Bidens Fed Interest Rates Impact & Outlook

Interest rates federal reserve biden are a crucial factor shaping the current economic landscape. The Federal Reserve’s decisions under President Biden’s administration are impacting everything from consumer spending to business investments, and even global markets. This analysis delves into the Fed’s policies, their rationale, and the potential consequences for various sectors.

Understanding the intricate relationship between interest rate adjustments, economic policies, and public perception is key to comprehending the current economic climate.

Federal Reserve’s Interest Rate Policy Under Biden

The Federal Reserve’s monetary policy, specifically its interest rate adjustments, plays a crucial role in managing the U.S. economy. Under the Biden administration, the Fed has navigated a complex economic landscape, balancing inflation concerns with the need to avoid a recession. This period has witnessed significant adjustments to interest rates, driven by various economic factors. Understanding these adjustments is crucial for comprehending the current economic climate and the path forward.

Summary of Interest Rate Policy Decisions, Interest rates federal reserve biden

The Federal Reserve’s primary objective is to maintain price stability and maximum employment. To achieve these goals, the Fed employs various tools, including adjusting the federal funds rate. Under the Biden administration, the Fed has implemented a series of interest rate hikes, aiming to combat inflation that had risen significantly from pre-pandemic levels. These actions were intended to cool down the economy and prevent a runaway inflationary spiral.

Biden’s stance on interest rates set by the Federal Reserve is likely to be influenced by the results of the New Hampshire Democratic primary. These results will show how voters feel about the current economic climate and could sway the administration’s approach to managing interest rates. Ultimately, the Federal Reserve’s decisions on interest rates will likely continue to be a major focus, regardless of the election results.

Rationale Behind Recent Interest Rate Adjustments

The recent interest rate adjustments by the Federal Reserve are primarily driven by inflation concerns. Rising inflation erodes purchasing power and can lead to economic instability. The Fed’s response aims to curb demand-pull inflation by making borrowing more expensive. Higher interest rates reduce consumer and business spending, ultimately slowing economic growth and tempering price increases. A notable factor influencing these decisions is the labor market’s strength and the potential for wage-price spirals.

The Fed must also consider the potential impact on the stock market and the overall financial health of the economy.

Economic Factors Influencing the Fed’s Policy Decisions

Several key economic factors significantly influence the Fed’s policy decisions. Inflation data, including the Consumer Price Index (CPI) and Producer Price Index (PPI), are crucial indicators. The strength of the labor market, measured by unemployment rates and wage growth, also plays a vital role. Economic growth, measured by GDP figures, is another critical consideration. Global economic conditions, including international trade and commodity prices, can also affect domestic economic policy.

The interplay of these factors dictates the Fed’s actions and influences their approach.

Comparison to Previous Administrations

The Federal Reserve’s approach under the Biden administration differs in some respects from previous administrations. While the fundamental goals of price stability and maximum employment remain consistent, the specific economic context and the tools employed can vary. The speed and magnitude of interest rate adjustments can differ based on the prevailing economic conditions, inflation rates, and the specific challenges faced by the economy.

Key Interest Rate Changes Under the Biden Administration

| Date | Interest Rate | Reason |

|---|---|---|

| March 16, 2022 | 0.25% | Initial rate hike to combat inflation |

| May 4, 2022 | 0.50% | Further tightening to address rising inflation |

| June 15, 2022 | 0.75% | Inflation remained elevated, requiring a more aggressive response |

| July 27, 2022 | 1.00% | Sustained inflationary pressures led to a further increase |

Impact of Interest Rates on the Economy

Interest rates, a fundamental tool of monetary policy, significantly influence economic activity. Changes in these rates ripple through various sectors, affecting consumer behavior, business decisions, and overall economic growth. Understanding these impacts is crucial for navigating the complexities of a dynamic economy.

Impact on Consumer Spending

Consumer spending, a vital component of economic growth, is directly affected by interest rates. Higher interest rates typically increase borrowing costs for consumers, making loans like mortgages and auto loans more expensive. This, in turn, can discourage borrowing and spending. For example, if mortgage rates rise significantly, prospective homebuyers might postpone their purchases, reducing demand in the housing market.

Conversely, lower interest rates can stimulate consumer spending by making borrowing more affordable, potentially leading to increased demand for goods and services. This can be seen in the increased consumer spending during periods of low interest rates, when individuals are more likely to take out loans for purchases like homes or cars.

