Intel Chipmaker Breakup Rumors Financial Woes

Intel chipmaker breakup rumors financial difficulties are swirling, casting a shadow over the semiconductor industry. Intel, a titan in the tech world, faces mounting financial pressures, fueling speculation about a potential company restructuring or even a breakup. This analysis delves into the background of the company, the nature of the rumors, potential financial challenges, and the ripple effects on the industry.

The rumors surrounding a potential breakup are based on a confluence of factors, including Intel’s recent struggles to maintain its competitive edge in the market, and its lagging financial performance compared to competitors. This piece explores these issues, examining the potential impacts on Intel’s employees, customers, and the broader semiconductor landscape.

Background on Intel: Intel Chipmaker Breakup Rumors Financial Difficulties

Intel, a name synonymous with the semiconductor industry, has played a pivotal role in shaping the digital world. Founded in 1968, the company quickly established itself as a pioneer in integrated circuit technology. Its relentless pursuit of innovation has led to the development of numerous groundbreaking products, making Intel a dominant force in the computing landscape.Intel’s journey has been marked by continuous advancements in microprocessor technology, pushing the boundaries of performance and capabilities.

This relentless drive to improve has been key to Intel’s success and its lasting impact on the tech industry.

Historical Overview of Intel’s Role

Intel’s origins lie in the burgeoning field of semiconductor technology. Initially focused on memory chips, the company quickly transitioned to developing microprocessors, a decision that proved to be a turning point in its history. Intel’s early success was fueled by its pioneering work in integrated circuit design and manufacturing, establishing a foundation for its future dominance. The development of the 8086 microprocessor marked a crucial step, laying the groundwork for the personal computer revolution.

This innovation fundamentally altered the computing landscape and introduced millions to the world of personal computing.

Intel’s Key Product Lines and Market Positioning

Intel’s product portfolio is extensive and diverse, encompassing a wide range of processors, chips, and other components. The company’s central focus is on central processing units (CPUs), which power the majority of personal computers, servers, and embedded systems. Intel’s market positioning is largely centered on its reputation for reliability, performance, and compatibility. This focus on compatibility ensures seamless integration with a vast ecosystem of hardware and software, contributing significantly to Intel’s enduring market presence.

Beyond CPUs, Intel also develops and manufactures memory solutions, including RAM and storage devices. This diverse portfolio further strengthens Intel’s position as a key player in the entire computing ecosystem.

