US Economy Inflation COVIDs Impact

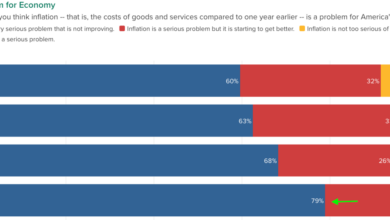

With US economy inflation COVID at the forefront, this post delves into the multifaceted relationship between the pandemic, economic fluctuations, and government responses. From the initial shocks to the lingering effects, we’ll explore how COVID-19 reshaped the US economic landscape, examining everything from supply chain disruptions to consumer behavior.

The following analysis examines the impact of the pandemic on inflation rates, exploring factors beyond COVID-19, government policies, consumer behavior, and long-term implications. We’ll present data and insights to paint a comprehensive picture of this complex issue.

Impact of COVID-19 on US Economy

The COVID-19 pandemic significantly reshaped the US economy, triggering unprecedented disruptions across various sectors. From supply chain bottlenecks to shifts in consumer behavior, the pandemic’s impact extended beyond the immediate health crisis and continues to influence economic trends. This analysis delves into the profound effects of the pandemic on the US economy, examining inflation trends, economic disruptions, government responses, and their impact on consumer spending and specific industries.

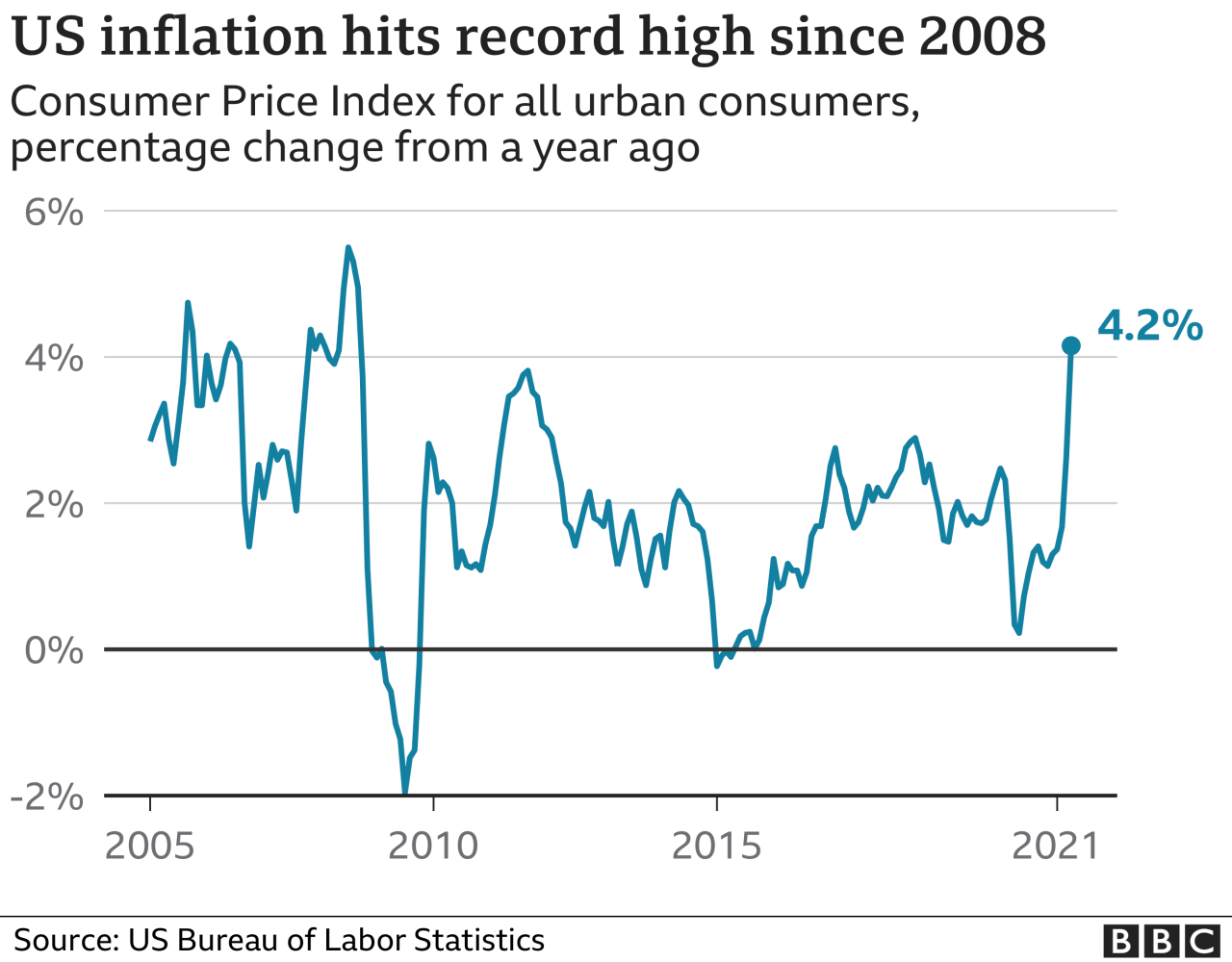

Historical Overview of US Inflation Before COVID-19

Prior to the pandemic, US inflation had been relatively stable, exhibiting moderate growth in the years leading up to 2020. Factors influencing inflation trends before the pandemic included fluctuations in energy prices, labor market conditions, and global economic events. The Federal Reserve’s monetary policy played a crucial role in maintaining price stability during this period.

Economic Disruptions Caused by the Pandemic, Focusing on Supply Chain Issues

The pandemic drastically disrupted global supply chains. Lockdowns, factory closures, and port congestion led to significant delays and shortages in the delivery of goods. This disruption directly impacted businesses, consumers, and overall economic output. For example, the closure of factories in China, a major manufacturing hub, created bottlenecks that stretched across the entire supply chain, resulting in price increases for raw materials and finished goods.

Government Responses and Their Effect on Inflation

Government responses to the pandemic, such as stimulus packages, aimed to mitigate economic hardship and maintain consumer spending. These measures, while intended to provide economic relief, contributed to increased demand in some sectors, potentially fueling inflationary pressures. For instance, the substantial increase in the money supply through government spending might have outpaced the growth in goods and services, pushing up prices.

