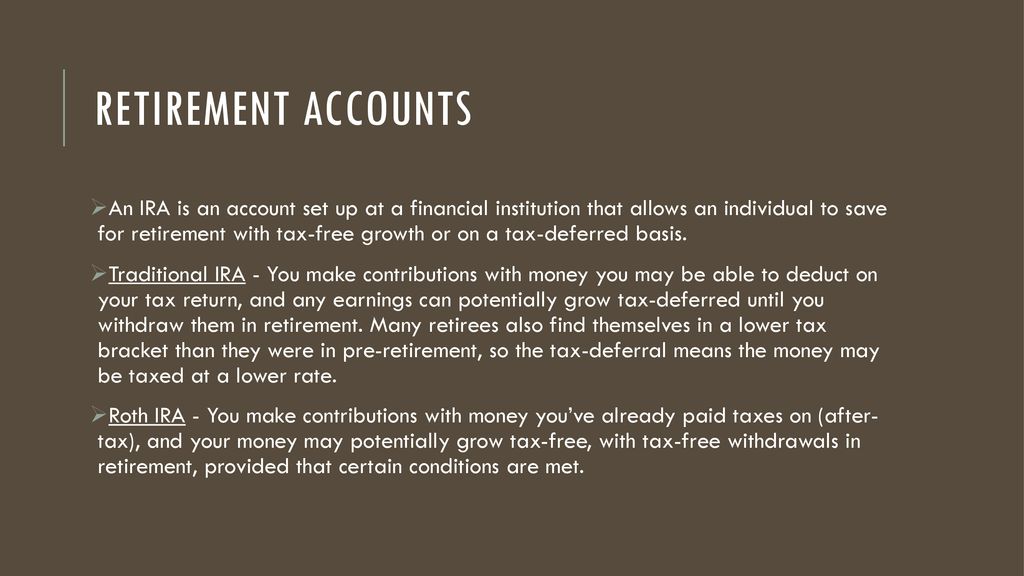

- Individual Retirement Accounts (IRAs): Individual Retirement Accounts (IRAs) are self-directed retirement savings plans. There are two primary types: Traditional and Roth.

- Traditional IRA: Contributions may be tax-deductible, potentially reducing your current tax liability. However, withdrawals in retirement are taxed as ordinary income.

- Roth IRA: Contributions are made with after-tax dollars, meaning no immediate tax deduction. However, qualified withdrawals in retirement are tax-free.

