IRS Tax Report Congress Congressional Scrutiny

IRS tax report congress is a complex interplay of congressional oversight, policy impacts, and public perception. This report delves into the historical scrutiny of IRS tax reporting procedures by Congress, examining the legislative proposals, political pressures, and the role of data in shaping tax policy. We’ll explore how various income brackets and demographics are reflected in the reports, and how public opinion affects congressional responses.

The report will cover the evolution of congressional involvement in IRS tax reporting, including the different committees involved. We’ll analyze the impact of tax reports on legislative debates and identify potential biases and limitations in using this data. The historical context will be illustrated with a table showing the evolution of approaches to IRS tax reporting regulations.

Congressional Scrutiny of IRS Tax Reporting

The Internal Revenue Service (IRS) plays a crucial role in collecting taxes and administering tax laws. Congressional oversight of the IRS, including its tax reporting procedures, is essential to ensure the agency functions effectively and adheres to established legal frameworks. This scrutiny is driven by various factors, including public concerns about tax fairness, the agency’s efficiency, and its potential for misuse.

Understanding the historical context, congressional oversight mechanisms, and legislative proposals surrounding IRS tax reporting provides insight into the ongoing dynamic between the legislative and executive branches.The relationship between Congress and the IRS is complex, evolving throughout history. Initially, Congress focused on broad tax policy, leaving the day-to-day operations of tax collection to the IRS. However, as the tax code grew more intricate and the IRS assumed greater responsibility, congressional oversight became more detailed and frequent.

The IRS tax report to Congress is always a hot topic, but lately, the global economic climate is also influencing the discussion. For example, the current state of the German economy, especially in relation to the potential for a Palestinian state, is creating ripples in the political discussions surrounding the report. This interconnectedness of global issues, as seen in the palestinian state german economy , means the IRS report is more than just numbers; it’s a reflection of broader international dynamics.

Ultimately, the report will still be a crucial tool for shaping future tax policies.

This shift reflects the growing need for accountability and transparency in the tax collection process.

Historical Overview of Congressional Involvement

Congress has a long history of involvement in the IRS’s tax reporting procedures. Early involvement primarily focused on establishing the agency’s structure and powers. As the tax code evolved and the agency’s responsibilities expanded, so did the scrutiny from Congress. The scrutiny encompasses a wide range of issues, from ensuring accurate tax collection to investigating potential abuses and inefficiencies within the system.

This involvement has resulted in significant changes to IRS procedures and policies over time.

