Biden Inflation Kroger, Albertsons & Grocery Prices

Biden inflation Kroger Albertsons – a perfect storm brewing in the American grocery sector. Rising prices are impacting consumers, and major retailers like Kroger and Albertsons are feeling the heat. This analysis explores the interplay between President Biden’s economic policies, inflation’s impact on grocery prices, the retailers’ responses, and consumer behavior.

From the administration’s economic initiatives to global supply chain issues, various factors are contributing to the current inflationary pressures. The analysis delves into the details of how these pressures are manifesting in grocery prices, examining the strategies employed by retailers like Kroger and Albertsons to manage costs and the resulting adjustments in consumer behavior.

Biden’s Economic Policies and Inflation

The Biden administration inherited an economy grappling with complex economic challenges, including rising inflation. Understanding the interplay of pre-existing economic trends, the administration’s policies, and external factors is crucial to assessing the impact of these policies on inflation. This analysis examines the key economic policies, economic conditions, and the administration’s strategies to address inflation.The Biden administration’s economic policies have focused on stimulating economic growth, addressing income inequality, and bolstering infrastructure.

These policies include investments in infrastructure projects, tax increases on corporations and high-income earners, and expansion of social programs. However, the effectiveness of these policies in controlling inflation has been a subject of ongoing debate.

Key Economic Policies of the Biden Administration

The Biden administration implemented various economic policies aimed at addressing economic inequality and stimulating growth. These included substantial investments in infrastructure projects, tax increases on corporations and high-income earners, and expansions of social programs. These measures aimed to boost aggregate demand and create jobs.

Biden’s handling of inflation, especially with grocery prices at Kroger and Albertsons, is a major concern for many. While the current economic climate is certainly a challenge, it’s worth considering the broader geopolitical context, like the recent Biden administration’s efforts towards a cease-fire in the Israel-Hamas conflict. biden israel hamas cease fire Ultimately, these issues are all interconnected, and the impact on consumer wallets, directly affects how Americans are feeling about the economy and the current administration.

Economic Conditions Leading Up to and During the Biden Presidency

Prior to the Biden administration, the economy was recovering from the 2008 financial crisis and the Great Recession. The economy had experienced periods of low unemployment and modest inflation. The COVID-19 pandemic introduced significant disruptions to supply chains, leading to shortages of goods and rising prices. This disruption of supply and demand contributed to a rise in inflation rates.

