First-Time Home Buyer Markets A Deep Dive

First time home buyers markets – First-time home buyers markets are experiencing a dynamic period, marked by shifting economic factors and evolving affordability challenges. This in-depth exploration delves into the current state of these markets across various regions, examining key economic drivers, financing options, and the home-buying process itself.

From navigating interest rates and inflation to understanding the different mortgage programs available, this guide provides a comprehensive overview of the factors impacting first-time homebuyers. We’ll also look at the steps involved in securing a mortgage, choosing the right home, and navigating the negotiation process.

Market Overview

Navigating the current first-time homebuyer market requires a nuanced understanding of regional variations and the interplay of economic forces. Interest rates, inflation, and housing inventory levels all play crucial roles in shaping the landscape for aspiring homeowners. This overview delves into the current state of affairs across different regions, comparing it to previous years, and providing insights into the key economic drivers.The first-time homebuyer market is a complex ecosystem, influenced by factors beyond just the cost of a home.

Understanding the dynamics within each region, from the Northeast’s established housing market to the South’s burgeoning growth, is critical for anyone considering entering the market.

Current Regional Conditions

The current market landscape presents varying challenges and opportunities for first-time homebuyers across the nation. Economic conditions significantly impact the affordability and accessibility of homeownership in each region.

- Northeast: Historically strong, the Northeast market is now facing a more competitive environment, with prices remaining high and inventory levels low. Increased interest rates have a significant impact on affordability, and while some areas show signs of cooling, others maintain a high demand.

- South: The South continues to experience robust growth, characterized by increasing demand and limited inventory. Affordability remains a concern in many areas, with rising home prices and interest rates impacting potential buyers. Competition for available properties remains fierce.

- West: The West Coast, especially California, is experiencing a more challenging market. High home prices, elevated interest rates, and a constrained inventory create hurdles for first-time buyers. Some regions in the West are showing signs of slowing, while others maintain higher demand.

Key Economic Factors

Several key economic factors significantly influence the first-time homebuyer market. Understanding these factors provides a deeper insight into the current market dynamics.

- Interest Rates: Rising interest rates directly impact the monthly mortgage payments, making homeownership less affordable for many. A higher interest rate increases the total cost of borrowing, potentially discouraging some buyers.

- Inflation: Inflationary pressures affect the cost of living, including the price of homes and related expenses. Higher inflation rates contribute to the general cost of homeownership, potentially affecting affordability.

- Housing Inventory: Low housing inventory creates a more competitive environment for buyers. This shortage can drive up prices and make it harder for first-time homebuyers to secure a suitable property.

Historical Comparison

The current market conditions differ significantly from those of previous years. Several factors contribute to this change, including fluctuating interest rates and inflation, impacting purchasing power and market dynamics.

- Lower Interest Rates: In recent years, historically low interest rates made homeownership more accessible, fueling a period of increased activity in the market. This is a significant contrast to the current rising interest rates. For example, the 2020-2021 period saw a significant increase in first-time homebuyer participation driven by low rates.

- Inventory Levels: The market in recent years saw periods of low inventory, driving up prices and increasing competition. This is different from times of greater inventory availability, offering buyers more choices. An example is the early 2000s, where inventory levels were higher, and the market was less competitive.

