Economy Recession Soft Landing Explained

Economy recession soft landing is a delicate balancing act, aiming for a period of economic slowdown without a full-blown recession. This in-depth exploration delves into the intricacies of this economic phenomenon, examining the indicators, policies, and potential pitfalls.

Understanding the nuances of a soft landing is crucial for navigating economic uncertainty. This article will unpack the various factors that can lead to a soft landing, and analyze past examples to glean valuable insights into the complexities of managing a delicate economic transition.

Defining a Soft Landing Economy: Economy Recession Soft Landing

A soft landing economy, in economic terms, is a scenario where an economy slows down significantly but avoids a full-blown recession. This delicate balance is characterized by a controlled deceleration in growth, rather than a sharp contraction. It’s a carefully navigated path between maintaining economic momentum and cooling down inflationary pressures. This careful management is crucial for avoiding the pitfalls of a prolonged recession, which can have devastating consequences for employment and investment.Economically, a soft landing is a desirable outcome, avoiding the worst impacts of a recession while still addressing inflationary concerns.

It involves a gradual reduction in economic activity, allowing businesses and consumers to adjust to a new normal without the abrupt shocks of a recession. It’s crucial to differentiate this from a hard landing, which involves a sharp and deep contraction, or a prolonged recession, characterized by sustained decline.

Economic Indicators Associated with a Soft Landing

Several key economic indicators point to a soft landing. These indicators typically show a moderate decline in growth, a slowing down of inflation, and a sustained labor market, while avoiding the sharp drops in employment seen during a recession. For example, a decrease in GDP growth rate from a high level to a more moderate level, without a negative growth rate, could be an indicator.

Similarly, a stable unemployment rate, coupled with a cooling down of inflation, suggests a possible soft landing. This is not an exhaustive list, and other indicators, such as consumer confidence and business investment, are also vital to assess the overall economic situation.

Key Characteristics Distinguishing a Soft Landing

A soft landing differs from a hard landing or a prolonged recession in several key aspects. The rate of economic decline is significantly lower in a soft landing, allowing businesses and individuals time to adjust to the changing economic conditions. Inflationary pressures, a major concern during economic expansion, start to cool down without causing a dramatic downturn. Crucially, a soft landing does not lead to a significant rise in unemployment, maintaining a relatively healthy labor market.

Furthermore, consumer confidence and business investment remain relatively stable, unlike a recession where both often plummet.

Economic Policies During a Soft Landing

Central banks, often in response to inflation concerns, implement a combination of policies during a soft landing. These policies are designed to manage the transition from a period of rapid growth to a period of more moderate growth, often aiming for a balance between controlling inflation and avoiding recession. These often include gradual interest rate increases, aimed at cooling down inflation without causing a significant contraction in the economy.

Fiscal policies, such as government spending cuts or tax increases, might also be used, but these are usually more carefully calibrated to avoid disrupting economic momentum.

Comparison of Policies in Different Scenarios

| Scenario | Interest Rate Policy | Fiscal Policy |

|---|---|---|

| Soft Landing | Gradual interest rate increases to control inflation without triggering a recession. | Fiscal policy adjustments, potentially including spending cuts or tax increases, but generally calibrated to avoid disrupting economic activity. |

| Hard Landing | Aggressive and rapid interest rate increases to curb inflation, potentially leading to a sharp contraction in the economy. | Significant fiscal policy measures to counteract the downturn, potentially including substantial government spending or tax cuts. |

| Prolonged Recession | High interest rates, prolonged, often causing a prolonged period of economic contraction. | Aggressive fiscal policy measures, such as large-scale stimulus packages, to counteract the downturn. |

A soft landing requires a careful balancing act between addressing inflation and avoiding a recession. The policies implemented must be precisely targeted and calibrated to ensure a smooth transition. Avoiding abrupt policy changes is key to a successful soft landing.

Economic Indicators and Metrics

Pinpointing a soft landing, where the economy slows but avoids a full-blown recession, relies heavily on carefully monitoring key economic indicators. These metrics provide a snapshot of the overall health and direction of the economy, allowing policymakers and analysts to assess whether the current trajectory is sustainable and whether a soft landing is achievable. A thorough understanding of these indicators is crucial for forecasting and implementing appropriate economic policies.