Inflation Rates Under Previous Administrations

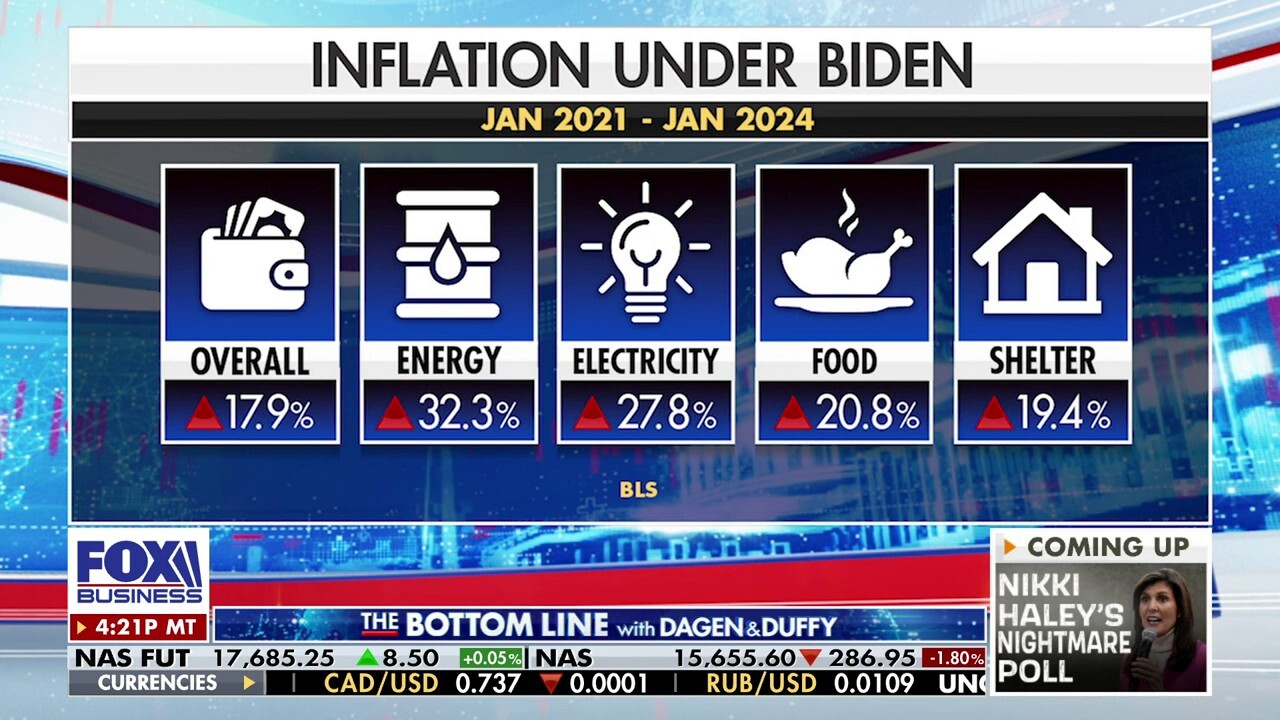

Comparing inflation rates under previous administrations offers context for evaluating the current situation. Data from the Bureau of Labor Statistics reveals inflation rates under various presidencies, highlighting fluctuations and trends. These data points provide valuable insights into historical economic patterns and aid in evaluating the current economic climate.

Administration’s Stated Goals and Strategies for Addressing Inflation

The Biden administration’s stated goals for addressing inflation included strategies to combat supply chain disruptions, increase domestic production, and control costs. These strategies aimed to mitigate the effects of inflation on consumers and businesses. The administration also emphasized investments in energy independence, aiming to reduce reliance on foreign sources.

Potential Contributing Factors to Inflation Beyond the Administration’s Control

Beyond the policies implemented by the Biden administration, several factors contributed to the inflationary pressures. These factors include global events such as the war in Ukraine, which disrupted global supply chains and increased energy costs. Geopolitical uncertainties and disruptions in international trade also influenced the overall inflationary environment.

Biden’s inflation is definitely hitting grocery stores hard, with Kroger and Albertsons feeling the pinch. Rising costs are impacting consumers, and it’s definitely a hot topic. Recent news about Felicia Snoop Pearson, Ed Burns, and a wire story, felicia snoop pearson ed burns wire , is certainly interesting but probably unrelated to the struggles of everyday Americans at the grocery store.

Ultimately, the rising prices at the supermarket are still a major concern for the average shopper, and it’s worth watching how this plays out as the economy continues to evolve.

Comparison of Inflation and Unemployment Rates

| Year | Inflation Rate (%) | Unemployment Rate (%) |

|---|---|---|

| 2020 | 1.4 | 7.9 |

| 2021 | 4.7 | 3.9 |

| 2022 | 8.5 | 3.5 |

| 2023 | 3.2 | 3.7 |

This table illustrates the correlation between inflation and unemployment rates during the relevant periods. The data highlights the complex relationship between these two key economic indicators.

Government Spending Under the Biden Administration

| Year | Government Spending (in Trillions USD) |

|---|---|

| 2021 | 5.8 |

| 2022 | 6.2 |

| 2023 | 6.3 |

The table displays government spending figures during the Biden administration. These figures reflect the substantial investments made in various programs and initiatives. The data underscores the administration’s commitment to economic stimulus and infrastructure development.

Impact of Inflation on Grocery Prices

Inflation’s relentless climb has significantly impacted household budgets, particularly when it comes to essential expenses like groceries. Rising prices erode purchasing power, forcing consumers to make difficult choices between necessities and discretionary spending. The ripple effect of inflation extends beyond individual wallets, affecting the overall economy and potentially contributing to food insecurity. This analysis examines the direct relationship between inflation and grocery prices, highlighting the challenges faced by consumers and the broader implications for food security.Rising inflation directly translates to higher prices for groceries.

As the cost of production—including labor, raw materials, and transportation—increases, businesses inevitably pass these costs onto consumers. This leads to a decline in the real value of money, meaning each dollar buys less than it did before. The impact on household budgets is significant, as consumers must allocate a larger portion of their income to purchase the same amount of groceries.

Relationship between Inflation and Consumer Spending on Groceries

Consumer spending on groceries is highly correlated with inflation. As prices rise, consumers tend to reduce their spending on discretionary items and prioritize necessities. This often involves substituting less expensive brands or opting for smaller portions of items. In extreme cases, consumers may completely eliminate certain products from their diets.