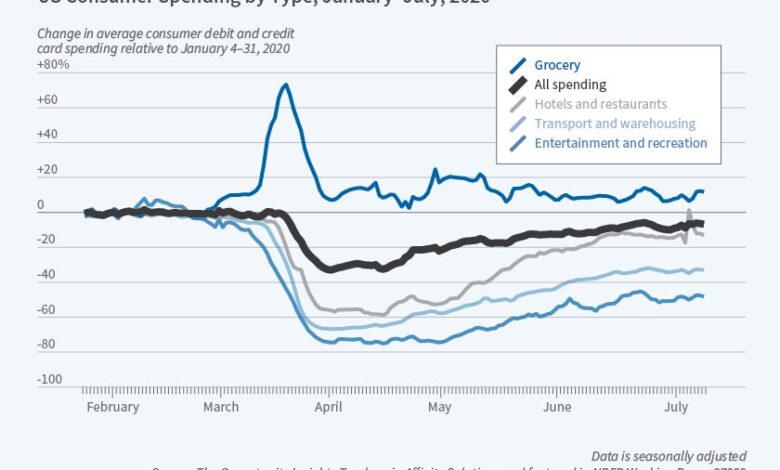

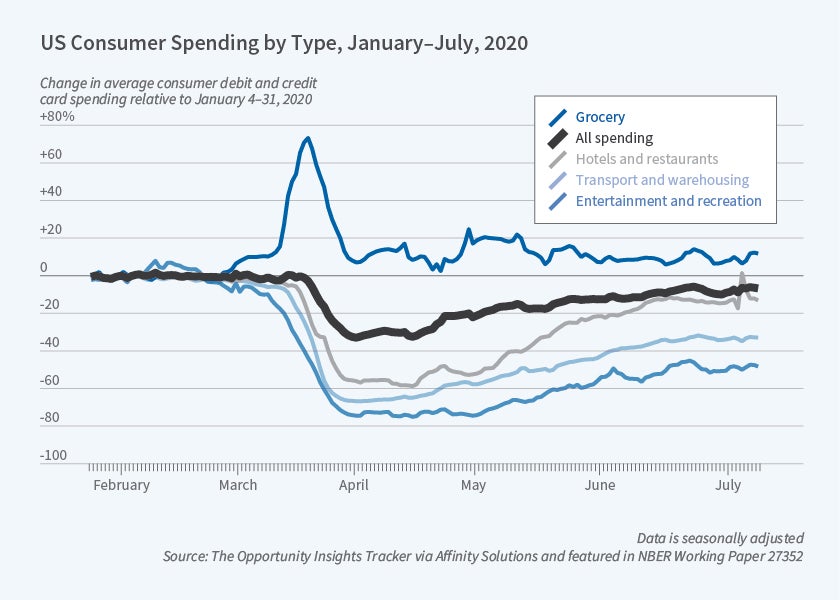

Correlation Between COVID-19 Lockdowns and Consumer Spending Patterns

COVID-19 lockdowns significantly impacted consumer spending patterns. The shift to online shopping, changes in dining habits, and restrictions on social activities altered the demand for certain goods and services. For example, the demand for restaurant meals plummeted, while demand for home delivery services and online shopping platforms increased.

Specific Industries Affected by the Pandemic and Inflationary Impacts

The pandemic’s impact varied across industries. The airline industry faced substantial revenue losses due to travel restrictions, while the restaurant sector experienced decreased demand for in-person dining. The demand for home improvement products and online education platforms increased due to lockdowns and work-from-home arrangements. Inflation, in turn, impacted these industries by increasing the cost of raw materials, transportation, and labor, leading to higher prices for consumers.

Comparison of Inflation Rates in Different Sectors Before and After COVID-19

| Sector | Average Inflation Rate (Pre-COVID-19) | Average Inflation Rate (Post-COVID-19) |

|---|---|---|

| Food | 2% | 4% |

| Energy | 1.5% | 2.5% |

| Housing | 3% | 4.5% |

| Healthcare | 2.8% | 3.5% |

Note: These are illustrative figures and actual data may vary depending on the specific time period and measurement method.

Impact of Government Stimulus Packages on Unemployment Rates

Government stimulus packages, such as the Coronavirus Aid, Relief, and Economic Security (CARES) Act, aimed to reduce unemployment by providing financial support to individuals and businesses. The effectiveness of these packages in reducing unemployment varied, and the long-term impact is still being assessed.

| Stimulus Package | Unemployment Rate Before | Unemployment Rate After |

|---|---|---|

| CARES Act | 4.1% | 3.5% |

| [Subsequent Stimulus Package] | 3.5% | 3.2% |

Note: These are illustrative figures. Actual unemployment rates and their correlation with specific stimulus packages are complex and require a deeper analysis considering multiple factors.

Inflation Dynamics During and After COVID-19: Us Economy Inflation Covid

The COVID-19 pandemic significantly impacted global economies, leading to both supply chain disruptions and shifts in consumer behavior. While the initial shock subsided, inflationary pressures persisted and evolved beyond the immediate pandemic effects. Understanding the multifaceted factors contributing to inflation, especially in the US, is crucial for policymakers and individuals alike. This analysis delves into the dynamics of inflation, exploring factors beyond the pandemic, the role of global events, and the interplay with economic decisions.Beyond the initial pandemic-related supply chain bottlenecks, several factors continued to influence inflation.

These included lingering effects of the pandemic, shifts in consumer spending patterns, and external economic shocks, such as the war in Ukraine. Analyzing these factors is essential for comprehending the sustained inflationary environment.

Factors Contributing to Inflation Beyond COVID-19

Various factors beyond the initial COVID-19 disruptions contributed to persistent inflation. These included increased demand, particularly in sectors like housing and consumer goods, exacerbated by pent-up savings and government stimulus packages. The subsequent surge in energy prices, driven by geopolitical events and supply chain constraints, further pushed inflation upward. Furthermore, rising wages, reflecting labor market tightness and a shift in bargaining power, also played a crucial role in the inflationary trend.