The economy’s potential for a soft landing during this recession is definitely up in the air, isn’t it? While the recent hiring of Arthur Smith as the Steelers’ offensive coordinator ( arthur smith hired steelers offensive coordinator ) might seem like a completely unrelated sports story, it actually highlights the complex interplay of factors affecting the economy. Perhaps this new leadership will spark a resurgence in the team’s performance, mirroring a potential soft landing for the overall economic climate.

Primary Economic Indicators for Gauging a Soft Landing

Various economic indicators are employed to gauge the health of an economy and its potential for a soft landing. These indicators paint a multifaceted picture, considering factors like inflation, employment, and consumer spending. A soft landing is characterized by a controlled slowdown in economic activity, avoiding the sharp contractions seen during recessions.

| Indicator Name | Definition | Typical Values during a Soft Landing |

|---|---|---|

| Gross Domestic Product (GDP) Growth Rate | The percentage change in the total value of goods and services produced in a country over a specific period. | Modest growth, typically slowing from previous high rates, but remaining positive. |

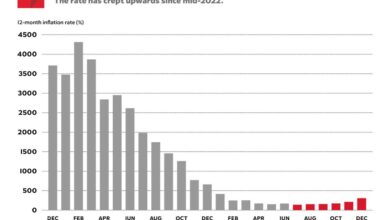

| Inflation Rate | The rate at which the general level of prices for goods and services is rising in an economy over a period of time. | Cooling but remaining above the target rate, gradually decreasing. |

| Unemployment Rate | The percentage of the labor force that is actively seeking employment but unable to find work. | Stable or slightly increasing, but remaining relatively low. |

| Consumer Confidence | A measure of the optimism or pessimism of consumers regarding the future economic outlook. | May fluctuate but generally remains at a moderate level. |

| Retail Sales | The total value of goods sold in retail stores. | Moderate growth or slight decline, reflecting the slowing economy but not a sharp contraction. |

Economic Indicators During a Recession

During a recession, the economic indicators exhibit distinct patterns compared to a soft landing. The difference lies in the magnitude and direction of the changes.

The economy’s potential for a soft landing during this recession is definitely a hot topic right now. Experts are divided, but a key factor in navigating this uncertainty could be the recent developments involving stars Harley Johnston, Oettinger, and Benn. Their actions and pronouncements are definitely being closely watched by those trying to predict the path of the economy.

The ripple effects of these developments, like any significant news cycle, will likely impact how the economic soft landing plays out. stars harley johnston oettinger benn are certainly influencing the current debate, and ultimately, how this economic soft landing pans out.

| Indicator Name | Definition | Typical Values during a Recession |

|---|---|---|

| GDP Growth Rate | The percentage change in the total value of goods and services produced in a country over a specific period. | Negative growth, signifying a contraction in economic activity. |

| Inflation Rate | The rate at which the general level of prices for goods and services is rising in an economy over a period of time. | Potentially declining or stagnating, potentially even deflation. |

| Unemployment Rate | The percentage of the labor force that is actively seeking employment but unable to find work. | Substantial increase, indicating a significant loss of jobs. |

| Consumer Confidence | A measure of the optimism or pessimism of consumers regarding the future economic outlook. | Declining sharply, reflecting widespread pessimism. |

| Retail Sales | The total value of goods sold in retail stores. | Significant decline, indicating reduced consumer spending. |

Examples of Indicator Fluctuations in Past Soft Landings

Analyzing past soft landings provides valuable insights into the behavior of economic indicators. For example, during the period of 2019-2020, the GDP growth rate slowed, but the unemployment rate remained relatively stable. This demonstrated a controlled slowdown that avoided a recession. Similarly, inflation rates cooled without a substantial drop, indicating a soft landing. These examples highlight the importance of examining the interconnectedness of these indicators to fully grasp the economic context.

While economists debate whether a soft landing is possible during this economic recession, local news highlights the complexities of financial realities. For instance, the recent Eugene Weekly embezzlement printing scandal eugene weekly embezzlement printing underscores the potential for unforeseen financial ripples that could complicate any attempt at a smooth economic transition. Ultimately, a soft landing remains a challenging goal, requiring careful management of these unexpected economic events.

