Retirement Income Middle Class Strategies

Retirement income middle class is a crucial topic for many, and this post delves into the complexities and potential solutions. We’ll explore the unique needs and challenges faced by the middle class during retirement, examining income sources, financial strategies, and government support.

Understanding the specific needs of the middle class in retirement is paramount. Average savings, expenses, and inflation are key factors, and different income sources like pensions, 401(k)s, and Social Security all play a vital role. We’ll analyze how demographics like age and location influence financial security in retirement.

Defining Retirement Income Needs for the Middle Class: Retirement Income Middle Class

Retirement planning for the middle class often presents unique challenges, requiring careful consideration of various factors. This involves understanding the typical income needs, exploring diverse sources of retirement funds, and assessing the financial security levels across different demographics. This exploration will delve into these aspects, providing a clear picture of the realities and complexities of retirement income for this segment of society.

Typical Retirement Income Needs

Middle-class households typically face a significant gap between desired retirement lifestyle and available resources. Average retirement expenses often exceed pre-retirement levels due to increased healthcare costs, potential long-term care needs, and the desire to maintain a comfortable standard of living. Inflation further compounds this issue, eroding the purchasing power of savings over time.

A reasonable estimate of retirement income needs for the middle class is often calculated based on replacement rates, considering a percentage of pre-retirement income. For instance, a replacement rate of 70% might be a target for maintaining a comparable lifestyle, but this varies based on individual circumstances and preferences.

Sources of Retirement Income

Middle-class individuals often rely on a combination of sources to fund their retirement. These include pensions, 401(k)s, IRAs, Social Security, and personal savings. The relative importance of each source varies considerably based on factors like employment history, investment strategies, and the availability of employer-sponsored retirement plans.

- Pensions: Employer-sponsored pensions, while less common today than in the past, can be a significant source of retirement income. They often offer a predictable income stream, though the specifics vary greatly depending on the plan’s design and the individual’s contribution history.

- 401(k)s and IRAs: Individual retirement accounts (IRAs) and 401(k)s are common savings vehicles for retirement. The amount saved and the investment returns play a critical role in meeting retirement goals. Individuals need to consider potential market fluctuations and the long-term growth potential of their investments.

- Social Security: Social Security benefits represent a crucial component of retirement income for many middle-class households. The amount of benefits received is based on the individual’s work history and earnings. It’s important to understand the formula and potential adjustments for future retirees.

- Personal Savings: Savings from personal investments, side hustles, or other sources can be critical to supplementing retirement income. Strategies for maximizing personal savings and investments should be considered, including diversification and risk tolerance.

Financial Security Levels Across Demographics

Financial security in retirement varies significantly across different demographics, including age, location, and profession. Younger individuals starting their retirement savings journey face a greater challenge in accumulating sufficient funds compared to those who started saving earlier. Geographic location plays a role, as cost of living varies widely across different regions.

Profession also influences retirement security. Individuals in high-demand professions may have access to better retirement plans and higher earning potential, leading to greater financial security in retirement. The potential for unexpected events, like medical emergencies or job loss, should also be considered in retirement planning, and appropriate insurance coverage is recommended.

Retirement Income Sources Comparison

| Source | Average Contribution | Potential Return |

|---|---|---|

| Pensions | Variable (dependent on employer) | Fixed or predictable income stream, depending on plan |

| 401(k)s | Variable (dependent on individual contributions) | Market-dependent returns, potential for high growth, but also risk |

| IRAs | Variable (dependent on individual contributions) | Market-dependent returns, potential for high growth, but also risk |

| Social Security | Variable (based on earnings history) | Fixed benefit amount, based on the Social Security Administration’s formula |

| Personal Savings | Variable (dependent on individual contributions and investment choices) | Variable (depending on investment choices and market performance) |

Challenges and Risks in Middle Class Retirement Income

Retiring comfortably is a significant aspiration for the middle class, yet achieving it presents numerous hurdles. Financial security in retirement often hinges on a delicate balance of income sources, careful planning, and mitigating potential risks. This discussion delves into the key challenges and risks associated with ensuring adequate retirement income for the middle class, examining factors like inflation, healthcare costs, market fluctuations, and the critical role of long-term care insurance.