Impact on Business Investment and Job Creation

Interest rates directly impact business investment decisions. Higher interest rates increase the cost of borrowing for businesses, making large-scale investments like expanding facilities or purchasing new equipment less attractive. This can lead to a decrease in business investment and potentially hinder job creation. Conversely, lower interest rates encourage business investment, as it becomes cheaper to borrow money for expansion or new projects.

This often translates into increased job opportunities as companies expand operations and production. Historical data shows strong correlations between periods of low interest rates and increased job creation.

Impact on Specific Sectors

Interest rates have varying effects on different sectors of the economy. For example, the housing sector is highly sensitive to interest rate changes. Higher interest rates typically lead to reduced demand for mortgages, impacting housing prices and construction activity. The automotive sector can also be significantly affected. Increased interest rates on auto loans can deter consumers from purchasing new vehicles, leading to a decline in sales.

The Federal Reserve’s interest rate decisions under President Biden are definitely a hot topic right now. Navigating these complex economic shifts is crucial, and understanding how they affect everything from personal finances to the overall economy is key. It’s fascinating to see how these decisions play out, and also consider the impact on family matters like naming a child, such as determining the baby’s last name.

For a deeper dive into the fascinating world of naming traditions, particularly regarding how a child’s last name is chosen, check out this article on the subject of apellido bebe madre padre. Ultimately, the Federal Reserve’s interest rate policies continue to have a significant influence on our financial future.

Conversely, lower interest rates can stimulate demand in these sectors.

Impact on Inflation and Economic Growth

Interest rates play a crucial role in managing inflation and influencing economic growth. Higher interest rates tend to curb inflation by reducing borrowing and spending, thus slowing down the economy. Lower interest rates, conversely, can stimulate economic growth by encouraging borrowing and spending, potentially leading to higher inflation if not carefully managed. The Federal Reserve carefully balances these considerations in its monetary policy decisions to maintain a stable economy.

Comparative Analysis of Interest Rate Scenarios

| Interest Rate Scenario | Consumer Spending | Business Investment | Inflation |

|---|---|---|---|

| Low Interest Rates | High | High | Potentially High (if not managed) |

| Moderate Interest Rates | Moderate | Moderate | Stable |

| High Interest Rates | Low | Low | Potentially Low |

Biden’s Economic Policies and Interest Rates

Biden’s economic agenda, emphasizing infrastructure investment and social programs, has significant implications for the Federal Reserve’s interest rate decisions. These policies aim to stimulate economic growth and reduce inequality, but their effects on inflation and the overall economic landscape are complex and intertwined with the Fed’s actions. The interplay between these two forces shapes the current economic environment, creating both opportunities and challenges.

Biden’s Economic Policies and Their Impact

Biden’s administration has pursued a multifaceted economic strategy, focusing on investments in infrastructure, clean energy, and social programs. The American Rescue Plan, for instance, provided substantial Covid-19 relief, while the Bipartisan Infrastructure Law aims to modernize the nation’s infrastructure, create jobs, and boost economic activity. These initiatives aim to address long-standing economic disparities and enhance productivity. The projected increase in government spending under these policies can potentially stimulate aggregate demand and lead to higher economic growth.

Relationship with Federal Reserve Interest Rate Decisions

The Federal Reserve’s interest rate decisions are primarily geared towards managing inflation. Higher interest rates curb borrowing and spending, cooling down an overheated economy. Conversely, lower interest rates encourage borrowing and investment, potentially stimulating economic growth. Biden’s policies, with their focus on increasing government spending and stimulating economic activity, may create pressure for the Federal Reserve to maintain lower interest rates to accommodate the increased demand.

This interplay can create tension, as lower rates might lead to higher inflation if demand outpaces supply.

Potential Conflicts and Synergies

There’s a potential conflict between Biden’s economic policies and the Fed’s interest rate goals. Increased government spending, coupled with potentially lower interest rates, could lead to higher inflation. However, there are also potential synergies. Investments in infrastructure and clean energy can increase productivity and efficiency, potentially mitigating inflationary pressures in the long term. The success of Biden’s policies in generating sustained economic growth without excessive inflation will depend on the Fed’s ability to manage interest rates appropriately.

The Fed will likely be watching closely for signs of inflation to ensure that the economic benefits of Biden’s policies are not outweighed by inflationary pressures.

