Consumer Spending Savings During Recession

Consumer spending savings recession is a crucial topic, especially during economic downturns. How do consumers adjust their spending and saving habits when faced with uncertainty and reduced income? This exploration dives into the intricate relationship between consumer behavior, economic indicators, and government policies during a recession.

The article delves into typical spending patterns, examining how different demographics react. We’ll analyze the impact of recessions on various sectors, from retail to housing, and explore the role of savings strategies and government interventions in mitigating the economic fallout. The analysis includes a deep dive into the correlation between spending and saving, providing insight into the cyclical nature of these economic forces.

Consumer Spending Patterns During Recessions

Recessions, periods of economic downturn, often lead to significant shifts in consumer spending habits. Understanding these patterns is crucial for businesses, policymakers, and individuals alike. Predicting and adapting to these changes can mitigate the impact of a recession and even help to navigate its complexities. This analysis explores the intricacies of consumer spending during economic downturns.Consumer spending during recessions is typically characterized by a marked decrease in overall expenditure.

The recent consumer spending savings recession is a complex issue, and global events certainly play a role. The current geopolitical climate, particularly the recent Biden-Israel-Hamas cease fire negotiations, biden israel hamas cease fire , could be impacting consumer confidence. This uncertainty, combined with rising interest rates, might be discouraging spending and impacting overall economic stability, which further compounds the recessionary pressure on consumer spending.

This is driven by factors such as job insecurity, reduced income, and heightened uncertainty about the future. Consumers often prioritize essential goods and services, deferring purchases of non-essential items. This shift in spending behavior is particularly pronounced during significant economic downturns.

Typical Consumer Spending Behaviors During Recessions

Consumers often adopt a more cautious approach to spending, prioritizing essential items over discretionary ones. This means a reduction in spending on entertainment, dining out, and non-essential purchases. Consumers may also delay or cancel large purchases, such as homes or vehicles. This conservation of resources becomes a key strategy for weathering the economic storm.

Spending Patterns Across Demographics

Consumer spending behaviors during a recession vary significantly across demographics. Younger generations, often with lower savings and higher debt, may experience a more pronounced impact on their spending. Middle-aged consumers, with potentially more accumulated savings, may be better positioned to withstand the downturn. High-income earners, with greater financial resources, often maintain spending levels more consistently, though they may also adjust their spending patterns to a degree.

The recent consumer spending savings recession is a tricky one, isn’t it? It’s hard to predict what the future holds, especially when considering unforeseen events like the unfortunate incident involving the armorer Alec Baldwin on the set of Rust. The tragic shooting incident on the film set of armorer alec baldwin rust shooting is definitely a significant factor in the current economic climate.

It’s impacting everything from production costs to consumer confidence, making the savings recession even more complex. All these things are affecting our spending habits and the overall economy. We need to see how things develop.

Geographic location also plays a role; areas with high unemployment rates may see a more significant decrease in spending compared to areas with a stronger job market.

Influence of Consumer Confidence Levels

Consumer confidence, or the perceived economic outlook, plays a critical role in spending decisions. During a recession, declining consumer confidence often results in further reductions in spending. Conversely, an improvement in consumer confidence may lead to a gradual increase in spending as consumers feel more secure about the future. This dynamic interaction between consumer confidence and spending behavior is often cyclical, influencing the duration and severity of the recession.

Key Sectors Impacted by Reduced Spending

Sectors heavily reliant on discretionary spending, such as retail, restaurants, and travel, are usually the most impacted during a recession. Reduced consumer confidence leads to decreased demand, impacting sales and profitability for these sectors. Businesses in these sectors often respond by implementing cost-cutting measures, adjusting their pricing strategies, or re-evaluating their product offerings.