Figuring out retirement income for the middle class is tough, right? It’s a whole different ballgame than, say, the glamorous world of the Critics Choice Awards red carpet, filled with dazzling gowns and dazzling smiles. Critics Choice Awards red carpet photos are always a treat, but the real challenge lies in planning for a secure and comfortable retirement income.

Still, the thought of that financial freedom is inspiring, isn’t it? It’s a far cry from the red carpet, but it’s a goal worth striving for.

Impact of Inflation and Rising Healthcare Costs

Inflation erodes the purchasing power of savings over time. Rising healthcare costs are a significant concern for retirees, as medical expenses can quickly deplete savings, even with health insurance. Without adequate planning, these factors can significantly impact the sustainability of retirement income.

Consider a scenario where a middle-class couple retires with savings sufficient for a comfortable lifestyle. However, if inflation rises at an average rate of 3% annually, the purchasing power of their savings decreases over time. Healthcare costs, if not accounted for, could quickly deplete their savings, leaving them vulnerable in their later years. The unpredictability of healthcare costs is a major risk factor in retirement planning.

Potential Risks of Market Downturns and Economic Uncertainty

Investment portfolios are crucial components of retirement income. However, market downturns can significantly reduce the value of retirement savings, potentially impacting the ability to maintain the desired lifestyle. Economic uncertainty adds another layer of complexity, as unexpected events can affect the overall economic climate and influence market performance.

For instance, the 2008 financial crisis significantly impacted retirement savings, causing substantial losses for many investors. The unpredictability of market fluctuations necessitates a diversified investment strategy and a long-term perspective. A diversified portfolio, with a mix of stocks, bonds, and other assets, can help mitigate the risk of substantial losses during market downturns.

Securing retirement income for the middle class is a crucial issue, especially given the current economic climate. Political maneuvering like that of DeSantis, Trump, and Iowa Republicans, as seen in desantis trump iowa republicans , could potentially impact future policies affecting retirement savings. Ultimately, the challenge of ensuring adequate retirement income for the middle class remains a critical concern.

Significance of Long-Term Care Insurance

Long-term care insurance is often overlooked but can be crucial for securing middle-class retirement income. The rising costs of long-term care services, such as assisted living or nursing homes, can be substantial and quickly deplete retirement funds. Without adequate protection, retirees may face financial hardship and reduced quality of life.

Long-term care insurance provides a safety net, covering the expenses of care services, allowing retirees to maintain their financial security and independence. The premiums for this type of insurance can vary depending on the coverage and benefits included, so careful consideration is necessary to ensure that the cost is manageable and the coverage aligns with individual needs.

Comparison of Retirement Income Security Strategies

| Strategy | Description | Pros | Cons |

|---|---|---|---|

| Defined Benefit Pension Plans | Guaranteed income stream throughout retirement. | Predictable income, security. | Less flexibility, potentially lower returns. |

| Defined Contribution Plans (401(k), IRA) | Individual contributions grow with investment returns. | Flexibility, potentially higher returns. | Income is dependent on investment performance, market risk. |

| Social Security | Government-provided retirement benefits. | Guaranteed minimum income. | Benefits may not be sufficient for a comfortable lifestyle. |

The table above highlights the differing characteristics of common retirement income security strategies. Careful evaluation of each strategy’s strengths and weaknesses is essential in developing a personalized retirement plan.

Strategies for Enhancing Retirement Income

Securing a comfortable retirement requires proactive planning and execution. This phase delves into actionable strategies for boosting retirement income, encompassing diverse financial approaches and critical life adjustments. Understanding and utilizing these methods can significantly impact the quality of your retirement years.Retirement income isn’t just about the numbers; it’s about the lifestyle you envision. By meticulously planning and adapting to changes, you can create a retirement that aligns with your aspirations and financial security.

Figuring out retirement income for the middle class is tricky, isn’t it? It’s a constant balancing act, and recent headlines about stars Harley Johnston, Oettinger, and Benn highlighting the challenges of navigating this financial terrain. Ultimately, though, securing a comfortable retirement income for the middle class remains a significant concern for many.