Comparison Chart

| Biden Policy | Fed Interest Rate Action | Economic Impact |

|---|---|---|

| American Rescue Plan (Covid-19 relief) | Low interest rates to stimulate economic recovery | Short-term economic growth, potential for increased inflation |

| Bipartisan Infrastructure Law | Potential for continued low rates to support investment | Long-term economic growth, potential job creation, potentially mitigated inflation |

| Social programs (e.g., child tax credit) | Continued low rates to encourage spending | Increased consumer spending, potential for increased inflation if supply can’t keep up |

| Clean Energy Investments | Potential for low rates to incentivize green energy investments | Reduced carbon emissions, potential for job creation and technological advancements, potentially mitigated inflation through energy efficiency |

Public Perception of Interest Rate Policy

Public opinion on the Federal Reserve’s interest rate policies under the Biden administration is complex and multifaceted. Different segments of the population hold varying perspectives on the effectiveness and appropriateness of these policies, often reflecting their individual economic circumstances and priorities. Understanding these diverse viewpoints is crucial for evaluating the overall impact of the Fed’s actions.The effectiveness of interest rate adjustments is often debated, with some arguing that they are necessary to curb inflation and stabilize the economy, while others contend that they disproportionately impact certain demographics or stifle economic growth.

Public sentiment is further shaped by factors such as the overall economic climate, current employment rates, and the perceived fairness of the policies.

Public Opinion on Interest Rate Hikes

Public opinion regarding the Federal Reserve’s interest rate hikes under the Biden administration is significantly influenced by their perceived impact on personal finances. For example, higher rates can lead to increased mortgage payments, potentially impacting homeowners and those seeking to purchase a home. Conversely, some view higher interest rates as a necessary measure to combat inflation, protecting the long-term value of savings and investments.

The Federal Reserve’s interest rate decisions under President Biden are definitely impacting things. While the recent moves might seem unrelated to the stunning displays of snow polo in St. Moritz, snow polo in St. Moritz and the growing concern about climate change highlight the interconnectedness of seemingly disparate issues. The strain on resources, and the ripple effect on global economies, are all factors the Federal Reserve considers when making these decisions.

Factors Influencing Public Sentiment

Several factors contribute to the public’s varied perspectives on the Federal Reserve’s interest rate policies. Economic conditions, such as inflation rates and unemployment figures, significantly shape public opinion. For instance, if inflation is high, a majority may support the Fed’s interest rate hikes, believing that this is necessary to control prices. Conversely, during periods of economic downturn, there is often opposition to interest rate increases, as they can hinder economic activity and increase borrowing costs.Another critical factor is the perceived fairness of the policies.

The Federal Reserve’s interest rate decisions under President Biden are definitely a hot topic right now. It’s fascinating to see how these economic moves play out, especially when considering the impact on everyday consumers and businesses. This all makes me think of Adrian Beltre, a legendary Texas Rangers player who’s now a Hall of Famer. Adrian Beltre’s hall of fame career is a testament to dedication and skill, reminding us that even in high-stakes scenarios, consistent effort is key.

Ultimately, the Federal Reserve’s actions are shaping the economic landscape, and it’s going to be interesting to see how this all unfolds.

Some argue that interest rate hikes disproportionately impact lower- and middle-income households, who are more reliant on borrowing for various purposes. Conversely, those who benefit from increased savings and investment returns might support these policies.

Sources of Public Concern and Support

Concerns regarding interest rate policies often stem from the potential for reduced consumer spending and economic slowdown. This can lead to job losses and a decline in overall economic activity. Support for the Fed’s actions typically comes from those who see higher rates as a necessary step to combat inflation and preserve the value of their savings. Financial analysts and economists provide insight into the potential consequences of these policies, often influencing public opinion.

Visual Representation of Public Sentiment

This hypothetical chart would visually display the distribution of public sentiment on interest rate changes. It would likely show a range of opinions, with some strongly supporting the Fed’s actions, some strongly opposing them, and a significant portion holding neutral or ambivalent views. The chart would use different colors or shading to represent the intensity of sentiment (e.g., strong support, moderate support, neutral, moderate opposition, strong opposition).

Potential Future Scenarios for Interest Rates: Interest Rates Federal Reserve Biden

The Federal Reserve’s interest rate policy is a critical factor in shaping the economic landscape. Predicting future interest rate decisions requires careful consideration of various economic indicators and potential shocks. Understanding the potential scenarios allows for better preparedness and informed decision-making by individuals and businesses alike.