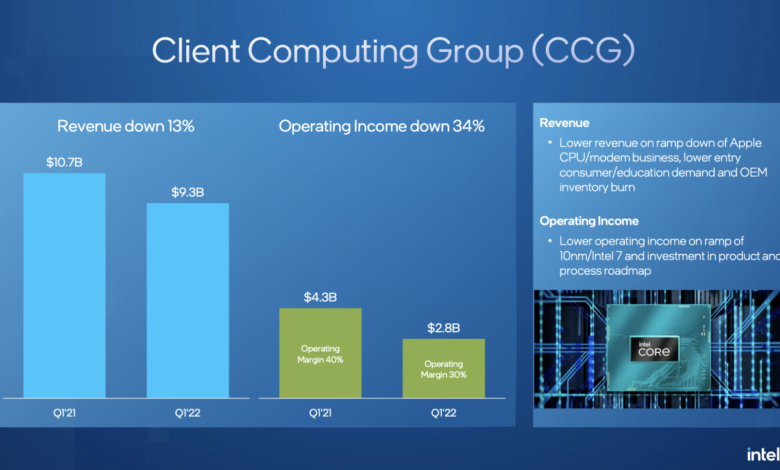

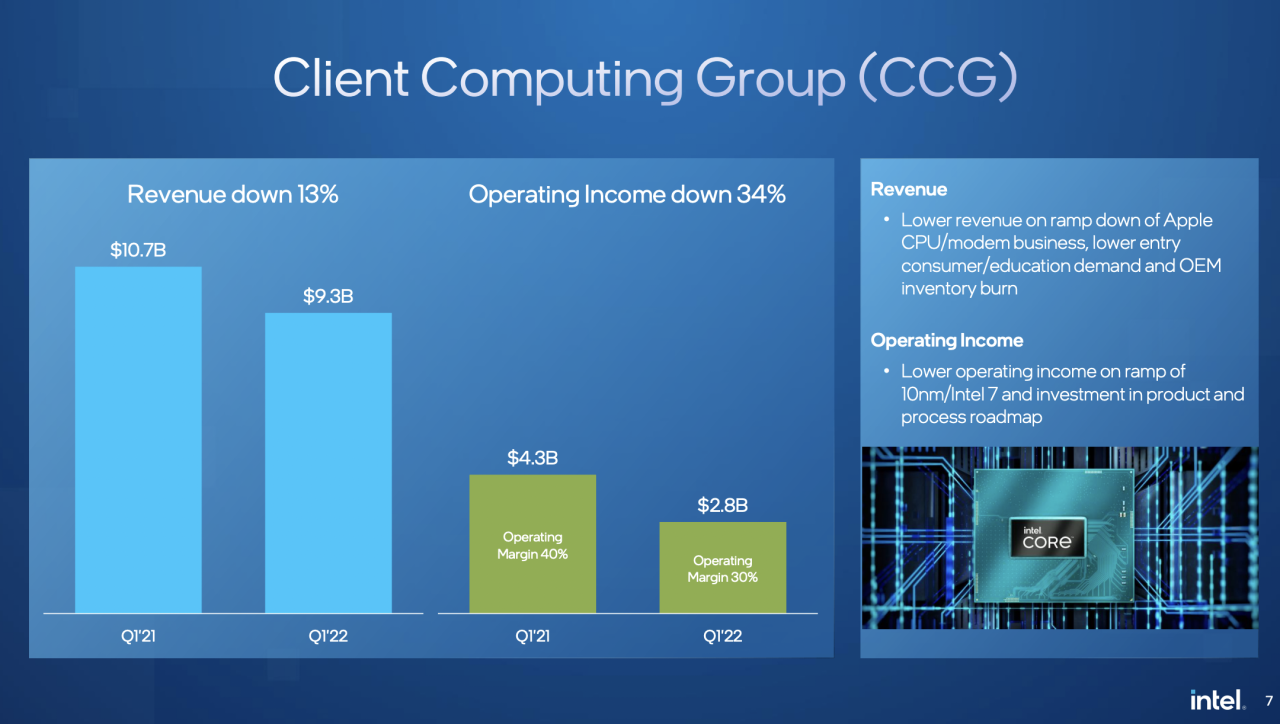

Recent Financial Performance

Intel’s recent financial performance has been a mixed bag, reflecting the dynamic and competitive nature of the semiconductor industry. Revenue figures have fluctuated, affected by factors such as global economic conditions, chip shortages, and intense competition. Profit margins have also experienced ups and downs, mirroring the broader trends in the industry. While specific numbers vary depending on the reporting period, a trend toward stabilization has been observed in recent years.

Detailed financial data can be found in publicly available reports from Intel. Accurate and comprehensive data on Intel’s financial performance is available through official company releases.

Competitive Landscape and Major Rivals

Intel faces intense competition from several formidable rivals in the semiconductor industry. AMD, a long-standing competitor, has consistently challenged Intel’s dominance in the CPU market. Other prominent players, including Nvidia and Qualcomm, have made significant inroads in specific market segments, such as graphics processing units (GPUs) and mobile processors. The competitive landscape is further complicated by the emergence of new players and innovations in the industry.

This competitive environment compels Intel to constantly innovate and adapt to maintain its position as a leader. Intel’s ongoing efforts to adapt to changing demands and develop new technologies are crucial for its long-term success. The competitive pressure from these rivals underscores the importance of innovation and adaptation in the semiconductor industry. A detailed analysis of each competitor’s strengths and weaknesses is necessary for a complete understanding of the landscape.

Rumors and Speculation

Whispers of a potential Intel breakup are swirling, fueled by persistent financial struggles and industry anxieties. These rumors, while not yet confirmed, highlight the immense pressure Intel faces to adapt and compete in a rapidly evolving technological landscape. The speculation raises crucial questions about the future of the company and its impact on the broader semiconductor industry.The very nature of these rumors, their sources, and the motivations behind them demand a closer look.

This analysis will explore the different scenarios of a potential breakup, the possible impact on Intel’s stock price, and the wider implications for the semiconductor sector.