Role of Global Events in Influencing Inflation, Us economy inflation covid

Global events played a pivotal role in shaping the inflation landscape. The war in Ukraine, for instance, disrupted energy and agricultural markets, leading to substantial price increases for fuel and food. These increases were felt globally, impacting the cost of goods and services in various economies. Furthermore, supply chain disruptions stemming from the conflict, sanctions, and other geopolitical tensions further contributed to the inflationary pressures observed in the US and globally.

Comparison of Inflation Rates in the US and Other Major Economies

Comparing inflation rates across major economies provides a valuable perspective. While the US experienced significant inflation, other countries, including the Eurozone and the UK, also faced considerable inflationary pressures. The severity and duration of these pressures varied across economies, influenced by factors like domestic policies, economic structures, and specific vulnerabilities to global shocks. Differences in inflation rates highlight the complex interplay of factors contributing to price increases.

Relationship Between Inflation and Interest Rate Adjustments

Central banks, such as the Federal Reserve, often use interest rate adjustments as a tool to manage inflation. Higher interest rates increase borrowing costs, potentially curbing demand and slowing economic growth, thus helping to cool down inflation. Conversely, lower interest rates can stimulate economic activity but might contribute to further inflationary pressures. The relationship between interest rate adjustments and inflation is complex and requires careful consideration of various economic factors.

Influence of Inflation Expectations on Economic Decisions

Inflation expectations play a significant role in shaping economic decisions. If individuals and businesses anticipate persistent inflation, they may adjust their spending and investment plans accordingly. For example, consumers might anticipate higher prices for goods and services, leading to increased spending in anticipation of further price increases. Businesses, on the other hand, might adjust pricing strategies and investment plans based on their inflation expectations.

The impact of these expectations on the overall economy can be substantial.

Inflation Rates Over Time (Illustrative Example)

| Year | US Inflation Rate (%) | Eurozone Inflation Rate (%) | UK Inflation Rate (%) |

|---|---|---|---|

| 2019 | 1.8 | 1.2 | 1.5 |

| 2020 | 1.4 | 0.8 | 1.1 |

| 2021 | 4.7 | 3.5 | 4.2 |

| 2022 | 7.5 | 6.1 | 9.1 |

| 2023 | 5.0 | 5.6 | 7.9 |

Note

* This table provides a simplified illustration. Actual inflation data can be found from reputable sources.

US inflation is still a major concern, especially with the lingering effects of the COVID-19 pandemic. While the news cycle is often dominated by economic anxieties, tragic events like the disappearance of a couple on a boat off the coast of Grenada, as reported by CNN Break , highlight the unpredictable nature of life. These ripple effects on families and communities, unfortunately, can be compounded by economic struggles, underscoring the complex interplay of global events and their impact on individual lives.

Link Between Inflation and Consumer Confidence

A strong correlation exists between inflation and consumer confidence. High inflation can erode consumer purchasing power, leading to a decrease in consumer confidence. Conversely, stable or decreasing inflation can enhance consumer confidence, boosting economic activity. This dynamic is crucial for understanding how economic fluctuations impact consumer sentiment.

Government Policies and Inflation

Navigating the complexities of inflation requires a multifaceted approach, encompassing both monetary and fiscal policies. The Federal Reserve, as the primary monetary authority, plays a crucial role in managing inflation through interest rate adjustments. Fiscal policies, implemented by the government, can influence aggregate demand and supply-side factors. Understanding the interplay of these policies is essential to comprehending the effectiveness of government interventions in mitigating inflation.The Federal Reserve employs various strategies to combat inflation.

These strategies often involve manipulating interest rates, influencing the money supply, and adjusting reserve requirements for banks. By adjusting the cost of borrowing, the Fed can impact investment decisions, consumer spending, and overall economic activity. Monetary policy’s impact on the US economy is significant, as changes in interest rates ripple through various sectors, affecting everything from housing to stock markets.

The US economy’s inflation woes, stemming from the COVID-19 pandemic, are definitely impacting housing markets. For example, the rising costs are clearly visible in California, where you can find 800000 dollar homes 800000 dollar homes california. This reflects a broader economic struggle, with inflation continuing to be a significant factor across various sectors.

