Mother-in-Law Retirement Savings Ethics A Guide

Mother in law retirement savings ethics – Mother-in-law retirement savings ethics sets the stage for navigating complex family financial dynamics. This in-depth exploration examines the ethical considerations surrounding a mother-in-law’s retirement savings, from potential financial conflicts to legal implications and alternative dispute resolution methods.

The article delves into the nuanced financial, familial, and ethical landscapes surrounding retirement savings. It highlights the importance of transparency, communication, and understanding generational differences in fostering healthy relationships while protecting the interests of all parties involved. From different types of retirement accounts to the impact of family dynamics, this guide provides a comprehensive overview of this sensitive topic.

Financial Considerations

Retirement savings, a crucial aspect of financial security, can often become a source of contention between mothers-in-law and their children. As individuals navigate the complexities of retirement planning, differing expectations, financial priorities, and generational perspectives can lead to misunderstandings and disagreements. These conflicts, if not addressed proactively, can strain familial relationships and create lasting resentment.

Potential Financial Conflicts

Financial conflicts can arise from various factors, including differing views on investment strategies, differing levels of financial security, and perceived fairness in resource allocation. Mothers-in-law may have established their own savings and investment patterns, which might differ significantly from those of their children. Children, on the other hand, might have specific needs or financial goals that necessitate a different approach to retirement savings.

Figuring out the ethics of helping your mother-in-law with her retirement savings can be tricky, especially when considering the recent controversy surrounding the retraction of a study on abortion pills. Like the questionable methodology in that study, abortion pills study retraction , it’s important to approach these financial decisions with transparency and a clear understanding of both sides’ needs.

Ultimately, open communication and a focus on fairness will be key to navigating these delicate situations, whether it’s retirement savings or anything else.

This divergence in financial perspectives can create tension and misunderstanding.

Examples of Disagreements

One common scenario involves a mother-in-law who prioritizes preserving capital, potentially opting for lower-risk investments. Her children, however, may favor higher-return investments, potentially exposing her savings to greater market volatility. Another scenario involves a mother-in-law who wishes to leave a significant portion of her retirement savings to a grandchild, potentially creating tension with her children, who might have different expectations for their own retirement plans.

Thinking about my mother-in-law’s retirement savings lately, and the ethical considerations around helping her, got me wondering about the bigger picture. It’s a tricky situation, especially when you consider recent events like the tragic NYC shooting on the D train. nyc shooting d train highlights the complex issues surrounding safety and security in our daily lives, which, in turn, makes me think even more about how we should approach supporting family members’ financial futures.

Ultimately, the best approach for my mother-in-law, and for all of us, is to find a solution that balances individual responsibility with family support.

Ultimately, these discrepancies can lead to disagreements over investment choices, the timing of withdrawals, and the distribution of assets.

Ethical Implications of Financial Decisions

Ethical considerations surrounding retirement savings decisions are multifaceted. A mother-in-law’s decision to prioritize her own financial security over the needs of her children, while understandable, might be perceived as lacking consideration for their well-being. Conversely, children pressuring their mother-in-law to invest in higher-risk ventures might compromise her long-term financial security, raising ethical concerns about their motives. Transparency and open communication are paramount in navigating these ethical dilemmas.

Legal Ramifications of Financial Disputes

Financial disputes between mothers-in-law and their children related to retirement funds can have significant legal implications. Clearly defined legal documents, such as wills and trusts, are essential to avoid future conflicts. These documents should Artikel the intended beneficiaries and the distribution plan for retirement savings, providing a framework for resolving potential disputes. Failure to have such documents in place can lead to costly legal battles and protracted disputes over assets.

Different Perspectives on Retirement Savings

Mothers-in-law often prioritize long-term financial security and stability, potentially emphasizing the preservation of capital. Their children, on the other hand, might focus on achieving specific financial goals, such as funding children’s education or securing a comfortable retirement. These differing priorities can lead to conflicting views on investment strategies and the distribution of assets. Open communication and a shared understanding of each other’s financial objectives are vital to bridging these gaps.