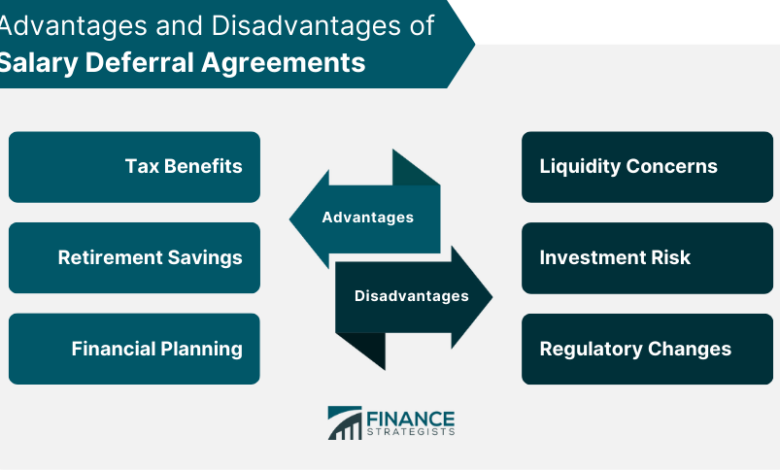

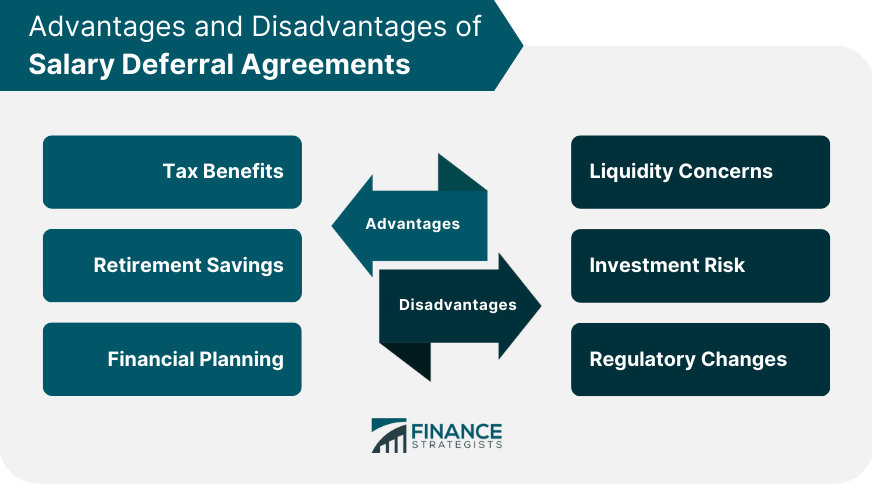

Tax Advantages and Disadvantages of Retirement Accounts

Tax implications play a significant role in choosing the right retirement account.

| Account Type | Tax Deduction (Contribution) | Taxation (Withdrawal) |

|---|---|---|

| Traditional 401(k) | Yes (pre-tax) | Yes (ordinary income) |

| Traditional IRA | Yes (often) | Yes (ordinary income) |

| Roth 401(k) | No (after-tax) | No (tax-free) |

| Roth IRA | No (after-tax) | No (tax-free) |

Understanding the tax implications of each account type is essential for tailoring your retirement plan to your individual financial situation.

Diversifying Investments

Diversifying investments is crucial for risk management and maximizing returns within your retirement plan.

Figuring out retirement plans, taxes, insurance, and managing finances can be tricky. It’s a lot to juggle, especially when you consider the legacy of players like Adrian Beltre, who made a name for himself as a Hall of Fame Texas Rangers player. His dedication and success on the field surely inspired many. It’s important to remember that careful planning and wise investments are key to securing a comfortable retirement, even as we admire the accomplishments of stars like Adrian Beltre.

Adrian Beltre Hall of Fame Texas Rangers are an excellent example of the dedication needed to succeed in any field. Good financial planning is a long-term strategy.

A diversified portfolio includes a mix of asset classes (stocks, bonds, real estate, etc.) and industries. This strategy helps mitigate the impact of market downturns on any single investment. The key is to allocate assets based on your risk tolerance and time horizon. For example, younger investors with longer time horizons can generally tolerate higher levels of risk and may allocate more to stocks.

Managing Risk and Preserving Capital

Preserving capital during retirement is a key concern. This involves strategies to mitigate the risk of outliving your savings and ensuring financial security in later life.

- Inflation Protection: Inflation can erode the purchasing power of your savings. Consider investments that provide returns that keep pace with inflation, such as inflation-protected securities or indexed funds.

- Withdrawal Strategies: A well-defined withdrawal strategy, such as the 4% rule, can help you maintain your capital and income throughout retirement.

- Estate Planning: Planning for the distribution of assets after death is a crucial part of retirement planning, ensuring your legacy is handled according to your wishes.

Sample Retirement Savings Plan (30s)

A sample retirement plan for someone in their 30s with a target of $1 million in retirement savings would involve aggressive saving early, considering a 401(k) with employer matching, and utilizing Roth IRA for tax-free growth.

Comparison of Investment Options

| Investment Option | Description | Risk Level | Potential Return |

|---|---|---|---|

| Stocks | Ownership in a company | High | High |

| Bonds | Debt instruments issued by companies or governments | Moderate | Moderate |

| Mutual Funds | Collections of stocks, bonds, or other assets | Variable | Variable |

| Real Estate | Owning physical property | Moderate to High | Moderate to High |

Tax Implications of Retirement Savings: Retirement Plan Tax Insurance Money Finance

Understanding the tax implications of retirement savings is crucial for maximizing your retirement nest egg and minimizing your tax burden. This section delves into the various tax aspects of contributing to, withdrawing from, and managing retirement accounts, ensuring you make informed decisions aligned with your financial goals.Retirement savings plans, whether traditional or Roth, offer tax advantages at different stages of your financial journey.

The key lies in understanding how these accounts interact with your overall tax liability.

Tax Implications of Contributions

Retirement contributions often offer tax deductions, reducing your current taxable income. This can lead to immediate tax savings, potentially increasing your after-tax returns. For example, contributions to a traditional IRA can lower your taxable income, reducing the amount of taxes you owe in the current year. Roth IRA contributions, on the other hand, are made with after-tax dollars, but withdrawals in retirement are tax-free.