Such analyses allow for a better understanding of how these indicators can provide early warning signals of potential economic downturns.

Causes and Potential Triggers of a Soft Landing

A soft landing, a delicate balancing act in economic policy, aims to curb inflation without triggering a recession. Achieving this requires a precise understanding of the factors that can propel an economy towards a smooth deceleration or, conversely, push it into a downturn. This delicate dance often involves a complex interplay of monetary policy, market dynamics, and inflationary pressures.The key to a successful soft landing lies in anticipating and managing potential triggers.

Economists and policymakers must be vigilant in monitoring various economic indicators and adjusting their strategies as needed. This requires a nuanced approach that considers the unique characteristics of each economic environment.

Monetary Policy Adjustments

Central banks play a crucial role in managing inflation and fostering a soft landing. Their actions, particularly interest rate adjustments, directly impact borrowing costs and consumer spending. A gradual and predictable tightening of monetary policy can help cool down the economy without triggering a sharp contraction. For instance, the Federal Reserve’s measured approach to raising interest rates in recent years aimed to temper inflation while avoiding a recession.

Market Dynamics and Consumer Confidence

Consumer confidence and market sentiment are vital components in a soft landing. A decline in consumer confidence can lead to reduced spending, impacting economic growth. Similarly, market volatility can create uncertainty, discouraging investment and potentially triggering a downturn. Maintaining stable market conditions and fostering confidence are crucial for a smooth transition.

The Role of Inflation

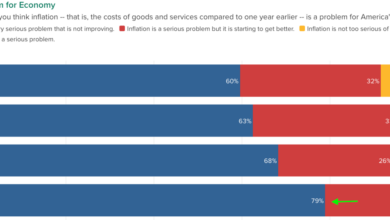

Inflation is a critical factor influencing the likelihood of a soft landing. If inflation remains stubbornly high, central banks may need to adopt more aggressive measures to curb it, potentially leading to a sharper slowdown and a higher risk of recession. A well-managed approach, however, can bring inflation down without triggering a severe downturn. Historically, periods of high and persistent inflation have often led to economic downturns, highlighting the importance of containing inflationary pressures.

Potential Triggers for a Recession

Several factors can derail a soft landing and push an economy into a recession. Unexpected shocks, such as a sudden surge in energy prices or a significant global economic downturn, can disrupt market stability and trigger a sharp decline in economic activity. Political uncertainty and geopolitical events can also negatively impact investor confidence and potentially trigger a recession.

Furthermore, a sudden and unforeseen decline in consumer spending or business investment can quickly reverse the intended slowdown and create a more significant economic contraction.

Economic Strategies for a Soft Landing

Various economic strategies can be employed to promote a soft landing. These include fiscal policies, such as targeted tax incentives or government spending programs, designed to support specific sectors or mitigate the impact of economic downturns. Furthermore, structural reforms, such as investments in infrastructure or education, can improve long-term productivity and support economic resilience. Additionally, robust regulatory frameworks can help maintain market stability and confidence.

Inflationary Pressures and their Management

“Controlling inflation is a critical element of a soft landing.”

Successfully managing inflationary pressures is essential for a smooth economic transition. Aggressive monetary policy, coupled with fiscal measures and structural reforms, can help curb inflationary pressures without causing a recession. Understanding the underlying drivers of inflation, such as supply chain disruptions or wage pressures, is critical in formulating effective policies.

Policy Responses and Actions

Navigating a soft landing requires a delicate balancing act. Central banks and governments must carefully orchestrate monetary and fiscal policies to cool the economy without triggering a recession. This involves understanding the nuances of economic indicators and the potential trade-offs between different policy approaches. A successful soft landing hinges on the ability to temper economic growth without significantly impacting employment and overall societal well-being.

Monetary Policy Responses

Central banks typically employ several tools to achieve a soft landing. These actions aim to moderate inflationary pressures without causing a sharp contraction in economic activity. Key monetary policy tools include adjusting interest rates, influencing the money supply through open market operations, and altering reserve requirements for banks.