Retirement Account Types

| Account Type | Contribution Limits | Tax Implications | Access Restrictions |

|---|---|---|---|

| 401(k) | Varying limits based on year and employee status | Pre-tax contributions reduce current income tax liability; distributions are taxed in retirement. | Generally, restrictions apply until retirement age. |

| IRA (Traditional) | Varying limits based on year and individual status | Pre-tax contributions reduce current income tax liability; distributions are taxed in retirement. | Generally, restrictions apply until retirement age. |

| IRA (Roth) | Varying limits based on year and individual status | After-tax contributions; distributions are tax-free in retirement. | Generally, restrictions apply until retirement age. |

| SEP IRA | Limits based on year and self-employment income | Pre-tax contributions; distributions are taxed in retirement. | Generally, restrictions apply until retirement age. |

This table provides a basic overview of common retirement accounts. Specific details and rules can vary, so consulting a financial advisor is recommended for personalized guidance.

Family Dynamics and Relationships

Navigating retirement savings decisions within families, particularly those involving a mother-in-law, often presents unique challenges. Beyond the financial considerations, the complexities of family dynamics, relationships, and generational perspectives can significantly impact the ethical landscape of these conversations. Understanding these nuances is crucial for fostering open communication and finding mutually agreeable solutions.Family relationships, ranging from close and supportive to distant or strained, directly influence the approach to retirement savings.

A close relationship often fosters trust and collaborative discussions, while a distant or strained relationship might require more careful consideration and a more structured approach to ensure fair and equitable outcomes. The level of trust between family members plays a vital role in the success of any discussion.

Impact of Family Relationships on Financial Decisions

Family relationships, whether close, distant, or strained, significantly affect financial decisions concerning retirement savings. Close-knit families often approach such decisions with collaborative discussions and mutual understanding, while strained relationships might require a more formal and structured approach to ensure fairness. Trust and open communication are paramount to resolving potential conflicts.

Role of Trust and Communication in Resolving Conflicts

Trust and open communication are essential for navigating potential conflicts regarding retirement savings. When trust is high, families can engage in honest and constructive dialogues about financial goals and expectations. This allows for a more collaborative approach to decision-making, ensuring that everyone’s interests are considered. Conversely, low trust may necessitate a more formal or legalistic approach to safeguard individual interests.

Open and honest communication about financial expectations and concerns is key to avoiding misunderstandings and potential conflicts.

Effective Communication Strategies for Addressing Disagreements

Effective communication strategies are critical when discussing retirement savings with family members. Active listening, empathy, and a willingness to compromise are essential components of these strategies. Clearly articulating financial goals, expectations, and concerns, while respecting differing viewpoints, is also vital. Using a neutral third party, such as a financial advisor, can facilitate productive discussions and help ensure everyone feels heard and understood.

Seeking professional mediation, if necessary, can also provide a structured framework for resolving disagreements.

Examples of Effective Communication Strategies

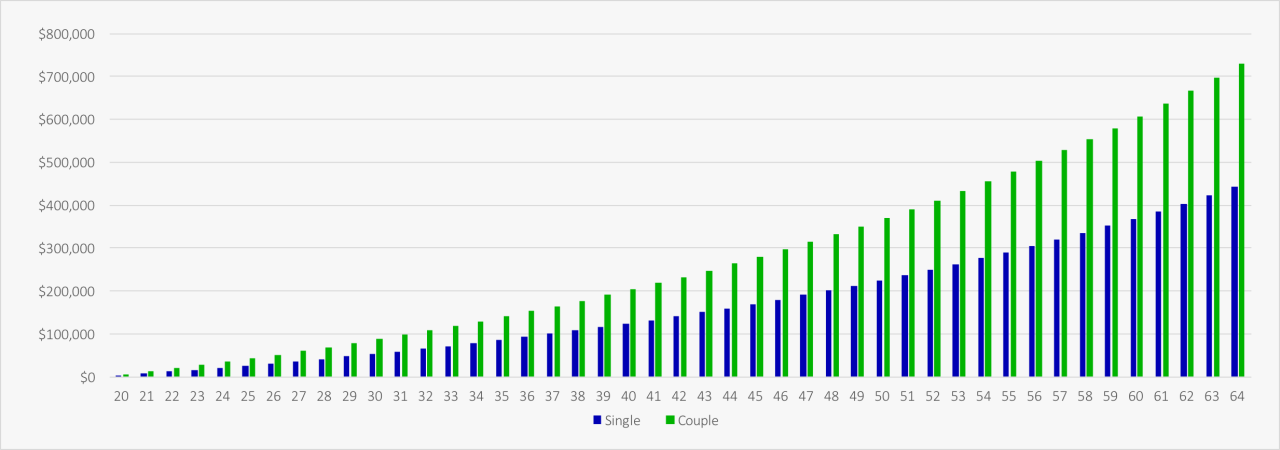

Examples of effective communication strategies include scheduled family meetings to discuss retirement plans, using visual aids to present financial data in a clear and understandable manner, and actively listening to each other’s concerns. Prioritizing open communication and active listening ensures that everyone feels heard and valued. Creating a shared understanding of financial goals and expectations is also crucial.