Congressional Committees and Subcommittees

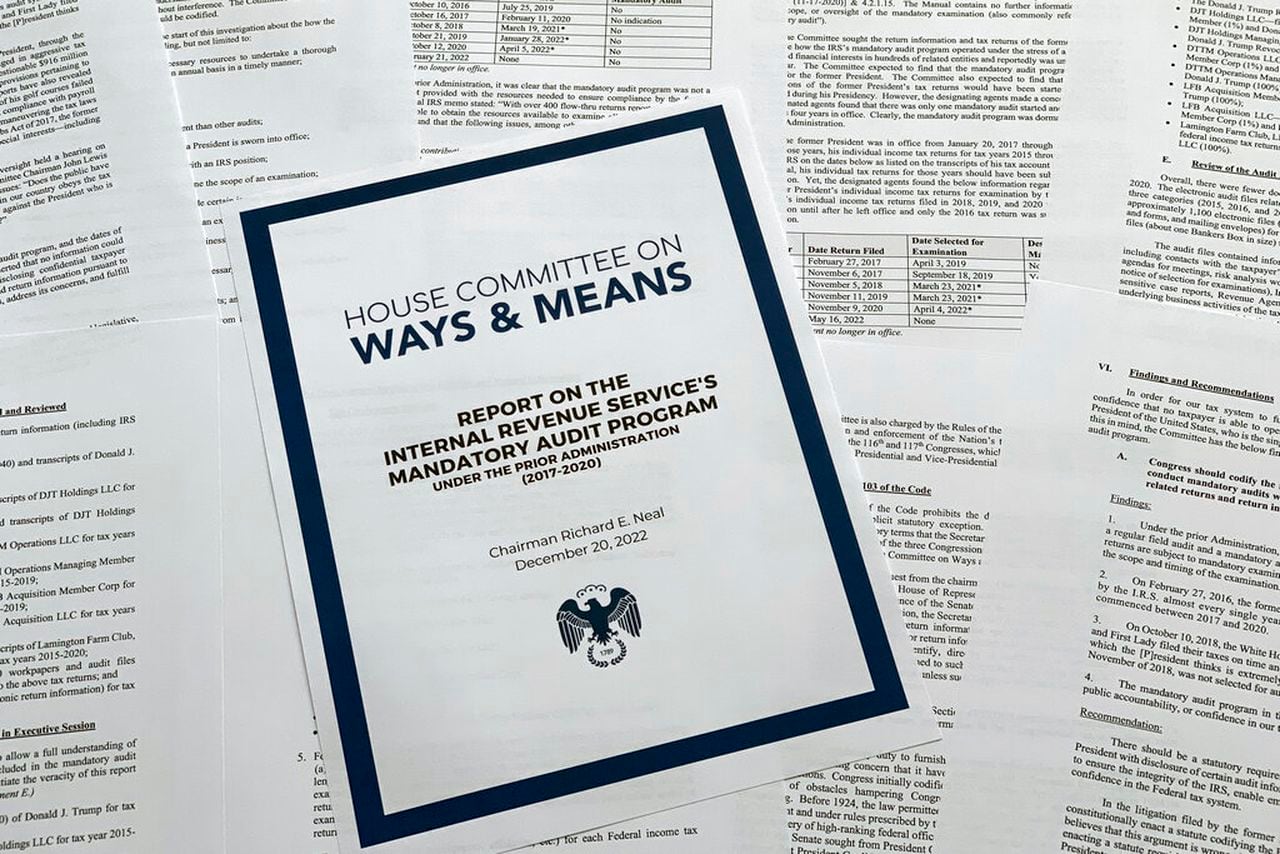

Several congressional committees and subcommittees have oversight responsibilities related to IRS functions, including tax reporting. The House Ways and Means Committee and the Senate Finance Committee are the primary committees responsible for shaping tax policy and overseeing the IRS. These committees hold hearings, conduct investigations, and review IRS reports, providing a critical check on the agency’s activities. Subcommittees within these committees often specialize in particular aspects of tax law and IRS operations, further enhancing the level of scrutiny.

These committees and subcommittees play a crucial role in the oversight process, ensuring that the IRS adheres to the law and meets the needs of taxpayers.

Legislative Proposals

Numerous legislative proposals have been introduced to address perceived deficiencies in IRS tax reporting. These proposals often aim to improve efficiency, enhance transparency, or address specific tax loopholes. Arguments for these proposals frequently center on fairness, accuracy, and reducing compliance burdens for taxpayers. Conversely, arguments against proposals often focus on potential unintended consequences, increased costs, or disruptions to existing systems.

Political Motivations and Pressures

Political motivations and pressures significantly influence congressional actions regarding IRS tax reporting. Political parties often propose legislation aligned with their respective ideologies and priorities. Public opinion and interest groups also exert pressure on legislators, advocating for changes in tax reporting procedures. These influences can result in legislative proposals that address specific concerns but may not always reflect a comprehensive and balanced approach.

Comparison of Approaches to IRS Tax Reporting Regulations

This table illustrates the evolution of approaches to IRS tax reporting regulations over time.table| Year | Approach | Key Features | Congressional Focus ||—|—|—|—|| 2000 | Simplified Tax Filing | Streamlined forms, online filing options | Increased taxpayer compliance and efficiency || 2010 | Enhanced Taxpayer Assistance | Expanded IRS resources, improved customer service | Reduced taxpayer burden, increased trust in the system || 2020 | Digital Tax Reporting | Increased reliance on digital platforms, mobile apps | Improved data security, enhanced accessibility for taxpayers |/table

Impact of Tax Reports on Congressional Policy

IRS tax reports serve as a crucial data source for shaping congressional policy debates. These reports provide a detailed snapshot of the economic landscape, revealing trends in income distribution, tax compliance, and the overall health of the economy. Understanding these patterns is vital for crafting effective tax codes and related legislation that address societal needs and economic realities.Congressional committees rely heavily on IRS data to analyze the effectiveness of existing tax laws and identify areas needing reform.