- Interest Rate Adjustments: Raising interest rates makes borrowing more expensive, reducing consumer and business spending, and thus cooling the economy. The magnitude and pace of rate hikes are critical; overly aggressive increases can tip the economy into recession. For example, the Federal Reserve’s gradual rate increases in the 2000s helped manage inflation without triggering a downturn.

- Open Market Operations: Central banks can buy or sell government bonds to influence the money supply. Buying bonds increases the money supply, while selling bonds reduces it. These actions impact borrowing costs and liquidity in the financial system.

- Reserve Requirements: Changes in reserve requirements for banks affect their ability to lend money. Higher reserve requirements limit lending, thereby slowing economic activity. This tool is less frequently used compared to interest rate adjustments.

Fiscal Policy Options

Governments can employ fiscal policies to complement monetary policy efforts. Fiscal policies influence aggregate demand through government spending and taxation.

- Targeted Spending Cuts: Reducing government spending on certain sectors can curb overall demand. This approach requires careful consideration of the potential impact on specific industries and employment. Examples of targeted cuts could include reductions in certain infrastructure projects or subsidies.

- Tax Increases: Raising taxes reduces disposable income, potentially decreasing consumer spending and cooling the economy. However, the type of tax increase (e.g., income tax, sales tax) and the specific rate adjustments have different impacts.

- Tax Credits or Incentives: Tax credits or incentives can encourage specific types of spending or investment, thereby counteracting the cooling effect of other fiscal policies. These actions are designed to mitigate the negative impacts on certain segments of the economy.

Trade-offs Between Policies

Different policy responses have potential trade-offs. For instance, raising interest rates can curb inflation but may also lead to higher unemployment and slower economic growth. Conversely, fiscal stimulus measures can boost economic activity but may worsen inflation if not carefully managed.

Effectiveness of Past Policy Tools

The effectiveness of different policy tools in past soft landings varies depending on the specific economic conditions and the actions taken. Analyzing historical cases can offer insights into the potential outcomes of different policy combinations. For example, the combination of monetary and fiscal policies during the early 2000s was effective in tempering inflation without causing a significant recession.

Challenges and Risks Associated with a Soft Landing

A soft landing, while desirable, presents a delicate balancing act. Economies must navigate a tightrope between cooling inflation without triggering a recession. This requires careful policy adjustments and a keen understanding of potential pitfalls. The path to a soft landing is rarely smooth, and risks abound.The difficulty stems from the inherent complexity of macroeconomic systems. Multiple factors influence economic performance, and predicting their interaction is challenging.

Even small miscalculations in policy response or unexpected external shocks can derail the delicate process of a soft landing.

Managing Inflation and Maintaining Growth

Successfully navigating a soft landing hinges on the ability to control inflation without suffocating economic growth. This requires a sophisticated understanding of the intricate relationship between these two forces. Inflationary pressures often stem from various sources, such as supply chain disruptions, rising energy costs, or increased demand. Consequently, cooling inflation while maintaining a healthy growth trajectory demands careful consideration of the specific drivers in each unique situation.

Strategies must be tailored to address the particular dynamics at play in the economy.

Potential Risks and Uncertainties

Several factors can introduce uncertainty into the soft landing scenario. Unforeseen global events, like geopolitical conflicts or natural disasters, can significantly disrupt supply chains and markets. Unexpected shifts in consumer sentiment or investor confidence can also impact economic performance. Moreover, the effectiveness of policy interventions is not always guaranteed. Economic models are simplified representations of complex realities, and their predictions can be inaccurate.

This introduces an element of risk into any economic policy.

Economic Consequences of a Failed Soft Landing

A failure to achieve a soft landing can lead to various undesirable outcomes. If inflation remains stubbornly high, central banks might be forced into more aggressive interest rate hikes, potentially triggering a sharp economic downturn. Conversely, if the economy slips into a recession, it can lead to job losses, decreased consumer spending, and a prolonged period of economic weakness.

The potential for financial instability also exists. The consequences of a failed soft landing are often widespread and can have significant social and political implications. Examples of past economic downturns serve as stark reminders of the dangers of mismanagement.