It’s important to avoid placing blame or engaging in personal attacks.

Generational Differences in Retirement Savings Ethics

Generational differences play a significant role in shaping perspectives on retirement savings ethics. Each generation has unique experiences and values that influence their approach to financial planning. Understanding these differences is essential for fostering productive conversations about retirement savings. Different generations may have different priorities, savings goals, and investment strategies.

Comparison of Generational Views on Retirement Savings, Mother in law retirement savings ethics

| Generation | Financial Priorities | Savings Goals | Investment Strategies |

|---|---|---|---|

| Baby Boomers (born 1946-1964) | Security and stability, often with a focus on traditional investments like bonds and real estate. | Sufficient retirement income to maintain their current lifestyle, often with a desire for a comfortable retirement. | Often favouring low-risk, conservative investments, potentially influenced by a greater emphasis on preserving capital. |

| Generation X (born 1965-1980) | Balance between security and flexibility, potentially seeking ways to generate passive income. | Financial independence and the ability to pursue their interests in retirement, often with an emphasis on early retirement. | More open to a mix of investments, potentially including stocks and alternative investments, while balancing risk and return. |

| Millennials (born 1981-1996) | Financial freedom and work-life balance, often seeking diverse income streams. | Early retirement and the ability to pursue their passions, often with a desire for a flexible retirement lifestyle. | Often embracing technology-driven investments, and potentially more comfortable with higher-risk, higher-reward investment strategies. |

| Gen Z (born 1997-2012) | Financial security and sustainability, often with a focus on ethical and socially responsible investments. | Building wealth and independence, often prioritizing experiences and travel over material possessions in retirement. | Seeking investments that align with their values, often favouring investments that are environmentally and socially conscious. |

Ethical Principles and Standards

Navigating retirement savings with family members, particularly when a mother-in-law is involved, requires a strong ethical compass. This section delves into the crucial principles of fairness, transparency, and accountability, highlighting potential conflicts of interest and emphasizing the importance of open communication and mutual respect. Understanding these principles ensures a harmonious and equitable process for everyone involved.The ethical management of retirement savings extends beyond simply adhering to legal frameworks.

Thinking about the ethics of helping my mother-in-law with her retirement savings is tricky. It’s a delicate balance between wanting to support her and ensuring she’s making sound financial decisions. Plus, seeing those gorgeous, avant-garde looks at khaite new york fashion week makes me wonder if she might be putting her savings into something less practical than a diversified portfolio! Ultimately, it’s all about open communication and ensuring her best interests are at heart, even if that means she might want to splurge on a few more designer pieces.

It involves a deep understanding of the values that underpin trust and cooperation within families. It’s about recognizing the unique responsibilities and potential challenges that arise when personal finances intersect with family relationships.

Fairness in Retirement Savings Management

Fairness demands equal consideration for all parties involved. When a mother-in-law involves her children in her retirement savings, it’s essential to ensure that everyone’s interests are weighed equally. This involves objective assessments of contributions, potential risks, and expected returns. Transparency and clear communication are key to fostering a sense of fairness.

Transparency in Retirement Savings Decisions

Transparency in retirement savings decisions is vital for building trust and preventing misunderstandings. Open communication about investment strategies, potential risks, and financial goals is paramount. Detailed records and regular updates should be shared to ensure everyone understands the process and the rationale behind decisions. This creates a shared understanding and a foundation of trust.

Accountability in Retirement Savings

Accountability plays a crucial role in maintaining the integrity of retirement savings. Clear roles and responsibilities should be defined, and all parties involved should be held accountable for their actions and decisions. This can be achieved through agreed-upon guidelines, regular review meetings, and documented agreements.

Potential Conflicts of Interest

Conflicts of interest can arise when family members, particularly children, are involved in a mother-in-law’s retirement savings. These can range from the perception of favoritism to situations where personal gain might outweigh the best interests of the mother-in-law. It’s important to proactively identify and mitigate these conflicts to maintain trust and ensure fairness. For example, if a child manages investments with the potential for personal gain, it is crucial to establish clear boundaries and oversight mechanisms.