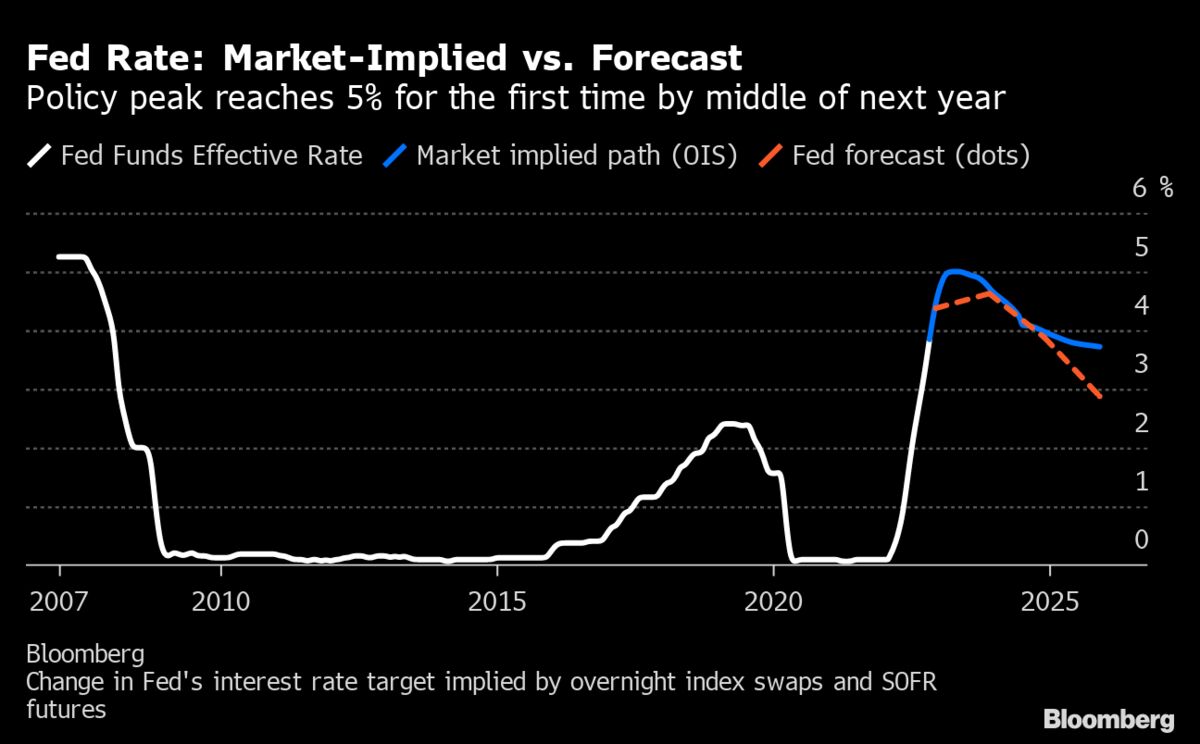

Possible Future Directions of Interest Rate Policy

The Federal Reserve’s approach to interest rates in the future will depend significantly on the trajectory of inflation and economic growth. If inflation remains stubbornly high, the Fed might maintain a restrictive monetary policy, potentially leading to a prolonged period of higher interest rates. Conversely, if inflation cools down and economic growth slows, the Fed could pivot towards a more accommodative stance, lowering interest rates to stimulate economic activity.

Economic Forecasts and Their Impact

Several economic forecasts predict varying scenarios for inflation and GDP growth. A scenario with persistent inflation could necessitate further rate hikes, while a scenario with a significant slowdown in economic growth might signal a shift towards lower rates. The Fed’s reaction to these forecasts will be crucial in determining the future direction of interest rates. For example, if economic forecasts project a sharp decline in consumer spending, the Fed might lower interest rates to stimulate demand and prevent a recession.

Biden’s administration is navigating tricky economic waters, with the Federal Reserve’s interest rate hikes impacting everything from consumer spending to the stock market. It’s a complex situation, and the recent heartbreaking story of lovers in Auschwitz, Keren Blankfeld and József Debreczeni, found tragically in the cold crematorium ( lovers in auschwitz keren blankfeld cold crematorium jozsef debreczeni ) serves as a stark reminder of the human cost of economic and political instability.

Ultimately, the Federal Reserve’s decisions will continue to play a critical role in shaping the future economic landscape.

Potential Challenges and Opportunities

The potential challenges and opportunities associated with different interest rate scenarios are numerous. Higher interest rates, while potentially curbing inflation, can also lead to slower economic growth and increased borrowing costs for businesses and consumers. Conversely, lower interest rates can stimulate economic activity but may also risk reigniting inflationary pressures. Maintaining a balance between these competing forces is the key challenge for the Federal Reserve.