Investment Diversification

Investment diversification is crucial for mitigating risk and maximizing returns over the long term. A well-diversified portfolio spreads investments across various asset classes, including stocks, bonds, real estate, and alternative investments. This approach reduces the impact of market fluctuations on your overall portfolio. A portfolio heavily concentrated in a single sector or asset class can experience significant losses during market downturns.

Strategic diversification, however, helps to reduce this vulnerability.

Tax-Advantaged Accounts

Maximizing the use of tax-advantaged accounts is essential for building retirement savings efficiently. These accounts, such as 401(k)s and IRAs, offer tax deductions or tax-deferred growth, allowing your money to accumulate faster. Understanding the nuances of various accounts—traditional, Roth, and SEP IRAs—is vital for choosing the strategy that best aligns with your individual tax bracket and financial goals.

For example, a Roth IRA allows after-tax contributions to grow tax-free, beneficial for individuals expecting to be in a higher tax bracket during retirement.

Estate Planning

Estate planning isn’t just for the wealthy; it’s a crucial aspect of retirement planning for everyone. It involves outlining how your assets will be distributed after your death. A well-structured estate plan minimizes potential tax liabilities and ensures your assets are transferred according to your wishes. For example, a will clearly defines how your property and assets will be divided among beneficiaries.

Navigating Social Security Benefits

Understanding and maximizing Social Security benefits is critical for supplementing retirement income. The optimal claiming strategy depends on individual circumstances, including your life expectancy, spouse’s earnings history, and the timing of when you start receiving benefits. Claiming benefits early may yield lower monthly payments but can provide an earlier start to retirement income. Conversely, delaying claiming can increase monthly payments but only if you live long enough to receive the larger benefits.

Reducing Expenses and Increasing Savings

Minimizing expenses and increasing savings during the pre-retirement phase is a vital component of securing a comfortable retirement. Identify areas where you can reduce spending, such as unnecessary subscriptions or lifestyle expenses. Explore ways to increase savings, such as taking on extra income-generating opportunities or increasing your contributions to retirement accounts. This could involve finding ways to cut back on discretionary spending while also aggressively contributing to your retirement savings.

Adjusting Financial Plans for Life Events

Retirement is not a static phase; life events can significantly impact financial plans. Anticipate potential changes like health issues, job loss, or the need for caregiving. Establish contingency plans to navigate these unforeseen events. For example, a comprehensive health insurance plan will help cover medical costs that may arise during retirement.

Investment Vehicle Comparison

| Investment Vehicle | Pros | Cons |

|---|---|---|

| Stocks | Potentially high returns | Significant risk of loss |

| Bonds | Lower risk than stocks | Potentially lower returns |

| Real Estate | Potential for appreciation and rental income | High initial investment and management costs |

| Mutual Funds | Diversification and professional management | Management fees and potential for underperformance |

| Exchange-Traded Funds (ETFs) | Lower expense ratios than mutual funds | Can be volatile in the short term |

Government Policies and Support for Middle-Class Retirement

Navigating retirement can be a complex journey, particularly for the middle class. While personal savings and investment strategies are crucial, government policies play a significant role in ensuring a comfortable and secure retirement for many. Understanding these policies and their impact is essential for informed financial planning.Government programs are designed to provide a safety net and support for retirement income, particularly for those who may not have accumulated substantial personal wealth.

The framework of these policies, however, is constantly evolving, requiring ongoing awareness and adaptation.

The Role of Social Security and Medicare

Social Security and Medicare are cornerstones of retirement security for the middle class. Social Security provides a crucial foundation of income, especially for those with limited personal savings. It’s a pay-as-you-go system, where current workers’ contributions fund the benefits of retirees. Medicare, on the other hand, offers health insurance coverage for seniors, ensuring access to essential medical care during retirement.

These programs are vital safety nets, but their adequacy is subject to various factors including longevity and inflation.