Sources of Rumors

Various sources contribute to the circulating rumors. Analyst reports, often based on market trends and financial data, frequently generate speculation. News articles, particularly those focusing on Intel’s financial performance and strategic direction, can amplify these rumors. Social media discussions, while not always reliable, can also fuel speculation, often echoing or building upon other sources. These various sources create a complex web of information, making it difficult to discern fact from fiction.

Motivations Behind Rumors

Several factors likely motivate the speculation. Intel’s struggles in the high-performance computing market, its relatively slow adoption of new technologies, and its lagging performance compared to competitors like AMD are often cited as potential triggers. Concerns about the company’s ability to adapt to changing consumer demands and the increasing dominance of other chipmakers further contribute to the narrative.

The possibility of strategic realignment or divestment of underperforming divisions is another key factor driving these rumors.

Heard whispers about Intel’s potential breakup? Financial troubles are definitely swirling, and it’s got me thinking about the struggles of powerful companies in the tech world. While these issues might seem miles away from the ongoing fight for justice, the family of the slain DRC politician, Cherubin Okwende, is facing a similar battle for answers in Six Months On: Family of Slain DRC Politician Seeks Answers.

It’s a reminder that even massive corporations can face serious challenges, just like families seeking justice. Ultimately, these situations highlight the complexities of power, loss, and the pursuit of answers, even in the face of potential corporate turmoil.

Potential Scenarios of a Breakup

The potential scenarios for a breakup are multifaceted. One scenario involves a complete separation of Intel’s different business units. This might include splitting off its data center business, foundry operations, or even specific chip design groups. Another scenario envisions a partial divestment, where Intel offloads less profitable segments while retaining core competencies. Finally, a restructuring focused on specific product lines, potentially emphasizing specific market niches, is also conceivable.

Impact on Intel’s Stock Price

The rumors surrounding a potential Intel breakup have the potential to significantly impact the company’s stock price. Negative investor sentiment, fueled by concerns about the company’s future and its ability to innovate, can lead to a decline in stock value. Conversely, a strategic realignment, or even a complete breakup, could create uncertainty and result in volatility. The market’s reaction will likely depend on the specifics of any proposed changes and the perceived value of the resulting entities.

Historically, similar situations have shown both positive and negative reactions from investors.

Implications for the Semiconductor Industry

The potential implications for the semiconductor industry are substantial. A breakup of Intel could create a power vacuum in certain segments, allowing competitors to gain market share. This would alter the competitive landscape and possibly lead to a more fragmented industry. It could also lead to a more dynamic and competitive environment, forcing other chipmakers to innovate and adapt to the new realities.

A change in the semiconductor landscape could have widespread effects on other technology sectors.

Financial Difficulties

Intel’s recent struggles highlight a complex interplay of factors impacting its financial health. The company, once a dominant force in the semiconductor industry, faces challenges stemming from evolving market dynamics, intense competition, and internal strategic choices. Understanding these difficulties is crucial for assessing Intel’s future prospects.Intel’s financial performance has been significantly affected by a confluence of issues. The company’s traditional dominance in the x86 processor market is being challenged by new entrants and innovative architectures.

This shift has forced Intel to adapt rapidly, which has come with substantial costs and delays.

Revenue Streams Analysis

Intel’s revenue primarily comes from the sale of processors, chipsets, and other related components. However, the reliance on these traditional revenue streams has become less predictable in recent years. The demand for high-end processors has fluctuated, impacting overall sales. Further, the growth of mobile computing and the increasing demand for specialized chips in areas like artificial intelligence and the Internet of Things (IoT) have created both opportunities and threats.

Intel chipmaker breakup rumors are swirling, and financial difficulties are a growing concern. The recent public transport walkout in strike-battered Germany, detailed in Public Transport Walkout Hits Strike-Battered Germany , highlights the ripple effects of economic instability. These disruptions, combined with the chip industry’s precarious position, could potentially lead to further setbacks in the tech sector, potentially impacting Intel’s future.

Intel’s efforts to diversify into these emerging markets are ongoing and have yet to significantly impact their bottom line.