Tax reports often expose disparities in tax burdens across different income levels and demographics, which can influence the design of tax policies aimed at achieving fairness and equity. Furthermore, changes in tax reporting trends can highlight emerging economic challenges or opportunities that require immediate attention from lawmakers. The comprehensive nature of IRS data makes it a powerful tool for informed policymaking.

Influence of Tax Reports on Tax Code Formulation

Tax reports play a direct role in shaping the specifics of tax codes. By analyzing patterns in income and deductions, lawmakers can identify areas where the current tax code might be creating inequities or disincentives. For example, a consistent decline in tax revenue from a particular sector might prompt investigations into the reasons behind this decline and potential legislative changes.

This analysis can lead to revisions in tax rates, credits, or deductions. Understanding the impact of existing tax laws on different economic sectors is vital for informed revisions. For instance, if a specific industry shows significant tax avoidance, this could lead to a tightening of regulations or adjustments in tax rates for that industry.

The IRS tax report to Congress is always a hot topic, but lately, a different kind of report has emerged in Nassau County. Concerns about midwife vaccinations and potential false immunization records are raising eyebrows, especially considering the potential impact on public health. This issue, as detailed in the article about midwife vaccinations false immunization records nassau county , is causing quite a stir.

Ultimately, the quality of the IRS tax report to Congress is still the key concern.

Potential Biases and Limitations in Policy Decisions

While IRS tax reports are invaluable, they do have limitations and potential biases that need consideration. One significant limitation is the potential for misinterpretation of data. Aggregating data from various sources and different reporting years can obscure certain nuances, potentially leading to skewed conclusions. Furthermore, data limitations, such as the omission of certain deductions or complexities in reporting, can influence the accuracy of the analysis.

Congress is currently reviewing the IRS tax report, a crucial document for understanding the nation’s financial health. While the report is a serious matter, it’s interesting to note how Mayor Eric Adams’s fashion choices, particularly his impressive suit selection, are also in the news. Digging deeper into the latest trends in Eric Adams suits fashion , one might find some intriguing parallels to the complex data presented in the IRS report, though I’m not sure exactly what those might be.

Regardless, it’s all part of the larger conversation surrounding the IRS tax report’s significance.

Careful consideration of these factors is necessary to ensure that policy decisions are well-informed and unbiased. Furthermore, political motivations or biases in data interpretation can potentially influence the outcomes. Therefore, it’s important to critically examine the context and methodology behind the data analysis.

Representation of Different Income Brackets and Demographics

Tax reports provide valuable insight into the economic standing of different income brackets and demographics. The data reveals patterns in income distribution, highlighting disparities in tax burdens. Analyzing the tax burden on various demographics, such as low-income households, middle-class families, and high-net-worth individuals, can help policymakers understand the impact of current tax policies. Understanding these trends helps in developing policies that promote fairness and economic opportunity for all.

However, limitations exist in accurately representing the full spectrum of socioeconomic backgrounds. Accurate representation of marginalized communities and individuals with unique circumstances requires additional data collection and analysis methods.

Table of Potential Implications of Tax Report Trends

Public Perception and Congressional Response

Public perception of the IRS and its tax reporting processes plays a significant role in shaping congressional actions. A negative public image can lead to legislative changes aimed at improving efficiency and transparency, while a positive view might encourage minimal intervention. This dynamic interplay between public opinion and congressional response is crucial in understanding the evolving landscape of tax reporting.

It’s not just about numbers and forms; it’s about how the public feels about the whole process.Understanding the correlation between public sentiment and congressional action requires a nuanced approach. Simply put, if the public perceives the IRS as inefficient or unfair, it creates pressure on Congress to act. This pressure can manifest in various ways, from demanding reforms to even threatening budget cuts for the agency.