The Current Legislative Landscape

The current legislative landscape surrounding retirement income is dynamic and reflects ongoing debates about the sustainability and adequacy of existing programs. Policymakers often consider adjusting benefits, eligibility criteria, and funding mechanisms to maintain the programs’ long-term viability. Changes can have a substantial impact on middle-class retirement security, affecting the level of income support and access to healthcare.

Figuring out retirement income for the middle class is tough, right? It’s a constant balancing act, and sometimes unexpected expenses pop up. That’s why exploring the ethics behind buying “stranger letters” – you know, those handwritten notes sold online – can offer a surprising parallel. Stranger letters purchase ethics often raises questions about authenticity and value, just like securing a stable retirement income does.

Ultimately, responsible planning and a clear understanding of the market are key for both situations.

Possible Government Interventions

Several government interventions could enhance retirement security for the middle class. Expanding eligibility for existing programs, such as Social Security and Medicare, to include a broader range of workers or adjusting benefit formulas to reflect rising living costs could make a significant difference. Promoting financial literacy initiatives for younger generations could also empower them to plan effectively for their retirement.

Exploring options like adjusting tax policies that benefit retirement savings could be another potential approach.

Summary of Government Programs

| Program | Description | Impact on Middle Class |

|---|---|---|

| Social Security | Provides monthly retirement benefits to eligible individuals. | Crucial source of income for many retirees, especially those with limited personal savings. |

| Medicare | Provides health insurance coverage for seniors. | Ensures access to essential medical care, crucial for maintaining quality of life in retirement. |

| 401(k) plans | Tax-advantaged retirement savings plans offered by employers. | Offer opportunities for middle-class workers to save for retirement with tax benefits. |

| Pension plans | Defined-benefit plans funded by employers to provide regular retirement income. | Provide a predictable stream of income in retirement. |

Note: This table provides a brief overview. Each program has specific eligibility requirements and rules.

Case Studies and Real-World Examples

Retirement planning for the middle class is often a balancing act between achieving financial security and maintaining a comfortable lifestyle. Real-world examples of successful middle-class families navigating this transition provide valuable insights and inspiration. Understanding their strategies can help others in similar situations develop their own personalized plans.Successful retirement income management for middle-class families often involves a combination of factors, including careful budgeting, prudent savings strategies, and a willingness to adapt to changing circumstances.

Adaptability and the ability to adjust spending habits based on market fluctuations and unexpected expenses are crucial to maintaining financial stability.

Real-World Examples of Successful Middle-Class Retirement Income Management

Middle-class families successfully navigating retirement often prioritize a diversified income stream. They might supplement Social Security and pensions with part-time work, rental income, or dividend investments. For instance, a couple might take on part-time consulting roles, using their existing skills to generate additional income. Another example involves a family who strategically invested in rental properties, creating a consistent stream of passive income.

These approaches demonstrate that middle-class families can achieve financial security through various strategies beyond traditional savings accounts.

Hypothetical Middle-Class Family Retirement Income Plan

Consider the Smith family, a middle-class couple approaching retirement. Their current annual income is $80,000, and they aim to maintain a similar lifestyle in retirement. Their retirement income plan includes:

- Social Security: $2,500 per month (estimated based on current earnings).

- Pension: $1,800 per month.

- Investment Portfolio: Yielding $1,500 per month through dividends and interest.

- Part-time work: $1,000 per month from a part-time consulting role.

- Total Monthly Income: $7,300

Their expenses are projected to be approximately $6,000 per month, leaving a comfortable surplus. This surplus is allocated to cover unexpected expenses and potentially reinvest in their portfolio.

Budget Template for a Middle-Class Family in Retirement

A sample budget template can help visualize income and expense allocation.

| Category | Monthly Allocation |

|---|---|

| Housing | $1,500 |

| Food | $1,000 |

| Healthcare | $500 |

| Transportation | $300 |

| Entertainment | $200 |

| Savings/Investments | $1,000 |

| Contingency Fund | $500 |

| Total Monthly Expenses | $6,000 |

| Total Monthly Income | $7,300 |

| Monthly Surplus | $1,300 |

This budget is a template and can be customized to fit the specific needs and circumstances of each individual or family.