Importance of Transparency and Open Communication

Open and honest communication is essential for navigating the complexities of family finances. Regular meetings, detailed financial reports, and active listening are vital to ensuring that everyone understands the decisions being made regarding retirement savings. This proactive approach minimizes potential misunderstandings and fosters trust. A clear understanding of investment strategies, potential risks, and financial goals for the mother-in-law should be shared with all involved parties.

Principles of Mutual Respect and Consideration

Mutual respect and consideration are fundamental when dealing with family finances. Acknowledging the mother-in-law’s autonomy and her right to make decisions about her own funds is critical. At the same time, children should feel comfortable expressing their concerns or seeking clarification on the management of these savings. This approach ensures that everyone feels valued and respected. Active listening and empathy are crucial for a respectful dialogue.

Different Ethical Frameworks for Resolving Conflicts

Various ethical frameworks, such as deontology (duty-based ethics), utilitarianism (outcome-based ethics), and virtue ethics (character-based ethics), can be applied to resolve conflicts in retirement savings. Deontology emphasizes adherence to moral rules, while utilitarianism focuses on maximizing overall benefit. Virtue ethics emphasizes the development of moral character. Understanding these frameworks can provide a structured approach to resolving disputes.

Ethical Considerations in Retirement Savings and Family Dynamics

| Ethical Principle | Definition | Example | Potential Conflict |

|---|---|---|---|

| Fairness | Equal consideration for all parties involved. | Equitable distribution of investment returns. | Favoritism in investment selection. |

| Transparency | Open communication about investment strategies and financial goals. | Regular financial reports and meetings. | Concealing investment details from family members. |

| Accountability | Clear roles and responsibilities for all parties involved. | Defined roles in managing the retirement fund. | Lack of oversight and monitoring of investment decisions. |

| Mutual Respect | Acknowledging the autonomy of the mother-in-law while allowing for open communication. | Valuing the mother-in-law’s decisions while addressing concerns. | Ignoring the mother-in-law’s input or imposing unwanted decisions. |

Legal and Regulatory Frameworks

Navigating the legal landscape surrounding retirement savings, especially when family members are involved, requires careful consideration. A mother-in-law’s retirement savings decisions can have significant legal implications, impacting not only her future but also the interests of her family members. Understanding the relevant laws and regulations is crucial for ensuring fairness and protecting the rights of all parties involved.

Legal Implications of Retirement Savings Decisions

Legal frameworks surrounding retirement savings decisions are multifaceted and often depend on specific jurisdictions. The legal implications extend beyond the mere financial aspects, encompassing potential inheritance disputes and family dynamics. Clear understanding of these implications is essential for avoiding future conflicts and safeguarding the interests of all parties.

Relevant Laws and Regulations Concerning Inheritance and Retirement Funds

Inheritance laws and regulations vary considerably by state or country. These laws dictate how assets, including retirement funds, are distributed upon the death of the account holder. Some jurisdictions have specific laws regarding retirement accounts, outlining rules for beneficiaries and potential tax implications. In addition to inheritance laws, there might be specific regulations governing the management of retirement funds by trustees or designated individuals.

Protecting the Interests of All Parties

Protecting the interests of all parties involved requires transparency, clear communication, and documentation. This includes outlining the intended beneficiaries of the retirement accounts and establishing clear guidelines for managing the funds. Open discussions with all family members regarding the distribution of funds can prevent misunderstandings and future disputes.

Seeking Legal Advice When Disputes Arise

When disagreements or disputes arise regarding retirement savings, seeking legal counsel is highly recommended. A legal professional can advise on the specific laws and regulations applicable to the situation, helping to navigate complex legal procedures and ensuring the best possible outcome. Legal counsel can provide guidance on how to protect the interests of all parties involved.

Clear Written Agreements for Family Members Managing Retirement Funds

Establishing clear written agreements is vital when family members are involved in managing retirement funds. These agreements should Artikel the responsibilities, limitations, and decision-making authority of each party. A well-defined agreement minimizes ambiguity and potential conflicts. The agreement should include details about how the funds will be managed, the terms of withdrawal, and the responsibilities of each party involved.