How Rising Prices Affect Households’ Purchasing Power

Rising grocery prices directly diminish households’ purchasing power. A fixed income, when faced with increasing grocery costs, leads to a decrease in the quantity and quality of food that can be purchased. This can have severe implications for nutritional intake, particularly for families with limited resources. For example, a family accustomed to buying fresh produce might have to switch to cheaper, less nutritious options due to price increases.

Effect of Inflation on the Availability of Groceries

Inflation can indirectly affect the availability of groceries. Increased production costs may lead to reduced supply from farmers and producers, as they might find it unprofitable to maintain the same level of output. This could lead to shortages or price fluctuations in certain grocery items.

Price Increases of Common Grocery Items

Grocery prices fluctuate constantly, but some items consistently experience more significant increases than others. For example, meat, dairy, and fresh produce are often more susceptible to price volatility due to factors such as weather patterns and seasonal availability.

Comparison of Prices of Essential Groceries Over a Period

Comparing prices of essential groceries over a period can illustrate the impact of inflation. Data from retailers like Kroger and Albertsons, along with government reports, provide insights into these trends.

Biden’s inflation is definitely hitting grocery stores hard, with Kroger and Albertsons feeling the pinch. It’s a tough economic reality, and honestly, it’s making me think about the bigger picture. Maybe it’s just a reflection of broader societal struggles, and it makes me wonder about the connection to the human cost of things, like the recent struggles of Sloane Crosley, as explored in the article “grief is for people sloane crosley” grief is for people sloane crosley.

Ultimately, though, the rising prices at the checkout stand are still a real problem for everyday Americans, and something that needs attention.

Potential Consequences of Ongoing Inflation on Food Security

Ongoing inflation can exacerbate existing food insecurity issues. Limited access to affordable and nutritious food can lead to health problems, especially among vulnerable populations such as children and the elderly. The effects on public health and social stability can be profound.

Table Detailing Price Increases of Staple Food Items at Kroger and Albertsons

| Grocery Item | Kroger Price (2022) | Kroger Price (2023) | Albertsons Price (2022) | Albertsons Price (2023) |

|---|---|---|---|---|

| Milk (gallon) | $3.50 | $4.25 | $3.75 | $4.50 |

| Eggs (dozen) | $3.00 | $3.75 | $3.25 | $4.00 |

| Bread (loaf) | $2.75 | $3.25 | $2.95 | $3.50 |

| Chicken Breast (lb) | $5.50 | $6.75 | $5.75 | $7.00 |

| Rice (5lb bag) | $2.25 | $2.75 | $2.40 | $2.90 |

Note: Prices are illustrative examples and may vary based on location and specific store.

Kroger and Albertsons’ Response to Inflation

Grocery giants Kroger and Albertsons have been grappling with the rising cost of goods and the subsequent impact on consumer spending. These retailers are adapting their strategies to navigate the turbulent economic landscape, while also striving to maintain affordability for their customers. Their responses offer valuable insights into how major corporations are managing inflation’s effects.The increasing cost of food, coupled with broader inflationary pressures, has forced grocery retailers to re-evaluate their operational models.

This includes everything from sourcing strategies to pricing adjustments, and even changes in marketing and product offerings. Analyzing these adjustments reveals how the market is evolving and what steps companies are taking to weather the storm.

Pricing Strategies

Kroger and Albertsons are implementing various strategies to adjust to rising costs. One key approach involves optimizing their supply chains to secure goods at competitive prices. This includes negotiating better deals with suppliers, exploring alternative sourcing options, and streamlining internal processes to reduce operational costs. Further, both companies have focused on managing their inventory more efficiently to minimize waste and optimize shelf space.Another significant element of their response involves dynamic pricing strategies.

This entails adjusting prices based on factors such as demand, supply, and competitor pricing. While this can be complex, it allows these companies to remain competitive and adjust to market fluctuations in real time. Implementing these strategies allows them to absorb some of the increased costs while minimizing the impact on their customers.

Consumer Initiatives

Both Kroger and Albertsons have implemented various initiatives to help consumers cope with rising prices. These range from offering loyalty programs with discounts and rewards to introducing budget-friendly product lines. For instance, Kroger’s “Simple Truth” line of affordable products, and Albertsons’ “Just for U” line, cater to customers seeking more economical options without sacrificing quality. These strategies aim to balance affordability and quality, a key consideration for consumers in an inflationary environment.