Importance of Professional Financial Advice in Retirement Planning, Retirement income middle class

Seeking professional financial advice is highly recommended for developing a comprehensive retirement income plan. A financial advisor can provide personalized guidance, assess risk tolerance, and recommend investment strategies tailored to individual needs and goals. They can also help navigate complex financial regulations and tax implications specific to retirement. Furthermore, a financial advisor can help families make informed decisions about their retirement income, ensuring they are adequately prepared for the financial demands of their golden years.

Developing a Comprehensive Retirement Income Plan

A comprehensive retirement income plan should be developed through a structured process:

- Assessment of current financial situation: Evaluate current assets, liabilities, income sources, and expenses.

- Goal setting: Define retirement lifestyle goals and desired income levels.

- Income projections: Estimate potential income sources during retirement, including Social Security, pensions, and investments.

- Expense planning: Project and categorize retirement expenses, considering potential inflation and healthcare costs.

- Investment strategies: Develop a diversified investment plan to generate income and preserve capital.

- Risk management: Evaluate and mitigate potential risks associated with market fluctuations and unexpected events.

- Review and adjustment: Regularly review and adjust the plan based on changes in circumstances and market conditions.

Following this structured approach can help middle-class families develop a robust and personalized retirement income plan.

Illustrative Examples for Visualizations

Retirement planning for the middle class often feels daunting. The sheer number of variables and potential outcomes can make it hard to grasp the long-term implications of decisions. Visualizations are crucial in making these complex concepts more understandable and actionable. They provide a concrete way to picture the future and make informed choices.