Tax Treatment of Withdrawals

The tax treatment of withdrawals varies significantly depending on the type of retirement account. Traditional IRA withdrawals are taxed in retirement as ordinary income, while Roth IRA withdrawals are tax-free. This fundamental difference shapes your long-term tax strategy. Consider how this impacts your overall tax bracket when choosing between these account types.

Required Minimum Distributions (RMDs)

Required Minimum Distributions (RMDs) are mandatory withdrawals from retirement accounts that begin at a specific age. These withdrawals are taxed as ordinary income in the year they are received. Failure to adhere to RMD rules can result in significant penalties. Knowing when RMDs begin and how they are taxed is essential for retirement planning.

Tax Deductions and Credits

Several tax deductions and credits can further enhance your retirement savings. The Saver’s Credit, for instance, can provide a credit for eligible taxpayers who contribute to a retirement account. These deductions and credits are subject to specific eligibility criteria and limitations.

Tax Implications of Early Withdrawals, Retirement plan tax insurance money finance

Early withdrawals from retirement accounts are generally subject to penalties, including a 10% tax penalty, and potentially ordinary income tax on the withdrawn amount. This penalty is designed to discourage premature access to funds, ensuring the accounts are used for retirement purposes. It’s crucial to understand the specific circumstances and rules governing early withdrawals to avoid incurring these penalties.

Tax Rates and Retirement Plan Contributions

| Income Level (Annual) | Tax Rate | Potential Contribution Impact |

|---|---|---|

| $0-$10,000 | 10% | Potential tax savings with deductions on traditional IRA contributions. |

| $10,001-$40,000 | 12% | Moderate tax savings. |

| $40,001-$85,000 | 22% | Significant tax savings depending on contribution amounts. |

| $85,001-$160,000 | 24% | Significant tax savings, but potentially affected by phase-outs of certain deductions. |

| Above $160,000 | 32% or higher | Potentially lower tax savings, depending on the specific tax bracket and applicable deductions. |

Note: This table provides a simplified illustration. Tax rates and contribution impacts can vary based on individual circumstances, including filing status and other deductions. Consult with a qualified financial advisor for personalized guidance.

Insurance for Retirement Security

Retirement planning is a multifaceted process, encompassing various strategies to ensure financial stability during your golden years. A crucial component often overlooked is the role of insurance in protecting your retirement nest egg and maintaining your desired lifestyle. Beyond traditional savings and investment plans, robust insurance coverage provides a safety net against unforeseen events that could significantly impact your retirement income.Comprehensive insurance strategies are vital for preserving the fruits of your labor and ensuring a secure retirement.

Life insurance safeguards your retirement savings, disability insurance replaces lost income due to unforeseen circumstances, and long-term care insurance addresses potential healthcare needs, all contributing to a more resilient and predictable retirement.

Life Insurance in Retirement Planning

Life insurance plays a critical role in protecting your retirement savings. If you pass away, your beneficiaries can receive the death benefit, ensuring that your retirement funds are available to them and not depleted by estate taxes or other expenses. This financial protection is essential, particularly if you have dependents who rely on your retirement income. The amount of life insurance coverage needed depends on various factors, including your retirement savings, outstanding debts, and the financial needs of your beneficiaries.

Types of Life Insurance for Retirement

Different types of life insurance policies cater to diverse needs and financial situations. Term life insurance offers coverage for a specific period, while whole life insurance provides lifetime coverage and builds cash value. Universal life insurance combines aspects of both term and whole life, offering flexibility in premium payments and death benefits. The suitability of each type depends on individual circumstances, risk tolerance, and long-term financial goals.

For retirement planning, permanent life insurance, such as whole life or universal life, may be a prudent choice if you want a combination of death benefit and cash value accumulation.

Disability Insurance and Retirement Income

Disability insurance is critical in maintaining your retirement income. Unforeseen illnesses or accidents can disrupt your ability to work, potentially impacting your retirement savings and lifestyle. Disability insurance provides a regular income stream if you become disabled and unable to work, safeguarding your retirement funds and allowing you to maintain your desired standard of living.

Types of Disability Insurance

Disability insurance comes in various forms. Short-term disability insurance provides income replacement for a shorter period, while long-term disability insurance offers benefits for extended periods. The choice between these depends on the anticipated duration of the disability. Factors to consider include the policy’s benefit amount, waiting period, and elimination period. Individual needs and circumstances should guide your selection.