Impact of External Factors

Global events can significantly impact the likelihood of a successful soft landing. For instance, a significant global recession can pull down domestic economies, even if policies are sound. Similarly, international conflicts can disrupt trade flows, leading to supply chain issues and rising prices. Geopolitical tensions, energy crises, or unexpected natural disasters can all throw off the delicate balance required for a soft landing.

Economic interdependence means that domestic success is often inextricably linked to global stability. Forecasting the effects of external factors is crucial for policymakers to navigate the complexities of a soft landing.

Illustrative Examples of Soft Landings

A soft landing in economics is a delicate dance, a careful maneuver to bring an economy down from a period of high growth to a sustainable pace without triggering a recession. Historical examples provide valuable insights into the strategies employed and the indicators observed during such transitions. Examining past soft landings reveals the crucial role of economic policies in achieving this desired outcome.

Historical Periods of Achieved Soft Landings

Successfully navigating a period of economic slowdown without triggering a recession is a complex undertaking. Key characteristics of successful soft landings include controlled inflation, gradual adjustments in economic growth, and proactive policy responses. Several historical instances illustrate the challenges and successes in achieving a soft landing.

The 1980s US Economy

The 1980s U.S. economy offers a compelling example of a soft landing. Facing high inflation and high unemployment, the Federal Reserve under Chairman Paul Volcker implemented aggressive interest rate hikes. These actions curbed inflation, though they also triggered a recession. However, the economy swiftly recovered, demonstrating a controlled return to a healthy growth rate.

A soft landing for the economy is looking increasingly precarious, with many experts worried about a potential downturn. Companies like KKR, a major player in private equity, are looking to employee ownership models like KKR private equity employee ownership to foster stability and resilience. This could be a key factor in mitigating the potential economic fallout and helping companies navigate the recessionary environment.

- High inflation and unemployment were major economic concerns.

- The Federal Reserve raised interest rates significantly to combat inflation.

- The initial response resulted in a short recession.

- The economy subsequently recovered, achieving a sustainable growth rate.

The Early 2000s US Economy

The early 2000s US economy witnessed another period where inflation was successfully brought under control without a major downturn. While there were some periods of concern about the tech bubble, the overall economic climate remained relatively stable. The Federal Reserve’s policy decisions played a key role in maintaining this stability.

- Technological advancements and innovations influenced economic growth.

- The Federal Reserve maintained a relatively stable monetary policy.

- Growth was gradual and controlled.

- Inflation remained relatively low and stable.

The 2010s US Economy

The 2010s US economy saw an example of a slow but steady recovery after the 2008 financial crisis. Policy responses focused on stimulating aggregate demand and reducing unemployment. While the recovery was not without its challenges, the overall trajectory demonstrated a controlled return to economic growth.

- Recovery from the 2008 financial crisis.

- Policy responses focused on increasing aggregate demand and reducing unemployment.

- Growth was gradual and sustained, avoiding a sharp downturn.

Summary Table of Soft Landing Examples

| Period | Key Characteristics | Policy Responses | Economic Indicators | Success/Failure Factors |

|---|---|---|---|---|

| 1980s US | High inflation, high unemployment | Aggressive interest rate hikes | Inflation decreased, recession followed by recovery | Effective Fed policy, timely response |

| Early 2000s US | Tech bubble concerns, stable overall climate | Stable monetary policy | Stable growth, low inflation | Controlled economic growth, proactive policy |

| 2010s US | Recovery from financial crisis | Stimulating demand, reducing unemployment | Gradual growth, stable inflation | Sustained recovery, policy effectiveness |

Impact on Different Economic Sectors

A soft landing, a delicate balancing act for the economy, navigates a tricky path between containing inflation and avoiding a full-blown recession. This delicate dance has varying effects across different sectors, requiring careful analysis to understand the nuanced impacts. The ripple effects of a soft landing, while aimed at mitigating severe economic downturns, can still lead to challenges in specific sectors.The key to a successful soft landing lies in understanding how various sectors respond to the evolving economic conditions.