A balanced approach, considering both short-term and long-term effects, is crucial for navigating economic volatility.

Illustration of Potential Future Scenarios

| Scenario | Interest Rate | Inflation | GDP Growth |

|---|---|---|---|

| Scenario 1: Persistent Inflation | 5.5%-6.5% | 3.5%-4.5% | 1.5%-2.5% |

| Scenario 2: Moderating Inflation | 4.5%-5.5% | 2.5%-3.5% | 2.5%-3.5% |

| Scenario 3: Economic Slowdown | 3.5%-4.5% | 2.0%-2.5% | 1.0%-2.0% |

This table presents three possible scenarios, each with varying interest rate, inflation, and GDP growth projections. These are illustrative examples and do not represent definitive predictions. The actual outcomes will depend on a complex interplay of various economic factors and policy decisions. Real-world examples of similar situations in the past can offer insights into the potential consequences of each scenario.

International Context of Interest Rate Decisions

The Federal Reserve’s interest rate policy isn’t isolated. Global economic conditions, actions of other central banks, and international financial markets all significantly influence the Fed’s decisions. Understanding this interconnectedness is crucial for interpreting the impact of U.S. interest rate adjustments on the broader global economy.The current global economic landscape presents a complex web of interconnected challenges and opportunities. Factors like inflation, currency exchange rates, and the performance of major economies abroad shape the Fed’s choices, requiring careful consideration of the potential ripple effects of its decisions on the international stage.

International Factors Influencing Federal Reserve Policy

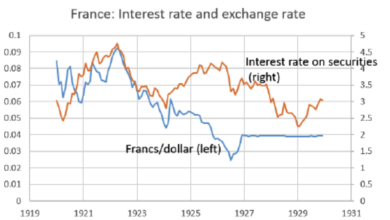

A multitude of international factors play a critical role in shaping the Federal Reserve’s interest rate decisions. These include global inflation trends, exchange rate fluctuations, and the economic performance of major trading partners. For example, if inflation rises significantly in Europe, the Fed might be prompted to raise interest rates more aggressively to maintain a competitive position for the US dollar and prevent capital flight.

Comparison of Federal Reserve Policy with Other Central Banks

The Federal Reserve’s interest rate policies are constantly being compared with those of other central banks, especially those in developed economies. This comparison reveals both similarities and differences in approach, reflecting the unique economic circumstances of each country.

Global Economic Impact of US Interest Rate Adjustments

Adjustments in U.S. interest rates have substantial global economic repercussions. For instance, if the Fed raises rates, it can potentially attract foreign investment to U.S. assets, leading to a stronger dollar. This, in turn, can impact global trade and commodity prices.

Conversely, if the Fed lowers rates, it might lead to capital outflow, affecting financial markets and economies reliant on U.S. investments.

Comparison Table of Interest Rate Policies

| Country | Central Bank | Interest Rate | Economic Context |

|---|---|---|---|

| United States | Federal Reserve | 2.25%-2.50% | High inflation, strong labor market |

| Eurozone | European Central Bank | 3.75% | Moderate inflation, concerns about energy prices |

| Japan | Bank of Japan | 0% | Deflationary pressures, low inflation |

| United Kingdom | Bank of England | 4.25% | High inflation, rising energy costs |

| China | People’s Bank of China | 1.90% | Stable growth, managing credit risks |

Final Conclusion

In conclusion, the interplay between interest rates federal reserve biden and the Biden administration’s economic policies paints a complex picture. The impact on the economy is multifaceted, affecting consumer behavior, business decisions, and global markets. Future scenarios remain uncertain, requiring careful consideration of economic forecasts and potential challenges.

Questions Often Asked

What is the Federal Reserve’s primary goal in setting interest rates?

The Federal Reserve aims to maintain stable prices and maximum employment in the US economy. Interest rate adjustments are a key tool in achieving these goals.

How do rising interest rates affect housing markets?

Higher interest rates typically increase mortgage costs, potentially slowing down housing market activity and reducing affordability for homebuyers.

What is the difference between the Fed’s policy and the Biden administration’s economic policies?

While both aim for economic stability, the Fed focuses on monetary policy (interest rates), while the Biden administration employs fiscal policy (government spending and taxation). These policies can sometimes align, but there can also be potential conflicts.

What are some potential future scenarios for interest rates?

Future interest rate adjustments will depend on economic indicators such as inflation, employment rates, and global economic conditions. Different scenarios will have varying impacts on various sectors of the economy.