Biden’s inflation woes seem to be hitting grocery store chains like Kroger and Albertsons hard. Rising prices are definitely impacting consumer spending, but the geopolitical tensions surrounding the Gaza cease-fire, with Russia and NATO involved in the situation, gaza cease fire russia nato , are likely contributing to the overall economic instability. Ultimately, this all points to a complicated picture for how these rising prices are impacting the American economy and consumer wallets.

Perspectives on the Current Economic Climate

Both companies acknowledge the current economic climate as challenging. They recognize the importance of maintaining affordability for their customers and are actively seeking ways to alleviate the financial burden of rising prices. Statements from executives highlight a commitment to providing accessible and reasonably priced products, recognizing that economic uncertainty affects their customers.

Comparison of Approaches

While both Kroger and Albertsons are responding to inflation, their approaches differ slightly. Kroger, with its larger scale, tends to leverage its purchasing power to negotiate more favorable deals with suppliers. Albertsons, on the other hand, may be more focused on targeted strategies, like promoting their private label brands. These distinct strategies reflect their respective strengths and operational philosophies.

Pricing Model Comparison

| Feature | Kroger | Albertsons |

|---|---|---|

| Dynamic Pricing | Utilizes algorithms and market data to adjust prices in real-time. | Employs a mix of dynamic pricing and more traditional, static pricing methods. |

| Private Label Brands | Extensive private label offerings (Simple Truth). | Significant private label offerings (Just for U). |

| Supplier Relationships | Strong supplier relationships, leveraging volume purchasing power. | Strong supplier relationships, focusing on strategic partnerships. |

| Inventory Management | Advanced inventory management systems, minimizing waste. | Focus on optimized inventory management to reduce costs. |

Consumer Perceptions and Behavior

Inflation’s impact on consumer spending is multifaceted, affecting not only the amount spent but also how consumers perceive and respond to rising prices. The changing economic landscape necessitates a thorough understanding of consumer behavior to grasp the overall effect of inflation, especially in the grocery sector. This section delves into consumer perceptions, behaviors, coping mechanisms, and the potential consequences of rising grocery costs.Consumers are increasingly aware of the rising cost of living.

They are actively monitoring price changes and comparing prices across different stores and brands. This heightened awareness directly influences their purchasing decisions. The impact on consumer confidence and shopping habits is significant and warrants careful analysis.

Public Perception of Inflation, Biden inflation kroger albertsons

The public’s perception of inflation is a complex interplay of factors, including the individual’s financial situation, the perceived severity of price increases, and the availability of information. Public opinion polls often reveal a significant concern about inflation, particularly regarding essential goods like groceries. This concern can be exacerbated by the visible rise in prices at grocery stores, which directly impacts households’ budgets.

Consumer Behavior in Response to Rising Grocery Prices

Consumers exhibit various responses to rising grocery prices. Some adjust their budgets by cutting back on discretionary spending, prioritizing essential items. Others seek out more affordable alternatives, like generic brands or smaller portions. A considerable portion of consumers are carefully evaluating their grocery shopping lists and altering their purchasing habits to cope with the increased costs.

Strategies Employed by Consumers to Cope with Inflation

Consumers employ various strategies to mitigate the impact of inflation on their grocery budgets. These include couponing, utilizing loyalty programs, and purchasing items in bulk. Seeking out discounts, comparing prices across different retailers, and preparing meals at home are also common strategies. The increasing use of online grocery shopping platforms is also notable, enabling consumers to compare prices and potentially save on delivery or pickup costs.

Potential Impact of Inflation on Consumer Confidence

Inflation can erode consumer confidence, leading to decreased spending and a cautious approach to purchases. When consumers feel their purchasing power is diminished, they tend to become more conservative in their spending habits. The long-term effect on consumer confidence will depend on the duration and severity of inflation.

Changes in Consumer Shopping Habits

Rising grocery prices have triggered notable shifts in consumer shopping habits. Consumers are more likely to comparison shop, looking for discounts and better deals. The use of online grocery delivery services is increasing as consumers seek convenience and potentially better prices. The rise in demand for affordable substitutes, like generic brands, and the growing popularity of meal planning and preparation also indicate changes in consumer behavior.