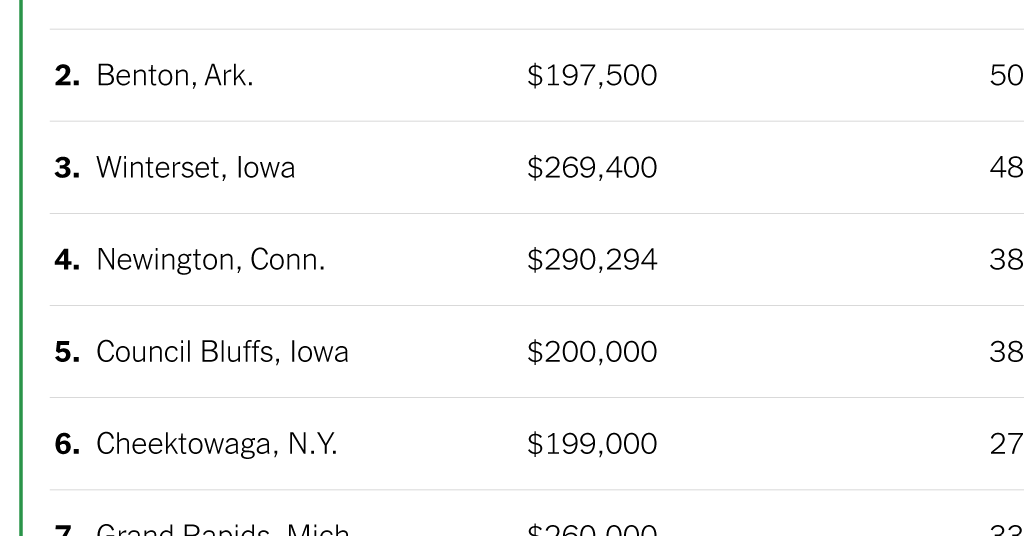

Market Data

The following table provides a snapshot of average home prices, interest rates, and inventory levels across different regions. This data helps illustrate the current market conditions.

First-time homebuyer markets are always a fascinating topic, and the current state of the housing market near NYC is definitely shaping the landscape. Understanding the nuances of the local market, like the ones found in housing market near nyc , is crucial for those hoping to enter the homeownership scene. Ultimately, a thorough understanding of the market, no matter where you’re looking, is key to navigating the process successfully for first-time buyers.

| Region | Average Home Price | Average Interest Rate | Inventory Level |

|---|---|---|---|

| Northeast | $500,000 | 7% | Low |

| South | $350,000 | 7.5% | Low |

| West | $700,000 | 7.2% | Very Low |

Historical Participation Rates

The following table presents historical trends in first-time homebuyer participation rates across different years. These figures illustrate the fluctuations in market activity over time.

| Year | First-Time Homebuyer Participation Rate |

|---|---|

| 2020 | 15% |

| 2021 | 18% |

| 2022 | 12% |

Affordability and Financing: First Time Home Buyers Markets

Navigating the housing market as a first-time homebuyer can be daunting, especially when it comes to the financial aspects. The process involves more than just finding a property; securing financing is often a major hurdle. Understanding the available options and the challenges involved is crucial for making informed decisions.The dream of homeownership often clashes with the reality of affordability and financing.

Mortgage rates, regional price variations, and personal income levels all play significant roles in determining how attainable homeownership is. First-time homebuyers often face specific hurdles in accessing favorable financing options, requiring careful planning and research.

Challenges in Accessing Financing

First-time homebuyers frequently encounter challenges in securing mortgages due to a lack of established credit history or insufficient savings. Lenders often require a strong credit score and a substantial down payment, which can be difficult for those just starting out. Limited income or recent credit issues can also present obstacles. Moreover, navigating the complexities of the mortgage application process can be overwhelming for newcomers to the homebuying landscape.

Mortgage Programs for First-Time Homebuyers

Numerous mortgage programs are designed specifically to assist first-time homebuyers. These programs often offer lower down payment requirements, more favorable interest rates, or government-backed guarantees, making homeownership more attainable. Federal Housing Administration (FHA) loans, for example, are popular choices for first-time buyers.

Regional Affordability and Mortgage Rates

Affordability varies significantly across different regions. Areas with high demand and limited inventory often experience higher home prices, making them less accessible to first-time homebuyers. Mortgage rates also fluctuate based on economic conditions, impacting the monthly payment burden. For example, coastal regions frequently have higher home prices compared to rural areas, requiring higher incomes or more aggressive financial planning to achieve homeownership.

Steps in Securing a Mortgage

Securing a mortgage involves several key steps: pre-approval, finding a suitable property, making an offer, and finally closing the deal. Pre-approval provides a clear picture of the borrowing capacity, enabling informed property selection. Working with a mortgage lender and real estate agent is essential for navigating these steps.