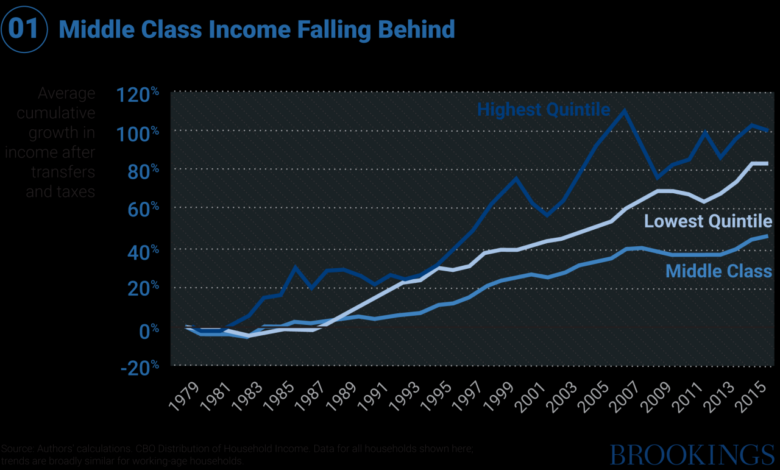

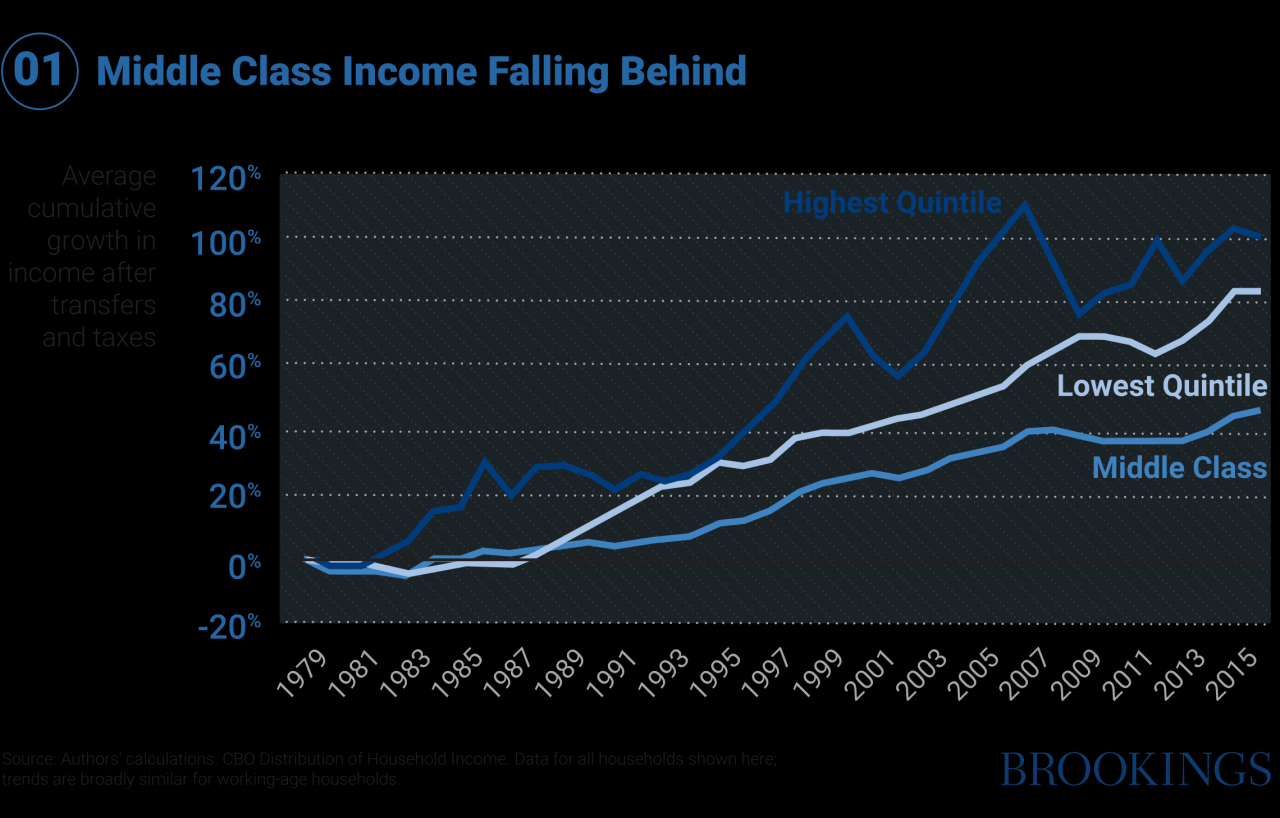

Projected Income Trajectory

A visual representation of a middle-class individual’s projected income trajectory throughout retirement is a powerful tool. This infographic could show a line graph, with the x-axis representing time (e.g., years since retirement), and the y-axis representing income. The line would illustrate the individual’s anticipated income, starting at a level close to their pre-retirement income, gradually declining over time.

The decline could be moderated by factors like Social Security benefits, pensions, and investment returns. Critical points like the impact of inflation on purchasing power and potential healthcare expenses could be highlighted. Realistic scenarios should be presented, acknowledging potential fluctuations in income due to market volatility or unexpected events. Different scenarios, such as a high-return investment strategy versus a conservative one, could be displayed using separate lines, emphasizing the impact of choice.

Impact of Investment Strategies

A table or bar chart illustrating the impact of different investment strategies on retirement income is valuable. The table could display the projected income over a set number of years for different investment portfolios. These portfolios should represent a range of risk tolerance levels, from highly conservative (e.g., bonds and CDs) to moderate (e.g., a mix of stocks and bonds) to more aggressive (e.g., a larger allocation to stocks).

Each portfolio would show its projected return, assuming various market conditions, alongside its associated level of risk. Visualizing the potential income differences across these strategies allows for a clear comparison and helps individuals make informed choices aligned with their personal risk tolerance and financial goals.

Steps in Creating a Comprehensive Retirement Income Plan

A flowchart outlining the steps involved in creating a comprehensive retirement income plan provides a structured approach. This flowchart would visually guide the individual through the process. It should start with defining retirement goals, followed by evaluating current assets and liabilities, calculating retirement income needs, selecting investment strategies, and creating a budget. Each step could be represented by a box, with arrows connecting them to show the sequential nature of the process.

The flowchart should also include a feedback loop to account for adjustments based on unforeseen circumstances or market changes.