Congressional responses are often tailored to address these concerns, demonstrating a direct link between public opinion and legislative priorities.

Public Opinion Polls and Congressional Discussions

Public opinion polls and surveys provide valuable insights into the public’s views on IRS tax reporting. These surveys frequently highlight areas of concern, such as perceived complexity, perceived fairness, and trust in the agency’s ability to handle taxpayer information. For example, a poll revealing widespread dissatisfaction with the IRS’s online services might trigger congressional hearings focusing on digital accessibility and user-friendliness.

These polls are not just snapshots of public sentiment; they act as catalysts for congressional action, pushing for reform and improvements.

Media Coverage and Public and Congressional Views

Media coverage significantly influences both public and congressional views on IRS tax reporting. Extensive negative media portrayals of the IRS, whether due to perceived inefficiencies or perceived political bias, can lead to a decline in public trust and increased pressure on Congress to intervene. Conversely, positive media coverage showcasing the agency’s efforts to improve efficiency or simplify procedures can foster a more favorable public image, potentially leading to reduced congressional scrutiny.

A critical aspect is the tone and depth of coverage. Are the issues being framed as systemic problems, or are they presented as isolated incidents? This context greatly affects the public’s understanding and Congress’s response.

Political Discourse and Public Perception

Political discourse surrounding tax reporting often influences public perception. Discussions that focus on perceived unfairness or targeting of specific groups can polarize the public, leading to stronger reactions and increased pressure on Congress. Conversely, discussions that highlight the need for a fair and efficient tax system can foster a more positive perception of the IRS. The language used in political debates directly impacts public understanding and shapes public opinion, thus impacting the political environment surrounding IRS reporting.

Strategies for Improving Public Understanding

Effective communication is crucial for bridging the gap between the IRS and the public.

- Improved Communication: The IRS should actively engage with the public through clear and accessible communication channels, such as simplified online resources, informative videos, and user-friendly FAQs. These channels need to be tailored to different audiences and address specific concerns.

- Simplified Reporting Processes: Streamlining tax filing procedures, reducing paperwork, and improving online tools can significantly improve the public experience. This includes simplifying complex tax forms, providing more intuitive online portals, and offering multilingual support. Providing clearer instructions, with various formats (visual, textual, auditory), can greatly improve the understanding of the process.

- Increased Transparency: Greater transparency about IRS operations, including its budget, staffing levels, and decision-making processes, can enhance public trust. This includes publishing data on taxpayer assistance requests, response times, and the outcomes of appeals. Open data initiatives can empower taxpayers and foster a greater understanding of the agency’s functioning.

Challenges and Future Directions of IRS Tax Reporting

Navigating the complexities of tax reporting is a constant challenge for both taxpayers and the IRS. The system, while fundamental to the functioning of the nation’s economy, is constantly evolving, requiring adaptation to technological advancements, global economic shifts, and shifting public expectations. Congressional oversight of these changes is crucial to ensuring fairness, efficiency, and accuracy in the tax collection process.The IRS faces numerous hurdles in modernizing its systems and procedures.

These range from the need for robust cybersecurity measures to protect sensitive taxpayer data to the ever-increasing need to adapt to new technological advancements in financial transactions. Furthermore, global economic fluctuations and the emergence of new tax structures in other countries necessitate a dynamic approach to tax reporting and enforcement.

Current Challenges in IRS Tax Reporting

The IRS faces significant challenges in maintaining a robust and efficient tax reporting system. These challenges impact congressional considerations in several ways. Outdated technology and inadequate infrastructure contribute to delays in processing returns, increasing the workload on both IRS agents and taxpayers. The sheer volume of returns to process, coupled with increasing complexity in financial transactions, necessitates continuous technological upgrades.

Furthermore, the ever-growing need for compliance with international tax reporting standards necessitates significant adjustments in internal processes. The increasing reliance on digital transactions also presents unique challenges regarding data security and the need for robust anti-fraud measures.

The IRS tax report to Congress is always a hot topic, but lately, the political climate is making it even more interesting. The results of the New Hampshire Democratic primary, available here , are definitely influencing the conversation, and likely impacting how the report is perceived. Ultimately, the Congress’s response to the IRS tax report will be key in shaping the coming fiscal year.