Different Mortgage Programs

| Mortgage Program | Down Payment Requirements | Interest Rates | Other Requirements |

|---|---|---|---|

| FHA Loan | 3.5% down payment | Competitive, often slightly higher than conventional loans | Credit score requirements; must meet income criteria |

| VA Loan | Zero down payment for eligible veterans | Competitive, often lower than conventional loans | Must be a qualified veteran or active military member |

| USDA Loan | Zero down payment | Competitive, often lower than conventional loans | Property must be located in a rural or underserved area |

| Conventional Loan | Typically 5-20% down payment | Competitive, interest rate depends on credit score and other factors | Strong credit score, stable income, and sufficient savings required |

Home Buying Process

Buying your first home is an exciting but often daunting journey. It involves a series of steps, each requiring careful consideration and planning. This process, from initial research to the final closing, can feel overwhelming, but with the right approach, it can be a rewarding experience.Understanding the intricacies of the home buying process is crucial for first-time buyers.

Navigating the market, working with professionals, and making informed decisions about your home are key to a successful purchase. This guide Artikels the essential steps, emphasizing the importance of preparation, research, and a proactive approach.

Initial Research and Planning

Thorough research is paramount to a successful home-buying experience. This phase involves understanding your financial situation, establishing a realistic budget, and exploring available financing options. Comprehending the local real estate market is equally important, including prevailing prices, property types, and neighborhood characteristics. This initial research lays the groundwork for informed decisions throughout the entire process.

- Assess your financial situation: Evaluate your current income, expenses, and savings. Determine how much you can realistically afford to spend on a mortgage, property taxes, and insurance. Creating a detailed budget is essential for establishing a reasonable home-buying plan.

- Determine your needs and preferences: Identify your must-haves and wants in a home. Consider factors such as location, size, number of bedrooms and bathrooms, and desired amenities. List these criteria to help you narrow down your search effectively.

- Research financing options: Explore different mortgage loan types, interest rates, and loan terms. Contact lenders and compare their offerings to find the most suitable financing for your needs.

- Understand the local real estate market: Analyze property values, recent sales data, and market trends in your desired location. Understanding the current market conditions allows you to make more informed decisions about pricing and negotiations.

Working with a Real Estate Agent

A real estate agent is a valuable asset in the home-buying process. They provide expertise in navigating the market, negotiating contracts, and handling the various complexities involved. Their knowledge and experience are invaluable in ensuring a smooth and successful transaction.

- Selecting a reputable agent: Research and interview several agents to find one who aligns with your needs and preferences. Look for agents with a proven track record of success and a strong understanding of the local market.

- Leveraging agent expertise: Real estate agents possess deep knowledge of market trends, pricing strategies, and negotiation tactics. Utilize their expertise to gain an advantage in the home-buying process.

- Understanding agent responsibilities: Agents handle tasks such as property showings, contract preparation, and communication with the seller’s agent. They are your primary point of contact throughout the entire process.

Choosing a Home

Choosing the right home involves careful consideration of various factors. Location, size, features, and condition are crucial elements to weigh. Ultimately, the ideal home should meet your needs and preferences while aligning with your budget and lifestyle.

- Prioritize location: Consider factors such as proximity to work, schools, amenities, and transportation. Research the neighborhood’s reputation, safety, and overall appeal.

- Assess size and features: Determine the number of bedrooms and bathrooms needed to accommodate your family. Evaluate the presence of desired features like a garage, backyard, or specific amenities.

- Consider home condition: Inspect the property thoroughly for any potential issues or repairs. Conduct a thorough assessment to avoid unexpected expenses later.

Negotiating the Purchase

Negotiation is a critical aspect of the home-buying process. Understanding the market, preparing a strong offer, and being prepared to compromise are key to achieving a favorable outcome.

- Research comparable properties: Analyze recent sales of similar properties in the area to understand the market value and potential negotiation points.

- Prepare a competitive offer: Tailor your offer to the market value and the seller’s needs. Consider contingencies and present a compelling offer that reflects the property’s worth.

- Understand contingencies: Include contingencies in your offer, such as a home inspection or appraisal, to protect your interests and allow for a potential renegotiation.