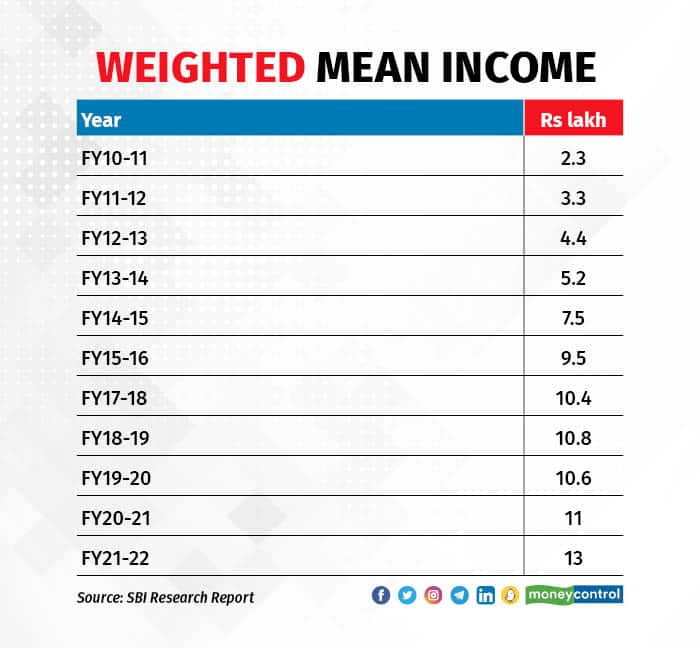

Impact of Economic Scenarios

A table showing the potential impact of various economic scenarios on retirement income is essential. The table could display the predicted income for different scenarios, such as a recession, a period of high inflation, or a sustained economic boom. Each scenario should be described briefly. For example, a recession scenario might depict a sharp decline in investment returns and a potential increase in expenses.

Figuring out retirement income for the middle class is a real head-scratcher. It’s a huge financial concern, especially when you consider how fluctuating entertainment industry trends like TV ratings affect the broader economy. For example, the recent Emmy Awards TV ratings, as reported by effectsnews.com , could offer some insight into the overall health of the entertainment sector, which in turn might have ripple effects on the retirement income landscape for the middle class.

Ultimately, securing a comfortable retirement income requires careful planning and a good understanding of market forces.

Visualizing the potential income variations under different scenarios allows individuals to prepare for diverse economic conditions and helps them create a more resilient retirement plan.

Characteristics of a Healthy Retirement Lifestyle

A well-designed retirement lifestyle is multifaceted. Key characteristics of a healthy retirement lifestyle include a balanced budget, regular physical activity, and social engagement. It’s important to plan for hobbies and activities, maintain relationships, and continue learning. It is vital to consider the financial aspect of healthcare, leisure, and travel expenses. The visualization could be a mind map or a network diagram, showing how these elements intertwine and support a fulfilling retirement.

It’s crucial to show that retirement isn’t just about financial security; it’s about overall well-being and personal fulfillment.

Conclusion

In conclusion, securing retirement income for the middle class requires a multifaceted approach. This involves careful planning, understanding potential risks, and exploring various financial strategies. Government policies also play a critical role, and seeking professional advice is often beneficial. By proactively addressing these issues, individuals can increase their chances of a comfortable and secure retirement.

FAQ Guide

What is the average retirement income needed for the middle class?

Unfortunately, there’s no single answer to this. Retirement income needs vary greatly based on individual expenses, lifestyle choices, and expected lifespan. However, resources and calculators are available to help estimate a suitable income target.

How can I maximize my Social Security benefits?

Maximizing Social Security benefits involves understanding the various claiming strategies. Claiming at full retirement age typically provides the highest monthly benefit. However, claiming earlier or later can impact the amount received.

What are some tax-advantaged retirement accounts for the middle class?

401(k)s, IRAs, and Roth IRAs are common tax-advantaged accounts. Choosing the right account depends on individual circumstances, income levels, and long-term financial goals.

How can I reduce my expenses in pre-retirement?

Reducing expenses involves careful budgeting and identifying areas where savings can be made. This could include reducing unnecessary subscriptions, renegotiating bills, or exploring cost-effective alternatives.