The impacts on consumer spending, investment, and exports are crucial indicators of the overall economic health. A soft landing, compared to a recession, often shows a more gradual slowdown in economic activity, leading to potentially less severe disruptions across different industries. However, a soft landing is not a guaranteed smooth transition, and specific sectors might experience different levels of impact.

Consumer Spending

Consumer spending, a significant driver of economic growth, is likely to moderate during a soft landing. Consumers may face increased borrowing costs and reduced purchasing power due to inflation. However, a soft landing typically prevents the drastic declines in employment and income associated with a recession. This moderated spending, in contrast to the substantial decline during a recession, may still be positive compared to an outright contraction.

For instance, the period following the 2008 financial crisis saw a period of moderate spending growth, indicating a potential recovery path.

Investment

Investment decisions are highly sensitive to economic signals. During a soft landing, businesses are more likely to maintain existing investments, avoiding large-scale reductions. This is in contrast to a recession, where substantial investment cuts are common due to uncertainty and declining demand. This avoidance of sharp declines in investment spending is crucial for maintaining a certain level of economic activity and future growth.

Exports

Exports are influenced by global economic conditions and exchange rates. A soft landing, characterized by a stable or slightly declining domestic economy, might lead to more stable export figures compared to a recession. In a recession, export demand tends to fall due to global economic weakness. Stable export performance during a soft landing could indicate a relative strength of the domestic economy in the global market.

Manufacturing

| Economic Scenario | Manufacturing Sector Impact |

|---|---|

| Soft Landing | Reduced production growth, but avoiding significant layoffs or factory closures. |

| Recession | Significant production cuts, potential factory closures, and substantial job losses. |

Manufacturing’s response to a soft landing is often characterized by reduced production growth, but avoiding substantial job losses or factory closures. This contrasts sharply with a recession, where significant production cuts, factory closures, and job losses are common.

Services, Economy recession soft landing

| Economic Scenario | Services Sector Impact |

|---|---|

| Soft Landing | Moderate slowdown in growth, with some sectors experiencing more pronounced declines than others. |

| Recession | Sharp decline in demand, leading to job losses and reduced service provision. |

The services sector during a soft landing might experience a moderate slowdown in growth. Certain service sectors, such as those heavily reliant on consumer spending, may experience a more pronounced decline compared to others. A recession, on the other hand, typically leads to a sharp decline in demand, resulting in job losses and reduced service provision.

Predicting and Forecasting Soft Landings

Forecasting a soft landing, where an economy slows without a full-blown recession, is a complex challenge. Economists employ a variety of methods, ranging from traditional econometric models to subjective expert opinions, to assess the likelihood of such an outcome. However, predicting a soft landing is inherently uncertain, as numerous factors can influence the trajectory of the economy. This section delves into the methods used, the limitations of these approaches, and the key considerations driving assessments of a soft landing’s probability.

Methods Used to Predict Soft Landings

Accurate prediction of a soft landing requires a multifaceted approach, encompassing both quantitative and qualitative techniques. These methods aim to anticipate the interplay of various economic indicators, allowing for informed policy responses.

- Econometric Models: Econometric models utilize statistical techniques to analyze historical data and identify correlations between economic variables. These models, like those based on autoregressive integrated moving average (ARIMA) or vector autoregression (VAR) methods, can project future economic scenarios based on past trends and relationships. For instance, a model might predict a specific GDP growth rate, inflation rate, and unemployment rate over a given period, providing a potential trajectory of a soft landing.

A critical element in these models is the accurate selection of relevant variables and the appropriate estimation techniques. For example, the inclusion of supply chain disruptions or geopolitical events as exogenous variables can be crucial for capturing potential deviations from the baseline prediction.

- Expert Opinions: Expert opinions and market analysis from economists, analysts, and financial institutions provide crucial qualitative insights. These insights often consider specific industry trends, geopolitical events, and policy decisions that can influence the economy. The integration of expert judgment into the forecasting process can complement quantitative models, offering nuanced perspectives on the likely impact of these factors on the economy’s overall performance.

Limitations and Inaccuracies in Forecasting

Forecasting a soft landing, like any economic prediction, is inherently subject to limitations. No model can perfectly capture the complexity of the real world. Unforeseen events, such as significant geopolitical shifts or unexpected technological advancements, can significantly impact the predicted trajectory.