Impact of Government Policies on Consumer Spending

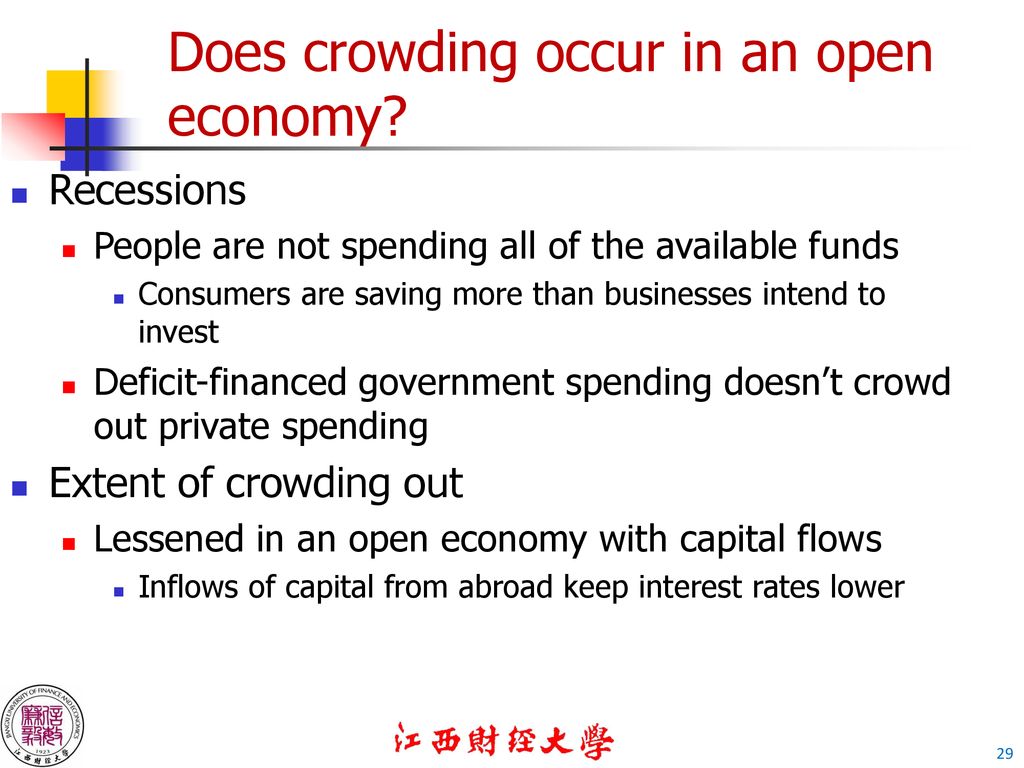

Government policies, such as stimulus packages and tax cuts, can significantly impact consumer spending during a recession. These policies aim to boost consumer confidence and stimulate economic activity. However, the effectiveness of such policies can vary depending on the specific design and implementation of the policy.

Comparison of Consumer Spending Categories, Consumer spending savings recession

| Spending Category | Before Recession | During Recession |

|---|---|---|

| Necessities (Food, Housing, Utilities) | Consistent spending, essential for survival | Continued spending, but potential for adjustments based on affordability |

| Discretionary Items (Entertainment, Dining Out, Apparel) | Variable spending, influenced by income and preferences | Significant decrease in spending, often deferred or eliminated |

| Durable Goods (Cars, Appliances) | Purchases made with reasonable frequency | Purchases delayed or canceled, replaced by more cost-effective options |

| Savings | Potential for savings and investments | Prioritization of savings, possible reduction in investments |

Savings Behavior in Times of Recession

Recessions, characterized by economic downturns and decreased consumer confidence, often trigger significant shifts in spending and saving habits. Understanding these shifts is crucial for individuals and policymakers alike, as they inform strategies for mitigating economic hardship and fostering a robust recovery. Consumers respond to the perceived uncertainty and potential loss of income by adjusting their financial behavior.During economic contractions, consumers prioritize security and stability, often leading to a noticeable increase in savings, particularly for emergency funds.

This shift is driven by a desire to protect against potential job losses, unexpected expenses, and general economic instability. This response is a natural human reaction to perceived threats.

With consumer spending seemingly on a downturn and savings dwindling during this recession, it’s easy to feel the pinch. Luckily, there are ways to find creative outlets for enjoyment, like exploring the rich musical world of Broadway cast albums, particularly those from shows like Sweeney Todd. Discovering the captivating harmonies and dramatic storytelling of broadway cast albums sweeney todd can be a fantastic escape, offering a welcome distraction from economic worries while potentially inspiring a fresh perspective on the current consumer spending savings recession.

Strategies Employed by Consumers to Save Money

Consumers employ a variety of strategies to save during recessions. These strategies often involve a combination of short-term and long-term approaches. Budgeting becomes crucial, with consumers scrutinizing every expense and identifying areas for potential savings. Reduced discretionary spending, such as dining out, entertainment, and non-essential purchases, is common. Increased frugality in everyday expenses, like transportation and groceries, is another key component of these strategies.