Expense Structure

Intel’s expenses are substantial, encompassing research and development (R&D), manufacturing, marketing, and general administrative costs. R&D expenditures are vital for innovation and maintaining a competitive edge, but also require significant capital investments. Manufacturing costs are impacted by the rising prices of raw materials and the complexity of producing advanced chips. The company’s investments in new factories and equipment, crucial for future growth, also contribute to a hefty expenditure structure.

In addition, the intense competitive environment has led to increased marketing and sales efforts to maintain market share.

Comparison with Competitors

Intel’s competitors, such as AMD and TSMC, have experienced different levels of financial success and challenges. AMD has made significant gains in recent years, particularly in the high-performance computing (HPC) and gaming markets. TSMC, a major foundry, has thrived due to its strong position in manufacturing advanced chips. Intel’s financial performance is often compared to these competitors to gauge its relative strength and weaknesses.

The comparison reveals that Intel’s ability to compete on cost and innovation has been weakened, especially in the consumer and enterprise markets.

Potential Strategies for Improvement

Several strategies could help Intel improve its financial performance. One crucial approach is to accelerate its transition into emerging markets like AI and IoT. Strategic partnerships and acquisitions could facilitate this transition and bring in revenue from these sectors. Another key strategy is to optimize manufacturing processes to reduce costs and increase efficiency. Further, a more aggressive pricing strategy in certain segments could increase market share and boost revenue.

The company may also need to reconsider its portfolio of products to focus on areas with higher profitability and market demand.

Impact on Long-Term Viability

Intel’s financial difficulties could impact its long-term viability, potentially leading to a decline in market share and a weakening of its overall position. The company’s future depends heavily on its ability to adapt to the changing technological landscape, effectively compete with rivals, and generate consistent profits. This requires significant investment in innovation, strategic acquisitions, and a refined approach to manufacturing and marketing.

The success of these strategies will determine Intel’s ability to remain a significant player in the semiconductor industry.

Potential Impacts of a Breakup

Intel’s potential breakup is a complex scenario with far-reaching implications. The fragmentation of such a large and established technology company would undoubtedly ripple through the industry, impacting not only Intel itself but also its competitors, suppliers, and customers. Understanding these potential ramifications is crucial for anyone seeking to grasp the full implications of this potential transformation.

Impact on Intel’s Supply Chain

The supply chain is a critical component of any major corporation. A breakup would necessitate a significant restructuring. Existing partnerships would likely be reevaluated, and new ones forged, potentially leading to shifts in the sourcing of components and materials. This could result in increased costs or delays for the new entities, depending on the new contracts and arrangements.

Furthermore, the intricate web of specialized suppliers accustomed to Intel’s specific requirements would face uncertainty about future orders and production demands.

Potential Outcomes of a Breakup

A breakup’s potential outcomes can be categorized as positive, negative, or neutral, depending on the perspective and specific division.

| Outcome | Description |

|---|---|

| Positive | Potential for focused innovation and cost reduction in specialized segments. New companies might attract specific investors and resources for a niche market. |

| Negative | Increased complexity in coordinating activities between the newly formed companies, disruptions in existing supply chains, and possible job losses. |

| Neutral | Limited immediate impact on the market share of the new entities. Some of the supply chains might remain similar. |

Impact on Intel’s Employees and Roles

A breakup would have a profound impact on Intel’s workforce. Existing employees would face uncertainty about their future roles and responsibilities within the new entities. There would likely be restructuring, layoffs, and the need for significant workforce adjustments. Specialized skills and experience, particularly in areas like chip design and manufacturing, would become highly sought after, leading to potential recruitment battles among the new entities.

Impact on Intel’s Customers, Intel chipmaker breakup rumors financial difficulties

Intel’s customers, which include PC manufacturers, mobile phone companies, and data center providers, would experience disruptions as well. Changes in product availability, pricing, and support services are all possible outcomes. The continuity of existing product lines and the quality of support for current products would be crucial factors for customer retention. Customers might also experience changes in terms of the availability of parts and the overall support they receive.

Existing contracts and agreements would be examined, potentially leading to renegotiation or termination.

Potential Acquisition Targets or New Companies Formed

The breakup could lead to several potential acquisitions or new companies.

- A dedicated semiconductor manufacturing company, focused on specific process technologies or manufacturing facilities, could be a target for acquisition or a new entity in the market.

- A specialized chip design company, perhaps focusing on specific market segments, such as embedded systems or automotive chips, might be formed.