Economists are cautiously optimistic about a potential soft landing for the economy, but recent events like the Carroll verdict against Haley and Trump are creating a lot of uncertainty. The legal wrangling and the public attention surrounding this case, carroll verdict haley trump , could potentially shift investor sentiment, impacting the overall economic outlook. Hopefully, the economic indicators will remain positive, and we’ll avoid a deeper recession.

- Data Limitations: Economic data, while crucial for model building, is often incomplete, delayed, or subject to revision. This can lead to inaccurate predictions, especially when forecasting short-term economic fluctuations. Furthermore, the quality and availability of data vary significantly across different countries and regions, potentially leading to biased predictions.

- Model Assumptions: Econometric models rely on assumptions about the relationship between variables. If these assumptions are incorrect, the model’s predictions may be unreliable. This is particularly true for complex economic systems, where unforeseen interactions between variables can easily disrupt the anticipated trajectory.

- Unexpected Shocks: Unforeseen events, like major geopolitical crises or natural disasters, can significantly impact economic performance. Such events often deviate significantly from the anticipated trajectory and can render the most sophisticated models ineffective.

Key Factors Considered by Economists and Analysts

Economists and analysts consider various factors when evaluating the likelihood of a soft landing. These factors are crucial for understanding the potential trajectory of the economy.

- Inflation Rate: The rate of inflation is a crucial indicator. A soft landing typically involves a deceleration in inflation without triggering a significant recession. Maintaining a controlled rate of inflation is key to achieving this outcome. For instance, if inflation remains elevated despite efforts to cool the economy, a soft landing becomes less probable.

- GDP Growth: GDP growth rate provides a measure of the overall economic expansion. A soft landing often implies a slowing of GDP growth, but not a contraction. The rate of deceleration and its implications for job creation are critical considerations.

- Labor Market Conditions: The health of the labor market is a vital indicator. A soft landing usually involves a stable labor market, with low unemployment rates. Sudden spikes in unemployment rates could signal a recession, whereas gradual adjustments might point towards a soft landing.

- Policy Responses: The effectiveness of policy responses (monetary and fiscal) significantly influences the economic trajectory. A well-timed and well-executed response to economic pressures can significantly impact the likelihood of a soft landing.

Prediction Methods Table

| Method | Description | Strengths | Weaknesses |

|---|---|---|---|

| Econometric Models | Statistical models that analyze historical data to project future economic scenarios. | Provides quantitative estimates, identifies relationships between variables. | Relies on assumptions, susceptible to data limitations, difficult to capture unexpected shocks. |

| Expert Opinions | Insights from economists, analysts, and financial institutions on industry trends, geopolitical events, and policy decisions. | Provides qualitative insights, nuanced perspectives on the economy. | Subjective, can be influenced by biases, not easily quantifiable. |

Wrap-Up

In conclusion, achieving a soft landing during an economic downturn is a complex challenge. It requires careful monitoring of key indicators, proactive policy responses, and a keen understanding of the potential risks. This article has provided a comprehensive overview of the factors involved, from definition to forecasting, and ultimately, offers a better understanding of the delicate dance between economic growth and stability.

Detailed FAQs

What are some common economic indicators used to gauge a soft landing?

Key indicators include GDP growth rate, unemployment rate, inflation rate, consumer confidence, and industrial production. A soft landing typically shows a slowdown in GDP growth, but not a significant decline. Unemployment remains relatively stable, and inflation is contained.

How do monetary policies impact a soft landing?

Central banks use monetary policy tools, like interest rate adjustments, to influence borrowing costs and overall economic activity. Careful management of interest rates can help slow the economy without causing a full-blown downturn.

What are the risks associated with failing to achieve a soft landing?

A failure to achieve a soft landing can result in a prolonged recession, high unemployment, and a decline in consumer confidence. The economic consequences can be widespread and severe.

What are some historical examples of successful soft landings?

Several historical periods show examples of successful soft landings. Analyzing these examples can provide valuable insights into the key factors and policy decisions involved in navigating a smooth economic transition.