Relationship Between Consumer Savings and Investment Decisions

Consumer savings and investment decisions are intertwined. Increased savings often lead to greater investment opportunities. Individuals with readily available funds may be more inclined to invest in low-risk options like savings accounts or government bonds, seeking to preserve capital while generating some return. Conversely, during periods of high uncertainty, individuals might reduce investment activity to avoid potential losses.

This relationship is dynamic, changing based on market conditions and individual risk tolerance.

Methods of Saving

Various methods of saving are employed, each with its own characteristics and potential benefits. Emergency funds, designed to cover unforeseen circumstances, are a critical component of any recessionary savings strategy. Long-term investments, such as retirement accounts, are also important, though their role might be affected by the economic climate. High-yield savings accounts, certificates of deposit (CDs), and money market accounts are popular choices for short-term savings.

This mix of approaches allows consumers to balance short-term security with long-term financial goals.

Savings Behaviors Across Different Income Levels

Savings behaviors differ across income levels during recessions. Higher-income individuals may have more resources to allocate to savings and investments, potentially including diversified portfolios. Lower-income individuals, however, may face greater challenges in saving, often forced to prioritize essential expenses. They might rely on emergency funds and explore government assistance programs to mitigate the impact of the recession.

This difference in capacity to save highlights the need for tailored financial strategies for diverse income groups.

Role of Financial Institutions in Encouraging Savings

Financial institutions play a crucial role in encouraging savings during recessions. They can offer incentives, such as higher interest rates on savings accounts, to motivate individuals to save. Education and financial literacy programs are also crucial in helping consumers develop effective savings strategies. Transparency in financial products and services can help build trust and encourage participation in savings programs.

Potential Effects of Savings Strategies on Future Spending

| Savings Strategy | Potential Effect on Future Spending |

|---|---|

| Increased emergency fund | Reduced vulnerability to unexpected expenses, allowing for more stable spending in the future. |

| Investment in low-risk securities | Potential for modest returns, increasing future spending power. |

| Reduced discretionary spending | Increased savings, potentially leading to higher future spending capacity, especially in the long term. |

| Focus on essential expenses | Maintaining essential needs, potentially hindering growth in discretionary spending. |

Note: This table represents potential effects, and individual experiences may vary. Economic conditions, individual circumstances, and the specific strategies employed can all impact the outcome.

The Interplay Between Spending and Savings

Recessions often trigger a complex dance between consumer spending and savings. Understanding this dynamic is crucial for navigating economic downturns and promoting long-term stability. Reduced consumer confidence and income anxieties frequently lead to changes in spending habits, which in turn impact savings rates and overall economic growth.

Impact of Spending Cuts on Savings Rates

When consumers cut back on spending, their disposable income often increases. This can lead to a corresponding rise in savings rates as individuals prioritize accumulating financial reserves for uncertain times. The relationship, however, is not always linear. Factors like the severity of the recession, individual financial situations, and the availability of alternative investment opportunities influence the extent to which spending cuts translate into higher savings.

Consequences of Excessive Saving and Reduced Spending

While saving is essential, an excessive reduction in consumer spending can have detrimental effects on economic growth. Reduced demand for goods and services can lead to decreased production, job losses, and further economic contraction. This is a vicious cycle, as decreased spending discourages businesses from investing and expanding, leading to a slowdown in economic activity. Historically, periods of excessive saving, particularly during severe recessions, have been associated with prolonged economic stagnation.

The Cyclical Relationship Between Spending and Saving During a Recession

The relationship between spending and saving during a recession is cyclical and often interconnected. Reduced spending can initially lead to a rise in savings, but if this reduction persists, it can negatively impact overall economic activity, potentially leading to a decline in savings as incomes fall further. Understanding this cyclical nature is critical for policymakers and individuals to implement strategies that encourage sustainable spending and economic growth.

The recent downturn in consumer spending and savings during this recession is impacting many households. Navigating these financial challenges can be tough, and it’s important to make smart choices about where to prioritize spending. This also means understanding the importance of preventative measures, like using condon prevencion vih sida , which can lead to long-term financial stability and reduce the risk of unexpected expenses.