Long-Term Care Insurance and Retirement Funds

Long-term care insurance addresses the potential financial burden of long-term care needs, such as nursing home care. As retirement savings often decline due to inflation and healthcare expenses, long-term care insurance can protect your retirement funds by covering these costs, preventing them from being depleted prematurely.

Figuring out retirement plans, taxes, insurance, and managing all that money can be a real headache. The recent New Hampshire Democratic primary results results new hampshire democratic primary are definitely stirring things up in the political arena, but I’m still trying to figure out how those outcomes will impact my retirement plan. Hopefully, the upcoming debates will offer some clarity on these important financial issues.

Comparing Life Insurance Options

| Type of Life Insurance | Cost | Benefits | Suitability |

|---|---|---|---|

| Term Life | Generally lower premiums | Coverage for a specific period | Suitable for those needing temporary coverage or with limited budget |

| Whole Life | Higher premiums | Lifetime coverage, cash value accumulation | Suitable for long-term financial security and building wealth |

| Universal Life | Premiums may vary | Flexible premium payments, cash value accumulation | Suitable for those seeking flexibility and potential growth |

Note: Costs and benefits vary by insurer and policy specifics. It’s essential to consult with a qualified financial advisor to determine the most appropriate life insurance policy for your needs.

Financial Planning for Retirement

Retirement planning isn’t just about saving; it’s a comprehensive strategy encompassing budgeting, investment choices, and estate considerations. A well-defined plan ensures a comfortable and secure transition into retirement, minimizing financial anxieties and maximizing enjoyment of this new chapter.

Budgeting and Expense Management in Retirement

Retirement budgeting differs significantly from pre-retirement budgeting. Expenses shift, with potential increases in healthcare costs and leisure activities, and decreases in work-related expenses. A meticulous review of anticipated income and expenses is crucial for creating a realistic budget. This includes considering potential inflation and health care costs, as well as anticipated leisure activities.

Adaptability is key. Regular reviews and adjustments to the budget are necessary to account for changes in income, inflation, and personal circumstances. Creating a detailed list of anticipated expenses, including housing, healthcare, food, travel, and entertainment, allows for better financial control.

Estate Planning in Retirement

Estate planning is not just for the wealthy. It’s a crucial aspect of retirement planning that ensures your assets are distributed according to your wishes after you’re gone. This involves creating a will, designating beneficiaries for accounts, and potentially setting up trusts to manage assets and minimize tax burdens for heirs. Proper estate planning can reduce potential conflicts among heirs and ensure the smooth transfer of assets.

Consider the potential impact of taxes on your estate. Proper legal advice is essential to ensure that your estate plan aligns with your goals and minimizes tax liabilities. Consult with a qualified estate attorney to create a plan that protects your assets and legacy.

Investment Strategies for Retirement

Choosing the right investment strategy is critical for retirement success. Diversification is paramount, spreading investments across different asset classes to manage risk. Strategies range from conservative, low-risk options like bonds, to more aggressive, high-growth choices like stocks. The appropriate mix depends on your risk tolerance, time horizon, and financial goals.

Consider factors like market conditions and personal financial circumstances. Regular review and rebalancing of your portfolio are essential to ensure your investment strategy remains aligned with your retirement goals. Investment strategies should evolve as your risk tolerance changes or your time horizon shortens.

Figuring out retirement plans, taxes, insurance, and all that financial stuff can be a real head-scratcher. But, when you’re considering the future, it’s also important to think about the next generation. For example, knowing the rules for naming a baby and the inheritance of family names, like apellido bebe madre padre , can influence financial decisions related to family legacy.

Ultimately, all these factors intertwine and impact your retirement plan’s long-term success.

Creating a Detailed Financial Plan for a Retirement Goal

A detailed financial plan for retirement involves outlining your desired lifestyle, calculating your required retirement income, and developing a savings strategy to achieve that goal. This requires understanding your current financial situation, estimating future expenses, and identifying potential sources of retirement income.

For example, if your retirement goal is to maintain your current lifestyle, the financial plan needs to account for expenses like housing, healthcare, food, travel, and entertainment. Detailed projections and simulations help you visualize your financial future and adjust your strategy as needed.

Projected Retirement Income Based on Savings Scenarios

| Savings Scenario | Annual Savings | Projected Retirement Income (Year 1) | Projected Retirement Income (Year 5) |

|---|---|---|---|

| Conservative | $10,000 | $30,000 | $35,000 |

| Moderate | $20,000 | $60,000 | $70,000 |

| Aggressive | $30,000 | $90,000 | $105,000 |

Note: These projections are illustrative and assume a 6% average annual return and do not account for taxes or inflation. Individual circumstances and investment performance may vary.