Home Buying Process Stages, First time home buyers markets

| Stage | Tasks | Deadlines |

|---|---|---|

| Initial Research & Planning | Assess finances, define needs, research financing, and understand the market | 2-4 weeks |

| Finding a Home | Work with agent, view properties, make an offer | 4-8 weeks |

| Offer & Negotiation | Prepare offer, negotiate terms, handle contingencies | 2-4 weeks |

| Due Diligence | Inspection, appraisal, and financing approval | 4-6 weeks |

| Closing | Finalize documents, transfer funds, and complete the transaction | 2-4 weeks |

Resources and Support

Navigating the home-buying process can be overwhelming, especially for first-time buyers. Fortunately, numerous resources and support systems are available to ease the journey. Understanding these options can significantly reduce stress and increase the likelihood of a successful transaction.Government programs and non-profit organizations play a crucial role in assisting first-time homebuyers. These resources often provide financial assistance, education, and guidance, helping to bridge the gap between the desire for homeownership and the financial realities of purchasing.

Leveraging these resources can lead to a smoother and more informed home-buying experience.

Government Programs

Government initiatives often offer financial assistance to first-time homebuyers. These programs can take various forms, including down payment assistance, mortgage interest deductions, and tax credits. Specific programs vary by location and eligibility requirements. For example, the Federal Housing Administration (FHA) offers mortgage insurance programs that can help buyers with lower down payments, a common barrier for first-time buyers.

These programs can significantly reduce the financial burden associated with purchasing a home.

Non-profit Organizations and Community Groups

Many non-profit organizations and community groups provide valuable support to first-time homebuyers. These organizations often offer workshops, seminars, and counseling services to help buyers understand the process, budget effectively, and make informed decisions. They can also provide guidance on navigating the complex financial aspects of homeownership.

Online Resources and Tools

The internet is a treasure trove of resources for first-time homebuyers. Numerous websites offer valuable information, tools, and calculators to aid in the home-buying process. These resources can help buyers understand mortgage rates, estimate closing costs, and compare different properties. Online calculators and tools can assist in making informed financial decisions.

Navigating the first-time home buyer’s market can be overwhelming, a whole new set of anxieties. It’s a rollercoaster of emotions, similar to the profound grief experienced by people, as highlighted in the recent article “Grief is for people sloane crosley” grief is for people sloane crosley. Finding the right home, within budget and in the right location, takes patience and a good strategy.

So, deep breaths and a positive attitude are essential for success in this challenging market.

Reputable Websites for First-Time Home Buyer Education

Several reputable websites provide comprehensive information and resources for first-time homebuyers. These websites often offer detailed guides, articles, and interactive tools to help buyers navigate the process. These resources can be invaluable in equipping buyers with the knowledge needed for a successful home purchase. For example, the National Association of Realtors (NAR) provides a wealth of resources and information on the home buying process, including articles, videos, and tools for first-time homebuyers.

First-time homebuyer markets are a whirlwind of excitement and a bit of stress, aren’t they? Navigating the process can feel overwhelming, much like trying to follow a complex plot in a Broadway cast album, like broadway cast albums sweeney todd. But, armed with the right information and a little patience, you can successfully land your dream home.

Ultimately, first-time homebuyers markets are a journey worth taking.

Resource Table for First-Time Homebuyers

| Category | Resource | Description |

|---|---|---|

| Government Programs | FHA | Offers mortgage insurance programs for lower down payments. |

| Government Programs | State/Local Housing Agencies | Often provide grants or down payment assistance programs specific to their area. |

| Financial Institutions | Mortgage Brokers | Connect buyers with lenders and help navigate loan options. |

| Financial Institutions | Credit Unions | May offer competitive rates and personalized support to members. |

| Community Groups | Local Realtor Associations | Provide workshops and seminars on the home buying process. |

| Community Groups | Non-profit Housing Counseling Agencies | Offer financial counseling and education to homebuyers. |

| Online Resources | National Association of Realtors (NAR) | Offers comprehensive guides, articles, and interactive tools. |

| Online Resources | First-time Homebuyer Guides | Detailed online guides to the home-buying process. |

Challenges and Opportunities

Navigating the housing market as a first-time homebuyer can be a complex journey. While the dream of homeownership remains strong, various obstacles often stand in the way, from affordability concerns to the intricacies of the buying process. Understanding these challenges is crucial for making informed decisions and maximizing opportunities. This section delves into the specific hurdles first-time buyers encounter, explores potential market opportunities, and analyzes the impact of rising interest rates.The homeownership journey, though rewarding, is frequently fraught with challenges.