Ultimately, careful budgeting and responsible choices are key to overcoming the current economic climate.

How Saving During a Recession Contributes to Long-Term Stability

Saving during a recession, even in a reduced capacity, can contribute significantly to long-term economic stability. Accumulated savings provide a financial cushion for individuals to weather economic storms, allowing them to maintain their standard of living and avoid taking on significant debt. Furthermore, these savings can be used for future investments, furthering economic growth in the long term.

The key is to find a balance between saving for the future and ensuring enough spending to sustain economic activity.

Role of Personal Finance Advice in Economic Downturns

Personal finance advice plays a crucial role in guiding consumers during economic downturns. Expert advice can help individuals develop realistic financial plans, prioritize spending, and make informed decisions about saving and investment strategies. This guidance can help consumers maintain financial stability and navigate the complexities of a recession.

Correlation Between Consumer Spending and Savings Rates During Different Recessionary Periods

| Recessionary Period | Consumer Spending Rate (Estimated) | Savings Rate (Estimated) | Impact on Economic Growth |

|---|---|---|---|

| 2008-2009 Financial Crisis | Decreased significantly | Increased moderately | Negative impact on short-term growth, long-term impact mixed |

| 1990-1991 Recession | Decreased moderately | Increased moderately | Negative impact on short-term growth, recovery period relatively swift |

| 1980-1982 Recession | Decreased significantly | Increased significantly | Negative impact on short-term growth, recovery period prolonged |

Note: Estimated values in the table are illustrative and based on general economic trends. Specific figures may vary depending on the region and other factors.

Recessionary Impacts on Specific Sectors

Recessions, characterized by reduced economic activity, invariably ripple through various sectors, impacting consumer behavior and business strategies. Understanding these sector-specific effects is crucial for businesses and policymakers alike to navigate the economic downturn and anticipate potential challenges. This analysis will delve into the specific impacts of recessionary periods on key sectors like retail, hospitality, housing, automotive, and technology.Recessions typically trigger a significant reduction in consumer spending, impacting businesses across various sectors.

The effects are often felt most acutely in sectors directly tied to consumer demand, where sales decline, and profitability suffers. These impacts extend beyond immediate sales figures, influencing employment rates, investment decisions, and overall economic stability.

Retail Sector Impacts

Decreased consumer spending directly translates to lower sales in the retail sector. Retailers experience a drop in demand for goods and services, leading to inventory buildup and potential markdowns. This often prompts cost-cutting measures, including layoffs, store closures, and reduced operating hours. Companies with a strong online presence may experience a greater reliance on e-commerce, with reduced reliance on physical stores.

For example, during the 2008 recession, many brick-and-mortar retailers faced significant challenges, forcing some to close permanently.

Hospitality and Tourism Impacts

Reduced consumer spending impacts the hospitality and tourism industries profoundly. Travel and leisure activities are often among the first to be curtailed during a recession, as consumers prioritize essential expenses. Hotels, restaurants, and airlines experience a decline in bookings and revenue. This can lead to job losses and reduced investment in the sector. For instance, the 2008 recession saw a significant drop in air travel and hotel occupancy rates.

Housing Market Impacts

The housing market is highly sensitive to economic downturns. During recessions, demand for housing typically decreases, leading to lower home prices and reduced construction activity. Foreclosures and short sales increase as borrowers struggle to meet mortgage obligations. The availability of mortgages may also decrease, further dampening the market. Historical examples demonstrate how housing market corrections are often a defining feature of recessions.

Automotive Sector Impacts

The automotive sector is significantly affected by recessions. Reduced consumer confidence and income lead to a decrease in car purchases. Automakers often respond with production cuts, leading to job losses in the manufacturing and related industries. Government incentives and financing options may be employed to stimulate demand. During the 2008 recession, new car sales plummeted, causing substantial disruption within the automotive industry.

Technology Sector Impacts

While the technology sector often appears resilient, recessions can still affect it. Reduced consumer spending can impact demand for technology products and services, particularly discretionary items. Companies may face pressure to cut costs, potentially leading to layoffs or hiring freezes. However, certain segments, like cloud computing and cybersecurity, may show relative resilience. The tech sector has experienced fluctuations in demand during past recessions, with some companies adapting better than others.