Retirement Plan and Money Management

Navigating the complexities of retirement planning requires a proactive and disciplined approach to money management. A well-structured retirement plan, encompassing investment tracking, periodic reviews, and adaptability to life changes, is crucial for a secure and comfortable retirement. This involves understanding potential financial pitfalls and developing strategies for efficient fund allocation.

Tracking and Monitoring Retirement Plan Investments

Regularly reviewing your retirement plan investments is vital for ensuring they align with your financial goals and risk tolerance. Utilize online account access or statements to track investment performance, noting any significant gains or losses. This allows for proactive adjustments if necessary. Compare your investment performance to market benchmarks to assess relative success. Consider employing investment tracking software or working with a financial advisor to streamline this process.

Figuring out retirement plan taxes, insurance, and overall financial strategy can be tricky. Understanding how large corporations like Koch and Chevron navigate legal precedents, like the recent Supreme Court decision on deference to their practices, koch chevron deference supreme court , can actually help us better understand the bigger picture of financial policies and how they affect our retirement planning.

Ultimately, a good understanding of these legal maneuvers will only strengthen our personal retirement planning.

Periodic Reviews of Retirement Plans

Periodic reviews are essential for assessing the ongoing viability of your retirement plan. This involves examining your current financial situation, including income, expenses, and investment performance. Evaluate your goals and risk tolerance against the projected retirement income. Adjustments might be needed based on factors like market fluctuations or changes in personal circumstances.

Adjusting Retirement Plans Based on Changing Financial Situations

Life circumstances can significantly impact retirement plans. Unexpected events, such as job loss or significant healthcare expenses, may necessitate adjustments to your savings and investment strategy. Proactively plan for these eventualities by creating a contingency fund. Review your budget and expenses regularly to identify areas for potential savings or adjustments.

Common Financial Pitfalls to Avoid in Retirement Planning

Several common pitfalls can jeopardize retirement security. One significant concern is overspending in retirement, especially in the initial years. Unrealistic retirement income projections based on historical market performance can also lead to disappointment. Ignoring inflation’s impact on living expenses is another frequent mistake. Also, failing to diversify investments or understand their potential risks can expose your portfolio to significant losses.

Managing and Allocating Retirement Funds Efficiently

Efficient fund allocation involves diversifying investments across various asset classes. A balanced portfolio, incorporating stocks, bonds, and potentially real estate or other assets, can mitigate risk while maximizing potential returns. Consider your risk tolerance and time horizon when making investment choices. Also, seek professional financial advice when necessary to create a personalized strategy.

Growth of Different Investment Options Over Time

The following table illustrates the potential growth of different investment options over a 20-year period, assuming various average annual returns. Real-world returns will vary, and this is not a guarantee of future performance. Historical data is used to project growth but does not predict future outcomes.

| Investment Type | Average Annual Return (Estimate) | Projected Value After 20 Years (Example, $10,000 Initial Investment) |

|---|---|---|

| Stocks (Aggressive Portfolio) | 8% | $48594.59 |

| Bonds (Moderate Portfolio) | 5% | $26532.98 |

| Balanced Portfolio (Mix of Stocks and Bonds) | 6% | $33999.99 |

| Certificates of Deposit (CDs) | 2% | $14859.47 |

Note: These figures are illustrative examples and do not constitute financial advice. Consult a qualified financial advisor for personalized recommendations. Actual returns will vary based on market conditions and individual investment choices.

Illustrative Case Studies

Retirement planning is a journey, not a destination. It’s a dynamic process that requires adaptation and adjustments throughout life. Understanding how different scenarios play out through real-life examples is crucial for creating a robust and personalized plan. This section explores case studies that illustrate successful retirement planning, highlighting the importance of flexibility and proactive decision-making.

A Successful Retirement Plan

A successful retirement plan is characterized by careful budgeting, diversified investments, and consistent contributions. Consider John, a 35-year-old software engineer, who started contributing to a 401(k) plan immediately after securing his first job. He diligently increased his contributions each year, keeping pace with his salary increases. He opted for a diversified portfolio, allocating funds to stocks, bonds, and real estate investment trusts (REITs).

This strategy allowed him to benefit from market growth while mitigating risk. He also proactively consulted with a financial advisor to ensure his plan aligned with his long-term goals. Over the years, his investment grew significantly, ensuring a comfortable retirement.