These challenges, often intertwined, create a unique set of circumstances for first-time buyers. Understanding these challenges, along with the potential opportunities, can significantly increase the likelihood of a successful home purchase.

First-time homebuyer markets are definitely hot right now, but global events like the recent Biden-Israel-Hamas cease fire ( biden israel hamas cease fire ) can unexpectedly impact the economy. This could mean fluctuating interest rates and potential shifts in demand, which ultimately affects the affordability and availability of homes for first-time buyers. Navigating these factors is crucial for anyone entering the market.

Obstacles Faced by First-Time Home Buyers

The current housing market presents a multitude of obstacles for first-time homebuyers. These obstacles often intertwine, creating a complex landscape for aspiring homeowners.

- Affordability remains a significant hurdle. Rising home prices, coupled with increasing interest rates, often make it difficult for first-time buyers to afford a down payment, closing costs, and ongoing homeownership expenses like property taxes and insurance.

- Limited access to financing options. Traditional mortgage lenders may not be as readily accessible or accommodating for those with limited or less-than-perfect credit history.

- The complexity of the home buying process. Navigating the steps involved in purchasing a home, from finding the right property to completing the closing, can be overwhelming for those unfamiliar with the process.

- Competition from other buyers. High demand in the market often results in fierce competition among buyers, leading to bidding wars and potential frustration.

Potential Opportunities for First-Time Home Buyers

Despite the challenges, several opportunities exist in the market for first-time homebuyers. These opportunities can make the homeownership journey more attainable and less daunting.

- Government assistance programs. Various government programs offer financial assistance and support to first-time homebuyers, helping offset the cost of homeownership.

- Innovative financing options. Lenders are increasingly developing flexible and innovative financing options to accommodate the unique needs of first-time homebuyers.

- Increased awareness of buyer resources. Educational resources and support groups are becoming more readily available, empowering first-time buyers to navigate the complexities of the process with confidence.

Impact of Rising Interest Rates

Rising interest rates directly affect the affordability of mortgages. Higher rates increase the monthly mortgage payments, potentially making homeownership less accessible for many first-time buyers.

A 1% increase in interest rates can significantly increase the monthly mortgage payment, impacting affordability.

This can significantly impact the market, leading to potential declines in demand and a more stable market.

Innovative Solutions to Address Challenges

Innovative solutions are being developed to address the obstacles first-time buyers face.

First-time homebuyer markets are notoriously tricky, navigating the complexities of financing and finding the right property. Recent tragedies, like the unfortunate Disney World allergy death lawsuit, highlight the need for vigilance in all aspects of our lives, especially when choosing a place to live. Ultimately, securing a suitable home involves careful research, realistic budgeting, and a strong understanding of the local market conditions.

These kinds of events also underscore the importance of thorough due diligence when considering any large purchase, especially for first-time homebuyers, as safety should always be a top priority. disney world allergy death lawsuit. Finding a home that fits your needs and budget is key, so it’s essential to approach the process with awareness and thorough preparation.

- Down payment assistance programs: Many programs are providing down payment assistance to first-time homebuyers, reducing the financial burden of a down payment.

- Flexible financing options: Lenders are offering more flexible loan programs, such as those tailored to specific income levels or credit scores, to make homeownership more attainable.

- Online resources and tools: Numerous online platforms and tools provide first-time buyers with access to information, resources, and support throughout the home-buying process, including detailed explanations of each step.