Summary of Legal Considerations

| Law/Regulation | Description | Potential Dispute | Resolution |

|---|---|---|---|

| Inheritance Laws (State Specific) | Govern the distribution of assets, including retirement funds, upon death. | Disagreement over the distribution of retirement funds among heirs. | Seek legal counsel to clarify inheritance laws and create a legally sound will or trust document. |

| Retirement Account Rules | Artikel the procedures for managing and accessing retirement accounts. | Mismanagement of funds by a designated manager. | Establish a clear written agreement defining responsibilities and procedures. |

| Trust Laws | Govern the creation and management of trusts to hold and distribute assets. | Dispute over the trustee’s actions regarding the retirement funds. | Create a well-defined trust document with clearly defined roles and responsibilities for the trustee. |

| Tax Regulations | Regulate the taxation of retirement funds and inheritance. | Misunderstanding regarding tax implications of the retirement fund distribution. | Consult with a tax advisor to ensure compliance with tax regulations. |

Alternative Dispute Resolution

Navigating family conflicts, especially those involving financial matters like retirement savings, can be incredibly challenging. Open communication and a willingness to explore alternative solutions are crucial for finding mutually agreeable outcomes. This section delves into different dispute resolution methods, highlighting their benefits and drawbacks, and emphasizing the role of a financial advisor in facilitating constructive conversations.Addressing disagreements regarding a mother-in-law’s retirement savings requires a sensitive approach.

Alternative dispute resolution (ADR) methods offer less adversarial pathways to resolve these disputes, fostering a more collaborative environment than traditional court proceedings. This can be particularly valuable in family situations where maintaining relationships is paramount.

Methods of Resolving Disputes

Different methods of alternative dispute resolution (ADR) can be employed to resolve disagreements about retirement savings. These methods aim to facilitate communication and compromise, potentially avoiding the emotional toll and financial burdens of litigation. Understanding the nuances of each approach is essential in choosing the most suitable method for a specific situation.

Mediation

Mediation is a process where a neutral third party, a mediator, helps facilitate communication and negotiation between disputing parties. The mediator guides the discussion, encourages understanding, and helps the parties reach a mutually acceptable agreement. In the context of family conflicts regarding retirement savings, a mediator can help family members express their concerns, explore different perspectives, and brainstorm potential solutions.

- Example: A family meeting regarding a mother-in-law’s retirement funds could benefit from mediation. A mediator could help clarify differing expectations about the funds’ use, ensuring all family members feel heard and understood, and fostering a collaborative solution that addresses everyone’s concerns.

“Mediation in family disputes regarding retirement savings fosters a more collaborative and understanding environment, helping to preserve family relationships while finding practical solutions.”

Thinking about the ethical implications of helping my mother-in-law with her retirement savings is tricky. It’s a delicate balancing act, especially when you consider the unique circumstances surrounding a subway weekend event like subway weekend jose lasalle. Ultimately, the key is open communication and a plan that prioritizes her financial well-being while respecting individual boundaries and responsibilities.

Arbitration

Arbitration is another ADR method where a neutral third party, an arbitrator, hears evidence and arguments from both sides and makes a binding decision. This decision is often legally enforceable. Arbitration can be faster and potentially less expensive than litigation, although the process can be more formal.

- Example: If family members cannot agree on the distribution of a mother-in-law’s retirement funds, arbitration could provide a structured process for determining a fair outcome. An arbitrator would consider the facts presented by both sides and issue a legally binding decision that all parties must abide by.

Financial Advisor’s Role

A financial advisor plays a critical role in facilitating communication and conflict resolution in such situations. They can provide objective financial guidance, clarifying the details of the retirement savings and potential implications of different outcomes. Their expertise in financial planning and their ability to foster open dialogue can significantly reduce tensions and promote a more productive discussion.

Comparing Mediation and Arbitration

| Method | Process | Advantages | Disadvantages |

|---|---|---|---|

| Mediation | A neutral third party facilitates communication and negotiation between parties to reach a mutually agreed-upon solution. | Preserves relationships, flexible, cost-effective, parties maintain control over outcome. | May not be suitable for highly contentious situations, no legally binding decision. |

| Arbitration | A neutral third party hears evidence and arguments, making a binding decision. | Faster and potentially less expensive than litigation, legally binding outcome. | Less flexible, may not address underlying family issues, decision is binding and less collaborative. |

Case Studies and Scenarios

Navigating the complex landscape of retirement savings within families requires careful consideration of potential conflicts and diverse perspectives. Understanding these scenarios is crucial for developing strategies to promote harmonious communication and fair outcomes. This section delves into specific case studies highlighting common challenges and ethical dilemmas.