Potential Future Directions for IRS Tax Reporting

The future of IRS tax reporting hinges on embracing technological advancements. The implementation of artificial intelligence (AI) and machine learning (ML) could automate various tasks, like data entry and basic audit analysis, freeing up human agents for more complex issues. Cloud-based systems could improve data accessibility and security, while mobile-first applications could enhance taxpayer convenience. These advancements, while promising, also present challenges related to data privacy, security breaches, and the potential for job displacement.

Technological Advancements and Legislative Responses, Irs tax report congress

Technological advancements, such as blockchain technology, could revolutionize tax reporting. Blockchain’s inherent transparency and immutability could enhance tax reporting accuracy and reduce fraud. However, implementing blockchain-based systems would require significant legislative adjustments, including updates to tax codes and regulations. The development of secure digital wallets and the integration of cryptocurrency transactions into tax reporting processes also necessitates a proactive legislative response.

The IRS tax report to Congress is always a hot topic, but lately, the political climate is making things interesting. For example, the recent court victory for Thailand’s Pita Limjaroenrat, Thailand’s Pita wins case , highlights the complexities of political and legal battles, which in turn could potentially affect the ongoing debate around tax reform. This all adds another layer to the discussion surrounding the IRS report.

These developments require ongoing scrutiny to ensure fair and equitable application across different income levels and economic circumstances.

Effects of Global Economic Shifts

Global economic shifts, including the rise of digital economies and international trade, significantly impact tax reporting practices. New tax structures and reporting standards in other countries necessitate the development of international tax treaties and cooperation mechanisms. The shift towards globalized commerce demands robust international tax reporting standards and a global framework for international tax compliance. These shifts affect congressional decisions, requiring consideration of international tax laws, treaties, and potential trade implications.

Congressional oversight is essential to adapt to these changes and ensure domestic tax policy aligns with global trends.

Interconnectedness of IRS Tax Reporting, Congressional Action, and Public Opinion

imgA dynamic infographic illustrating the complex relationship between IRS tax reporting, congressional action, and public opinion would visually connect these aspects using arrows and icons. For example, an arrow from “IRS Tax Reporting” to “Congressional Action” could be labeled “Feedback,” indicating that the IRS’s operations, challenges, and successes inform congressional decisions. An arrow from “Public Opinion” to “Congressional Action” could be labeled “Pressure,” highlighting the impact of public sentiment on legislative priorities.

Different shades of color or iconography could be used to represent the intensity of the influence, and interactive elements could allow users to explore specific aspects in detail. This visual representation would effectively showcase the interconnectedness and influence of these three factors./img

Last Point

In conclusion, the relationship between IRS tax reports and congressional action is multifaceted and dynamic. This report highlights the historical trends, current challenges, and future directions in IRS tax reporting, with an emphasis on the influence of public perception and technological advancements. The infographic included provides a visual representation of the intricate connections between these factors. Understanding this complex relationship is crucial for effective policymaking and maintaining public trust in the tax system.

FAQ Resource: Irs Tax Report Congress

What are some common criticisms of using IRS tax reports to inform policy decisions?

Potential biases and limitations in the data, such as underreporting or inaccurate income data for specific demographics, are significant factors. Also, the reports may not fully capture the complexities of economic factors influencing tax contributions.

How has media coverage influenced congressional discussions on IRS tax reporting?

Media coverage can shape public opinion and put pressure on Congress to address issues related to tax reporting. Negative media portrayals can lead to congressional investigations or legislative changes. Conversely, positive coverage can increase public support for specific reporting approaches.

What are some examples of legislative proposals related to IRS tax reporting?

Historical examples might include proposals for expanding reporting requirements, changes to tax brackets, or new reporting methods. Details on specific examples would need to be researched further from primary sources.

What are the potential implications of global economic shifts on IRS tax reporting practices?

Global economic shifts can affect tax revenues, tax evasion patterns, and the need for adjustments to tax reporting practices. This could influence congressional decisions about tax policies, particularly international tax agreements.