- A company focused on specific software or intellectual property (IP) related to the chip designs could be a new entity.

The specific companies formed or acquired would depend on various factors, including market demand, financial resources, and the strategic goals of the new entities.

Industry Response

Source: pcmag.com

The swirling rumors of an Intel breakup have sent ripples throughout the semiconductor industry, prompting a range of reactions from cautious observation to aggressive maneuvering. Companies are assessing the potential ramifications of such a dramatic restructuring, considering its impact on their own strategies and the future of the global semiconductor landscape.

Reactions of Rival Semiconductor Companies

Intel’s potential disintegration would reshape the competitive landscape. Existing competitors are likely analyzing the situation to identify any vulnerabilities or opportunities. Some might leverage the resulting market instability to gain a larger market share, while others may take a more cautious approach, observing the unfolding situation before acting. For example, AMD, a major competitor, could potentially accelerate its expansion efforts, targeting Intel’s lost market segments.

Strategies of Industry Players

Various strategies are conceivable for industry players. Some might seek to acquire Intel’s underperforming segments or assets, creating new competitive advantages. Others may focus on bolstering their own research and development efforts to enhance their technology capabilities and position themselves as stronger contenders in a potentially fragmented market. Furthermore, partnerships could emerge to address specific technology gaps created by the possible fragmentation.

Intel’s chipmaking woes and rumored breakup are causing a ripple effect, raising questions about their financial stability. It’s all a bit like that hilarious Dan Aykroyd SNL50 Bass-O-Matic sketch details, where everything seemed fine on the surface but there were hidden issues bubbling beneath. Ultimately, these financial difficulties for Intel, like the sketch’s comedic absurdity, highlight the potential for unexpected outcomes in the tech industry.

Maybe a little bit of unexpected humor is what Intel needs right now.

Impact on the Global Semiconductor Supply Chain

A breakup of Intel could significantly disrupt the global semiconductor supply chain. The intricate web of relationships between manufacturers, suppliers, and distributors would be affected. This could lead to increased costs, delays in product delivery, and potential shortages of specific components. The impact would likely vary depending on the specific segments of the industry affected, and the resulting supply chain inefficiencies would have repercussions throughout the global economy.

Expert Opinions on Implications

Industry experts are divided in their opinions on the potential implications. Some suggest that a breakup could lead to more innovation and competition, fostering a more dynamic market. Others fear that it might result in a more fragmented and less efficient industry, potentially harming overall innovation and the ability to meet global demand. These differing views highlight the complex and uncertain nature of the situation.

Potential Influence on Global Economies

The economic ramifications of an Intel breakup are significant and wide-ranging. The semiconductor industry is a critical component of global economies, and any disruption could have ripple effects across numerous sectors. For instance, the production of personal computers, smartphones, and other consumer electronics could be impacted, potentially affecting consumer spending and economic growth. Furthermore, the geopolitical implications of a possible shift in global semiconductor power dynamics are significant.

Alternatives to Breakup

Source: co.uk

Intel’s recent financial struggles have fueled speculation about a breakup. However, a complete dissolution might not be the optimal solution. Alternative strategies, including mergers, acquisitions, and operational restructuring, could help the company navigate its current challenges and maintain its competitive edge in the long term.Several alternatives to a complete breakup offer Intel pathways to regain financial stability and market leadership.

These include strategic alliances, focused restructuring, and innovative product development, all aimed at strengthening the company’s core competencies and improving its overall financial health.

Potential Mergers and Acquisitions

Intel could explore strategic mergers or acquisitions to consolidate its position in specific market segments. A merger with a smaller, specialized chip designer could bolster Intel’s expertise in a particular niche, while an acquisition of a leading company in a complementary technology might accelerate Intel’s expansion into new markets. This strategy could provide access to new technologies, talent pools, and market share, enhancing Intel’s competitive strength.

Examples include NVIDIA’s acquisition of ARM, which expanded its access to mobile technology. Similarly, Intel’s acquisition of a company specializing in AI chipsets could strengthen its position in the rapidly growing AI market.

Improving Operational Efficiency

Optimizing existing operations is critical to bolstering Intel’s financial performance. Reducing costs across all business units is crucial. This could involve streamlining manufacturing processes, negotiating better contracts with suppliers, and implementing lean management principles. Evaluating current infrastructure for redundancies and consolidating operations can reduce overheads. This approach aims to maximize output while minimizing waste and overhead.