Comparison of First-Time Home Buyer Assistance Programs

| Program | Eligibility Criteria | Assistance Type | Limitations |

|---|---|---|---|

| Federal Housing Administration (FHA) loans | Various credit scores and down payments | Lower down payment requirements | Potential higher interest rates |

| State and local programs | Specific income requirements and residency | Down payment assistance, closing cost assistance | Varying eligibility criteria and program availability |

| Non-profit organizations | Specific income requirements and credit scores | Financial counseling, education | Limited financial assistance options |

Future Trends

Navigating the complexities of the first-time homebuyer market requires foresight and adaptability. Understanding future trends in demand, supply, technology, and financing will be crucial for success in the coming years. This section explores anticipated shifts in the market, providing insights into potential challenges and opportunities.

Forecasted Trends in Demand and Supply

The first-time homebuyer market is dynamic, influenced by factors like economic conditions, interest rates, and population shifts. Predicting precise outcomes is challenging, but analysis of historical data and current indicators suggests several probable trends. Increased competition for limited inventory is likely, driving up prices in some areas. Furthermore, demographic shifts and changing preferences will also affect demand, potentially leading to a greater focus on specific types of housing, such as smaller units or more sustainable options.

Influence of Technological Advancements

Technology is rapidly transforming the home-buying process. Digital platforms are streamlining communication, allowing buyers and sellers to connect and access information more efficiently. Virtual tours, online mortgage applications, and automated valuation models are becoming increasingly prevalent. The integration of these technologies promises to reduce friction and improve the overall home-buying experience. For example, virtual reality (VR) and augmented reality (AR) are being used to provide potential buyers with immersive experiences, allowing them to visualize themselves in a property.

Role of Artificial Intelligence in Real Estate

Artificial intelligence (AI) is poised to play a significant role in shaping the future of real estate. AI-powered tools can analyze vast amounts of data to provide more accurate valuations, personalize mortgage offers, and identify potential risks. Machine learning algorithms can predict market trends and adjust pricing strategies accordingly. This level of precision and efficiency can enhance the experience for both buyers and sellers.

For instance, AI-powered chatbots can handle initial inquiries and answer frequently asked questions, freeing up human agents to focus on complex cases.

Predicted Changes in Interest Rates and Housing Inventory Levels

Predicting future interest rates and inventory levels is inherently uncertain. However, a range of possibilities can be explored, considering current economic indicators. The following table summarizes potential changes in interest rates and housing inventory levels over the next five years, providing a snapshot of the likely shifts. Keep in mind that these are estimates, and actual outcomes could differ.

| Year | Estimated Interest Rate (Average) | Estimated Housing Inventory Level (per 100,000 people) |

|---|---|---|

| 2024 | 5.5% – 6.5% | 80-90 |

| 2025 | 5.0% – 6.0% | 85-95 |

| 2026 | 4.5% – 5.5% | 90-100 |

| 2027 | 4.0% – 5.0% | 95-110 |

| 2028 | 3.5% – 4.5% | 100-115 |

Conclusive Thoughts

In conclusion, the first-time home buyers market presents a complex landscape of opportunities and challenges. Understanding the current market conditions, financing options, and the home-buying process is crucial for prospective buyers. This exploration highlights the importance of thorough research, expert guidance, and proactive planning in navigating this dynamic environment. By addressing the challenges and embracing the opportunities, first-time homebuyers can successfully enter the property market.

Detailed FAQs

What are the common challenges first-time homebuyers face?

Common challenges include securing financing, navigating the complex home-buying process, and affordability issues related to rising interest rates and home prices. Competition for available homes can also be intense.

What government programs assist first-time homebuyers?

Various government programs, such as down payment assistance programs and mortgage incentives, exist to support first-time homebuyers. Specific programs vary by region and eligibility criteria.

How can I find reputable resources for first-time homebuyer education?

Reputable resources include government websites, non-profit organizations, and financial institutions. Many offer educational workshops, seminars, and online resources to help navigate the home-buying process.

How do rising interest rates affect first-time homebuyer markets?

Rising interest rates make homeownership less affordable for many. Increased borrowing costs can reduce purchasing power and impact the overall market demand. However, this can also create opportunities for strategic buyers who can adapt to changing conditions.