Adjusting a Retirement Plan for Changing Market Conditions

Market fluctuations are inevitable. A well-designed retirement plan anticipates these changes and allows for adjustments. For example, consider Sarah, a 48-year-old teacher. When the stock market experienced a significant downturn, she didn’t panic. Instead, she consulted her financial advisor and adjusted her portfolio to include more stable investments, such as bonds and certificates of deposit (CDs).

This strategy helped her maintain her financial stability and continue on track for retirement. She also took advantage of opportunities to rebalance her portfolio when market conditions improved. This demonstrates the importance of adapting to market conditions without abandoning long-term goals.

Adjusting a Retirement Plan for a Family with Dependents

Raising a family can significantly impact retirement planning. Consider David and Emily, a couple with two young children. They realized that their current retirement plan wasn’t sufficient to cover the expected expenses of raising their children. To address this, they adjusted their contributions to their retirement accounts, factoring in the increased costs of childcare, education, and other family expenses.

They also explored options like creating a separate college fund for their children. By incorporating these adjustments, they ensured their retirement goals remained attainable while also providing for their family’s needs.

Thinking about retirement planning, taxes, insurance, and all that financial stuff can be daunting. But, sometimes, the stark realities of human suffering, like the tragic story of lovers in Auschwitz, Keren Blankfeld and József Debreczeni, found in the cold crematorium, here , can offer a different perspective on the importance of securing your future. Ultimately, understanding the value of financial security is key to a comfortable retirement.

Retirement Plan for a Self-Employed Individual

Self-employed individuals often face unique challenges in retirement planning. Consider Maria, a freelance graphic designer. She understood the importance of setting aside funds for retirement, but the lack of employer-sponsored retirement plans presented a challenge. To address this, she established a Solo 401(k) plan, allowing her to contribute to retirement savings. She also sought professional advice to determine the appropriate contribution amount and investment strategy, considering her unique financial situation.

This illustrates how self-employed individuals can successfully plan for retirement by leveraging available tools and professional guidance.

Importance of Financial Literacy for Retirement Planning

Financial literacy is essential for making informed decisions about retirement planning. Consider Michael, a 22-year-old recent college graduate. He understood the importance of retirement planning but lacked a clear understanding of investment strategies and tax implications. He took a personal finance course and learned about various investment options and tax-advantaged retirement accounts. This knowledge enabled him to create a personalized retirement plan and made him more confident in managing his finances.

His proactive approach highlights the value of financial literacy in achieving long-term financial goals.

Importance of Professional Financial Advice in Retirement Planning

Seeking professional financial advice can significantly enhance retirement planning. Consider Linda, a 55-year-old small business owner. She had been saving for retirement, but she wasn’t sure about the best investment strategies for her unique circumstances. She sought the guidance of a certified financial planner (CFP). The CFP helped her create a personalized retirement plan, taking into account her income, expenses, risk tolerance, and investment goals.

By leveraging professional expertise, she was able to make informed decisions and ensure her retirement plan was aligned with her aspirations. This emphasizes the value of professional advice in navigating the complexities of retirement planning.

Ultimate Conclusion

In conclusion, planning for retirement is a multifaceted process encompassing savings, taxes, insurance, and financial management. This guide has provided a framework for understanding these crucial aspects. By implementing the strategies Artikeld, individuals can develop a comprehensive retirement plan that aligns with their specific financial goals and circumstances. Remember, consistent effort and a proactive approach are key to securing a comfortable and fulfilling retirement.

FAQ Insights

What are some common financial pitfalls to avoid in retirement planning?

Failing to properly estimate expenses, underestimating inflation’s impact on future costs, and not having a plan for unexpected events can lead to financial strain during retirement. Also, neglecting estate planning and not seeking professional advice when needed are significant pitfalls.

How often should I review my retirement plan?

Regular reviews, ideally annually or every few years, are essential to adjust your plan based on changing circumstances, market conditions, and personal goals.

What are the differences between a 401(k) and an IRA?

401(k)s are often employer-sponsored plans, while IRAs are individual retirement accounts. Tax implications, contribution limits, and investment options differ between the two, making it important to understand the nuances for your situation.

What are required minimum distributions (RMDs), and when do they apply?

RMDs are mandatory withdrawals from retirement accounts starting at a certain age. This is to ensure that retirement funds are utilized during your later years. The specific age varies, and it’s crucial to understand the applicable rules for your specific account types.