Changes in Consumer Spending Patterns Related to Groceries

| Spending Pattern | Description |

|---|---|

| Increased use of online grocery shopping | Consumers are increasingly turning to online platforms for grocery shopping, potentially seeking better deals and convenience. |

| Bulk purchasing | Consumers may purchase larger quantities of items to potentially take advantage of lower per-unit prices. |

| Emphasis on generic brands | Consumers are shifting towards generic brands to save money. |

| Meal planning and preparation | More consumers are opting for meal planning and preparing meals at home to reduce grocery costs. |

| Reduced consumption of discretionary items | Consumers are likely cutting back on non-essential grocery items, such as snacks and processed foods. |

Consumer Grocery Shopping Habits

| Shopping Habit | Description |

|---|---|

| Comparison shopping | Consumers are more likely to compare prices across different stores and brands to find the best deals. |

| Couponing and loyalty programs | Consumers are utilizing coupons and loyalty programs more frequently to save on grocery costs. |

| Focus on essential items | Consumers are prioritizing essential items and cutting back on non-essential purchases. |

| Seeking out discounts and deals | Consumers are actively searching for discounts and deals to minimize the impact of rising prices. |

| Increased frequency of smaller purchases | Consumers might be making more frequent, smaller purchases instead of fewer, larger ones to better manage their budget. |

External Factors Influencing Grocery Prices: Biden Inflation Kroger Albertsons

Grocery prices are a complex interplay of domestic and global factors. While government policies and market dynamics within the US play a significant role, external forces often exert a powerful influence on the cost of food at the grocery store. Understanding these external pressures is crucial to comprehending the full picture of inflation and price fluctuations.

Global Supply Chain Disruptions

Global supply chains are intricate networks, and disruptions in any part can ripple through the entire system, impacting grocery prices. These disruptions can stem from various sources, including natural disasters, political instability, and pandemics. The COVID-19 pandemic, for example, significantly disrupted global supply chains, leading to shortages of certain goods and increased shipping costs. This, in turn, directly affected the availability and price of imported food items.

For instance, a shortage of shipping containers led to delays in transporting produce from countries like Mexico to the US, causing price increases for fresh produce.

Impact of International Events

International events can significantly influence global food prices. Conflicts, trade wars, and sanctions can all disrupt the flow of goods and services, leading to shortages and price hikes. For instance, the war in Ukraine has disrupted the export of key agricultural products like wheat and sunflower oil, sending prices soaring in global markets. The impact on grocery prices is evident in increased costs for bread, pasta, and vegetable oils.

Effect of Weather Patterns and Agricultural Production

Weather patterns and agricultural production are intrinsically linked to food prices. Droughts, floods, and extreme temperatures can significantly reduce crop yields, impacting the supply of key food products. Unpredictable weather events can disrupt harvests and lead to food shortages, driving prices upward. For example, prolonged droughts in California can lead to decreased citrus production, impacting the availability and cost of orange juice.

Role of Geopolitical Factors

Geopolitical factors, including trade disputes, political instability, and sanctions, can create significant disruptions in the global food supply. These factors can affect the production, transportation, and distribution of food, leading to price volatility. For instance, trade disputes between major agricultural exporters can reduce the availability of certain commodities in global markets, increasing prices.

Summary of Global Factors Affecting Grocery Prices

| Global Factor | Impact on Grocery Prices |

|---|---|

| Supply Chain Disruptions | Shortages, increased shipping costs, price hikes |

| International Events (e.g., Wars, Sanctions) | Reduced supply, increased prices for affected products |

| Weather Patterns/Agricultural Production | Reduced yields, shortages, price volatility |

| Geopolitical Factors (e.g., Trade Disputes, Political Instability) | Disruptions in supply, price volatility |

How Global Events Impact Grocery Prices

Global events have demonstrably impacted grocery prices in recent years. The COVID-19 pandemic disrupted global supply chains, leading to shortages and price increases for various food items. The war in Ukraine has further exacerbated the issue by impacting the availability of key agricultural products. These events highlight the interconnectedness of global food systems and the vulnerability of grocery prices to external shocks.

A significant example is the spike in wheat prices following the war in Ukraine, which directly influenced the cost of bread and pasta globally.