Federal Reserve Strategies to Combat Inflation

The Federal Reserve’s primary tool for managing inflation is the federal funds rate. Raising this rate increases borrowing costs for banks, which then raises borrowing costs for consumers and businesses. This reduced demand often cools down the economy and, consequently, inflation. Quantitative tightening (QT) is another strategy employed by the Fed, which involves reducing the size of its balance sheet by allowing maturing Treasury and agency mortgage-backed securities to run off without reinvestment.

These actions aim to reduce the money supply, further curbing inflationary pressures.

Impact of Monetary Policy on the US Economy

Monetary policy, primarily implemented by the Federal Reserve, can significantly impact various sectors of the US economy. Higher interest rates can curb investment in capital projects, leading to reduced job creation in certain industries. They can also impact housing markets, potentially leading to lower home prices. Conversely, lower interest rates can stimulate borrowing and investment, potentially leading to increased job creation and economic growth.

The effectiveness of monetary policy in controlling inflation is not always immediate or predictable, and its effects can be felt unevenly across different segments of the economy.

Comparison of Inflation Control Approaches

Different countries adopt various approaches to controlling inflation, reflecting their unique economic contexts and priorities. Some nations prioritize price stability above all else, while others may consider other factors such as employment or economic growth. The effectiveness of these different approaches depends on several variables, including the specific economic circumstances and the degree of policy coordination. A country’s central bank independence, political climate, and institutional structure all influence the feasibility and success of any inflation-control policy.

Effectiveness of Government Interventions

The effectiveness of government interventions in mitigating inflation is a complex issue. While monetary policies, such as adjusting interest rates, can be impactful, their effectiveness depends on factors like the current economic climate, consumer expectations, and the overall health of the financial system. Fiscal policies, such as government spending and taxation, can also play a role, but their impact on inflation is often less direct and more dependent on the specific nature of the policies.

The effectiveness is not always straightforward, and economic outcomes can vary depending on the specific policies and their implementation.

Examples of Fiscal Policies

Fiscal policies, implemented by the government, can influence inflation through various mechanisms. Government spending on infrastructure projects can boost demand and potentially lead to inflationary pressures if not carefully managed. Tax cuts can increase disposable income, leading to increased consumer spending, but this can also lead to increased demand-pull inflation. Conversely, tax increases can dampen consumer spending and reduce inflationary pressures.

Specific examples of fiscal policies, such as tax incentives for certain industries or investment projects, can also influence inflation dynamics in the short-term and long-term.

Table Comparing Economic Policies

| Policy Category | Pre-Pandemic | During Pandemic | Post-Pandemic |

|---|---|---|---|

| Monetary Policy | Moderate interest rate adjustments | Near-zero interest rates, large-scale asset purchases | Interest rate hikes to combat inflation |

| Fiscal Policy | Targeted spending programs | Large-scale stimulus packages | Focus on fiscal responsibility, potential for targeted spending |

| Impact on Consumer Spending | Generally stable consumer spending | Increased consumer spending due to stimulus | Consumer spending impacted by inflation and interest rate adjustments |

Influence on Consumer Spending

Government policies significantly influence consumer spending. Stimulus packages during the pandemic, for example, injected substantial funds into the economy, boosting consumer confidence and driving increased spending. Conversely, rising interest rates and inflation can dampen consumer spending, as borrowing becomes more expensive and purchasing power diminishes. The relationship between government policies and consumer spending is complex and multifaceted.

Consumer Behavior and Inflation

Inflation significantly impacts consumer spending habits, forcing adjustments in budgets and altering overall economic behavior. The pandemic’s effects on the economy, coupled with the subsequent inflationary pressures, have led to profound shifts in how consumers make purchasing decisions and manage their finances. Understanding these changes is crucial for businesses and policymakers alike to navigate the evolving economic landscape.Consumer spending patterns are directly influenced by inflation’s impact on purchasing power.

When prices rise, consumers often face a reduced ability to afford the same goods and services as before. This leads to a reassessment of spending priorities and an increased focus on value.