Projected Impacts of a Recession on Different Sectors

| Sector | Potential Impacts |

|---|---|

| Retail | Lower sales, inventory buildup, markdowns, store closures, job losses |

| Hospitality & Tourism | Reduced bookings, lower revenue, job losses, reduced investment |

| Housing | Lower home prices, reduced construction, increased foreclosures, reduced mortgage availability |

| Automotive | Decreased car purchases, production cuts, job losses |

| Technology | Reduced demand for products, cost-cutting measures, potential layoffs |

Economic Indicators and Consumer Spending: Consumer Spending Savings Recession

Understanding consumer behavior during economic fluctuations is crucial for businesses and policymakers. Consumer spending, a significant driver of economic growth, is deeply intertwined with various economic indicators. Analyzing these indicators helps predict future spending trends and allows for proactive adjustments to economic strategies.Economic indicators like GDP, unemployment, and inflation provide valuable insights into the overall health of an economy.

These indicators influence consumer confidence, which, in turn, directly impacts spending decisions. Changes in interest rates and inflation further modify consumer purchasing power and preferences. By understanding these intricate relationships, we can better anticipate consumer spending patterns and adjust strategies accordingly.

GDP and Consumer Spending

Gross Domestic Product (GDP) reflects the total value of goods and services produced in a country. A growing GDP generally signals a healthy economy, boosting consumer confidence and encouraging spending. Conversely, a declining GDP often leads to uncertainty and reduced spending. Historically, periods of high GDP growth have correlated with increased consumer spending.

Unemployment Rate and Consumer Spending

The unemployment rate is a key indicator of the labor market’s health. A low unemployment rate often signifies a strong economy, which can lead to increased consumer spending. Higher unemployment rates, on the other hand, typically result in decreased consumer spending due to reduced disposable income and uncertainty about the future.

Interest Rates and Consumer Spending

Changes in interest rates significantly impact consumer spending. Lower interest rates make borrowing more affordable, stimulating spending on durable goods like homes and cars. Conversely, higher interest rates increase borrowing costs, potentially reducing consumer spending. For example, during periods of low interest rates, home purchases often increase.

Inflation and Consumer Spending

Inflation erodes the purchasing power of money. High inflation can reduce consumer spending as individuals struggle to afford goods and services. Conversely, low, stable inflation can foster consumer confidence and encourage spending. A consistent and predictable rate of inflation tends to be beneficial to the economy, as consumers can better plan their spending.

Consumer Confidence and Spending

Consumer confidence indicators, such as surveys measuring consumer expectations, offer insights into future spending intentions. High consumer confidence suggests optimism about the economy and future prospects, leading to increased spending. Conversely, low consumer confidence can discourage spending, as individuals anticipate economic hardship. Consumer confidence surveys are used to anticipate trends and adjust economic policies accordingly.

Correlation between Economic Indicators and Consumer Spending

[Description of the chart: A line graph displaying the correlation between GDP growth (horizontal axis) and consumer spending (vertical axis) over time. The graph shows a positive correlation, indicating that periods of higher GDP growth are generally associated with higher consumer spending.]

[Description of the chart: A line graph displaying the correlation between GDP growth (horizontal axis) and consumer spending (vertical axis) over time. The graph shows a positive correlation, indicating that periods of higher GDP growth are generally associated with higher consumer spending.]

Relationship Between Key Economic Indicators and Consumer Spending During Previous Recessions

| Economic Indicator | Impact on Consumer Spending (During Recession X) | Impact on Consumer Spending (During Recession Y) |

|---|---|---|

| GDP | Decreased | Decreased |

| Unemployment Rate | Increased | Increased |

| Interest Rates | Increased (likely) | Increased (likely) |

| Inflation | Potentially increased or decreased, depending on the specific situation | Potentially increased or decreased, depending on the specific situation |

| Consumer Confidence | Decreased significantly | Decreased significantly |

[Note: Recession X and Recession Y refer to specific historical recessions. The table demonstrates the general tendencies observed during those periods. The specific impacts can vary based on the unique circumstances of each recession.]

Government Policies and Consumer Response

Government policies play a crucial role in shaping consumer behavior during economic downturns. Stimulus packages, tax policies, and initiatives to encourage savings can significantly impact consumer spending patterns and overall economic recovery. Understanding these interactions is vital for policymakers seeking to mitigate the negative effects of recessions and foster economic stability.Government interventions often aim to bolster consumer confidence and stimulate demand.