Innovative Product Development Strategies

Intel needs to invest in research and development to stay ahead of the curve in the rapidly evolving semiconductor industry. Focusing on emerging technologies like quantum computing or specialized AI chips can open new avenues for growth. Adapting to new technological paradigms is vital to securing future market dominance. Examples include companies like Qualcomm investing heavily in 5G technology, which significantly boosted their market share.

Cost-Cutting Measures

Implementing cost-cutting measures is crucial for stabilizing Intel’s finances. These measures must be carefully considered to avoid detrimental effects on innovation and product development. Comparing different approaches is essential to ensure the chosen strategy minimizes disruptions to the company’s core operations. Strategies like reducing workforce, optimizing supply chains, and negotiating lower prices with vendors could lead to significant cost savings.

For example, Tesla’s lean manufacturing approach resulted in considerable cost reductions, enabling aggressive pricing and maintaining profitability.

| Cost-Cutting Strategy | Potential Benefits | Potential Drawbacks |

|---|---|---|

| Reduce Workforce | Immediate cost reduction | Loss of expertise, potential negative morale |

| Optimize Supply Chains | Reduced material costs, faster delivery times | Potential disruptions if not properly managed |

| Negotiate Lower Prices with Vendors | Reduced material costs | Potential for reduced quality or service levels |

Illustrative Scenarios

Intel’s recent performance has sparked intense speculation, raising questions about its future trajectory. The chipmaker faces significant challenges, from intense competition to potential financial difficulties. Understanding possible scenarios, both positive and negative, is crucial for evaluating the company’s prospects and the broader industry impact.This section delves into hypothetical situations, exploring how Intel might navigate its challenges, the implications of a potential breakup, and the diverse interpretations of current market sentiment.

It also provides a look at the possible effects of a merger or restructuring.

Hypothetical Scenario: Intel’s Breakup

Intel’s breakup would likely involve the division of its various business segments. This could lead to a fragmented landscape, with each new entity focusing on a specific niche within the semiconductor industry. One potential outcome could see the creation of specialized companies, such as an entity focusing solely on mobile chips, another on data center processors, and a third on embedded solutions.

This fragmentation could accelerate innovation in specific areas, as new companies are driven to excel in their respective markets. However, the loss of Intel’s unified R&D and supply chain could create significant inefficiencies, particularly in the short term.

Hypothetical Scenario: Intel’s Successful Navigation of Challenges

Intel could successfully address its current difficulties through several strategic moves. One approach would be to aggressively invest in research and development of advanced semiconductor technologies. Another might be focusing on strategic acquisitions to fill critical gaps or gain competitive advantages. For instance, Intel could acquire a company specializing in memory technology to strengthen its position in the broader chip ecosystem.

Furthermore, a potential restructuring could involve streamlining operations, cutting costs, and improving efficiency.

Interpreting Market Sentiment

Market sentiment surrounding Intel can be interpreted in multiple ways. Negative sentiment might stem from concerns about the company’s declining market share or the escalating competition. Alternatively, this negative sentiment could be viewed as a buying opportunity for investors, anticipating a turnaround. Conversely, positive market sentiment might be attributed to industry trends favorable to Intel’s core competencies, such as increasing demand for certain chip types.

This sentiment could also reflect investor optimism about Intel’s potential for innovation and future growth. Market sentiment is a dynamic and multifaceted reflection of the overall industry dynamics.

Implications of a Merger

A merger involving Intel and another significant semiconductor company could result in a formidable player in the market. This could potentially lead to economies of scale and increased bargaining power, enabling the combined entity to better compete with rivals. However, such a merger could also face regulatory hurdles, as antitrust concerns could arise. The integration process itself could also be complex, requiring careful consideration of cultural differences and overlapping operations.

Mergers often present both significant opportunities and substantial challenges.

Implications of a Company Restructuring

A restructuring at Intel could involve a variety of measures, such as layoffs, cost-cutting measures, and streamlining of operations. These actions could lead to short-term pain but could potentially position Intel for long-term growth and stability. For example, a focus on efficiency improvements in manufacturing or R&D could yield significant cost savings. Such restructuring might involve focusing on a select number of key products and markets to improve focus and profitability.