Potential Long-Term Effects

The ongoing inflationary pressures, particularly in the grocery sector, are likely to have profound and lasting impacts on consumers, retailers, and the overall economy. Understanding these potential long-term effects is crucial for navigating the changing landscape and adapting to the evolving consumer behaviors. The grocery industry, a fundamental part of daily life, is particularly vulnerable to these trends.The sustained period of inflation, combined with the specific challenges faced by the grocery sector, suggests a significant restructuring of the market.

Consumer spending patterns, retailer strategies, and even the very definition of an affordable grocery basket are poised for transformation. This shift will ripple through the broader economy, potentially affecting economic stability and impacting the well-being of numerous households.

Potential Impact on Consumer Spending and Market Share

Consumer spending patterns are likely to be significantly affected by persistent inflation. Consumers might adjust their spending habits to prioritize essential goods and reduce discretionary purchases. This could lead to a shift in market share among grocery retailers, with those offering competitive pricing and value-added services gaining a stronger foothold. For instance, budget-friendly grocery stores might see increased customer traffic while premium brands face a challenge in maintaining their customer base.

Potential Implications for Economic Stability

Inflation, particularly when affecting essential goods like groceries, can have broader implications for economic stability. A prolonged period of high inflation could lead to decreased consumer confidence and reduced investment, potentially slowing economic growth. The ripple effect of higher grocery prices can impact other sectors of the economy, as consumers allocate more of their disposable income to food.

Potential Changes in Consumer Habits and Preferences

Consumers might adapt their shopping habits in response to rising grocery prices. Increased reliance on sales, coupons, and loyalty programs might become more prevalent. There could be a growing emphasis on home cooking and a shift away from eating out. This change in consumer habits could lead to a rise in demand for certain types of groceries, such as cheaper alternatives to premium products.

For example, the rise of online grocery shopping might increase, driven by the need for convenience and potentially better deals.

Potential Long-Term Effects on the Companies Involved

Retailers like Kroger and Albertsons will need to adapt their strategies to navigate the changing landscape. This could involve focusing on cost-cutting measures, improving supply chain efficiency, and developing innovative strategies to retain customers. They might also need to enhance their online presence and delivery services to cater to evolving consumer preferences. Ultimately, companies that can effectively manage costs and provide value will be better positioned to thrive.

Biden’s inflation is definitely impacting grocery prices, and it’s noticeable at Kroger and Albertsons. Meanwhile, over in Paris, the high-fashion world is buzzing with the latest Saint Laurent and Dior creations at saint laurent dior paris fashion week. While the runway shows are all about luxury, the everyday struggles of affording groceries remain a real concern for many, highlighting the disconnect between the opulent and the ordinary, and ultimately, back to the ongoing impact of inflation on our wallets.

Potential Shifts in the Grocery Market

| Factor | Potential Shift |

|---|---|

| Pricing Strategies | Emphasis on value and affordability; increased use of promotions and coupons |

| Supply Chain Management | Greater focus on efficiency and cost reduction; potential for more strategic partnerships |

| Consumer Preferences | Shift towards budget-friendly options; increased demand for home-cooked meals; rise in online grocery shopping |

| Market Share | Possible consolidation among retailers; growth of discount and value-focused chains |

| Economic Stability | Potential for reduced consumer confidence and economic growth; increased importance of food security |

Last Recap

In conclusion, the interconnectedness of Biden’s economic policies, inflation, and the grocery industry is undeniable. Kroger and Albertsons are navigating a complex landscape, and consumers are adapting their shopping habits in response. The long-term effects of these trends remain uncertain, but the analysis highlights the need for careful consideration of both internal and external factors affecting the American grocery sector.

FAQ

What are some specific policies from the Biden administration that have been cited as contributing to inflation?

Specific policies, such as increased government spending and certain tax policies, are often cited as contributing factors, though their precise impact remains a subject of ongoing debate and analysis.

How have global events impacted grocery prices in the US?

Geopolitical events, supply chain disruptions, and weather patterns globally can significantly impact the availability and cost of goods, affecting grocery prices in the US.

Are there any specific examples of consumer behavior changes in response to inflation?

Consumers are often reported to be purchasing less expensive alternatives, reducing consumption of certain items, and opting for more budget-friendly shopping strategies in response to inflation.

What are the potential long-term consequences of inflation for consumers?

Potential long-term consequences include reduced purchasing power, financial strain on households, and potentially a shift in consumer preferences toward more affordable options.