The success of these measures depends on various factors, including the specific design of the policy, the prevailing economic climate, and the level of public trust in the government’s ability to manage the crisis effectively. The effectiveness of government policies is not always immediately apparent and often needs time to take effect.

The recent consumer spending savings recession feels like a collective, nationwide bout of financial grief. It’s a tough time for everyone, and the anxieties are palpable. This economic downturn, however, is far from unique; it’s mirrored in the personal struggles of individuals, as explored in the poignant article “grief is for people sloane crosley” grief is for people sloane crosley.

Ultimately, navigating these economic challenges requires a combination of resilience and practical strategies for managing our resources.

Influence of Stimulus Packages on Consumer Spending

Stimulus packages, typically involving direct payments or tax rebates, aim to inject money into the economy, thereby encouraging spending and bolstering aggregate demand. The effectiveness of these measures often depends on the timing and design of the program, as well as the overall economic context. For instance, a timely stimulus package can help maintain consumer confidence and prevent a further decline in spending.

However, if the package is poorly designed or implemented too late, its impact may be minimal or even counterproductive.

Effectiveness of Government Interventions in Boosting Consumer Confidence

Various government interventions aim to restore consumer confidence. These strategies often include clear communication regarding the economic situation, transparent policy measures, and assurances about future economic prospects. For instance, a transparent and predictable approach to managing a crisis can often help maintain public trust, thereby promoting a more positive economic outlook. Conversely, ambiguity or lack of clarity in government actions can exacerbate anxieties and hinder the recovery process.

Government Policies to Encourage Savings During a Downturn

Governments often implement policies aimed at encouraging savings during a recession. These might include tax incentives for savings accounts or retirement plans, or subsidies for specific types of savings. Such policies can help individuals build up their financial reserves, providing a cushion during economic hardship and reducing their reliance on borrowing.

Impact of Government Policies on Consumer Behavior in Different Sectors

Government policies can influence consumer behavior across various sectors. For example, tax incentives for renewable energy investments can encourage spending in the green energy sector, while subsidies for homebuyers can boost the housing market. The impact of such policies is often sector-specific and needs to be carefully considered to ensure that the desired effects are achieved.

Impact of Tax Policies on Consumer Spending and Savings

Tax policies significantly influence consumer behavior. Lower taxes on income, for example, can lead to increased disposable income and potentially higher spending. Conversely, increased taxes may reduce disposable income and potentially discourage spending. Changes in tax policies can also impact savings behavior, as individuals might save more if they expect lower taxes in the future.

Effectiveness of Different Government Policies in Encouraging Savings During Recessions

| Policy | Potential Effectiveness | Potential Drawbacks |

|---|---|---|

| Tax incentives for savings accounts | Can encourage saving, especially for those with limited access to other investment options. | May not be effective for all income groups, and might incentivize short-term savings over long-term investments. |

| Subsidies for retirement plans | Can encourage long-term saving and reduce the reliance on government assistance in retirement. | May be seen as unfair or inequitable, particularly if not broadly accessible. |

| Government-backed savings programs | Can increase public confidence in saving and provide access to financial instruments that might otherwise be unavailable. | Can be complex to administer and potentially increase government debt if not carefully planned. |

Conclusive Thoughts

In conclusion, consumer spending and savings during a recession are complex issues with wide-ranging effects. Understanding the interplay between these elements is crucial for navigating economic downturns effectively. The article has explored various aspects, from consumer behaviors to the impact on specific sectors and the role of government policies. This understanding can guide individuals and businesses alike in making informed decisions during challenging economic periods.

General Inquiries

What are some common strategies employed by consumers to save money during a recession?

Consumers often cut back on discretionary spending, prioritize necessities, and explore methods like creating emergency funds or increasing contributions to existing savings accounts.

How does consumer confidence affect spending decisions?

High consumer confidence often leads to increased spending, while low confidence typically results in decreased spending and increased saving.

What role do financial institutions play in encouraging savings during a recession?

Financial institutions can play a significant role by offering incentives for savings, providing educational resources, and promoting responsible financial practices.

How can government policies influence consumer spending and saving?

Government policies, such as stimulus packages or tax incentives, can influence consumer spending and saving behaviors by impacting consumer confidence and disposable income.