Restructuring is often a necessary but complex process with significant implications.

Potential Future Trends

The semiconductor industry is in a constant state of flux, driven by innovation and market demands. Intel’s rumored breakup, alongside broader industry pressures, will undoubtedly shape the future landscape. Predicting precise outcomes is impossible, but analyzing potential trends offers valuable insights into the evolving market dynamics.The future of semiconductors is inextricably linked to factors such as advancements in materials science, the growth of specific applications (like AI and the Internet of Things), and global geopolitical tensions.

These elements, combined with the ongoing chip shortage and fluctuating economic conditions, create a complex environment for Intel and its competitors.

Potential Advancements in Semiconductor Materials

Materials science plays a crucial role in improving chip performance and reducing manufacturing costs. The development of new materials with higher conductivity and lower power consumption is accelerating. This is leading to the exploration of alternative materials beyond silicon, such as gallium nitride and carbon nanotubes, which promise significant performance improvements. Companies are also focusing on more sustainable manufacturing processes.

Examples include exploring techniques to reduce the environmental impact of chip fabrication and the use of recycled materials.

Impact of Artificial Intelligence on Chip Design

The surge in AI applications is driving a significant increase in the demand for powerful processing units. This is leading to a specialization of chip design, with dedicated AI chips emerging as a new market segment. The future of chips will likely see a convergence of general-purpose processors and specialized AI accelerators, tailored to specific AI tasks. This trend mirrors the development of graphics processing units (GPUs) in the past, which were initially specialized for graphics rendering but later became crucial components for general-purpose computing.

Global Geopolitical Tensions and Regulatory Changes

Geopolitical tensions and the potential for increased protectionism are significantly impacting global chip supply chains. Countries are likely to prioritize domestic chip production to enhance national security and reduce reliance on foreign suppliers. This trend is expected to increase the fragmentation of the chip market, with the creation of regional chip hubs. This could lead to new regulatory requirements and trade restrictions, potentially affecting Intel’s operations and global chip supply chains.

For example, China’s push for self-sufficiency in the semiconductor industry is impacting global supply chains and trade relations.

Market Reactions to Various Outcomes

The market will likely react differently to various outcomes regarding Intel’s future. A successful breakup might lead to a more specialized and competitive chip market, potentially benefiting some companies and hurting others. If the breakup results in financial losses, the impact on Intel’s stock price and investor confidence would be substantial. The global chip market will be significantly influenced by the financial stability and strategic decisions of major players like Intel.

Potential Future Regulatory Changes and their Impact

Governments worldwide are increasingly scrutinizing the semiconductor industry, and potential future regulations may impact Intel’s future. Regulatory changes could involve tighter control over exports, investment restrictions, and potential mandates for greater environmental sustainability in chip production. This could affect Intel’s global operations and its ability to compete effectively. For instance, a country might impose restrictions on the export of advanced semiconductor technology, forcing Intel to adapt or face challenges in certain markets.

Concluding Remarks

The speculation surrounding Intel’s potential breakup or restructuring is undeniably significant. The company’s financial performance and competitive standing are under intense scrutiny. This piece explored the potential ramifications, from employee and customer impacts to industry-wide implications. The future of Intel, and the semiconductor industry as a whole, remains uncertain, but this analysis provides a comprehensive overview of the current situation and potential pathways forward.

Answers to Common Questions

What are the primary sources of these breakup rumors?

Analysts and market commentators have pointed to Intel’s declining market share and underperformance in certain product segments as contributing factors to the rumors. Concerns about the company’s ability to adapt to the evolving chip market also play a significant role.

What are some alternative solutions besides a breakup?

Potential alternatives include mergers, acquisitions, or a strategic restructuring of Intel’s operations. Innovative product development strategies and operational efficiency improvements could also mitigate some of the current challenges.

What is the potential impact on Intel employees?

A breakup or restructuring could lead to job losses or significant organizational changes. Employee roles and responsibilities might shift, potentially affecting compensation and benefits.

How might this impact the global semiconductor supply chain?

Disruptions in Intel’s operations could create instability in the global semiconductor supply chain, potentially impacting other companies and industries that rely on Intel’s products.