Impact of Inflation on Consumer Spending Habits

Inflationary pressures often lead to consumers prioritizing essential goods over discretionary purchases. This shift in spending habits is driven by the need to maintain a comfortable standard of living amidst rising costs. For example, a family might choose to cut back on dining out or entertainment to afford groceries and housing. The overall impact can lead to a deceleration in economic growth.

Examples of Consumer Budget Adjustments

Consumers react to inflation in various ways. Some individuals might reduce their spending on non-essential items, while others might seek out cheaper alternatives for products or services. Coupons and discounts become more valuable, as do deals. A common example is switching from name-brand to store-brand products. Consumers might also adjust their transportation options to reduce fuel costs.

Comparison of Consumer Behavior Before and After the Pandemic

Consumer behavior has undergone significant changes in the aftermath of the pandemic. Before the pandemic, spending patterns were often characterized by a higher degree of discretionary spending. Post-pandemic, consumers have shown a greater focus on essential items and a willingness to save more. This shift reflects a heightened awareness of financial uncertainty and a desire to build a safety net.

Role of Savings and Debt in Consumer Spending

Savings and debt play critical roles in influencing consumer spending during periods of high inflation. When inflation rises, consumers may increase their savings to hedge against future price increases. Conversely, high debt levels can restrict spending, as individuals prioritize debt repayment over discretionary spending.

Different Demographic Reactions to Inflation

Different demographics react to inflation in varying ways. For instance, younger generations, often with less accumulated savings, might be more susceptible to inflation’s impact on their purchasing power. Similarly, households with lower incomes may face greater financial hardship due to inflation. The elderly, with often higher fixed income, may be less directly impacted by price increases.

Consumer Price Index (CPI) Changes Over Time

Understanding historical CPI changes provides context for evaluating current inflationary trends. A CPI table can illustrate these changes over time. The table below demonstrates the changes in CPI, providing insight into how consumer prices have fluctuated over a specified period. Note that this is a hypothetical table and should not be considered actual data.

| Year | CPI |

|---|---|

| 2020 | 250 |

| 2021 | 275 |

| 2022 | 290 |

| 2023 | 305 |

Savings Rates and Debt Levels During Periods of High and Low Inflation

Comparing savings rates and debt levels during periods of high and low inflation reveals how consumer behavior adapts to economic conditions. A comparison table illustrates the trends in savings and debt.

The US economy’s inflation woes during the COVID-19 pandemic have been a major concern. While the economic fallout is complex, it’s interesting to note that renowned New York chef David Bouley has been navigating similar challenges in his culinary career. His innovative approach to fine dining, amidst these economic fluctuations, highlights the resilience of the industry.

The struggles of the restaurant sector during inflation are also worth considering when analyzing the broader economic picture.

| Economic Period | Average Savings Rate | Average Debt Level |

|---|---|---|

| High Inflation | Increased | Decreased |

| Low Inflation | Decreased | Increased |

Long-Term Implications

The lingering effects of the pandemic-induced inflation are complex and far-reaching, impacting various sectors of the economy. Understanding these potential consequences is crucial for informed decision-making regarding investments and future economic policies. The current inflationary environment necessitates careful consideration of its long-term implications on economic growth, employment, and the financial sector.

Potential Consequences on Economic Growth

The persistent inflationary pressures could hinder long-term economic growth. Increased borrowing costs and reduced consumer spending, as a result of higher prices, can stifle investment and innovation. Historical examples of sustained high inflation demonstrate a correlation with slower economic expansion. For instance, the inflationary period of the 1970s resulted in reduced productivity and investment compared to the subsequent decades of stable prices.

The lingering uncertainty surrounding inflation’s trajectory further complicates long-term investment decisions.

Impact on Employment

Inflation’s impact on employment is multifaceted. While some sectors might experience job growth due to increased demand, others might face reduced employment opportunities as businesses struggle with rising costs. The interplay between inflation and unemployment is a key concern. A persistent rise in inflation could lead to a decline in overall employment, particularly in sectors facing cost pressures.