Hypothetical Scenario: Disputed Retirement Savings

A mother-in-law, Mary, has diligently saved for retirement, contributing significantly to her retirement account. However, disagreements arise between Mary and her children concerning the management and distribution of these funds. One child, concerned about Mary’s health and well-being, advocates for a trust fund to ensure her needs are met. Another child, believing in Mary’s financial acumen, wants her to retain control.

A third child, focused on their own financial goals, wants a specific portion of the funds for their own future use. These differing perspectives create tension and potential conflict.

Inheritance of Retirement Funds

John’s mother, having accumulated substantial retirement funds, passes away. The will designates a portion of her retirement account to each of her children, but disputes arise over the value of the account. The children, with varying levels of financial understanding, interpret the will’s stipulations differently. One child argues the valuation should reflect the account’s current balance, while another claims the valuation should be based on the account’s value at the time of the mother’s death.

This disagreement leads to legal complications and strained family relationships.

Impact of Generational Differences

Sarah, a millennial mother-in-law, has different investment strategies and priorities for her retirement savings than her Gen X children. Sarah prioritizes long-term growth and potentially higher-risk investments, while her children prefer more conservative strategies. This generational divide creates a significant conflict in managing the retirement savings. The children may feel unsure about their mother’s strategies, and Sarah may struggle to understand their concerns about risk.

Maintaining Control of Retirement Savings

A mother-in-law, Elizabeth, wishes to maintain complete control over her retirement savings throughout her lifetime. She prefers to make all investment decisions without outside interference from her children. However, her children are concerned about her well-being and her ability to make sound financial judgments as she ages. This situation highlights the tension between maintaining autonomy and ensuring sound financial decisions.

Thinking about my mother-in-law’s retirement savings and the ethical considerations around them got me pondering similar concepts in other areas. For example, safe sex practices, like using condon prevencion vih sida , are crucial for protecting individuals from STIs. Ultimately, responsible financial planning for retirement, just like responsible sexual health choices, boils down to making sound decisions that benefit all involved.

Involving Children in Management

A mother-in-law, Susan, feels it’s crucial to involve her children in managing her retirement savings. She believes that their input and guidance will be beneficial, especially as she approaches retirement. This collaborative approach can lead to better decisions, but potential conflicts may arise if children have different ideas about the investment strategies.

Ethical Dilemmas in Family Retirement Savings

| Scenario | Issue | Stakeholders | Ethical Concerns |

|---|---|---|---|

| Disputed Retirement Savings | Determining the best course of action for managing the retirement funds | Mother-in-law, children | Honoring the mother-in-law’s wishes, safeguarding her financial well-being, ensuring fair treatment for all children |

| Inheritance of Retirement Funds | Interpreting the will and valuing the retirement account | Heirs, legal representatives | Accuracy, transparency, fairness in distribution of assets |

| Generational Differences | Reconciling differing investment philosophies | Mother-in-law, children | Understanding each other’s perspectives, finding a balance between risk tolerance and security |

| Maintaining Control | Balancing autonomy with safeguarding financial well-being | Mother-in-law, children | Respecting the mother-in-law’s wishes, addressing concerns about her competence |

Final Review: Mother In Law Retirement Savings Ethics

In conclusion, navigating mother-in-law retirement savings ethics requires careful consideration of financial, familial, and ethical factors. This guide has presented a multifaceted approach, exploring potential conflicts, legal frameworks, and alternative dispute resolution methods. Ultimately, open communication, mutual respect, and a commitment to fairness are crucial for resolving disputes and maintaining healthy family relationships amidst the complexities of retirement savings.

Key Questions Answered

What are some common financial conflicts between a mother-in-law and her children regarding retirement savings?

Disagreements can arise over contributions, investment strategies, access to funds, and differing views on the mother-in-law’s financial autonomy. Family dynamics, trust issues, and generational differences can further complicate these situations.

What are the legal ramifications of financial disputes related to retirement funds?

Legal ramifications can vary depending on the specific circumstances and jurisdiction. Laws regarding inheritance, trusts, and financial agreements play a crucial role in determining the rights and responsibilities of all parties involved. Seeking legal counsel is highly recommended in such situations.

How can generational differences impact the perception of retirement savings ethics?

Different generations often have varying financial priorities, savings goals, and investment strategies. These differences can lead to misunderstandings and conflicts when discussing retirement savings within a family. Open communication and acknowledging these differences is crucial.

What role does a financial advisor play in facilitating communication and conflict resolution?

A financial advisor can act as a neutral third party, helping to facilitate communication and understanding between family members involved in retirement savings. They can also offer guidance on financial strategies and legal implications.