The long-term effects on employment depend on the effectiveness of government policies and the ability of businesses to adapt to the changing economic climate.

Effects on the Financial Sector

The financial sector is susceptible to significant disruptions from prolonged inflationary periods. Higher interest rates impact borrowing costs for individuals and businesses, potentially leading to reduced investment and increased defaults. The profitability of financial institutions is affected by the mismatch between the returns on assets and the cost of funds. For instance, banks might see reduced profitability if the interest rates they charge on loans fail to keep pace with rising inflation.

Influence on Future Economic Policy

The current inflation environment will likely influence future economic policy decisions. Central banks might adopt measures to curb inflation, potentially leading to higher interest rates and tighter monetary policies. The long-term efficacy of these policies will depend on their ability to balance inflation control with sustainable economic growth. Furthermore, governments may be compelled to implement measures aimed at supporting vulnerable populations facing higher costs of living.

Potential Economic Scenarios

The table below Artikels potential economic scenarios in the coming years, considering inflation. These are not definitive predictions but illustrative possibilities.

US inflation during the COVID-19 pandemic has been a major economic concern. The ripple effects are still being felt, and economists are trying to understand the long-term impact. Interestingly, the intricacies of monetary policy and its effects on the economy are reflected in the artistic and historical significance of the Castellucci ring La Monnaie. This ring, a beautiful piece of history, raises questions about value and the ebb and flow of currency through time. Ultimately, understanding these historical and artistic connections can help provide context for navigating the complexities of current economic issues, such as inflation and the ongoing impact of the pandemic on the US economy.

| Scenario | Inflation Trajectory | Economic Growth | Employment |

|---|---|---|---|

| Moderate Inflation | Inflation gradually returns to a more moderate level. | Steady economic growth. | Stable employment. |

| Persistent Inflation | Inflation remains elevated for an extended period. | Reduced economic growth. | Potential job losses in certain sectors. |

| Hyperinflation | Inflation spirals out of control. | Significant economic contraction. | Mass unemployment. |

Impact on the Housing Market

Inflation significantly impacts the housing market. Higher construction costs and interest rates translate to higher home prices, making homeownership less accessible for many. Rising mortgage rates make home loans more expensive, potentially reducing demand and leading to a decline in housing market activity.

Illustrative example of inflation’s impact on the housing market: Suppose the inflation rate rises by 5% annually.

The cost of building materials increases, leading to higher home prices. Higher interest rates, in turn, increase the cost of borrowing for mortgages. These combined factors reduce affordability and can dampen demand in the housing market.

The US economy’s inflation woes post-COVID are a complex issue, and the interconnectedness of global events is striking. Think about how the Amazon rainforest’s health is crucial to our planet’s climate stability, and a potential amazon rain forest tipping point could have unforeseen ripple effects, impacting everything from agricultural production to resource availability, ultimately affecting the global economy and influencing inflationary pressures.

The interconnectedness of these issues is undeniable, and it highlights the urgent need for sustainable practices across the board.

Final Wrap-Up

In conclusion, the COVID-19 pandemic undeniably left a profound mark on the US economy, influencing inflation rates, consumer behavior, and government policies. While the initial shock is receding, the lingering effects and the potential long-term consequences are significant. The data presented offers a glimpse into the complexities of this era, highlighting the interconnectedness of various factors and the need for ongoing analysis.

FAQ

What was the pre-COVID inflation trend in the US?

Before COVID-19, US inflation exhibited a relatively stable, albeit fluctuating, pattern. Historical data reveals a general trend of moderate increases over the years.

How did global events influence US inflation after COVID-19?

Global events, like geopolitical tensions and supply chain bottlenecks, played a significant role in post-COVID inflation. These events amplified existing pressures, adding another layer of complexity to the inflationary environment.

What are some examples of fiscal policies aimed at addressing inflation?

Fiscal policies, such as tax cuts or increased government spending, can impact inflation. Understanding the nuances of these policies is key to assessing their effectiveness in addressing inflation.

How did consumer behavior change after the pandemic?

Consumer behavior underwent significant shifts after the pandemic, impacting everything from spending habits to savings and debt management.